We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Comtech Telecommunications Corp. (NASDAQ: CMTL)

Today’s penny stock pick is the next-gen telecommunication solutions company, Comtech Telecommunications Corp. (NASDAQ: CMTL).

Comtech Telecommunications Corp. engages in the provision of next-gen telecommunication solutions in the United States and internationally. The company’s Satellite and Space Communications segment offers satellite ground station technologies, services and system integration that facilitates the transmission of voice, video, and data over GEO, MEO and LEO satellite constellations, including solid-state and traveling wave tube power amplifiers, modems, VSAT platforms, and frequency converters; and satellite communications and tracking antenna systems, including high precision full motion fixed and mobile X/Y tracking antennas, RF feeds, reflectors, and radomes.

This segment also provides over-the-horizon microwave troposcatter equipment that can transmit digitized voice, video, and data over distances up to 200 miles using the troposphere and diffraction, including the Comtech; and solid-state, RF microwave high-power amplifiers and control components designed for radar, electronic warfare, data link, medical and aviation applications, as well as engages in the procurement and supply chain management of electrical, electronic, and electromechanical parts for satellite, launch vehicle, and manned space applications.

Its Terrestrial and Wireless Networks segment offers next generation 911 solutions, which include emergency call routing, location validation, policy-based routing rules, logging, and security functionality; emergency services IP network transport infrastructure for emergency services communications and support; call handling applications for public safety answering points; wireless emergency alerts solutions for network operators; and software and equipment for location-based and text messaging services for various applications including for public safety, commercial, and government services.

Website: https://www.comtechtel.com

Latest 10-k report: https://d2ghdaxqb194v2.cloudfront.net/2718/192570.pdf

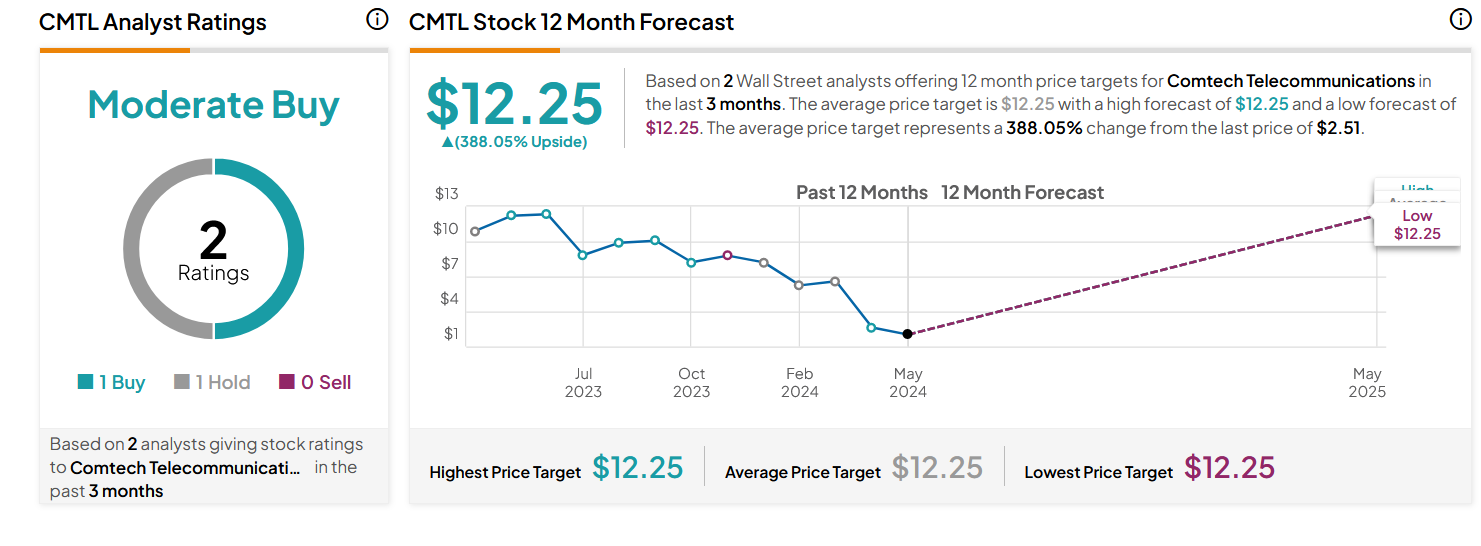

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for CMTL in the last 3 months, the stock has an average price target of $12.25, which is nearly 388% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- Private equity firms, White Hat Capital Partners LP and Magnetar Capital, recently invested $100 million to revamp and boost CMTL’s growth strategy and leadership transition plan.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#5 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart and is also moving higher from oversold levels, indicating possible bullishness.

#6 Bullish RSI: In the weekly chart, the RSI is moving higher from oversold levels. This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for CMTL is above the price of $2.60.

Target Prices: Our first target is $4.00. If it closes above that level, the second target price is $5.30.

Stop Loss: To limit risk, place a stop loss at $1.80. Note that the stop loss is on a closing basis.

Our target potential upside is 54% to 104%.

For a risk of $0.80, our first target reward is $1.40, and the second target reward is $2.70. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

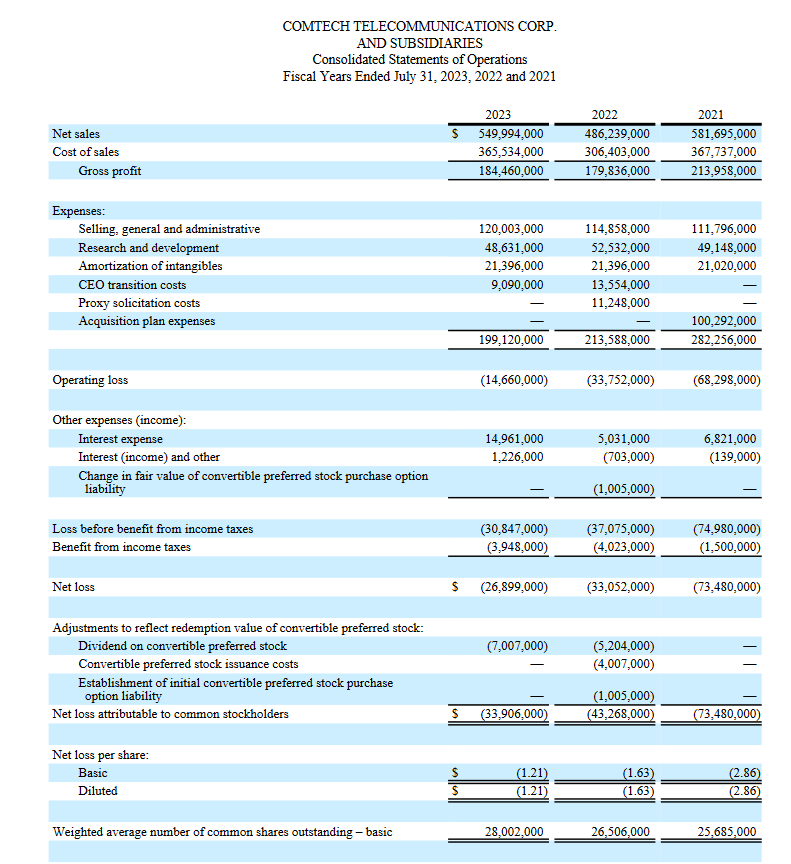

- The company has a history of net losses.

- During the fiscal years ended July 31, 2023, 2022, and 2021, sales to the U.S. government were $172.0 million, $132.6 million, and $201.1 million or 31.3%, 27.2% and 34.6% of the consolidated net sales, respectively. This makes the company’s business highly dependent on the budgetary decisions of government customers.

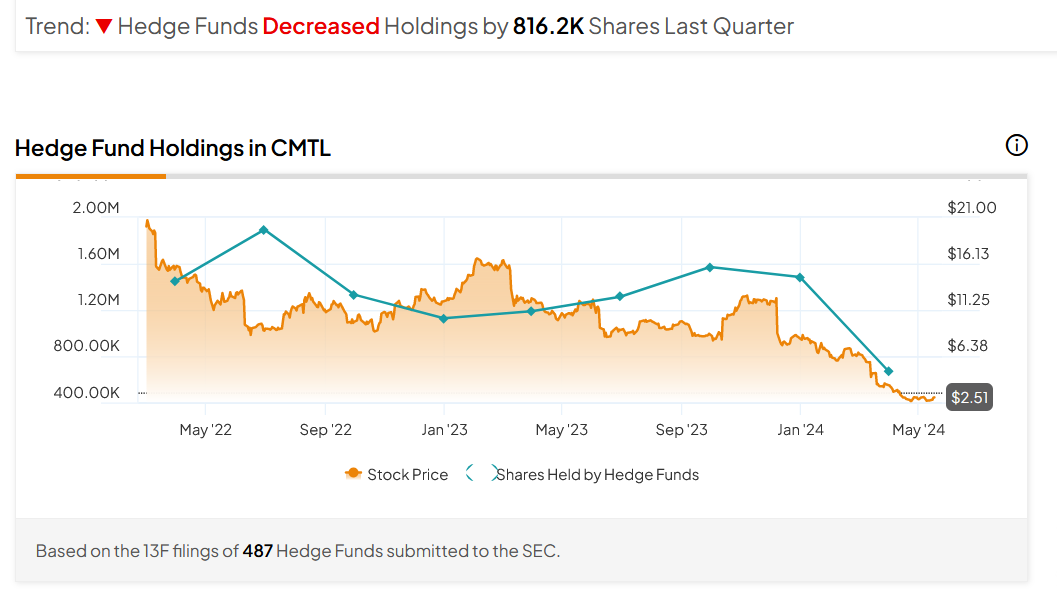

- Hedge Funds Decreased Holdings by 11.3M Shares Last Quarter.

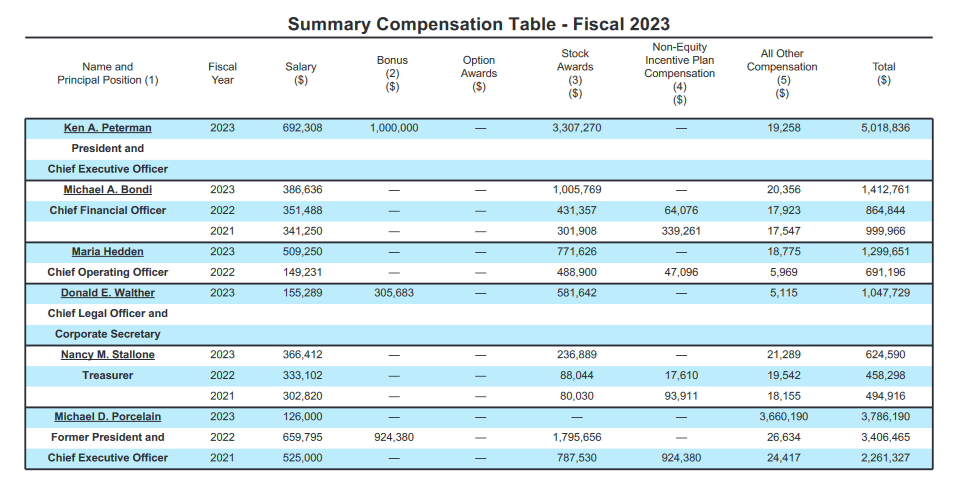

- Despite being a loss-making company, the executives are being paid significant compensation.

- For the quarter ended October 31, 2023, the company’s report contained a “going concern” qualification due to worries about Comtech’s continued compliance with its financial covenants. The Company further revealed it had drawn down most of its credit facility and was engaged in protracted negotiations to renew that facility, set to expire in October 2024.

- The company’s President & CEO Ken Peterman was recently dismissed for alleged ethics violations.

- The timing and circumstances of all these recent events have prompted prominent investors’ rights law firms to open an investigation into potential violations of the U.S. securities laws.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price. Get 25% off using Daily Trade Alert's special referral link and coupon code AFFILIATE25

Source: Trades of the Day