Why do high-quality dividend growth stocks make for such great long-term investments? Well, it’s quite simple. These stocks represent equity in great businesses.

Great businesses, great stocks, great investments. Stock prices tend to follow earnings over time. Rising earnings, rising stock prices. And it’s those rising earnings that are used to afford rising dividend payments to shareholders.

So, yeah, these stocks can be great long-term investments. But when these stocks are on sale – when they’re undervalued – that’s when they can be even greater.

See, price and yield are inversely correlated. All else equal, lower prices result in higher yields.

This means more dividend income on the same invested dollar, making financial independence an easier and faster target to reach. Now, lower valuations often come when there’s volatility. But I always see short-term volatility as a long-term opportunity.

That perspective helped me to go from below broke at age 27 to financially free at 33.

By the way, I explain exactly how I achieved financial freedom in just six years in my Early Retirement Blueprint. If you’re interested, you can download a free copy of my Early Retirement Blueprint.

With all of that out of the way, it’s a big market, and some ideas are better than others. Focusing on the very best long-term ideas right now is what this article is all about.

Today, I want to tell you my top 5 dividend growth stocks for February 2024.

Ready? Let’s dig in

My first dividend growth stock for February 2024 is Comcast Corporation (CMCSA). Comcast is a media and entertainment conglomerate. Comcast has built up a media and entertainment empire over the years, with the conglomerate stretching out across interests in cable TV, broadband internet, broadcasting, film, streaming, live entertainment, and theme parks. There’s really no other business in America quite like it.

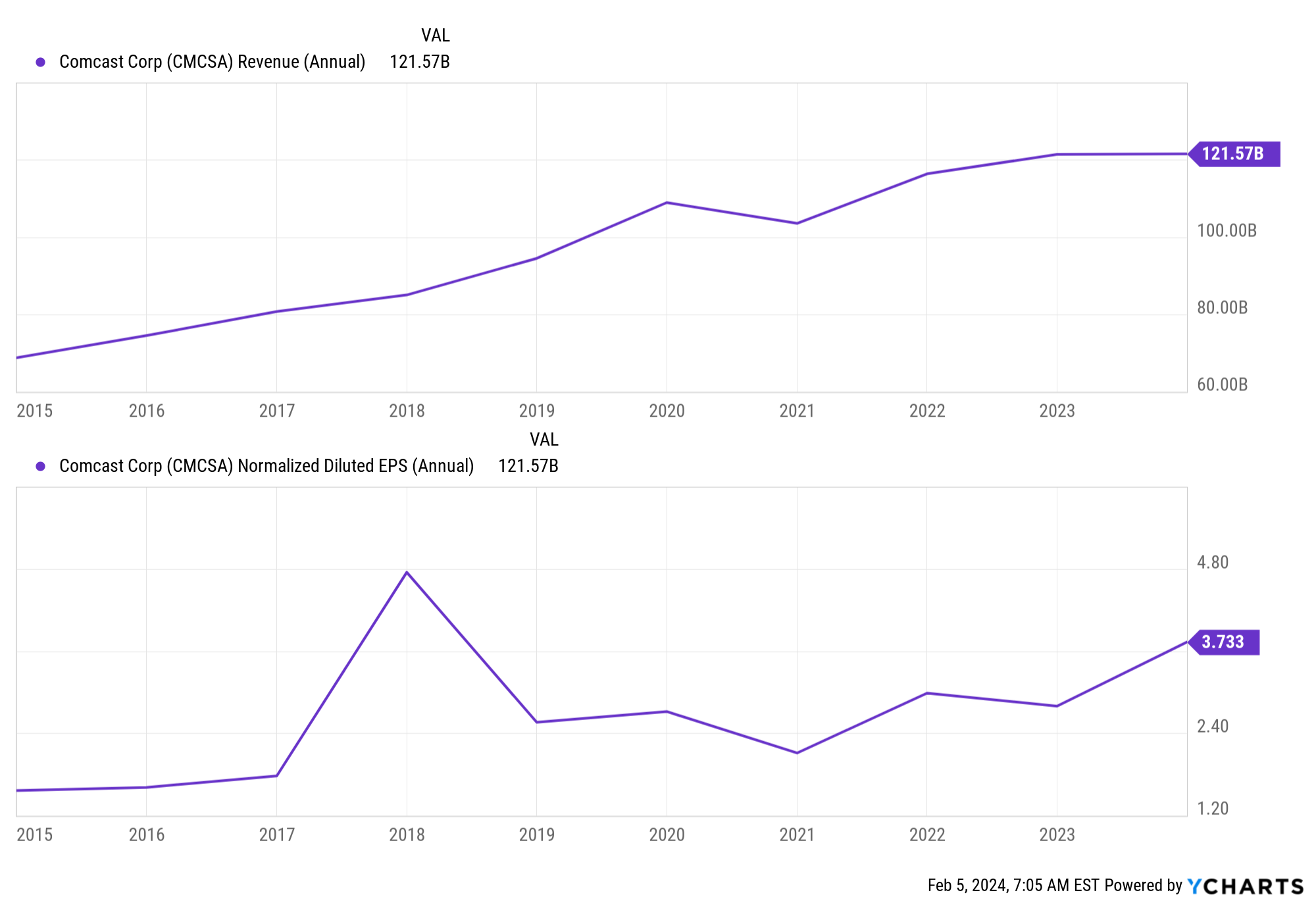

The bench is just so deep here. If one area of the business is experiencing issues – such as cable TV – you have multiple other areas there to pick up the slack. Putting it all together as one big company, the results are better than you might think. How about a 7.2% CAGR for revenue and 12.3% CAGR for EPS over the last decade. Not bad.

Also not bad? The dividend growth that’s been occurring here. Indeed, Comcast has increased its dividend for 16 consecutive years. The 10-year DGR is 13.3%, which is strong and only barely exceeds EPS growth over the same time period.

Also not bad? The dividend growth that’s been occurring here. Indeed, Comcast has increased its dividend for 16 consecutive years. The 10-year DGR is 13.3%, which is strong and only barely exceeds EPS growth over the same time period.

Now, recent dividend raises have been a HSD range, which I actually think is quite decent. After all, the stock yields a respectable 2.7%. If you can get a near-3% yield and HSD growth, that’s lining things up for a LDD annualized total return. The payout ratio is only 32.3%, so Comcast has plenty of flexibility around the size of future dividend raises.

This stock looks downright cheap. There’s a bit of consistent pessimism around this name. And I think that’s because of too much focus on the cable TV facet of the business. Sure, cable TV doesn’t have much appeal. But, again, Comcast is so much more than cable TV. And that’s why it’s growing.

A P/E ratio of 12, on a business that’s been growing at 12% annually, shows you just how low the expectations have gotten here. We already put together the basics on a full analysis and valuation video on Comcast, and that should be live soon (if it’s not already). The fair value estimate of the business came out to just over $53/share. The stock is currently priced at about $43. So it looks almost 20% undervalued. Have a look at Comcast.

My second dividend growth stock for February 2024 is Lithia & Driveway (LAD). Lithia & Driveway is an American automotive dealership group. The auto dealership business model is a fantastic one. Why? Well, it goes beyond the fact that you can only buy a new or certified pre-owned vehicle from an OEM dealership.

See, a dealership locks you into an economic flywheel even after the vehicle purchase is complete. Because only OEM dealerships are authorized to do warranty repair work.

Furthermore, these dealerships are often the only places qualified to do all kinds of other repair and maintenance work on modern-day cars. I say that as someone who worked in the business for almost a decade. Lithia & Driveway takes this fantastic business model and kicks it up a notch by employing the serial acquirer method to build out a dealership empire. And that explains why the company has been able to compound its revenue at an annual rate of 24.2% and its EPS at an annual rate of 30.4% over the last decade.

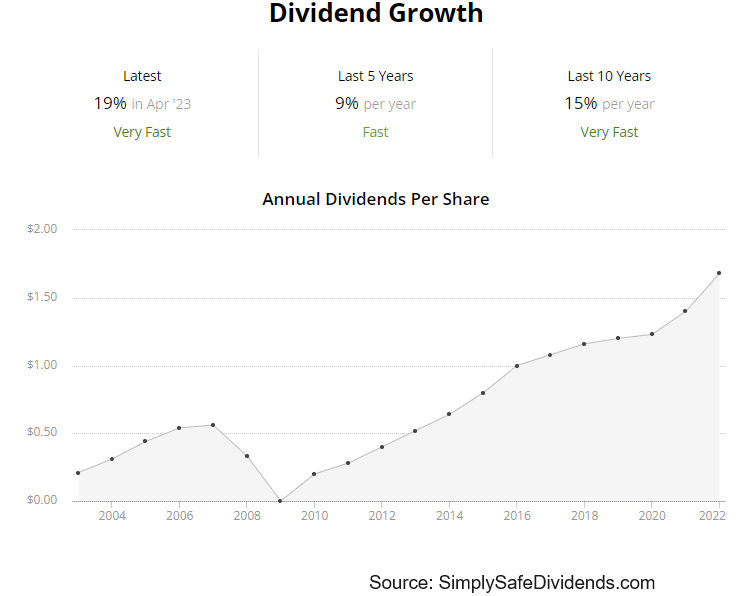

Incredible business growth. Incredible dividend growth. Yes, Lithia & Driveway is a dividend growth monster. The company has increased its dividend for 14 consecutive years. The 10-year DGR is 14.6%. Strong, right? Well, the last couple of dividend raises were approximately 20% each. That’s more like it.

Now, that kind of double-digit dividend growth is almost necessary in this case. And I say that because the stock yields only 0.7%. Keep in mind, this isn’t some income play. It’s a high-quality compounder. And with the payout ratio being just 5.3%, in spite of those massive dividend raises, Lithia & Driveway is clearly in the driver’s seat as it pertains to handing out more massive dividend raises in the years ahead.

Now, that kind of double-digit dividend growth is almost necessary in this case. And I say that because the stock yields only 0.7%. Keep in mind, this isn’t some income play. It’s a high-quality compounder. And with the payout ratio being just 5.3%, in spite of those massive dividend raises, Lithia & Driveway is clearly in the driver’s seat as it pertains to handing out more massive dividend raises in the years ahead.

Should we acquire shares of this serial acquirer? Perhaps so. The stock looks surprisingly cheap. The P/E ratio is below 8. Yes, below 8. On a business that’s been growing its EPS at over 30%/year. You do not see that kind of disconnect every day.

Now, there could be an earnings reckoning here, due to the fact that car prices – especially used car prices – have been trending down. And so that may cause a reconciliation between the earnings multiple and the actual earnings. Still, we recently put together a full analysis and valuation piece on this business, and the fair value estimate came out to nearly $350/share. That video should be live soon, if it’s not already. Meanwhile, with the stock priced at under $300, this could be a prime time to strike.

My third dividend growth stock for February 2024 is Mid-America Apartment Communities (MAA). Mid-America Apartment Communities is a multifamily housing real estate investment trust.

This REIT owns and operates approximately 102,000 apartment units across the US. But here’s the neat thing about this particular multifamily housing REIT: The company’s property portfolio has a fantastic geographic footprint that is almost completely concentrated on the US sunbelt region.

Some of its top markets are Tampa, FL and Austin, TX. This is super favorable. Because of tax, climate, and other considerations, Americans are flocking to cities in the southern and SW regions of the country. That helps to explain why occupancy is over 95%. It also helps to explain why the REIT’s revenue has compounded at an annual rate of 13.7% over the last decade, while its Core FFO/share has a CAGR of 6.2%. This REIT pays a generous, growing dividend – backed by demand for a basic need.

The company has increased its dividend for 14 consecutive years. With a 10-year DGR of 7.3% and a yield of 4.3%, you have a pretty compelling combination of yield and growth here – especially if you lean toward yield or need to boost your portfolio’s income production. The payout ratio, based on midpoint guidance for FY 2023 Core FFO/share, is 71.7%. Elevated, yes, but not uncommonly so for a REIT. REITs are income plays. They tend to have higher payout ratios. There’s a lot to like here about the dividend profile.

If you want to be a landlord without doing any of the hard work, this is a great way to do it. When you buy shares in Mid-America Apartment Communities, you instantly own a slice of more than 100,000 apartment units that are nearly all currently leased out and earning rental income.

If you want to be a landlord without doing any of the hard work, this is a great way to do it. When you buy shares in Mid-America Apartment Communities, you instantly own a slice of more than 100,000 apartment units that are nearly all currently leased out and earning rental income.

You have an economic interest in hundreds of apartment communities across the Southeastern, Southern, and Southwestern parts of the US. And you don’t have to deal with any of the hard work. No scouting, financing, closing, leasing, maintenance.

Just collect those large, growing dividend checks which are funded by steadily rising rents. I’m not a huge fan of REITs, in general, but I really, really like the multifamily housing REITs. People will always need a place to live, so there’s no risk of obsolescence. At 14 times cash flow for a stock that has averaged nearly 20 times cash flow over the last five years, now might be a great time to get into this one.

My fourth dividend growth stock for January 2024 is PepsiCo (PEP). PepsiCo is an American multinational food, snack, and beverage corporation. We all know PepsiCo. Many of us probably enjoy their various products on a regular basis. But did you know this company has more than 20 different billion-dollar brands? That’s more than 20 different brands with over $1 billion in sales per year.

Many companies would love to have even just one such brand. That’s how successful PepsiCo and its roster of products such as Doritos and the eponymous Pepsi have been. PepsiCo isn’t putting up crazy growth. Instead, it’s a blue-chip name consistently moving the needle while shareholders sleep well at night. Revenue has a CAGR of 3% over the last 10 years, while EPS has compounded at an annual rate of 4.5% over that time frame.

Many companies would love to have even just one such brand. That’s how successful PepsiCo and its roster of products such as Doritos and the eponymous Pepsi have been. PepsiCo isn’t putting up crazy growth. Instead, it’s a blue-chip name consistently moving the needle while shareholders sleep well at night. Revenue has a CAGR of 3% over the last 10 years, while EPS has compounded at an annual rate of 4.5% over that time frame.

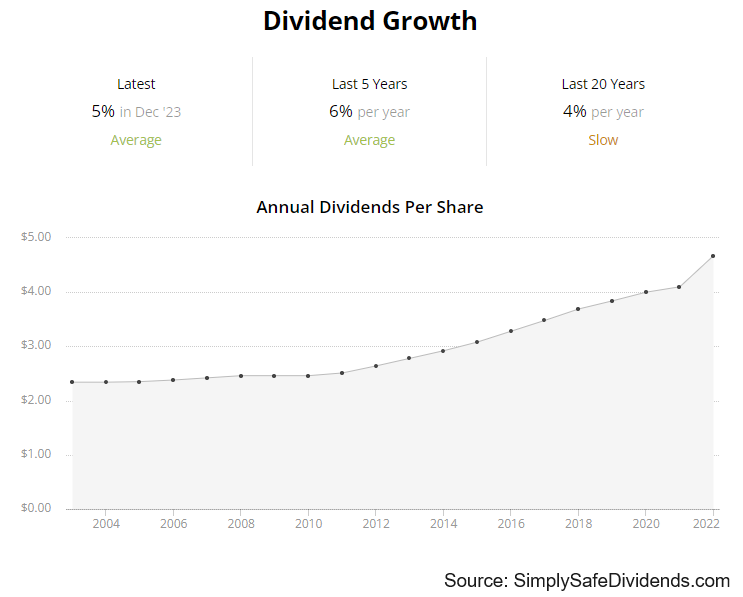

PepsiCo is one of the most well-known dividend growth stocks out there. Does the reality live up to the hype? Well, yeah. First, the track record. It’s outrageously impressive. The company has increased its dividend for 51 consecutive years. How many things in this world are that reliable and consistent? Other than the sun setting and rising, not much.

For more than five straight decades, PepsiCo shareholders have been able to count on dividend income that has been rising, year after year, through it all – wars, disasters, political upheaval, inflation, etc. The 10-year DGR is 8.1%. Well in excess of inflation and enough to keep one’s purchasing power increasing.

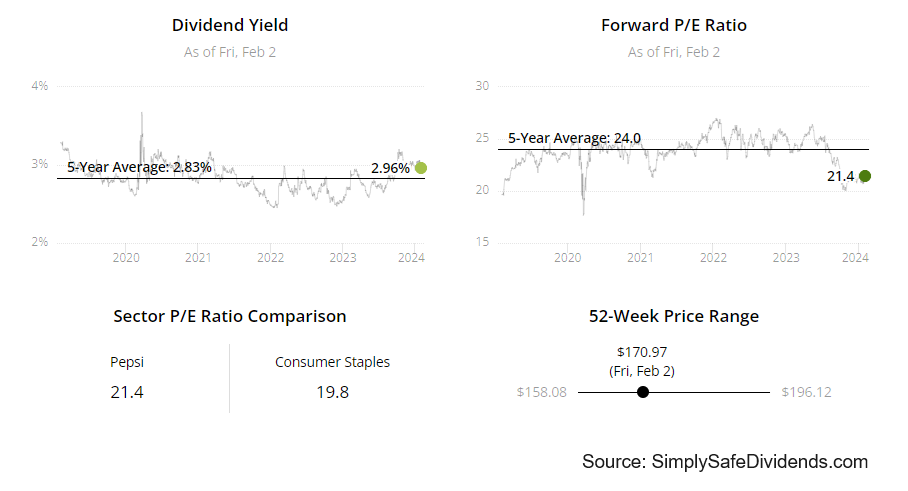

The stock also yields a respectable 3%, so there’s not even a major yield sacrifice to be made. And with a payout ratio of 67.4%, PepsiCo still has room left in the tank to keep that 51-year track record going. Almost nothing to complain about here. Just a Dividend King doing King things.

Is this the cheapest name out there? No. But I think you’re looking at a better-than-fair deal on one of the bluest-chip dividend growth stocks in the world. From pretty much every angle, the stock appears to be on the market for a slight discount. The P/E ratio is 22.2, based on TTM adjusted EPS. That is not terribly high for a world-class business.

The sales multiple of 2.5 is also not high, and it compares favorably to its own five-year average of 2.8. Also, that aforementioned 3% yield – it’s 30 basis points higher than its own recent historical average. Our full analysis and valuation video on PepsiCo showed a great business that appears to be worth about $190/share.

Shares are currently trading hands for about $168/each. I rarely find PepsiCo interesting enough to mention it as a long-term investment idea, but this is one of those rare times. Take a look.

Shares are currently trading hands for about $168/each. I rarely find PepsiCo interesting enough to mention it as a long-term investment idea, but this is one of those rare times. Take a look.

My fifth dividend growth stock for February 2024 is Skyworks Solutions (SWKS). Skyworks Solutions is an analog and mixed-signal semiconductor company. There is so much to like about Skyworks Solutions. For one, it has an extensive product portfolio: amplifiers, attenuators, diodes, filters, mixers, modulators, switches, voltage regulators, etc.

It goes on and on. For another thing, the company boasts more than 6,000 customers around the world. Also, this is one of the world’s RF leaders, and the increasing complexity of smartphones and networks leads to the requirement for more advanced content per device. That plays right into the hands of Skyworks Solutions. Another thing to like? Growth. The company’s 10-year CAGR for revenue is 8.5%, while the 10-year CAGR for EPS is 11.1%.

If you like double-digit dividend growth and a pretty nice yield, here you go. Skyworks Solutions has increased its dividend for 10 consecutive years. And what a great start things are off to. The 10-year DGR is 13.2%. That double-digit dividend growth lines up pretty well with the double-digit EPS growth over the last decade, so you can clearly see how those big dividend raises have been funded.

With the stock yielding a very decent 2.5%, this is a compelling combination of yield and growth. It’s balanced so well. And with the payout ratio at only 44.4%, I suspect we’re looking at more double-digit dividend raises in the years to come. This could be one of the very last deals in all of tech.

With the stock yielding a very decent 2.5%, this is a compelling combination of yield and growth. It’s balanced so well. And with the payout ratio at only 44.4%, I suspect we’re looking at more double-digit dividend raises in the years to come. This could be one of the very last deals in all of tech.

Most of tech, especially in the semiconductor space, has run up to stratospheric levels. That leaves new buyers with capital to deploy in a tough spot, having to either wait it out or pay up.

However, this stock’s recent performance has been pretty muted. And that’s led to very pedestrian multiples, such as the earnings multiple of only 17.6. I mean, 17.6. In this market? For tech? That is shockingly low. Our recent analysis and valuation video covering Skyworks Solutions estimated intrinsic value at over $116/share. The stock is currently priced at just over $104. If you want tech but don’t like high valuations, Skyworks Solutions could be calling your name.

— Jason Fieber

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Dividends & Income