Consistent sales growth is critical for a company’s success, as it’s the foundation of generating profits. Strong revenue generation allows companies to achieve scaling efficiencies, generate continuous shareholder value, and many other clear benefits.

And when it comes to top line strength, three companies – Chipotle Mexican Grill (CMG) , Copart (CPRT) , and PDD Holdings (PDD) – have been standouts.

All three have enjoyed solid revenue growth over the last several years and have seen recent positive earnings estimate revisions, with the latter reflecting optimism among analysts.

For those seeking top line compounders, let’s take a closer look at each.

Chipotle Mexican Grill

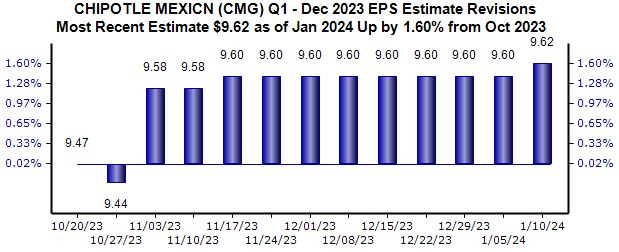

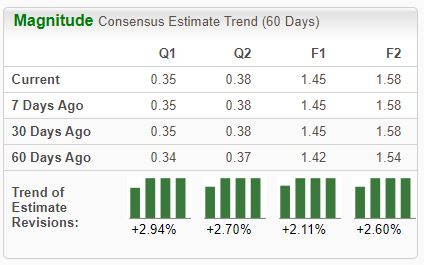

Chipotle Mexican Grill, a Zacks Rank #2 (Buy), operates quick-casual and fresh Mexican restaurant chains. Keep an eye out for the company’s upcoming quarterly release expected in early February, as the Zacks Consensus EPS Estimate of $9.62 has been taken 2% higher since October, with the value suggesting 16% growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

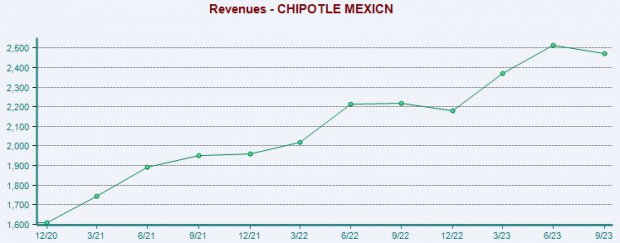

Our consensus revenue estimate for the quarter to be reported stands at $9.8 billion, reflecting an improvement of 14% year-over-year. The company’s sales growth has been explosive, with CMG posting double-digit year-over-year revenue growth rates in 13 consecutive releases.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

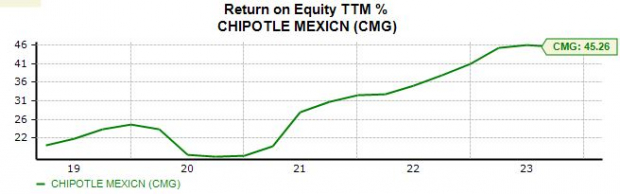

Further, CMG’s 45.3% trailing twelve-month return on equity (ROE) is worth highlighting, reflecting a higher efficiency level in generating profits from existing assets. Shares have been monster performers thanks to the company’s growth, up nearly 350% over the last years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

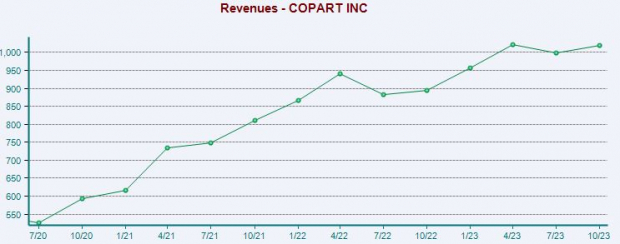

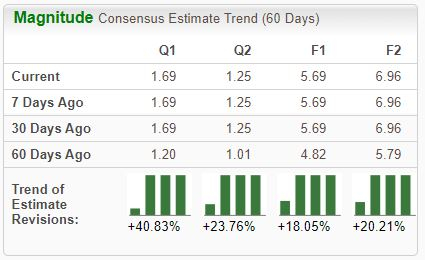

Copart

Copart is a global leader in online car auctions featuring used, wholesale, and repairable vehicles. The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company has consistently posted results above expectations as of late, exceeding both earnings and revenue expectations in each of its last four releases. Impressively, the average beat across its previous four prints works out to be 10.3%.

Copart’s quarterly revenue grew 14% year-over-year throughout its latest period, with estimates for its current fiscal year (FY24) alluding to a 10% improvement from FY23.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock is also a member of the Zacks Auction and Valuation Services industry, which is currently ranked in the top 2% of all Zacks industries.

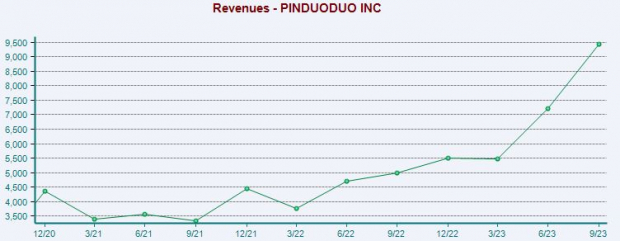

PDD Holdings

PDD Holdings is a multinational commerce group that owns and operates a portfolio of businesses. Estimates have shot higher across the board, landing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company’s growth expectations are the brightest of the bunch, with consensus estimates for its current year suggesting 43% earnings growth on 75% higher sales. Looking a bit ahead, expectations for FY24 currently suggest an additional 22% earnings growth paired with a 40% sales bump.

PDD’s sales have shot higher as of late.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

It’s worth highlighting that shares have respected the 50-day moving average, finding buyers in back-to-back instances and resuming their recent bullish trend. This is illustrated below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Strong revenue generation leads to many positives, such as scaling efficiencies and meaningful earnings growth.

And when it comes to strong revenue trends, all three companies above – Chipotle Mexican Grill (CMG) , Copart (CPRT) , and PDD Holdings (PDD) – precisely fit the criteria.

In addition to inspiring revenue growth, all three have enjoyed favorable earnings estimate revisions, indicating bullishness among analysts.

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks