We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Petco Health and Wellness Company, Inc. (NASDAQ: WOOF)

Today’s penny stock pick is the pet health and wellness company, Petco Health and Wellness Company, Inc. (NASDAQ: WOOF).

Petco Health and Wellness Company, Inc. operates as a health and wellness company and focuses on enhancing the lives of pets, pet parents, and its Petco partners in the United States, Mexico, and Puerto Rico. The company provides veterinary care, grooming, training, tele-health, and Vital Care and pet health insurance services, as well as veterinary services through Vetco mobile clinics.

It also offers pet consumables, supplies, and services through its petco.com, petcoach.co, petinsurancequotes.com, and pupbox.com websites. The company offers its products under the WholeHearted, Reddy, and Well & Good brands.

Website: https://corporate.petco.com

Latest 10-k report: https://ir.petco.com/static-files/de462517-9dbe-4695-b99c-7db1308c83e2

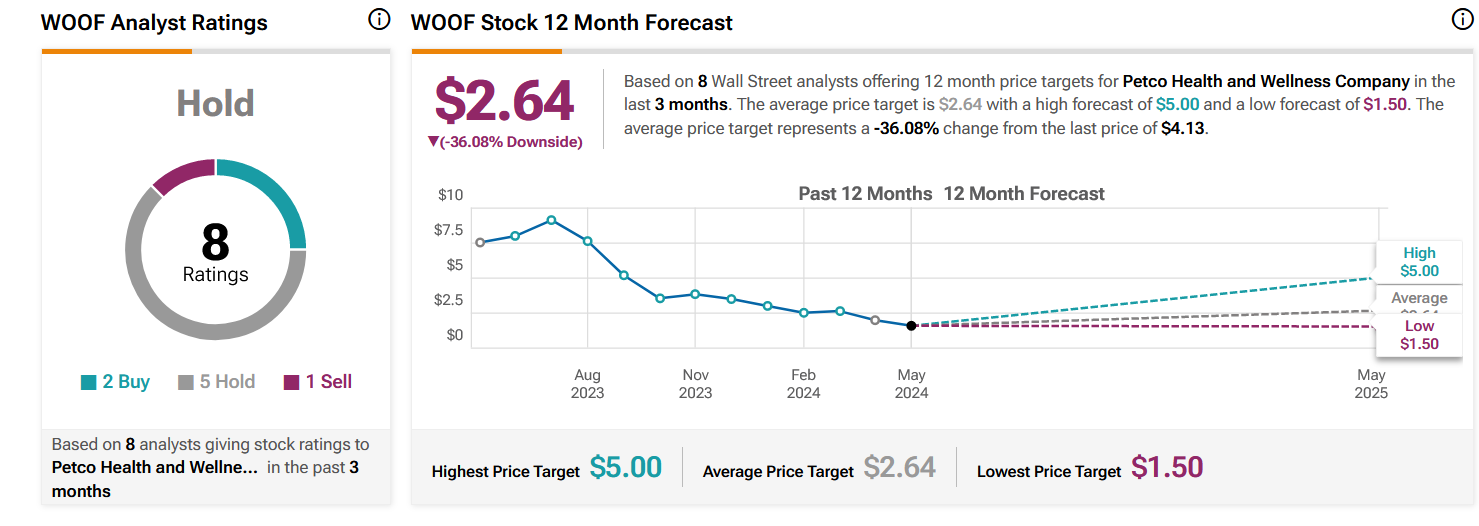

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for WOOF in the last 3 months, the stock has an average price target of $2.64.

Potential Catalysts / Reasons for the Hype:

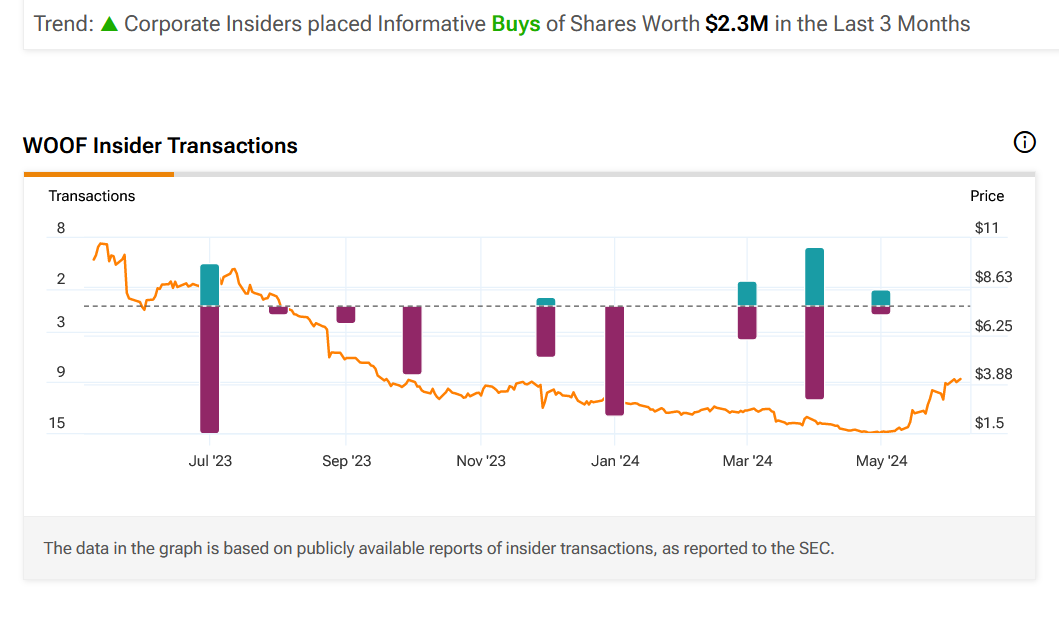

- Corporate Insiders placed Informative Buys of Shares Worth $2.3M in the Last 3 Months.

- The company recently announced leadership WOOF is expanding the Executive Leadership Team to include: Tim Buckenberger, SVP, Merchandise Planning, Inventory & Supply Chain; Steve Janowiak, VP Digital; Stephen Reyes, SVP, Services; James Roth, Chief Stores Officer; and Shari White, Interim Chief Merchant.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Downtrend Channel Breakout: The daily chart shows that the stock has broken out of a downtrend channel, which is shown as purple color lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#6 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for WOOF is above the price of $4.25.

Target Prices: Our first target is $5.60. If it closes above that level, the second target price is $6.80.

Stop Loss: To limit risk, place a stop loss at $3.40. Note that the stop loss is on a closing basis.

Our target potential upside is 32% to 60%.

For a risk of $0.85, our first target reward is $1.35, and the second target reward is $2.55. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

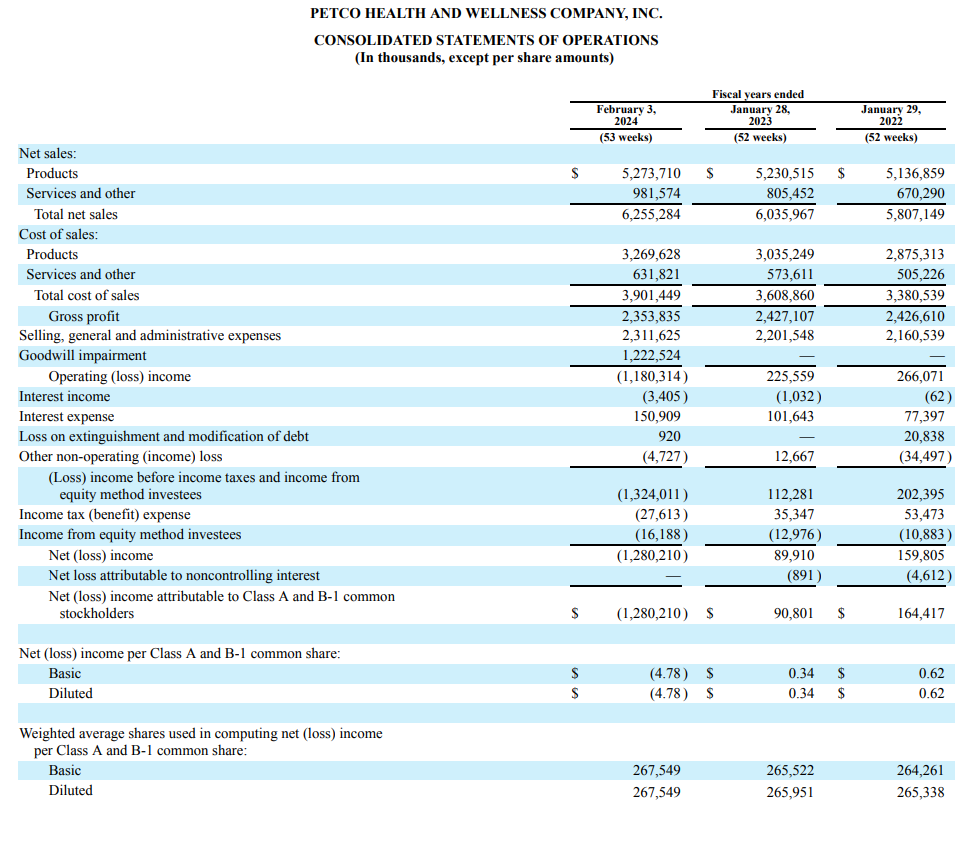

- The company has a history of net losses. WOOF’s net loss for the fiscal year ending February 2024 was $1,280 million.

- The company is involved in litigations including claims related to federal or state wage and hour laws, working conditions, product liability, consumer protection, advertising, employment, intellectual property, tort, privacy, and data protection, disputes with landlords and vendors, claims from customers or employees alleging failure to maintain safe premises, and other matters.

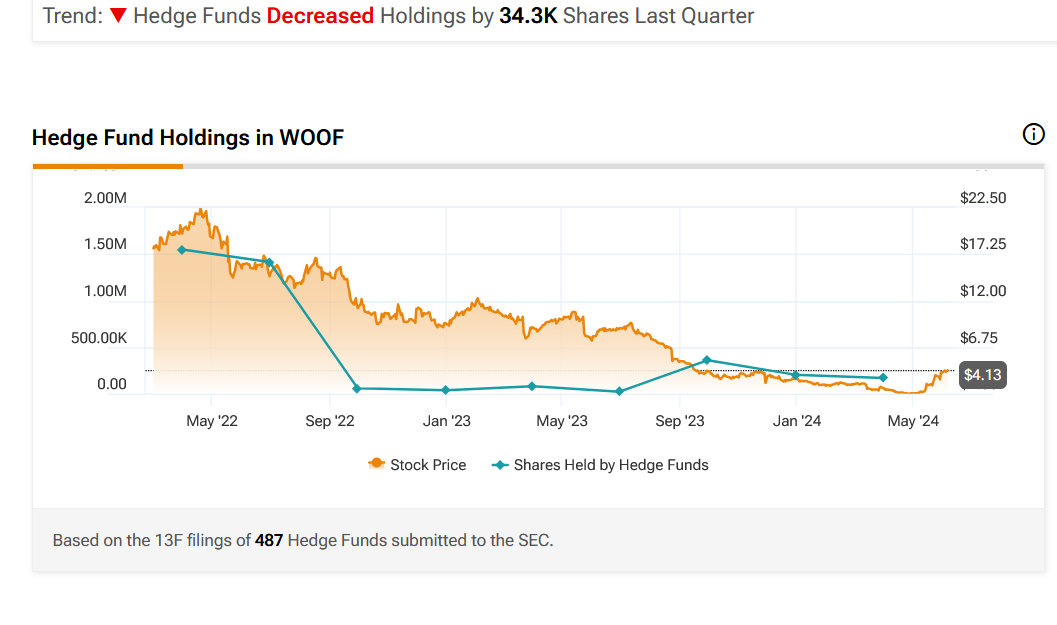

- Hedge Funds Decreased Holdings by 34.3K Shares Last Quarter.

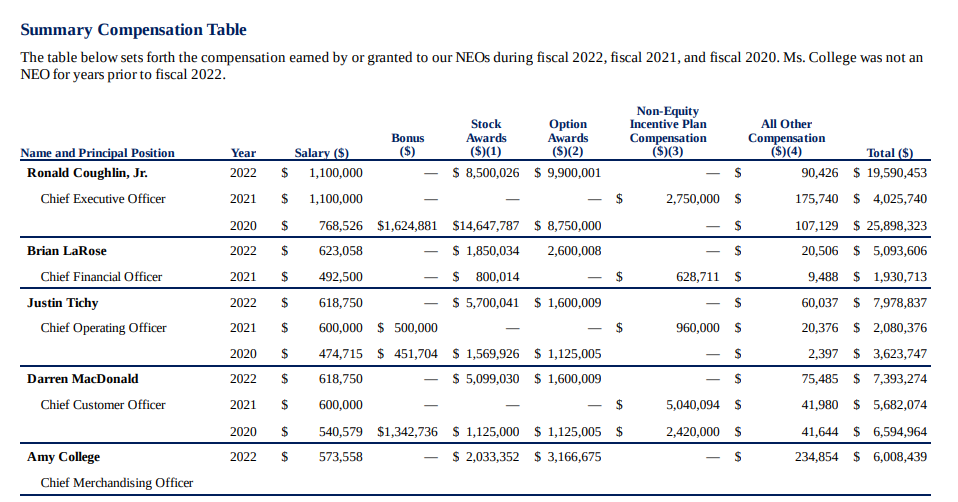

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company has significant debt. As of February 3, 2024, WOOF had a $1,700 million secured term loan facility maturing on March 4, 2028, and a secured asset-based revolving credit facility providing for senior secured financing of up to $500 million, subject to a borrowing base, maturing on March 4, 2026.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price. Get 25% off using Daily Trade Alert's special referral link and coupon code AFFILIATE25

Source: Trades of the Day