Investing over the long term is as much about avoiding wrong as it is doing right.

But how do we avoid wrong?

Well, repeatedly investing in terrible businesses is a great way to go wrong.

Paying far too much for equity is another way to go wrong.

If one can simply avoid doing these two things, they’ve gone a long way toward avoiding wrong.

This is why I’m such a fan of dividend growth investing.

This strategy advocates buying and holding shares in high-quality businesses that pay safe and growing dividends.

It almost automatically funnels an investor right into great businesses.

By extension, one tends to avoid the terrible businesses.

You can see what I mean by looking over the Dividend Champions, Contenders, and Challengers list.

This is a list that has compiled invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

You’ll notice a lot of great businesses on this list.

You’ll notice a lot of great businesses on this list.

And that makes sense.

After all, it takes a special kind of business to be able to afford to pay out ever-larger cash dividends to shareholders, year in and year out.

I’ve been using this strategy for myself for more than a decade now.

It’s guided me as I’ve gone about building the FIRE Fund.

That’s my real-life, real-money portfolio.

It generates enough five-figure passive dividend income for me to live off of.

I’ve actually been in the very fortunate position of being able to live off of dividends since I quit my day job and retired in my early 30s.

My Early Retirement Blueprint explains how I was able to accomplish that.

My Early Retirement Blueprint explains how I was able to accomplish that.

Now, much of my success came down to investing in the right businesses.

But that’s not all.

It was also about investing at the right valuations.

Whereas price is what you pay, value is what you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Buying high-quality dividend growth stocks when they’re undervalued allows one to, by extension, avoid overpriced low-quality stocks.

Of course, all of that requires one to first have some kind of familiarity around how to value businesses.

Well, that’s where Lesson 11: Valuation comes in.

Part of an overarching series of “lessons” on dividend growth investing, it was penned by fellow contributor Dave Van Knapp in order to help familiarize investors with the basic ins and outs of how to go about estimating the fair value of just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

D.R. Horton, Inc. (DHI)

D.R. Horton, Inc. (DHI)

D.R. Horton, Inc. (DHI) is an American home construction company.

Founded in 1978, D.R. Horton is now a $47 billion (by market cap) homebuilding major that employs over 13,000 people.

By volume, D.R. Horton is the largest homebuilder in the United States.

The company operates in 119 different markets across 33 states.

D.R. Horton has three key tailwinds working in its favor.

First, there’s a structural imbalance between supply and demand.

It’s been estimated that the US has a supply deficit of somewhere around six million homes.

For many years, and for many reasons, annual US home production has been consistently short of what’s necessary to meet demand.

This cumulative deficit, which has been years in the making, is now massive.

Even if new home construction suddenly starts to pick up in a meaningful way, it’ll take many years of overproduction just to close the existing gap – before factoring in the growing demand from new household formation.

However, issues such as red tape and labor shortages continue to weigh on production capacity.

Second, D.R. Horton has scale in an industry where scale is important.

Building homes is extremely capital intensive – requiring massive upfront investments – and D.R. Horton’s status as the “800-pound gorilla” in its industry gives it the financial wherewithal to thrive during the good times and survive the bad times.

Because the capital requirements are so high, it’s difficult for new entrants to come in and compete.

Third, D.R. Horton is catering to the most active area of the US housing market.

The company focuses on the first-time buyers who prioritize affordability and value.

Approximately 70% of its homes close at under $400,000.

This is the area of the market where the largest imbalance between supply and demand can be found, as there’s a constant stream of young adults forming households and trying to buy single-family homes at affordable price points.

D.R. Horton’s stock has had a breathtaking move since its bottoming during the aftermath of the GFC.

The stock is up by more than 500% over the last decade alone, supported by rapid growth and improving fundamentals across the business.

With the three tailwinds I just outlined blowing D.R. Horton’s way, I see no reason why the next decade can’t also be extremely successful – but we are starting from a higher and healthier base on the stock and business.

Maybe 500%+ doesn’t come to pass, but highly satisfactory performance appears poised to occur.

A combination of scale, structural supply shortages, and targeted construction all bode well for D.R. Horton and its shareholders over the long term.

With that, aggressive revenue, profit, and dividend growth should transpire over the coming years.

Dividend Growth, Growth Rate, Payout Ratio and Yield

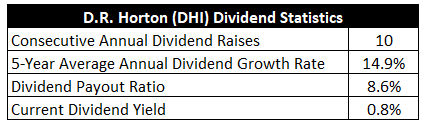

To date, D.R. Horton has increased its dividend for 10 consecutive years.

In my view, this company is just getting started here.

But what a start it’s off to, with a five-year dividend growth rate of 14.9%.

As strong as that growth rate is, it’s actually been accelerating.

As strong as that growth rate is, it’s actually been accelerating.

Indeed, D.R. Horton recently increased its dividend by 20%.

That kind of growth rate really gets compounding moving.

And the stock even offers a respectable yield of 0.8%.

This yield is close to its own five-year average.

Again, it’s a respectable yield, not a particularly high one.

This is really more of a high-quality compounder than an income play – a 500%+ rise over the last 10 years just goes to show what a compounder it is.

I don’t know about you, but I’d gladly take a 500% 10-year gain over an extra 3% (or whatever) in yield per year.

With a payout ratio of only 8.6%, the company has plenty of room for more dividend growth and compounding over the coming years.

For dividend growth investors who gravitate toward high-quality compounders, this stock’s growth profile should be taken very seriously.

Revenue and Earnings Growth

As seriously as these numbers should be taken, though, many of them are looking at what’s already transpired in the past.

However, investors must always be thinking about what may come to pass in the future, as the capital of today is risked for the rewards of tomorrow.

As such, I’ll now build out a forward-looking growth trajectory for the business, which will be highly useful when later attempting to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Amalgamating the proven past with a future forecast in this manner should give us enough information to roughly gauge where the business could be going from here.

D.R. Horton advanced its revenue from $8 billion in FY 2014 to $35.5 billion in FY 2023.

That’s a compound annual growth rate of 18%.

Truly remarkable top-line growth here.

This is up there with some of the best businesses in the whole world.

Meanwhile, earnings per share grew from $1.50 to $13.82 over this period, which is a CAGR of 28%.

Special, special stuff from D.R. Horton.

Homebuilders have had to overcome negativity around the cyclicality and capital-intensive nature of the industry, but I think D.R. Horton is doing an amazing job of stating its case with these results.

It’s hard to overstate just how impressive this is.

A combination of buybacks and margin expansion helped to drive excess bottom-line growth.

For perspective on the former point, the outstanding share count was reduced by almost 7% over this 10-year stretch.

Looking forward, CFRA believes that D.R. Horton will compound its EPS at an annual rate of 9% over the next three years.

Notably, this is up from the 5% number CFRA had pinned down the last time I analyzed D.R. Horton (back in September 2023).

So CFRA is starting to come around.

But I still think CFRA is not doing full justice to this business’s potential.

D.R. Horton has a backlog of $7 billion – before factoring in the new work that continues to flow in.

There’s really no demand end in sight.

And much of this stems from a supply-constrained housing market that’s suffered from years of not building enough homes (not necessarily a fault of D.R. Horton or other industry players).

Speaking of this, I’d like to point something out: Even with not building enough homes, D.R. Horton still put up remarkable growth.

It’s almost like the business had one arm tied behind its back while it compounded at nearly 30% per year.

It’s quite amazing.

Also, D.R. Horton is about as “vertically integrated” as it gets for a homebuilder.

Forestar Group Inc. (FOR), a publicly-traded residential lot development company, is a majority-owned subsidiary of D.R. Horton.

So D.R. Horton can acquire and develop its own lots.

In addition, D.R. Horton owns its own title agency and provides financing directly to buyers.

From lot development to the sale of a finished product, it’s a one-stop shop.

I’m inclined to believe that D.R. Horton will grow its EPS at a rate that exceeds 9% over the next few years.

Supporting this view is the fact that the company’s most recent quarter, Q2 FY 2024, showed 29% YOY EPS growth.

If we can assume just mid-teens EPS growth over the near term (roughly splitting the difference between where CFRA is at and where D.R. Horton’s actual results have been coming in at), that still puts forth an easy case for high-teens (or better) dividend growth.

That makes the most recent dividend raise of 20% a pretty decent base case on a go-forward basis.

In sum, it look like more of the status quo.

And the status quo has been very, very good.

Financial Position

Moving over to the balance sheet, D.R. Horton has a stellar financial position.

The long-term debt/equity ratio is only 0.2.

The ~$5 billion in long-term debt that D.R. Horton ended FY 2023 with is relatively immaterial for a company with a market cap nearing $50 billion.

Moreover, D.R. Horton ended FY 2023 with a cash balance that offset more than half of L-T debt.

There are no debt maturities in 2024.

Profitability is outstanding.

Return on equity has averaged 25.5% over the last five years, while net margin has averaged 13.4%.

Pretty amazing to see a homebuilder putting up tech-like growth and returns on capital.

This is a terrific business.

And with economies of scale, barriers to entry, leading market share, vertical integration, and industry know-how, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

The housing industry is notoriously cyclical and sensitive to overall economic trends, although the severe dearth of housing supply in the US offers a shock absorber to these concerns.

There is direct exposure to interest rates, as interest rates affect demand for mortgages and housing.

Building homes is a capital-intensive activity, and D.R. Horton must continuously manage its inventory properly.

Input costs are a serious consideration, and inflation is causing upward pressure on these costs.

D.R. Horton’s catering to first-time, entry-level homebuyers makes the business especially sensitive to overall economic health (since those on the lower end of the socioeconomic strata are more financially fragile).

Labor has recently been tight in the US, and any labor shortages could severely curtail production.

I see considerable risks, but D.R. Horton has deftly managed through them.

And with the valuation being as low as it is, a lot of risk is being priced in…

Valuation

The P/E ratio is a lowly 9.9.

This is a company with tech-like growth being valued like a tobacco company in secular decline.

It’s quite strange.

The sales multiple of 1.3 gives further evidence of just how little the market seems to think of D.R. Horton.

And the yield, as noted earlier, is close to its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis.

I factored in a 10% discount rate, a 10-year dividend growth rate of 18%, and a long-term dividend growth rate of 8%.

This is an aggressive model, and it’s one that I tend to reserve for businesses that are showing rare levels of growth and quality.

But I’m bringing out the big guns here.

D.R. Horton has been consistently compounding its EPS at 20%+ per year, even recently.

The last dividend raise was 20%.

And I see nothing to indicate why this tech-like growth will suddenly come to a halt, outside of some severe recession.

After all, the structural undersupply of US housing, which has worked to D.R. Horton’s advantage for the past decade, is still present and showing no signs of being fixed in the near term.

This isn’t just a multiyear problem; otherwise, it would have been fixed by now.

No, this is a multidecade issue, and D.R. Horton, being the biggest player in this field, should do quite well by providing the new supply that’s so badly needed.

Keep in mind, D.R. Horton’s payout ratio is under 10%, so even HSD EPS growth could sustain high-teens dividend growth for quite a while.

I noted earlier that the most recent dividend raise of 20% was actually a pretty good level for the near-term base case, but I’m dialing it back just a bit with the expectations here.

The DDM analysis gives me a fair value of $148.77.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

What I see is a wonderful business being priced at least fairly, if not better, and I’m always okay to pay a fair price for a wonderful business.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates DHI as a 3-star stock, with a fair value estimate of $140.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates DHI as a 4-star “BUY”, with a 12-month target price of $171.00.

I’m somewhere in the middle here. Averaging the three numbers out gives us a final valuation of $153.26, which would indicate the stock is possibly 5% undervalued.

Bottom line: D.R. Horton, Inc. (DHI) is a high-quality business putting up world-class growth and returns on capital. The structural imbalance between US housing supply and demand should work to the company’s favor for many years to come. With a respectable yield, an extremely low payout ratio, double-digit dividend growth, 10 consecutive years of dividend increases, and the potential that shares are 5% undervalued, this looks like a wonderful business with a better-than-fair price for long-term dividend growth investors to consider.

Bottom line: D.R. Horton, Inc. (DHI) is a high-quality business putting up world-class growth and returns on capital. The structural imbalance between US housing supply and demand should work to the company’s favor for many years to come. With a respectable yield, an extremely low payout ratio, double-digit dividend growth, 10 consecutive years of dividend increases, and the potential that shares are 5% undervalued, this looks like a wonderful business with a better-than-fair price for long-term dividend growth investors to consider.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is DHI’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 85. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, DHI’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income

Disclosure: I’m long DHI.