The following is an excerpt from an article that originally appeared on Dividends & Income Select, a premium Investing Group service on Seeking Alpha. Dividends & Income Select is for investors focused on dividends, income, and growth. To learn more, take a 14-day free trial here.

Today I’m going to give an update on February’s “Option Income Trade Alert.” There’s a good lesson to be had here.

Before we get started, in case you’re not familiar, for this monthly series, exclusive to Dividends & Income Select members, I make a relatively safe, high-income play on a dividend growth stock or fund that’s trading at an attractive price.

Most of the time, I’ll make the option trade on a security that’s been recently featured by one of our resident DGI analysts—Dave Van Knapp, Mike Nadel or Jason Fieber.

From time-to-time though, I’ll make a trade on an idea shared by an “outside” analyst I follow, like Brian Bollinger of Simply Safe Dividends or Chuck Carnevale of FAST Graphs.

At the end of the day, this series is focused on selling options for income on high-quality dividend growth securities that are reasonably priced at current levels.

With this in mind, let’s review what happened with my February trade…

Update on My Option Income Trade for February

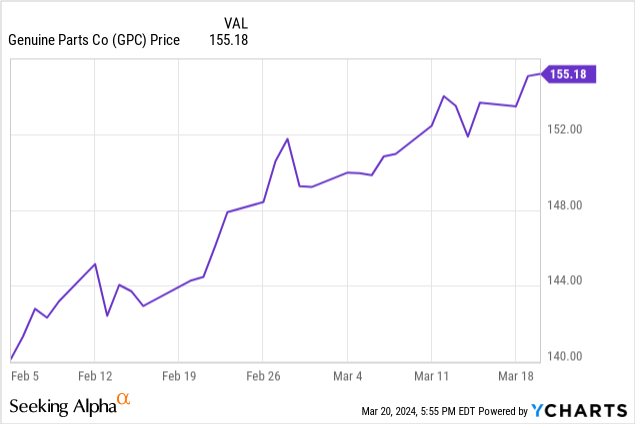

For my February 2024 trade, I had sold a cash-secured put option on Genuine Parts Company (GPC). At the time I placed my trade on February 5, GPC looked undervalued and was selling for $140.41 per share. The February 16, 2024 $140 put options were going for $3.10 per share, and I sold one of these options. This trade generated $310 in instant income, which was instantly added to my 401k retirement account at Fidelity.

Since making the trade, GPC has pretty much gone straight up…

Since the price of GPC stayed above $140 by February 16, the expiration date of my option contract, the contract expired “worthless” and I was not obligated to buy any shares of GPC. I walked away with the $310 and no further obligation.

While this was a winning trade, it’s also the perfect example of one of the risks of selling put options like I do, and it illustrates one of the psychological barriers you need to be able to overcome if you’re going to participate in selling options the way I do.

You see, instead of selling the put option like I did on February 5, what if I had simply bought 100 shares of GPC at their $140.41 per share market value? I had that opportunity. Today, with the stock trading at $155.18, I’d be up 10.5%. If I cashed out today and sold those 100 shares I could be netting $1,477 in 43 days. Compare that to the $310 in cash I generated in 11 days by selling the put option. I’m sure many people would prefer the $1,477 even though it would have taken nearly four times as long to generate the gain.

But here’s the thing: no one could have known that GPC was going to rise 10.5%. When selling options for income, I’m pretty conservative, and I typically consider a bird in the hand to be worth two in the bush. In other words, for this particular scenario, I was content generating a guaranteed $310 in cash by selling the put option vs. potentially generating more money from an unknown capital gain that may or may not happen if I were to buy shares at the market price and hold them. I hope that makes sense.

Either way, I just want to emphasize that what happened with this GPC trade was a perfect illustration of the upside potential that we give up when we sell put options like this. And the psychological barrier you need to get over is you’ve got to be OK with these kinds of outcomes when they happen.

At the end of the day, this trade closed out a winner. We walked away with $310 in cash income in just 11 days, which is the equivalent of a 73.5% annualized yield. It’s hard to be bitter about those results!

Greg Patrick

P.S. Just days ago, I made my Option Income Trade Alert for March 2024. It’s a safe, high-income play on a high-quality dividend growth stock that looks significantly undervalued right now. The trade generated $190 in “instant income” for selling the call options, and sets me up for an additional $134 from cash dividends. The trade is poised to generate annualized yields ranging from 23.5% to 41.3%. If you’d like to follow along with this trade and get all the details, check out Dividends & Income Select with our 14-day free trial.