We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Plug Power Inc. (NASDAQ: PLUG)

Today’s penny stock pick is the fuel cell company, Plug Power Inc. (NASDAQ: PLUG).

Plug Power Inc. delivers end-to-end clean hydrogen and zero-emissions fuel cell solutions for supply chain and logistics applications, on-road electric vehicles, stationary power markets, and others. It engages in building an end-to-end green hydrogen ecosystem, including liquid green hydrogen production, storage and handling, transportation, and dispensing infrastructure.

The company offers GenDrive, a hydrogen-fueled proton exchange membrane (PEM) fuel cell system that provides power to material handling electric vehicles; GenFuel, a liquid hydrogen fueling delivery, generation, storage, and dispensing system; GenCare, an ongoing Internet of Things-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel hydrogen storage and dispensing products, and ProGen fuel cell engines; and GenSure, a stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications, transportation, and utility sectors.

It also provides GenKey, an integrated turn-key solution for transitioning to fuel cell power; ProGen, a fuel cell stack and engine technology used in mobility and stationary fuel cell systems, and as engines in electric delivery vans; Liquefaction systems; and Electrolyzers that are hydrogen generators optimized for clean hydrogen production.

Website: https://www.plugpower.com

Latest 10-k report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001093691/3342283e-af4e-44f7-bc11-00a2959ba1b0.pdf

Analyst Consensus: As per TipRanks Analytics, based on 24 Wall Street analysts offering 12-month price targets for PLUG in the last 3 months, the stock has an average price target of $7.72, which is nearly 74% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company management announced that it has begun operating its new green hydrogen plant in Georgia; which is now the largest liquid green hydrogen plant in the U.S.

- ROTH MKM analysts upgraded Plug Power’s stock to Buy’ from Neutral and doubled their price target on the stock to $9 per share.

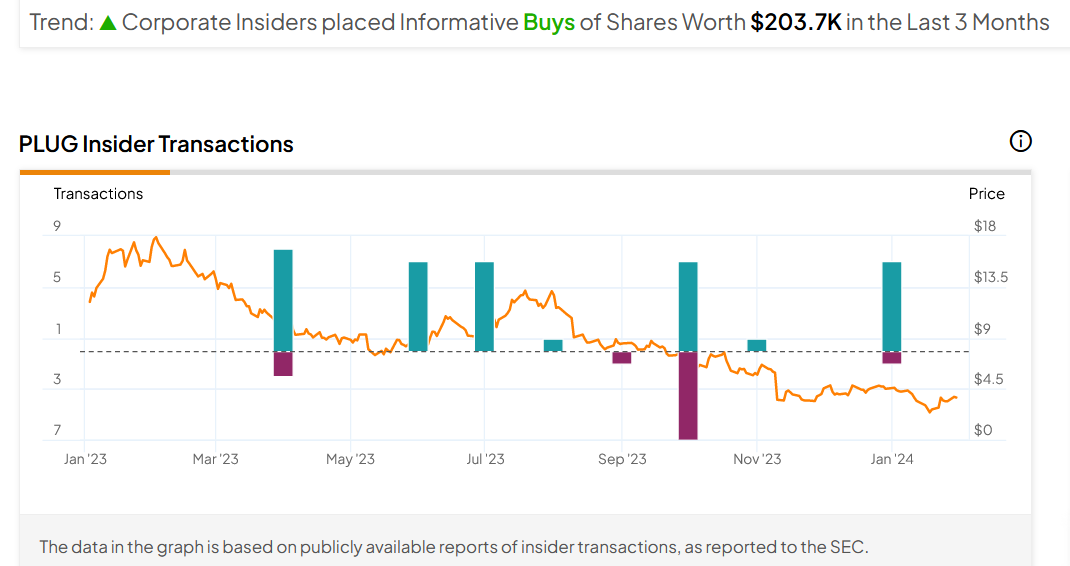

- Corporate Insiders placed Informative Buys of Shares Worth $203.7K in the Last 3 Months.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for PLUG is above the price of $4.80.

Target Prices: Our first target is $6.00. If it closes above that level, the second target price is $7.40.

Stop Loss: To limit risk, place a stop loss at $4.00. Note that the stop loss is on a closing basis.

Our target potential upside is 25% to 54%.

For a risk of $0.80, our first target reward is $1.20, and the second target reward is $2.60. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

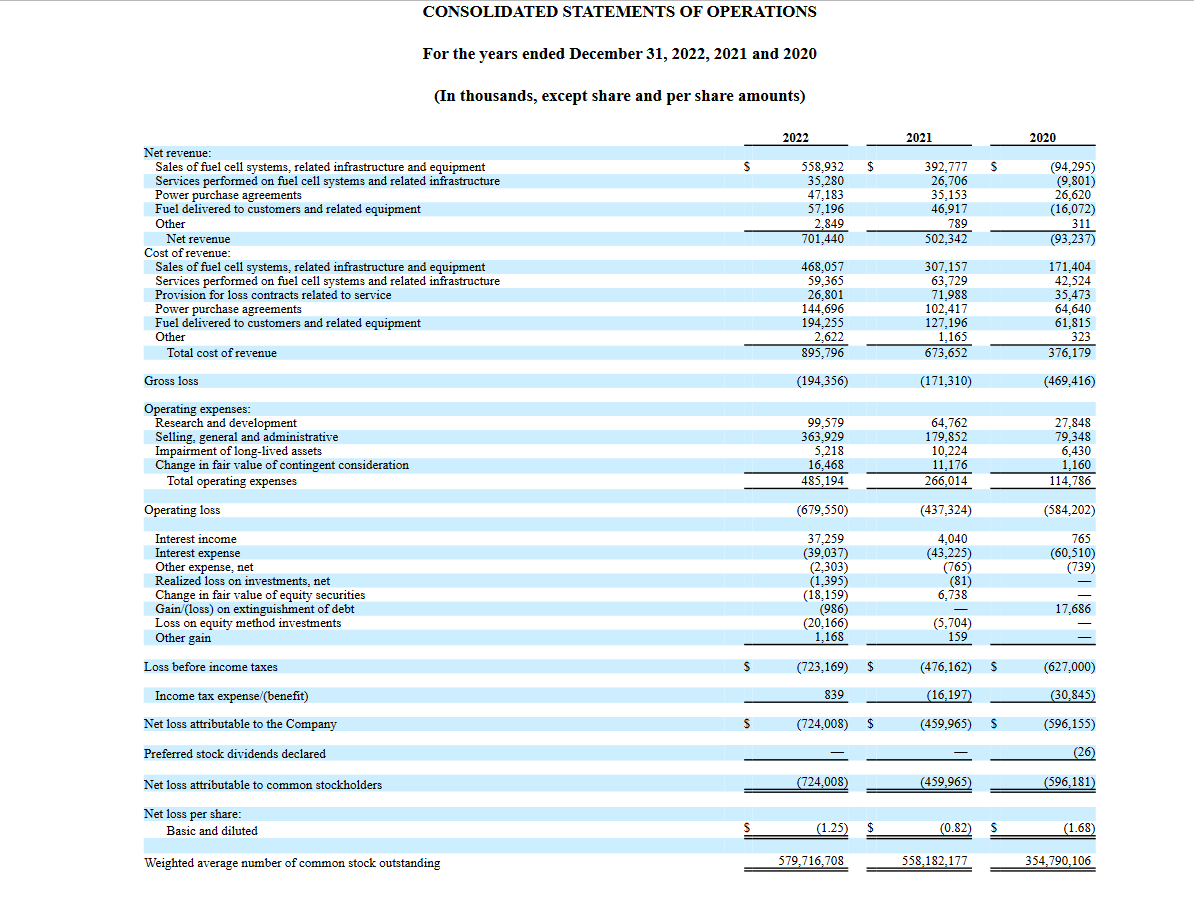

- The company has a history of net losses. PLUG’s net losses were $724.0 million in 2022, $460.0 million in 2021, and $596.2 million in 2020. As of December 31, 2022, the company had an accumulated deficit of $3.1 billion.

- Several actions were filed in the U.S. District Courts for the Southern District of New York and for the Central District of California asserting claims under the federal securities laws against the Company and two of its senior officers, Mr. Marsh and Mr. Middleton (In re Plug Power, Inc. Securities Litigation, No. 1:21-cv-2004). There are also several ongoing legal proceedings – Liu v. Marsh et al., Case No. 1:21-cv-02753; Levy et al. v. McNamee et al., Case No. 1:21-cv- 02891; Max v. Marsh, et. al., case no. 1:22-cv-00781; Khambati v. McNamee, et. al., C.A. no. 2022-05691; Graziano v. Marsh, et. al., C.A. no. 2022-0629; and St. Clair v. Plug Power Inc. et al., Index No. 653167/2021. The company is also litigating lawsuits against Proctor & Gamble in Louisiana, Structural Composites Industries, LLC, Worthington Industries, Inc., and Worthington Cylinder Corp. in New York.

- The company had implied bankruptcy was a real possibility when it issued a “going concern” warning with its third-quarter report in November.

- The markets for energy products, including PEM fuel cells, electrolyzers, and hydrogen production are intensely competitive.

- Hedge Funds Decreased Holdings by 1.9M Shares Last Quarter.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day