We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Gorilla Technology Group Inc. (NASDAQ: GRRR)

Today’s penny stock pick is the software company, Gorilla Technology Group Inc. (NASDAQ: GRRR).

Gorilla Technology Group Inc. provides video intelligence, Internet of Things (IoT) security, and edge content management hardware, software, and services in the Asia Pacific region. The company operates through three segments: Video IoT, Security Convergence, and Other segments. It offers intelligent video analytics AI models for various verticals, such as behavioral analytics, people/face recognition, vehicle analysis, object recognition, and business intelligence that can scan video for patterns and distinguish specific items using AI algorithms and metadata.

The company also provides information technology (IT) and operational technology (OT) security convergence AI algorithms for system administrators and security engineers to detect suspicious behaviors in real time; network anomaly detection AI models; and endpoint malware and suspicious behavior detection AI models.

In addition, it offers intelligent video analytics (IVA) appliances to analyze and turn unstructured video and picture data into structured data; IVAR appliance that provides insight into business and operations in a statistic dashboard; smart attendance to track employee health and safety, work hours, clock-ins/outs, and absenteeism, as well as to protect company assets and intellectual properties; event and video management system appliances to store event/object attributes in temporal-spatial big data database from Gorilla; and operation technology security appliance to monitor and control physical devices, processes, and infrastructure, as well as to protect industrial systems and networks from various threats.

Further, the company provides smart retail SaaS for shopper demographics, visualized shopper behavior, and advanced data analytics, smart city and transportation SaaS for traffic management, public safety, and planning data; and endpoint security SaaS that protects endpoints against security threats.

Website: https://www.gorilla-technology.com

Latest 10-k report: https://investors.gorilla-technology.com/static-files/8a8c4df4-f159-4746-85e4-ca4f5d1d89af

Analyst Consensus: Not Covered By Wall Street Analysts

Potential Catalysts / Reasons for the Hype:

- The company unveiled its financial outcomes for the nine months concluding on September 30, 2023. GRRR witnessed significant growth in revenue, gross margin, and profitability.

- Gorilla had recently inked a contract with the Government of Egypt worth $270 million over a period of three years. It has also built a strong pipeline of contracts and partnerships, which are not yet reflected in the financials, and management guidance suggests positive cash flow in 2024.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern with a high volume. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart and is also moving higher from oversold levels, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart as well, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for GRRR is above the price of $1.23.

Target Prices: Our first target is $2.00. If it closes above that level, the second target price is $2.60.

Stop Loss: To limit risk, place a stop loss at $0.80. Note that the stop loss is on a closing basis.

Our target potential upside is 63% to 111%.

For a risk of $0.43, our first target reward is $0.77, and the second target reward is $1.37. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

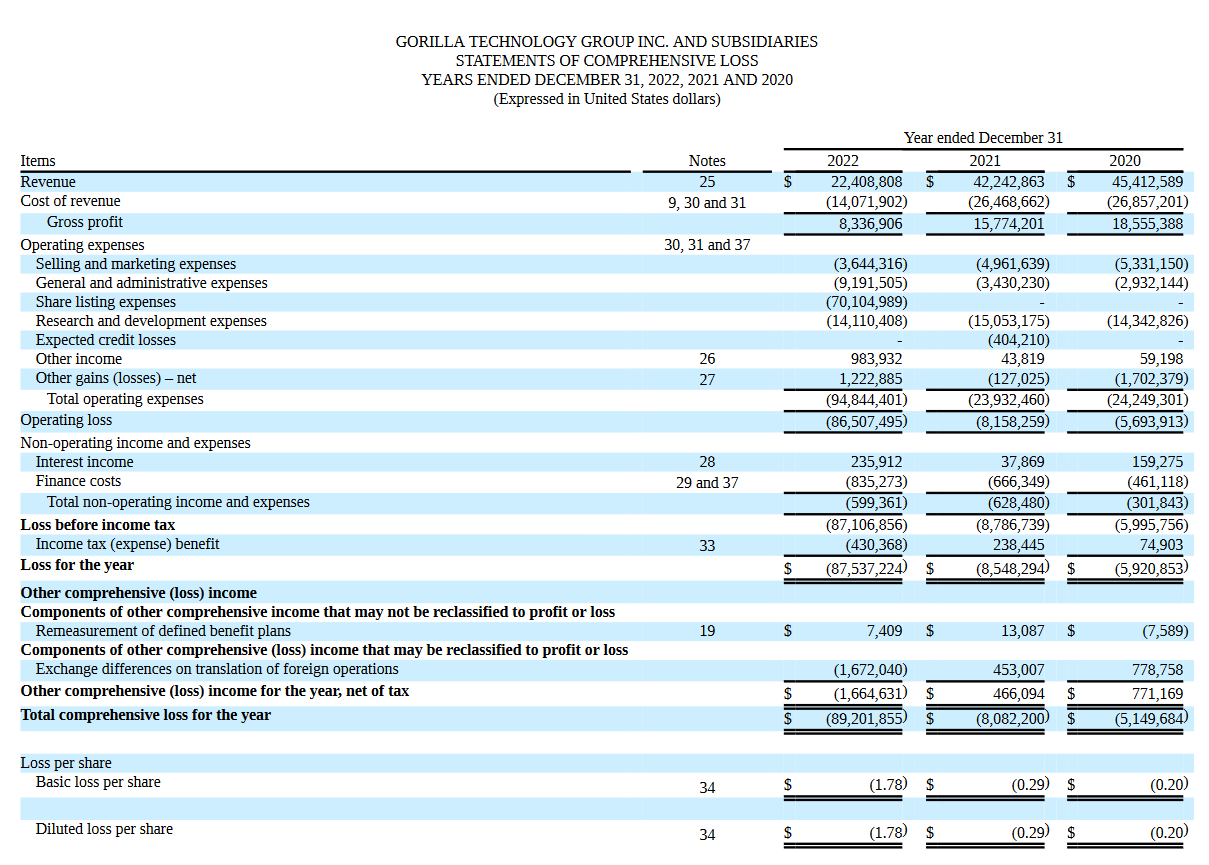

- The company has a history of net losses and was in a net loss position for the year ended December 31, 2022, and 2021.

- To date, Gorilla has relied, in part, on a variety of partnerships to grow its business, including partnering with leading technology companies and government agencies. Any difficulties in continuing existing partnerships or entering into new partnerships could disrupt its ongoing business, increase its expenses, and adversely affect its business, results of operations, and financial condition.

- The company has customer concentration risk. Historically, a single customer has accounted for a material portion of Gorilla’s revenues and another customer is anticipated to account for a material portion of Gorilla’s future revenues.

- On November 3, 2023, Gorilla Technology Group Inc. received a letter from the Listings Qualifications Department of The Nasdaq Capital Market notifying the Company that the minimum closing bid price per share for its ordinary shares was below $1.00 for a period of 30 consecutive business days and that the Company did not meet the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2).

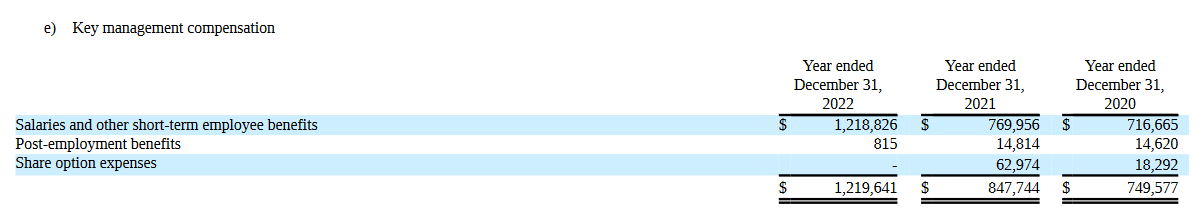

- Despite being a loss-making company, the company’s key management was given increased net compensation year-over-year.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Trades of the Day