We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Core Scientific, Inc. (NASDAQ: CORZ)

Today’s penny stock pick is the information technology services company, Core Scientific, Inc. (NASDAQ: CORZ).

Core Scientific, Inc. operates facilities for digital asset mining and colocation services in North America. It provides blockchain infrastructure, software solutions, and services. The company mines digital assets for its own account and provides hosting colocation services for other large-scale miners. It operates in two segments, Equipment Sales and Hosting.

The company owns and operates computer equipment that is used to process transactions conducted on one or more blockchain networks in exchange for transaction processing fees rewarded in digital currency assets, commonly referred to as mining; and datacenter facilities to provide colocation and hosting services for distributed ledger technology, also commonly known as blockchain. It also develops blockchain-based platforms and applications, including infrastructure management, security technologies, mining optimization, and recordkeeping.

Website: https://www.corescientific.com

Latest 10-k report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001839341/262eca9b-e780-40f9-90fe-7d97f6194096.pdf

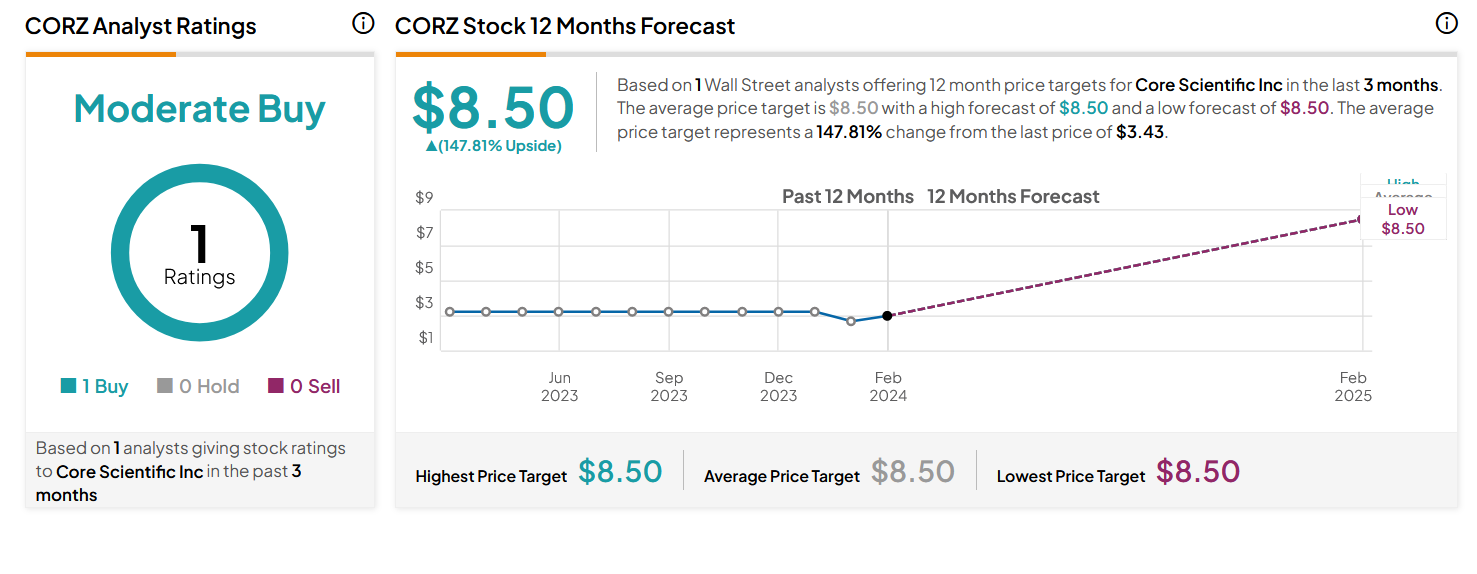

Analyst Consensus: As per TipRanks Analytics, based on 1 Wall Street analyst offering 12-month price targets for CORZ in the last 3 months, the stock has an average price target of $8.50, which is nearly 148% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company emerged from Chapter 11 more than a year after it filed for bankruptcy protection.

- The recent surge in bitcoin prices. This was buoyed by renewed interest from investors after spot bitcoin exchange-traded funds (ETFs) were approved by the SEC in the U.S. and ahead of upcoming bitcoin halving. CORZ had produced 1,027 bitcoins in January from its owned fleet of miners.

- CORZ also announced significant operational updates for January 2024, showcasing an expansion in self-mining and enhanced energy efficiency in its mining fleet.

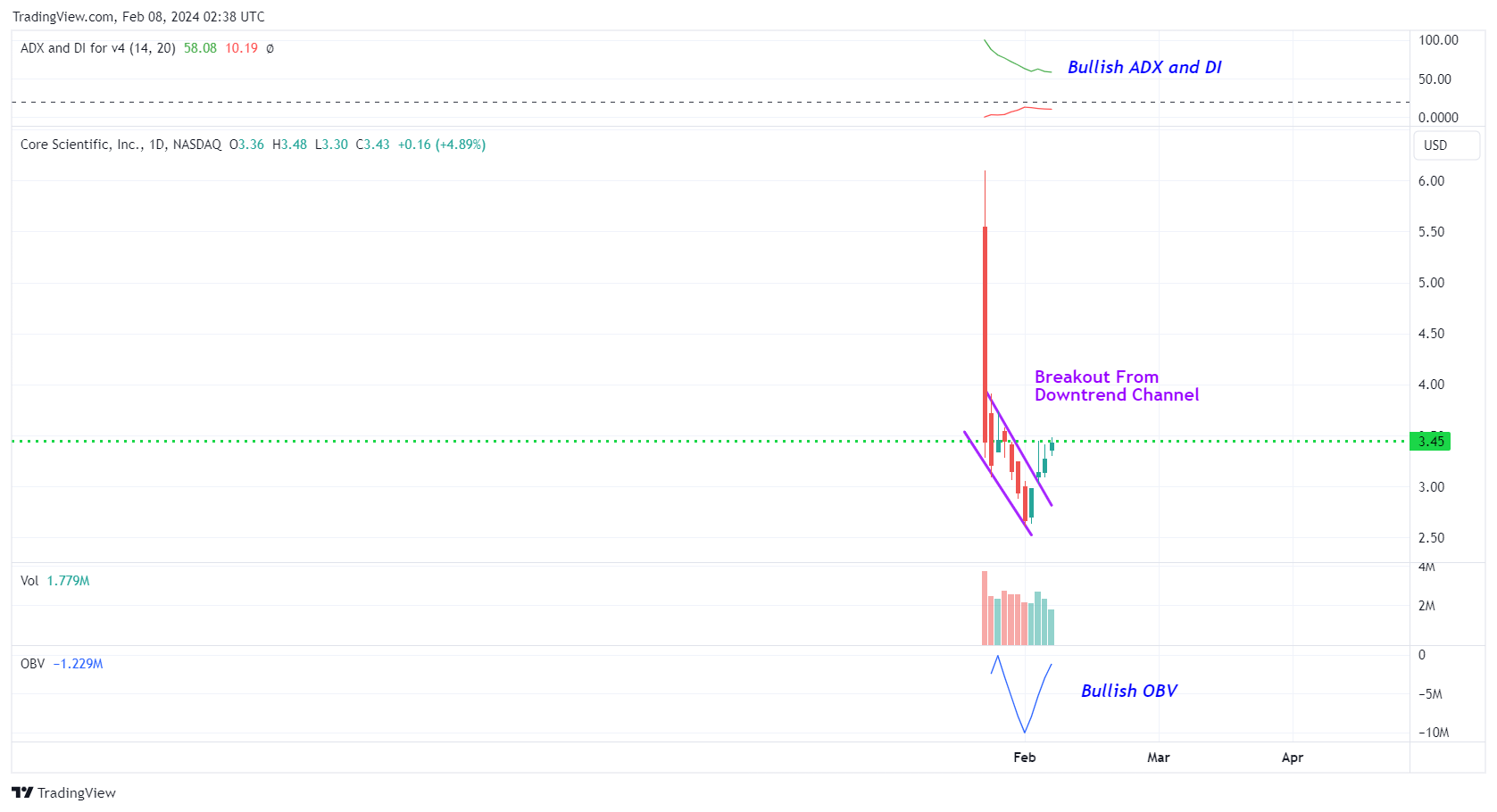

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Downtrend Channel Breakout: The daily chart shows that the stock has broken out of a downtrend channel, which is shown as purple color lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line.

#3 Bullish OBV: The daily chart shows that the OBV indicator is currently rising. OBV rises when volume on up days outpaces volume on down days. A rising OBV typically reflects positive volume pressure that can lead to higher prices.

#4 Bullish Reversal Candlestick Pattern: The weekly chart shows that the stock is forming a bullish reversal candlestick pattern called “inside bar” pattern. An “inside bar” pattern is a two-bar price action trading strategy in which the inside bar is smaller and within the high to low range of the prior bar, i.e. the high is lower than the previous bar’s high, and the low is higher than the previous bar’s low. This pattern is marked as a pink color ellipse. This is a possible bullish sign.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for CORZ is above the price of $3.45.

Target Prices: Our first target is $4.00. If it closes above that level, the second target price is $4.60.

Stop Loss: To limit risk, place a stop loss at $3.10. Note that the stop loss is on a closing basis.

Our target potential upside is 16% to 33%.

For a risk of $0.35, our first target reward is $0.55, and the second target reward is $1.15. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

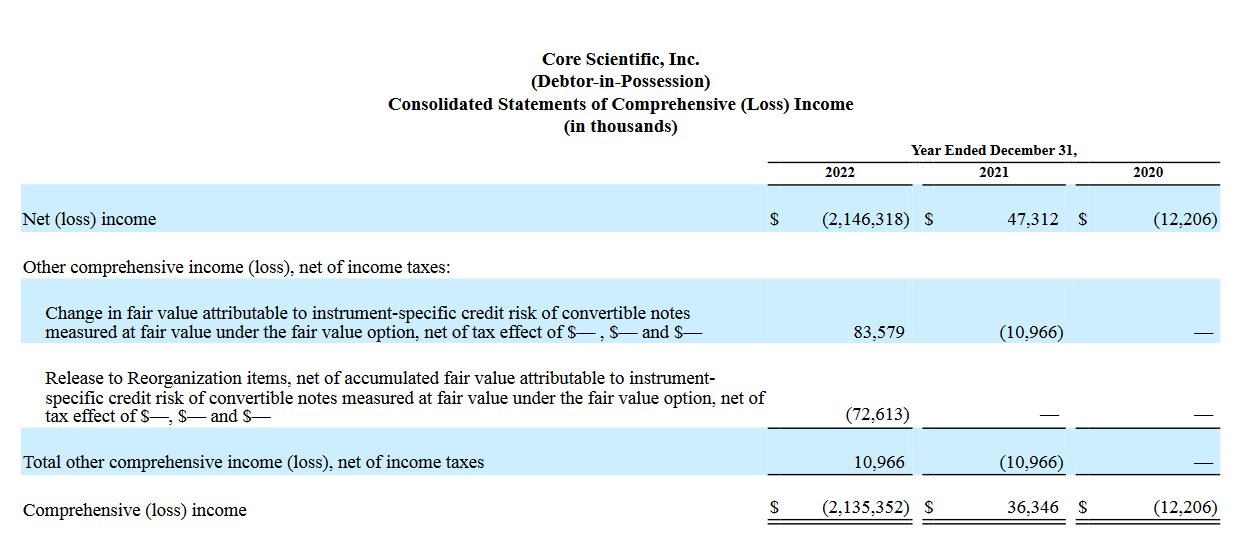

- The company has a history of net losses. CORZ had a net loss of $2.15 billion for the year ended December 31, 2022. As of December 31, 2022, the company’s accumulated deficit was $2.17 billion.

- The company has ongoing legal proceedings. In November 2022, Sphere 3D Corp. filed a demand for arbitration with JAMS alleging the existence and breach of a contract for hosting services. In November 2022, McCarthy Building Companies, Inc. filed a complaint against the Company in the United States District Court for the Eastern District of Texas, alleging breach of contract for failing to pay when due, certain payments allegedly owing under a contract for construction entered into between the parties.In November 2022, plaintiff Mei Peng filed a putative class action in the United States District Court, Western District of Texas, Austin Division, asserting that the Company violated the Securities Exchange Act by failing to disclose to investors, among other things, that the Company was vulnerable to litigation, that certain clients had breached their agreements, and that this impacted the Company’s profitability and ability to continue as a going concern.

- The company had filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code. The company has substantial indebtedness upon emergence from Chapter 11, it may adversely affect its financial health and operating flexibility.

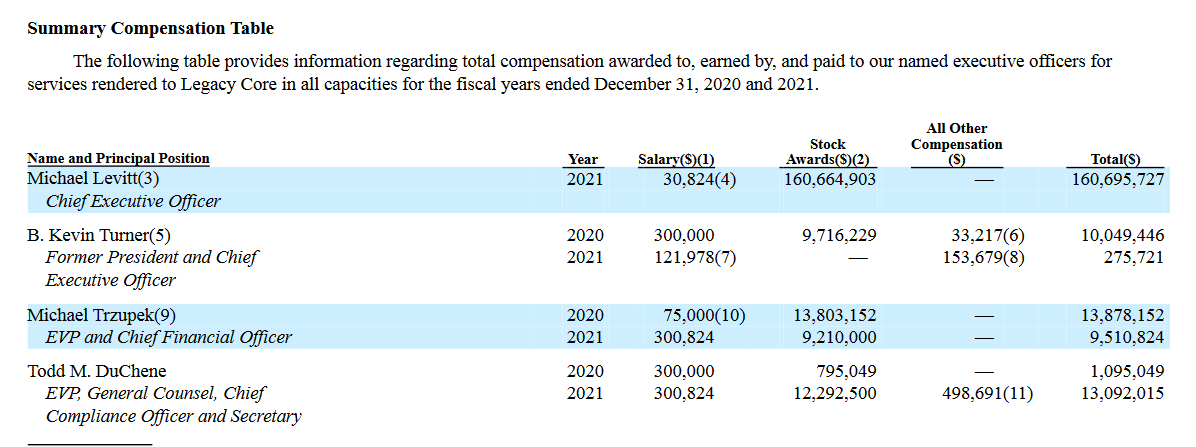

- Despite being a loss-making company, the executives are being paid millions as compensation.

- A significant portion of the company’s assets including its miners and mining facilities are pledged to various creditors.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day