We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Nine Energy Service, Inc. (NYSE: NINE)

Today’s penny stock pick is the Oil and Gas equipment and services company, Nine Energy Service, Inc. (NYSE: NINE).

Nine Energy Service, Inc. operates as an onshore completion services provider that targets unconventional oil and gas resource development in North American basins and internationally. It offers cementing services, including blending high-grade cement and water with various solid and liquid additives to create a cement slurry that is pumped between the casing and the wellbore of the well.

The company also provides open hole and cemented completion tool products, such as liner hangers and accessories, fracture isolation packers, frac sleeves, stage one prep tools, casing flotation tools, specialty open hole float equipment, disk subs, composite cement retainers, and centralizers that provide pinpoint frac sleeve system technologies.

In addition, it offers wireline services consisting of plug-and-perf completions, which is a multistage well completion technique for cased-hole wells that consists of deploying perforating guns and isolation tools to a specified depth; and coiled tubing services, which perform wellbore intervention operations utilizing a continuous steel pipe that is transported to the wellsite wound on a large spool. The company was formerly known as NSC-Tripoint, Inc. and changed its name to Nine Energy Service, Inc. in October 2011.

Website: https://nineenergyservice.com

Latest 10-k report: https://otp.tools.investis.com/clients/us/nine_energy_service1/SEC/sec-show.aspx?FilingId=17352875&Cik=0001532286&Type=PDF&hasPdf=1

Analyst Consensus: Not Covered By Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- The company recently announced that it has agreed to acquire Magnum Oil Tools International, LTD, for roughly $493 million.

- The overall increase in oil and natural gas prices.

- The company had reported revenue of $144.07 million for the fourth quarter of 2023. This was 1.35% higher than the analyst estimates for revenue of $142.15 million.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several days. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Oversold RSI: The RSI is currently moving higher from oversold levels, indicating possible bullishness.

#3 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a long-term support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#5 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

#6 Bullish OBV: The weekly chart shows that the OBV indicator is currently rising. OBV rises when volume on up weeks outpaces volume on down weeks. A rising OBV typically reflects positive volume pressure that can lead to higher prices.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for NINE is above the price of $1.80.

Target Prices: Our first target is $2.80. If it closes above that level, the second target price is $3.60.

Stop Loss: To limit risk, place a stop loss at $1.20. Note that the stop loss is on a closing basis.

Our target potential upside is 56% to 100%.

For a risk of $0.60, our first target reward is $1.00, and the second target reward is $1.80. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

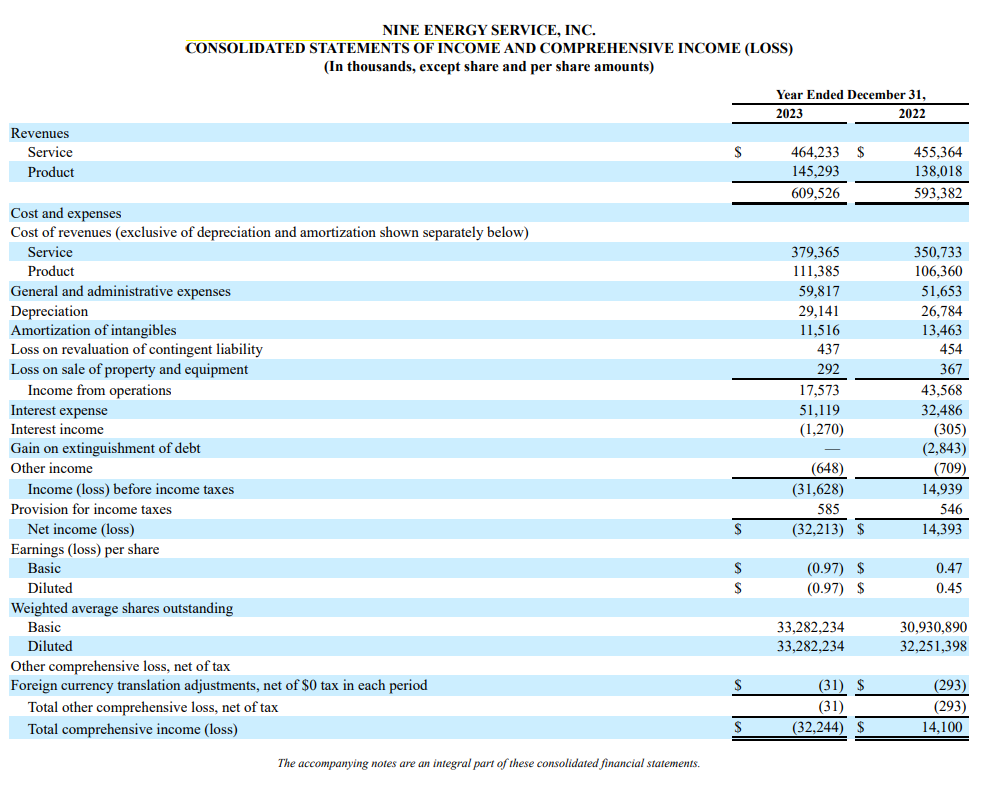

- The company has a history of net losses. For the year ended December 2023, the company reported a net loss of $32.2 million.

- Any decline in oil and natural gas commodity prices may adversely affect the demand for NINE’s products and services and the overall profitability.

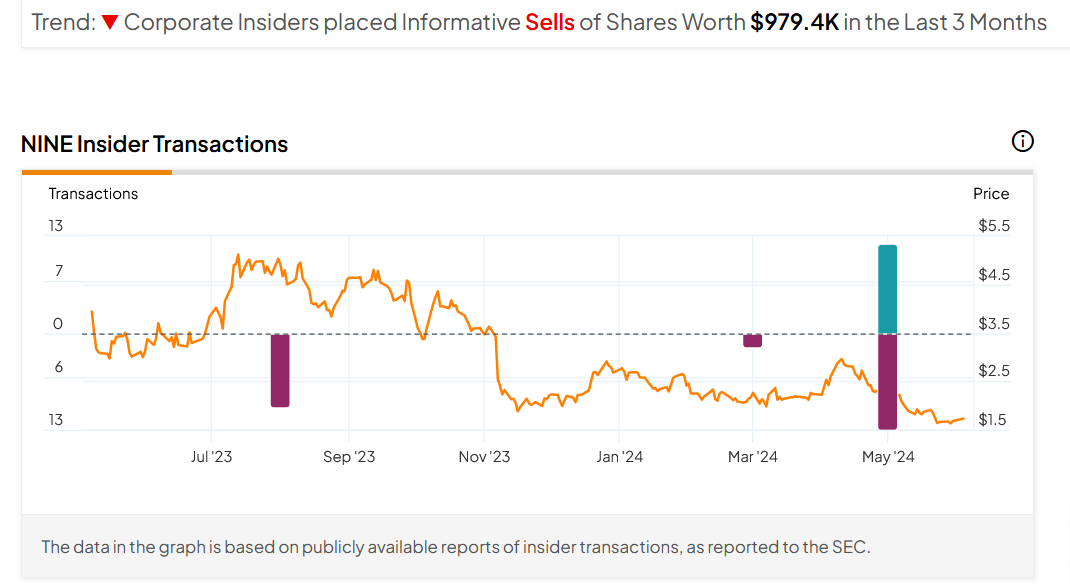

- Corporate Insiders placed Informative Sells of Shares Worth $979.4K in the Last 3 Months.

- NINE has substantial debt obligations. As of December 31, 2023, NINE had $300.0 million of 13.000% Senior Secured Notes due 2028 outstanding, and $57.0 million of borrowings under the ABL Credit Facility.

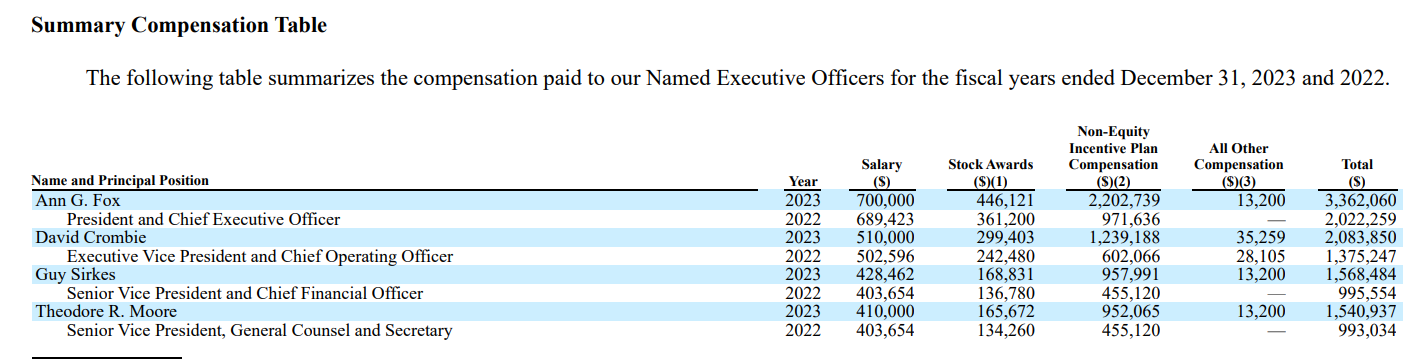

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company’s business is cyclical and depends on its customers’ willingness to make operating and capital expenditures to explore for, develop, and produce oil and natural gas, which, in turn, largely depends on prevailing industry and financial market conditions that are influenced by numerous factors.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: Trades of the Day