We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: BlackBerry Limited (NYSE: BB)

Today’s penny stock pick is the intelligent security software and services company, BlackBerry Limited (NYSE: BB).

BlackBerry Limited provides intelligent security software and services to enterprises and governments worldwide. The company operates through three segments: Cybersecurity, IoT, and Licensing and Other.

The company offers CylancePROTECT, an endpoint protection platform and mobile threat defense solution; CylanceOPTICS, an endpoint detection and response solution; CylanceGUARD, a managed detection and response solution; CylanceGATEWAY, an AI-empowered zero-trust network access solution; CylancePERSONA, a user and entity behavior analytics solution; BlackBerry unified endpoint management, a central software component for secure communications platform; BlackBerry Dynamics, a development platform and secure container for mobile applications; and BlackBerry Workspaces solutions.

It also provides BlackBerry SecuSUITE, a multi-OS voice and text messaging solution; BlackBerry AtHoc and BlackBerry Alert, which are secure and networked critical event management solutions; BlackBerry QNX that offers real-time operating systems, hypervisors, middleware, development tools, and professional services; BlackBerry Certicom, a cryptography and key management product; BlackBerry Radar, an asset monitoring solution; and BlackBerry IVY, an intelligent vehicle data platform.

In addition, the company is involved in the patent licensing and legacy service access fees business. The company has a partnership with Stellar Cyber Inc. to deliver Open XDR for comprehensive threat detection and response. The company was formerly known as Research In Motion Limited and changed its name to BlackBerry Limited in July 2013.

Website: https://www.blackberry.com

Latest 10-k report: https://otp.tools.investis.com/clients/us/blackberry_inc/SEC/sec-show.aspx?Type=html&FilingId=16535452&CIK=0001070235&Index=10000

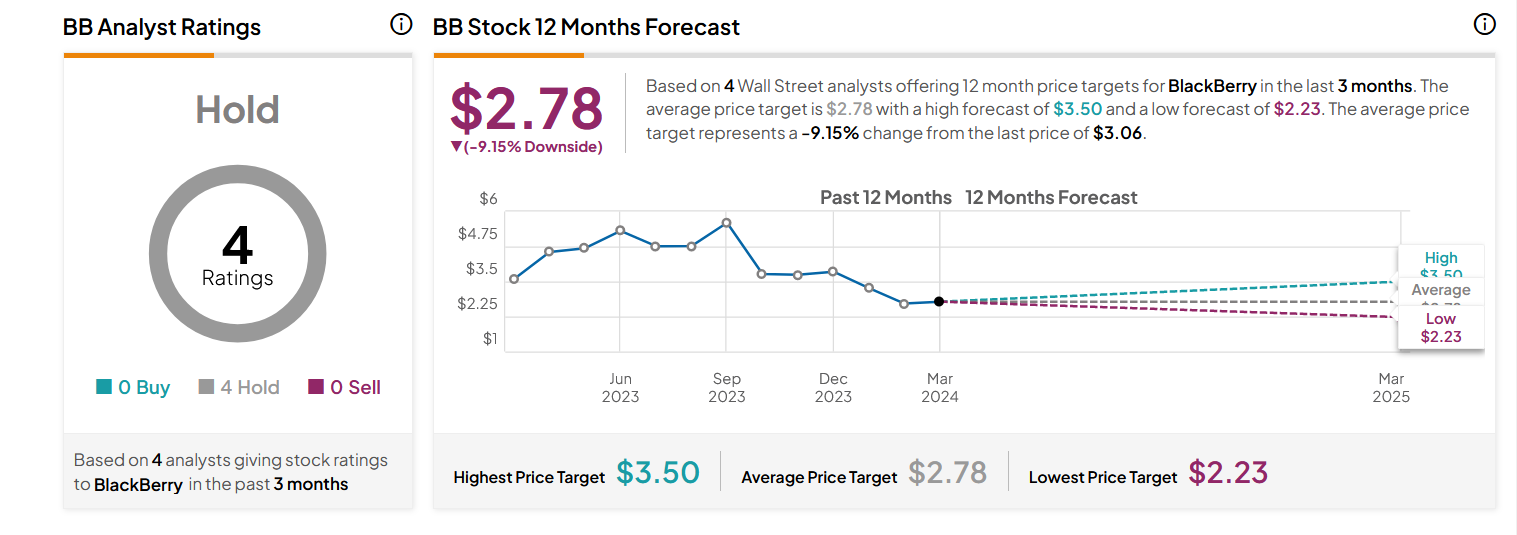

Analyst Consensus: As per TipRanks Analytics, based on 4 Wall Street analysts offering 12-month price targets for BB in the last 3 months, the stock has an average price target of $2.78.

Potential Catalysts / Reasons for the Hype:

- The company recently expanded its alliance with TTTech Auto to handle the critical challenges that are increasingly posing complexities in the advancement of software-defined vehicles (SDVs).

- BB announced a three-year cooperative agreement with intermodal container chassis manufacturer, Max-Atlas. The deal will make BlackBerry Radar® asset tracking and monitoring technologies available for installation during the manufacture of Max-Atlas’ range of products.

- The company recently announced plans to reduce positions within its cybersecurity business to save $27 million annually and withdraw from six of its 36 worldwide office sites to cut expenses.

- A partnership with Baidu was formed to enhance information security functions in the Baidu Apollo self-driving car, with the goal of developing a Level 4 (and above) self-driving platform comparable to Google’s Waymo.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart and is also moving higher from oversold levels, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for BB is above the price of $3.10.

Target Prices: Our first target is $3.90. If it closes above that level, the second target price is $4.60.

Stop Loss: To limit risk, place a stop loss at $2.60. Note that the stop loss is on a closing basis.

Our target potential upside is 26% to 48%.

For a risk of $0.50, our first target reward is $0.80, and the second target reward is $1.50. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

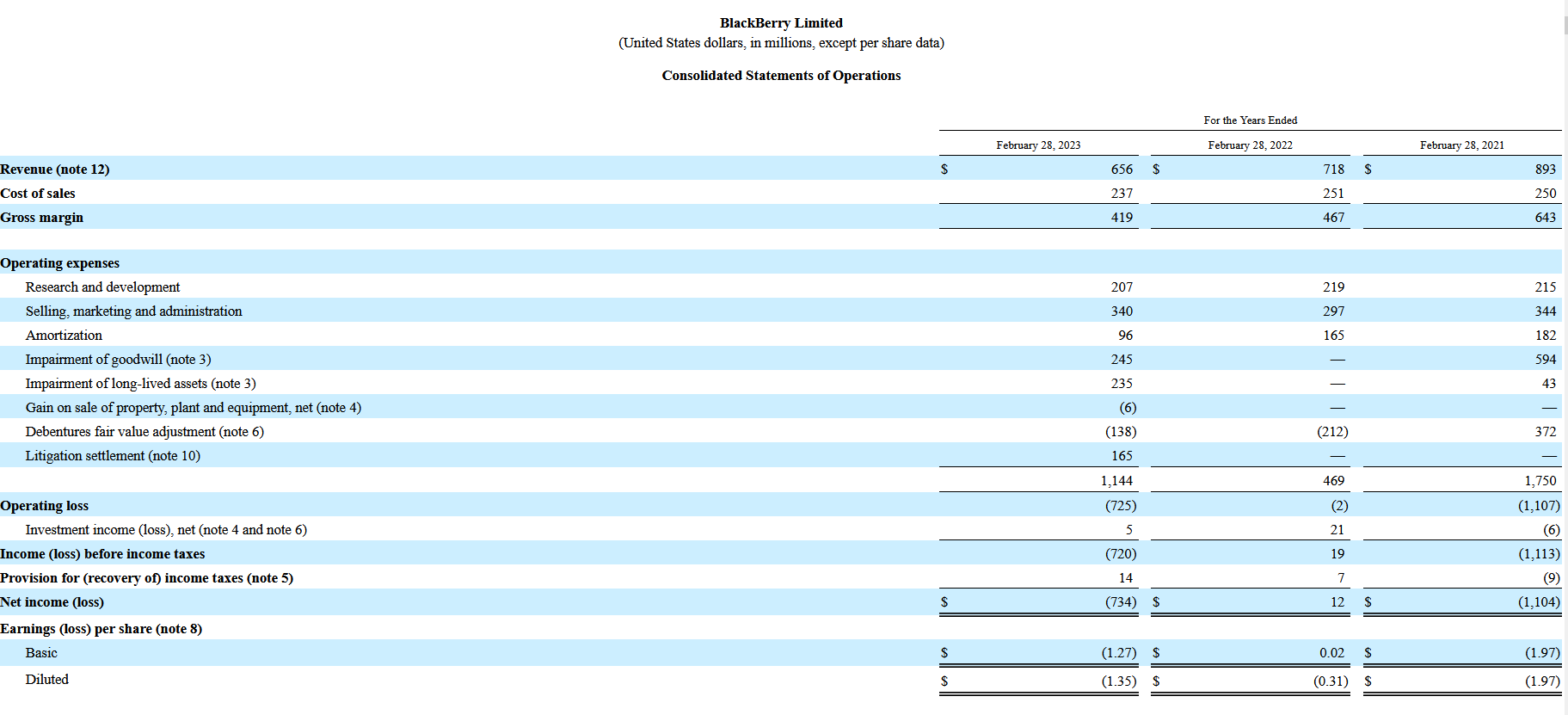

- The company has a history of net losses. In fiscal 2023, the Company incurred a net loss of $734 million.

- The company has ongoing legal proceedings – Swisscanto Fondsleitung AG v. BlackBerry Limited, et al. and Parker v. BlackBerry Limited. Between October and December 2013, several purported class action lawsuits and one individual lawsuit were filed against the Company and certain of its former officers in various jurisdictions in the U.S. and Canada alleging that the Company and certain of its officers made materially false and misleading statements regarding the Company’s financial condition and business prospects and that certain of the Company’s financial statements contain material misstatements.

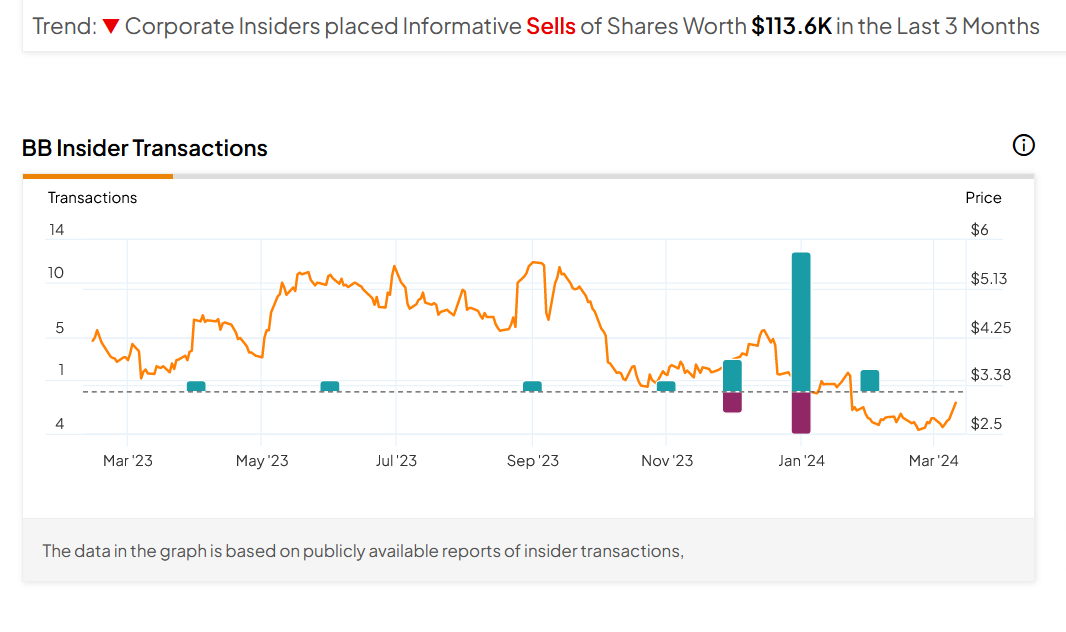

- Corporate Insiders placed Informative Sells of Shares Worth $113.6K in the Last 3 Months.

- The Company is engaged in markets that are highly competitive and rapidly evolving, and has experienced, and expects to continue to experience, intense competition from a number of companies.

- BB has outstanding indebtedness, which currently includes a $365 million aggregate principal amount of 1.75% Debentures maturing on November 13, 2023. The degree to which the Company is leveraged could have significant negative consequences.

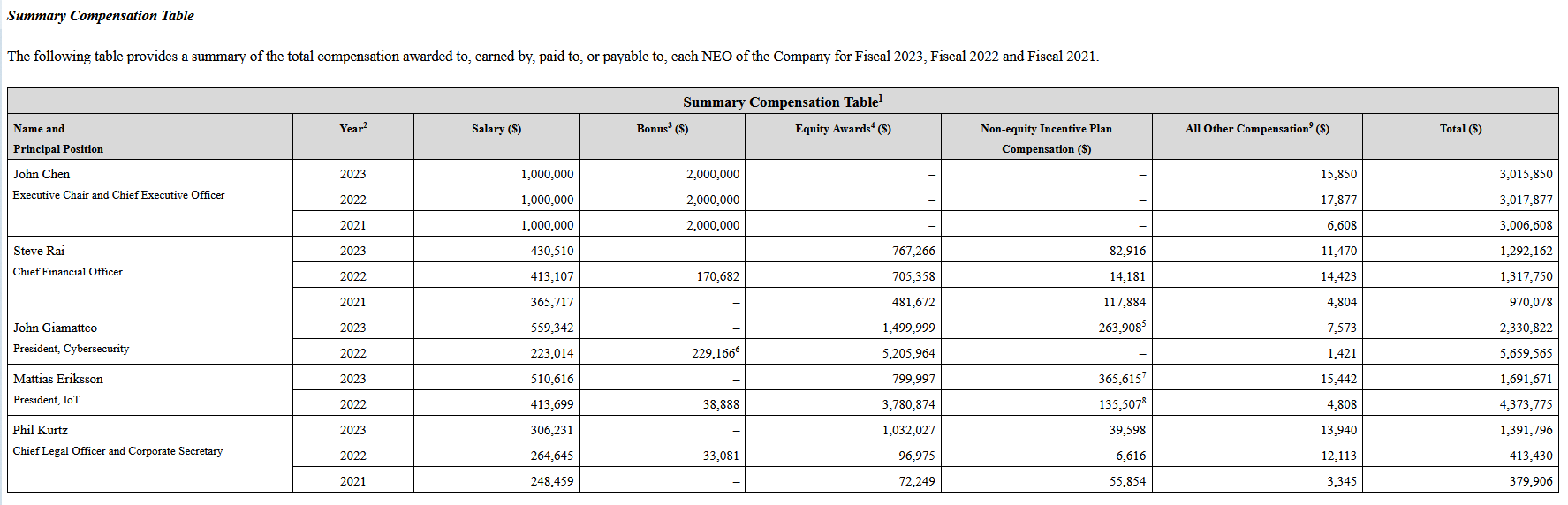

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Trades of the Day