Zacks Rank #1 (Strong Buy) stock Nvidia (NVDA) is the global leader in visual computing technologies and the inventor of the graphic processing unit, or GPU. Though Nvidia has been growing for years due to revenue streams from PC graphics and gaming and virtual reality (VR) platforms, the company has experienced exploding, “hockey stick” like growth for its artificial intelligence (AI) solutions that support high-performance computing (HPC).

Revenue from Nvidia’s complex and powerful chips has lifted NVDA to a more than $2 trillion market cap and has solidified the company as the undisputed leader in the AI space, far ahead of semiconductor competitors like Intel (INTC) and Advanced Micro Devices (AMD).

Blackwell Platform is a Bullish Catalyst

Though Nvidia is already the dominant player in the AI space, visionary CEO Jensen Huang is not sitting back and enjoying the success. Instead, NVDA recently announced the Blackwell platform, “enabling organizations everywhere to build and run real-time generative AI on trillion-parameter large language models at up to 25x less cost and energy consumption than its predecessor.”

As mega-cap tech companies race to AI dominance, large language models like Open AI and Microsoft’s (MSFT) ChatGPT will require efficiency for two reasons. First, large language models like ChatGPT require GPUs to “train” their models. Presently, companies like OpenAI and Alphabet (GOOGL) are engaged in an AI arms race. Furthermore, by 2030 the data center share of electricity will be the equivalent of the electricity consumption of one-third of U.S. homes (which explains the recent bull trends in utility stocks like Vistra (VST).

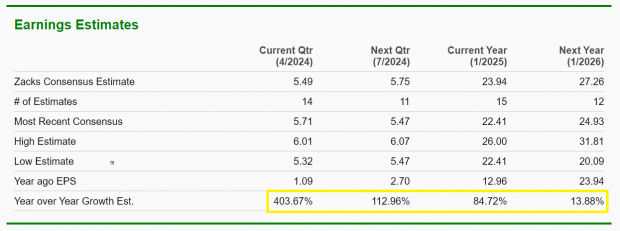

Explosive Growth Expected

Earnings, which have already been growing like a weed, are expected to increase by a triple-digit clip over the next two quarters and juicy 84.72% next year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Technical View

Price is the ultimate “tell” in investing because it represents real supply and demand. From this standpoint, Nvidia is bullish for two reasons:

Relative Strength: While some AI-related stocks like Arm Holdings (ARM) and Super Micro Computer (SMCI) are well off their 52-week highs, NVDA is suffering a mild correction and is within 10% of its all-time high – a sign of relative strength.

Shakeout + Regain of 10-week MA: If investing were easy, everybody would be rich. Every so often stocks need to “shake the tree” and get rid of “weak hands” before resuming higher. NVDA plunged nearly 10% in mid-May before ripping back above the 10-week moving average (a level that has contained most of the stock’s multiyear move.

Image Source: TradingView

Image Source: TradingView

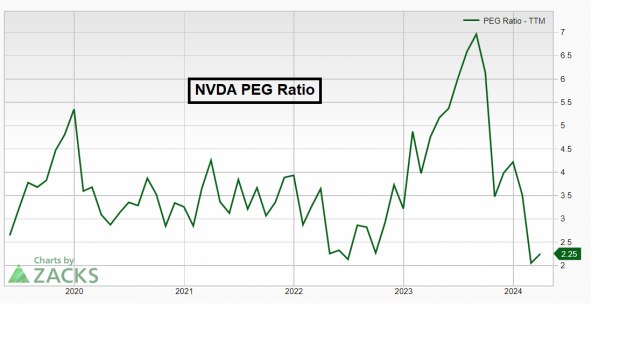

Valuation is Still Cheap

Amateur investors often make the mistake of conflating an appreciating stock price with a company being “overvalued.” However, NVDA’s Price-to-Earnings Growth (PEG) ratio is near a multiyear low and remains cheap.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

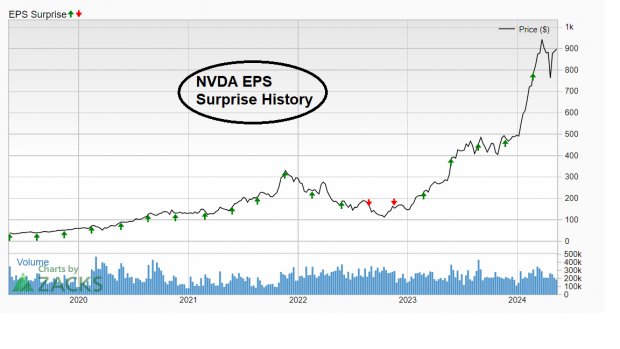

Earnings ESP + Zacks Rank #1

Our extensive, in-house back test shows that stocks that sport a Zacks Rank #3 or better and have a positive Earnings Surprise Prediction (ESP) score tend to beat earnings and outperform. Furthermore, while Wall Street is bullish on the stock, NVDA has beaten consensus estimates in 18 of the past 20 quarters.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Cloud Demand

Data center demand is not only due to AI, but also to cloud growth. Companies like Amazon (AMZN), Meta Platforms, and Baidu (BIDU) are all investing billions in expanding their cloud presence.

EV Opportunities

As automakers strive for autonomous vehicles, Nvidia stands to benefit. The company is working with more than 320 automakers, suppliers, and automotive research institutions to develop AI systems for self-driving vehicles.

Bottom Line

Data center and AI growth, top-tier fundamentals, and new product offerings are just a few reasons to own Nvidia, the true market leader.

— Andrew Rocco

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks