Intrinsic Value

In today’s video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation is going to look at how to calculate the intrinsic value of a common stock and why it is so important to long-term investing success.

Every investor in common stocks is faced with the challenge of knowing when to buy, sell or hold a common stock. This challenge will be approached differently by a true investor than it would by a speculator. This video will be focused on assisting true investors who are desirous of a sound and reliable method that they could trust and implement when attempting to make these important buy, sell or hold investing decisions.

It logically follows that true investing requires a diligent focus and comprehensive understanding of the true worth of any business under consideration.

It logically follows that true investing requires a diligent focus and comprehensive understanding of the true worth of any business under consideration.

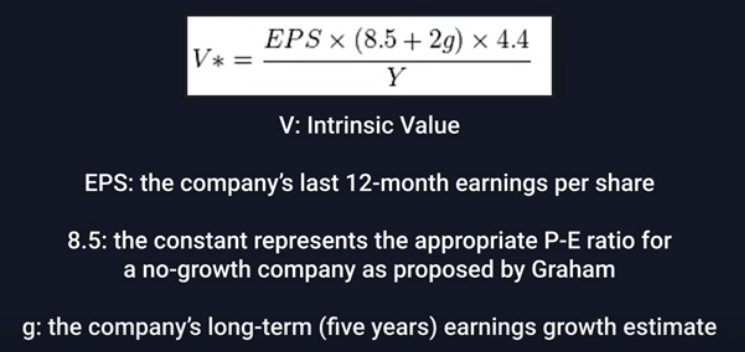

We can call it intrinsic value, fundamental value, either fair value or true worth, it really doesn’t matter. What matters is that we are making sound and safe investing decisions that are based on reasonable fundamental values, and that, therefore, we will be able to fully participate in any of the stocks that we invest in.

In this video Chuck will go over General Mills Inc (GIS), American Electric Power Co (AEP), Spire Inc (SR), Conagra Brands Inc (CAG), Cencora Inc (COR), Amdocs Ltd (DOX), Elevance Health Inc (ELV)

— Chuck Carnevale

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: FAST Graphs