As one of the stock market’s best performers this year, Dell Technologies (DELL) shares have been boosted by implementing AI into its most sought-after IT solutions.

With its stock coveting a Zacks Rank #1 (Strong Buy) and landing the Bull of the Day, Dell’s expanding integrated PC solutions make now an ideal time to invest. To that point, Dell’s growth and streak of beating earnings expectations have fueled an impressive year-to-date rally that could certainly continue.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

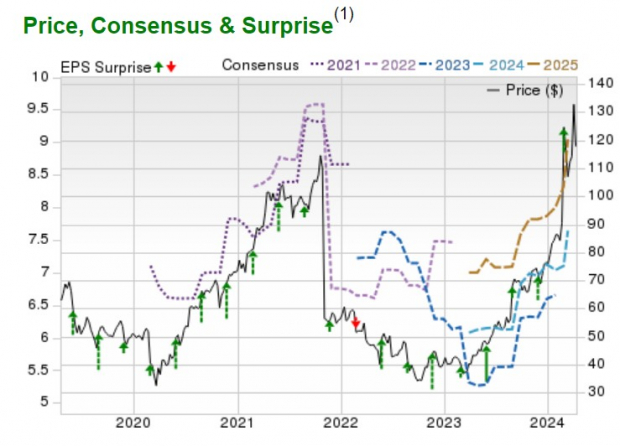

Defying Expectations

As alluded to by the green arrows in the price, consensus, and surprise chart, Dell has now surpassed earnings expectations for eight consecutive quarters. Most recently, Dell crushed its fourth quarter earnings expectations by 27% in late February with Q4 EPS at $2.20 compared to estimates of $1.73 a share. Even better, Dell has posted an average earnings surprise of 39.9% in its last four quarterly reports.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

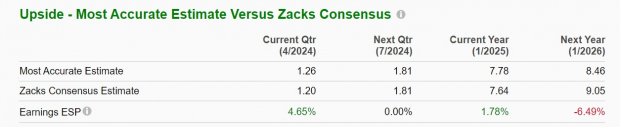

Furthermore, the Zacks ESP (Expected Surprise Prediction) indicates Dell could continue this impressive streak when the company reports its Q1 results on May 30. In this regard, the Most Accurate Estimate for Dell’s Q1 EPS is currently pegged at $1.26 which is 4% above the Zacks Consensus of $1.20 a share.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

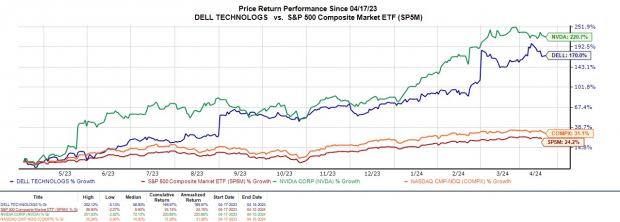

The Nvidia Boost

Dell’s improved probability has been fueled by its collaboration with Nvidia (NVDA), which has helped the company expand outside of its renowned hardware offerings as a leading provider of PCs and desktop monitors.

Backed by Nvidia’s AI chips, Dell has extended its presence among IT solutions for both traditional and multi-could environments with their “Project Helix” venture offering cutting-edge computing platforms for AI workloads. Notably, the PowerEdge XE9680 is Dell’s flagship eight-way GPU-accelerated server for generative AI training, model customization, and large-scale AI inferencing which supports various chips from Nvidia including the H100 Tensor Core, H100 HGX, and the much-anticipated Blackwell GPUs.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

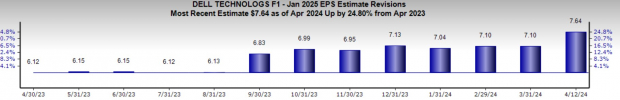

P/E Valuation & EPS Growth

While Dell’s stock has soared +55% YTD and is now up +170% over the last year, the revived tech giant’s valuation alludes to even more upside. Trading around $118, DELL trades at a 15.4X forward earnings multiple which is still a pleasant discount to the Zacks Computers-IT Services Industry average of 24.4X and the S&P 500’s 21.6X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Plus, Dell’s EPS is now expected to rise 7% in its current fiscal 2025 to $7.64 per share with earnings estimate revisions trending 25% higher in the last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

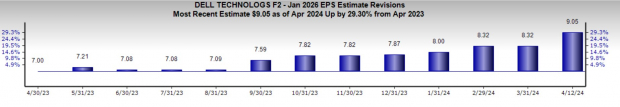

More intriguing, FY26 EPS is projected to expand another 18% to $9.05 per share and earnings estimate revisions have now trended 29% higher from a year ago.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

The trend of upward earnings estimate revisions remains compelling for Dell Technologies stock and in addition to its strong buy rating DELL has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks