We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Upland Software, Inc. (NASDAQ: UPLD)

Today’s penny stock pick is the cloud-based software applications company, Upland Software, Inc. (NASDAQ: UPLD).

Upland Software, Inc. together with its subsidiaries, provides cloud-based software applications under the Upland brand name in the United States, the United Kingdom, Canada, and internationally. It offers software applications that enable organizations to plan, manage and execute projects, and work in the areas of marketing, sales, contact center, knowledge management, project management, information technology, business operations, human resources, and legal.

The company also provides professional services, such as implementation, data extraction, integration and configuration, and training services, as well as customer support services. It serves corporations, government agencies, and small and medium-sized businesses in the financial, consulting, technology, manufacturing, media, telecommunication, insurance, non-profit healthcare, life sciences, retail, and hospitality sectors. The company was formerly known as Silverback Enterprise Group, Inc. and changed its name to Upland Software, Inc. in November 2013.

Website: https://uplandsoftware.com/

Latest 10-k report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001505155/39de574c-0555-44a9-a4a2-44d6e5e4e17f.pdf

Analyst Consensus: As per TipRanks Analytics, based on 4 Wall Street analysts offering 12-month price targets for UPLD in the last 3 months, the stock has an average price target of $7.00, which is nearly 119.4% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company reported encouraging results for the first quarter of 2024, beating EPS and revenue estimates.

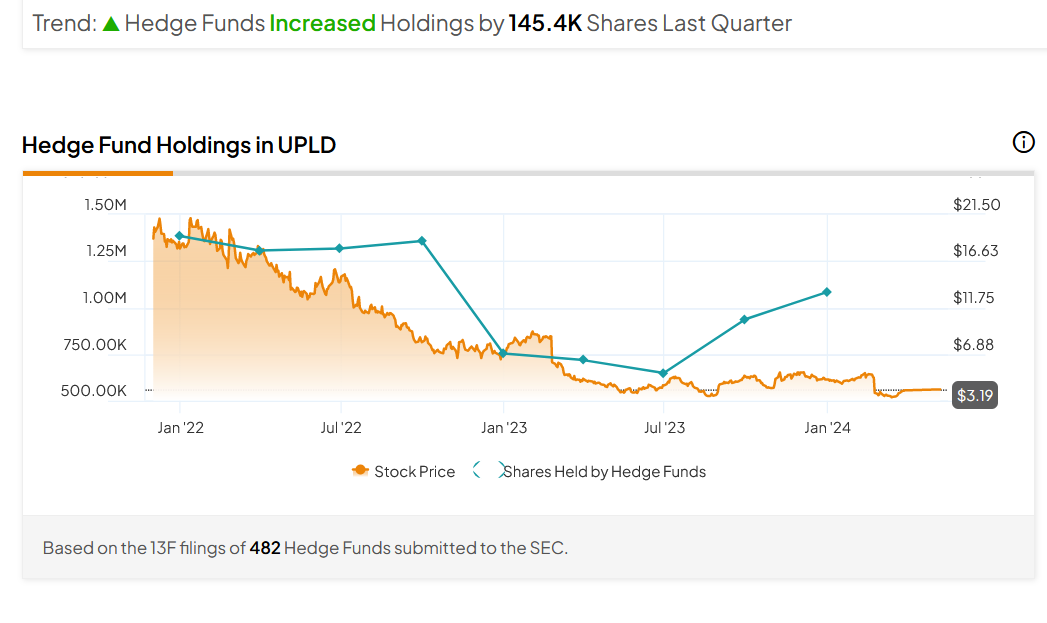

- Hedge Funds Increased Holdings by 145.4K Shares Last Quarter.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart and is also moving higher from oversold levels, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for UPLD is above the price of $3.35.

Target Prices: Our first target is $4.30. If it closes above that level, the second target price is $5.00.

Stop Loss: To limit risk, place a stop loss at $2.80. Note that the stop loss is on a closing basis.

Our target potential upside is 28% to 49%.

For a risk of $0.55, our first target reward is $0.95, and the second target reward is $1.65. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

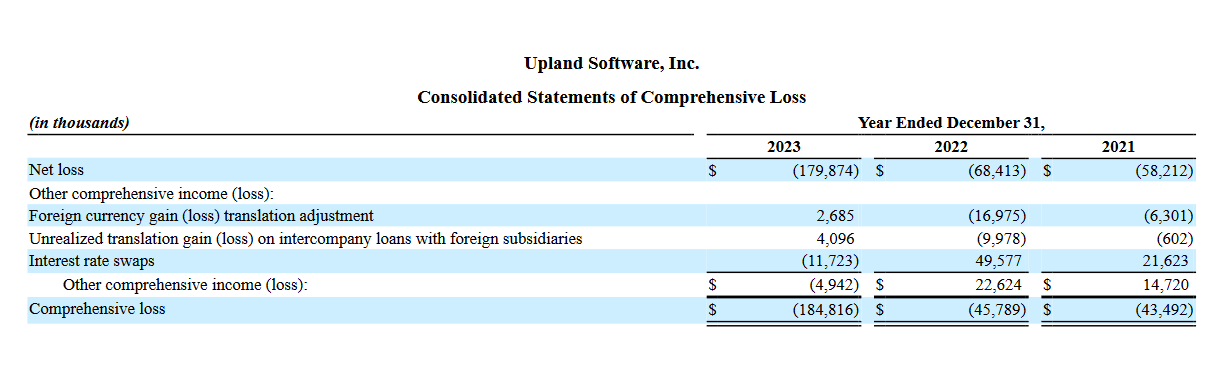

- The company has a history of net losses.

- The company faces significant competition. Many of its competitors and potential competitors are larger and have greater brand name recognition, longer operating histories, larger marketing budgets, and significantly greater resources. The market for software is also rapidly evolving and subject to changing technology.

- UPLD has variable rate indebtedness, subjecting it to interest rate risk, which could cause debt service obligations and interest expense to increase significantly. As of December 31, 2023, the company’s total outstanding indebtedness under Credit Facility was $482.1 million.

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price. Get 25% off using Daily Trade Alert's special referral link and coupon code AFFILIATE25

Source: Trades of the Day