With tax season approaching now appears to be an ideal time to buy H&R Block’s (HRB) stock which currently sports a Zacks Rank #1 (Strong Buy) and lands the Bull of the Day.

Even better, here’s a look at why the tax preparation services leader is shaping up to be a viable investment for 2024 and beyond.

AI Boost & Tax Season Growth

H&R Block’s fiscal third quarter is most crucial for the company as it leads up to the tax filing deadline which is typically April 15. After posting a narrower adjusted earnings loss in its Q2 report on Tuesday and sales growth of 7% momentum is building for the busy current quarter.

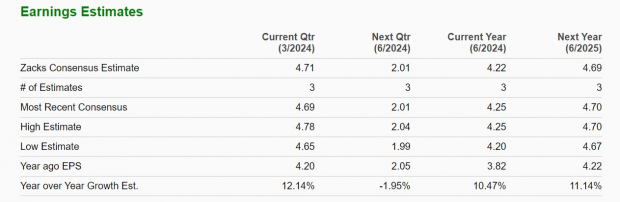

Most importantly, H&R Block’s Q3 earnings are expected to be up 12% to $4.71 per share with sales forecasted to rise 2% to $2.15 billion. To that point, H&R Block is well positioned upon implementing artificial intelligence into its offerings and launching its AI Tax Assist at the beginning of the year to streamline the tax preparation process.

Overall, H&R Block’s annual earnings are now projected to rise 10% in fiscal 2024 and climb another 11% in FY25 to $4.69 per share. Plus, total sales are forecasted to be up 2% this year and rise another 2% in FY25 to $3.64 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Recent Performance & Attractive Valuation

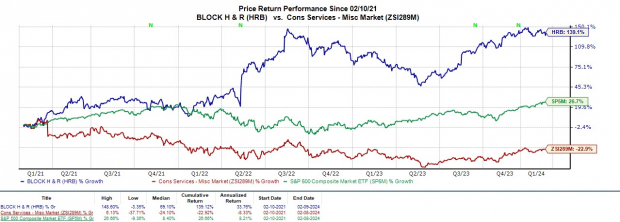

H&R Block’s price performance has roughly matched the S&P 500 over the last year rising +20% to easily top its Zacks Consumer Services-Miscellaneous Market’s +2%. More impressive, over the last three years, HRB shares have soared +139% to largely outperform the benchmark and its Zack Subindustry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Furthermore, HRB shares still trade at 10.8X forward earnings which is a considerable discount to the S&P 500’s 21X and nicely beneath its Zacks Consumer Services-Miscellaneous industry average of 12X with some of the other notable names in the space being Cimpress (CMPR) , BJ’s Wholesale Club (BJ) , and BrightView (BV).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Enticing Dividend

Adding more value to H&R Block’s stock is its 2.8% annual dividend yield in an industry where most companies don’t offer a payout to shareholders. It’s also noteworthy that this tops the S&P 500’s 1.32% average and H&R Block’s dividend has increased four times in the last five years. Better still, H&R Block’s payout ratio is only at 33% and suggests there is plenty of room for more dividend increases in the future.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

H&R Block’s stock is starting to check the boxes heading into the busy tax season and in addition to its strong buy rating has an overall “A” VGM Zacks Style Scores grade for the combination of Value, Growth, and Momentum.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks