We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: HUB Cyber Security Ltd. (NASDAQ: HUBC)

Today’s penny stock pick is the cyber security solutions company, HUB Cyber Security Ltd. (NASDAQ: HUBC).

HUB Cyber Security Ltd. provides cyber security solutions in Israel and internationally. The company offers HUB Secure File Vault, a super charged managed file transfer backed by dedicated hardware driven security, which creates a secure enclave to protect the organization’s data driven workflows; HUB Guard, a recurring security assessment, continuous network, and infrastructure monitoring and analysis, and planned incident response; D.Storm, a powerful SaaS DDoS simulation platform; RAM Commander, a software tool for reliability prediction and analysis, reliability block diagram, Markov chains analysis, maintainability prediction, spares optimization, FMEA/FMECA, testability, fault tree analysis, event tree analysis, and safety assessment; and Safety Commander designs to evaluate the safety of highly integrated systems in a model-based design environment.

It also provides complementary trusted advisory and professional services facilitating cyber risk assessment, cyber risk mitigation, cyber incident response, quality reliability, and safety of critical systems.

Website: https://hubsecurity.com/

Latest 10-k report: https://investors.hubsecurity.com/static-files/53fbeb3a-b21a-469f-8898-3d6c1a9107f2

Analyst Consensus: Not Covered By Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- Earlier this month, the company secured $8 million in debt to supercharge its global growth.

- Rumors of an upcoming high-value contract.

- The company had completed its acquisition of QPoint Technologies, which provides its solutions to companies to Rafael Advanced Defense Systems, the developer of the Iron Dome system. HUBC stock is also likely rising because of the recent attack by Iran, against which the Iron Dome worked well.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 Bullish RSI: In the weekly chart, the RSI is currently nearing 50 and moving higher. This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for HUBC is above the price of $2.10.

Target Prices: Our first target is $3.00. If it closes above that level, the second target price is $4.50.

Stop Loss: To limit risk, place a stop loss at $1.40. Note that the stop loss is on a closing basis.

Our target potential upside is 57% to 114%.

For a risk of $0.70, our first target reward is $1.20, and the second target reward is $2.40. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

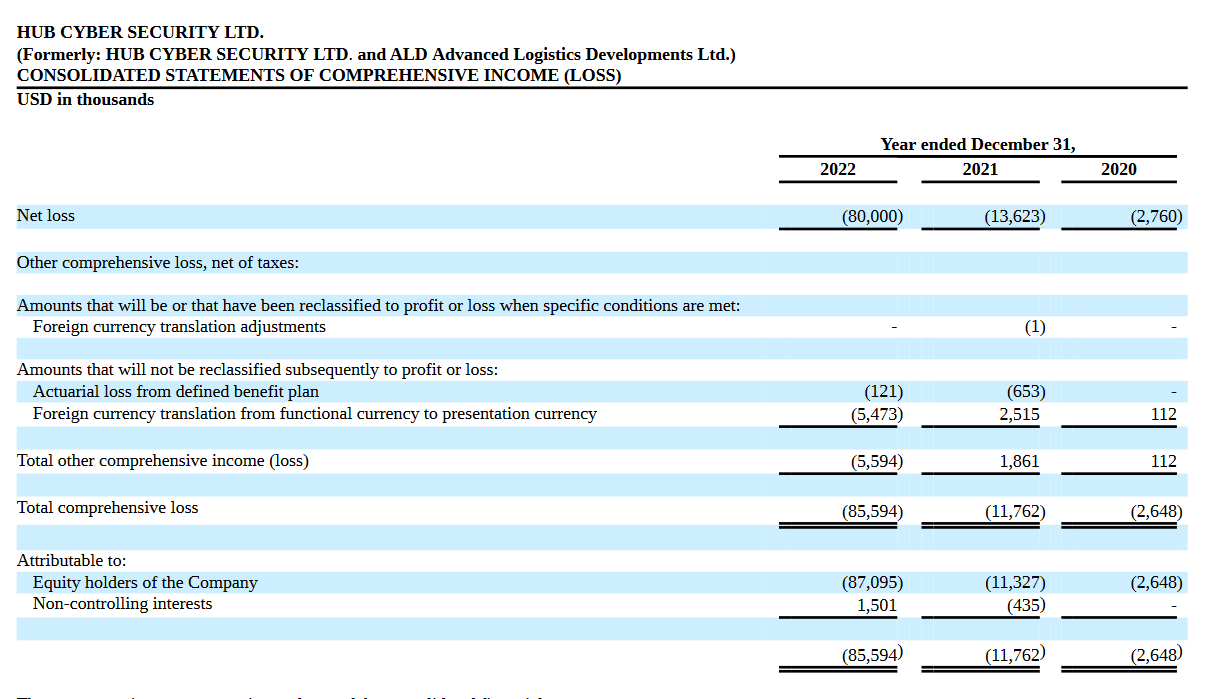

- The company has a history of net losses. HUBC incurred net losses in each year since its inception, including net losses of $80,000 thousand and $13,623 thousand in the years ended December 31, 2022, and 2021, respectively.

- HUBC has ongoing legal and arbitration proceedings which include Insurance reimbursement claim; Contract Tender Litigation; Request for disclosure of documents according to section 198a of the Companies Law; PIPE Financing Litigation; Oppenheimer Suit; Employee Claims; and class action lawsuits alleging violation of Section 12(a)(2) of the Securities Act, and under Sections 11, 12(a)(2), and 15 of the Securities Act, and Sections 10(b) and 20(a) of the Exchange Act.

- One of the major investors, Dominion Holdings recently sold 390,672 shares of HUBC stock.

- On April 20, 2023, the company’s board of directors appointed a Special Committee of Independent Directors to oversee an internal investigation in order to review certain allegations of misappropriation of Company funds and other potential fraudulent actions regarding the use of Company funds by a former senior officer of the Company. The reported material weaknesses in internal control over financial reporting, subjecting the company to additional litigation and regulatory examinations, investigations, proceedings, or court orders, including additional cease and desist orders, the suspension of trading of securities, delisting of securities, the assessment of civil monetary penalties, and other equitable remedies.

- On May 19, 2023, HUBC received a notification letter from the Listing Qualifications Department of Nasdaq stating that the company was not in compliance with the requirements of Nasdaq Listing Rule 5250(c)(1) as a result of not having timely filed its Annual Report with the SEC.

- On June 9, 2023, the company received a deficiency notice from Nasdaq informing that HUBC’s ordinary shares had failed to comply with the $1.00 minimum bid price required for continued listing under Nasdaq Listing Rule 5450(a)(1) (the “Minimum Bid Price Requirement”).

- Approximately 0.89% of the company’s stock is owned by Institutional Investors, 0.00% is owned by Insiders and 99.11% is owned by Public Companies and Individual Investors. The lack of insider ownership is typically considered as a lack of confidence in the company.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: Trades of the Day