There’s something to be said about the personal growth that one can get from investing.

The monetary rewards are great, no doubt about it.

Beyond the money, though, there are a lot of intangible benefits to being a long-term investor.

For example, investing has forced me to think very long term about life, business, and money.

Because successful investing requires a long-term view, I’m thinking about decades into the future – reverse engineering the person I want to become and the life I want to live.

The investing game is about so much more than just money, in my experience.

And even the money isn’t about just money.

And even the money isn’t about just money.

A lot of it is about the independence that money buys.

By living below my means and intelligently investing my spare capital, I was able to go from below broke at age 27 to financially independent at 33.

I was even able to retire in my early 30s.

My Early Retirement Blueprint shares aspects of that journey.

A key pillar of my success is the investment strategy I’ve used to get here.

That strategy is dividend growth investing.

This is a strategy that advocates buying and holding shares in great businesses that pay safe, growing dividends to shareholders.

You can find hundreds of examples of these businesses on the Dividend Champions, Contenders, and Challengers list, which has compiled invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

Why is this such an effective strategy?

Well, if you want to experience great investment results over the long run, you almost have to invest in great businesses.

It’s pretty difficult to experience great results with terrible businesses.

Likewise, you wouldn’t build a sports team with terrible players and expect to win many games.

Likewise, you wouldn’t build a sports team with terrible players and expect to win many games.

If you want to win with anything in life, you want greatness on your side.

Fortunately, dividend growth investing tends to funnel one right into great businesses.

That’s because growing dividends are only sustainable over the long run when the growing profit necessary to afford those payments is being generated.

By following this strategy over the last 10+ years, I’ve built the FIRE Fund.

That’s my real-life, real-money portfolio.

It produces enough five-figure passive dividend income for me to live off of.

As important as it is to select the right businesses, it’s also important to invest at the right valuations.

While price is what you pay, it’s value that you actually get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

By investing your spare capital into undervalued high-quality dividend growth stocks, you can unlock so many rewards – monetary and otherwise – over the long term.

Of course, recognizing undervaluation means that one has some basic understanding of valuation in the first place.

No need to fret.

My colleague Dave Van Knapp put together Lesson 11: Valuation in order to help.

One of his “lessons” on dividend growth investing, it demystifies the entire concept of valuation by providing an easy-to-follow discussion and template.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Comcast Corporation (CMCSA)

Comcast Corporation (CMCSA)

Comcast Corporation (CMCSA) is a media and entertainment conglomerate with interests in cable, broadcasting, film, streaming, live entertainment, and theme parks.

Founded in 1963, Comcast is now a $174 billion (by market cap) media juggernaut that employs more than 180,000 people.

The company reports operations across five segments: Cable Communications, 55% of FY 2022 revenue; Media, 20%; Sky, 16%; Theme Parks, 7%; and Studios, 2%.

Cable Communications consists of the operations of Comcast Cable, which provides millions of cable video connections, high-speed internet connections, and voice services connections.

Media consists of NBCUniversal’s television and streaming platforms, including a variety of cable networks, the NBC broadcast network, the Telemundo broadcast network, certain television stations, and Peacock.

Sky consists of the operations of Sky, a leading European entertainment company that creates content and provides video, broadband, voice, and wireless phone services.

Studios consists of NBCUniversal’s film and television studio production and distribution operations, including Universal Pictures – one of the five major US film production studios.

Theme Parks consists of the worldwide Universal theme parks.

Comcast also has other business interests that consists primarily of the operations of Comcast Spectacor, which owns the Philadelphia Flyers and the Wells Fargo Center arena in Philadelphia, Pennsylvania.

We know that media is changing in ways that do not necessarily benefit the traditional gatekeepers.

Streaming has already taken over a landscape that was previously dominated by OTT cable TV packages.

And if that’s all Comcast had to offer, it’d be a business model in trouble.

However, that’s far from reality.

Comcast is a conglomerate that touches nearly every part of media.

Yes, there is still a cable TV distribution offering in there.

But Comcast has built a streaming platform of its own, called Peacock, which now claims 28 million customers after recently growing its paid subscriber base by 80% YOY.

Moreover, Comcast has sports, news, theme parks, and television and movie production.

Perhaps most importantly, it’s the dominant provider of broadband internet connections in the US.

How dominant?

Morningstar has this to say: “Comcast’s cable business has steadily gained broadband market share over its primary competitors, phone companies like AT&T and Verizon, as high-quality internet access has become a staple utility. We estimate the firm has increased broadband market share in the areas it serves to about 65% from 50% a decade prior, meaning Comcast’s customer base in the typical market area is twice the size of its rivals’.”

Demand for high-speed internet access is nearly insatiable, and that confers a certain amount of pricing power to a dominant player like Comcast.

After all, you cannot stream (or do much of anything else in this modern-day society) without a high-speed internet connection.

I would go as far as saying that high-speed internet is almost as important and necessary as electricity in 2024.

It’s because of this broad diversification and dominant position in broadband that Comcast has been able to consistently grow straight through one of the most disruptive periods that media has ever seen.

That growth, by the way, includes Comcast’s dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

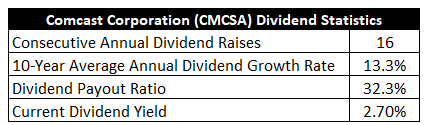

Indeed, the company has increased its dividend for 16 consecutive years.

The 10-year dividend growth rate is 13.3%, which is strong, but recent dividend raises have been in a high-single-digit range (around 8%).

Still, seeing as how the stock yields 2.7%, that’s enough dividend growth to get the job done.

Still, seeing as how the stock yields 2.7%, that’s enough dividend growth to get the job done.

This market-beating yield, by the way, is 50 basis points higher than its own five-year average.

And with a payout ratio of 32.3%, Comcast has plenty of headroom for more high-single-digit dividend raises over the years to come.

What I see is a well-balanced dividend profile here, with a good yield, solid growth, and plenty of safety.

Really just so much to like across the board.

Revenue and Earnings Growth

As likable as these dividend numbers might be, though, these metrics are mostly looking into the past.

However, investors must always be looking into the future, as today’s capital is being used to capture the rewards of tomorrow.

As such, I’ll now build out a forward-looking growth trajectory for the business, which will be of aid when the time comes to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past with a future forecast in this manner should give us what we need in order to make an informed decision about what the future growth path of the business may look like.

Comcast moved its revenue from $64.7 billion in FY 2013 to $121.4 billion in FY 2022.

That’s a compound annual growth rate of 7.2%.

That’s surprisingly impressive.

I’m usually looking for a mid-single-digit rate top-line growth rate out of a mature business like this.

Make no mistake about it, Comcast is very mature.

Despite its size and maturity, Comcast was able to move the revenue needle in a meaningful way.

In the interim, the company grew its earnings per share from $1.28 to $3.64 (adjusted) over this period.

That’s a CAGR of 12.3%.

Again, impressive stuff out of Comcast.

This totally busts the narrative out there about Comcast being some kind of “dying” cable company.

Dying companies don’t compound earnings at 12%+ annually.

To the contrary, Comcast has been growing faster than a lot of other higher-profile businesses out there.

It’s important to note that I used adjusted EPS for FY 2022.

That’s only because Comcast recorded non-cash impairment charges related to Sky during FY 2022, which artificially skewed EPS results for the year.

Also, we can see quite a bit of excess bottom-line growth, and this was mostly driven by prolific share buybacks.

Comcast reduced its outstanding share count by approximately 17% over the last decade.

Looking forward, CFRA is projecting an 8% CAGR for Comcast’s EPS over the next three years.

I like that.

I think it’s a pretty sober assessment of the reality of the business.

CFRA does a good job of summing a lot of it up with this passage: “We think Comcast’s results in the first half of 2023 showed a firming recovery path for TV/film content, and theme parks businesses—benefiting from pent-up demand. Meanwhile, with the cable broadband business recently riding some demand tailwinds, the company has increasingly pivoted to a broadband-led connectivity strategy and gained significant traction in its nascent wireless offering.”

This is a diversified media conglomerate with multiple levers to pull, and the levers are being pulled.

A multi-pronged entertainment strategy, spearheaded by broadband, positions the entire business well for continued changes across media.

After all, it’s impossible to consume all of that online content if one is not online – and this creates a demand funnel for broadband.

I’d also point out that this is a rare family-run business, as Brian Roberts (part of the founding Roberts family) runs Comcast as CEO and owns all of the company’s B shares (giving Roberts about 1/3 of all voting control).

It’s not often to see so much “skin in the game” in a US company (I usually see this much more often in foreign companies).

Now, CFRA’s 8% number would represent a pretty sizable drop in growth relative to what Comcast has put up over the last decade.

However, I don’t see a 12%+ CAGR as necessary or realistic for Comcast.

Even just a HSD bottom-line growth rate (driven by a combination of MSD revenue growth and share buybacks) is enough to propel similar dividend growth.

And you get to pair that kind of growth with the near-3% starting yield.

It’s a pretty straight path from there to a ~10% annualized total return out of the stock, assuming no serious changes in valuation.

Nothing wrong with that at all, in my view.

Comcast surely isn’t dying, but it’s also not going to provide world-beating performance.

If you have reasonable expectations, Comcast should be a very good investment over the coming years.

Financial Position

Moving over to the balance sheet, Comcast has a less-than-stellar financial position.

The long-term debt/equity ratio is 1.2, while the interest coverage ratio is hovering around 6.

Comcast ended FY 2022 with nearly $100 billion in long-term debt, which is a sizable, and slightly concerning, number – even for a company with a market cap approaching $175 billion.

That said, the balance sheet has improved slightly in recent years (L-T debt was nearly $110 billion in FY 2018).

In my view, the balance sheet is easily the weakest and least desirable aspect of the business.

Profitability is more than decent.

Return on equity has averaged 13.6% over the last five years, while net margin has averaged 10.2%.

The returns on capital aren’t the highest out there, but Comcast is putting up respectable numbers.

Notably, these five-year averages would both be higher if not for the impairment that was recorded in FY 2022.

Overall, I see a lot to like here.

Comcast has assembled an empire of durable, complementary assets that are positioned well for the changing landscape across media.

And with economies of scale, high barriers to entry, and the ability to operate as a local monopoly in many markets, the business does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

While the broader media industry is fiercely competitive, Comcast benefits from often being the only major cable player in any given market.

Streaming TV is an existential threat to the cable bundle, but Comcast counters this with Peacock and broadband (because one cannot stream television without internet access).

Cable television usage is in secular decline, and this disproportionately harms the company: It hurts both the distribution (i.e., cable video) side of the business and production (i.e., networks) side.

Comcast faces technological obsolescence risk, with competitors constantly trying to bring better, cheaper, and/or faster internet access options to market (e.g., 5G wireless, LEO satellites).

The high debt load limits the company’s future flexibility in terms of M&A and network buildouts.

Comcast also has a poor reputation for customer service.

I think these risks are worth serious consideration, but the underlying asset empire seems attractive enough to overcome the risks.

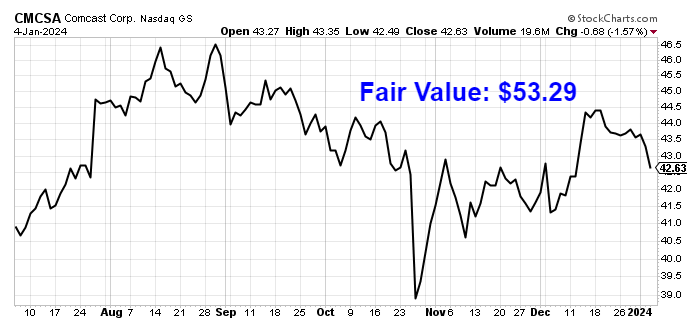

Also, with the stock down about 30% from all-time highs, the valuation seems attractive…

Stock Price Valuation

We have a P/E ratio of 12 on the stock right now.

That’s about half of the broader market’s earnings multiple.

It’s also well off of the stock’s own five-year average P/E ratio of 19.4.

The cash flow multiple of 6.4 is also quite a bit lower than its own five-year average of 7.7.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7.5%.

I’m basically assuming a continuation of the status quo here.

This growth rate is lower than the demonstrated EPS and dividend growth out of Comcast over the last decade, although it’s pretty close to where recent dividend raises have been coming in at.

I’m also slightly below where CFRA is at on the near-term forecast for EPS growth.

With the payout ratio being as low as it is, the dividend growth could actually outpace EPS growth for a number of years.

However, I’d rather err on the side of caution.

CFRA might be too optimistic.

Also, management may decide to take it easy on the dividend raises (in order to address the balance sheet).

Either way, the model accounts for some conservativeness.

The DDM analysis gives me a fair value of $49.88.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I think I put together a pretty sensible valuation model, yet this stock still comes out looking cheap.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates CMCSA as a 4-star stock, with a fair value estimate of $60.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates CMCSA as a 4-star “BUY”, with a 12-month target price of $50.00.

I came out within pennies of where CFRA is. Averaging the three numbers out gives us a final valuation of $53.29, which would indicate the stock is possibly 19% undervalued.

Bottom line: Comcast Corporation (CMCSA) has built a dynamic media conglomerate with an empire of durable, complementary assets. In spite of the narrative around cable companies, Comcast shows surprising strength and growth. With a market-beating yield, a double-digit long-term dividend growth rate, a low payout ratio, more than 15 consecutive years of dividend increases, and the potential that shares are 19% undervalued, long-term dividend growth investors looking for media exposure ought to have this name on their radar.

Bottom line: Comcast Corporation (CMCSA) has built a dynamic media conglomerate with an empire of durable, complementary assets. In spite of the narrative around cable companies, Comcast shows surprising strength and growth. With a market-beating yield, a double-digit long-term dividend growth rate, a low payout ratio, more than 15 consecutive years of dividend increases, and the potential that shares are 19% undervalued, long-term dividend growth investors looking for media exposure ought to have this name on their radar.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is CMCSA’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 89. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, CMCSA’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Disclosure: I’m long CMCSA.

Source: Dividends & Income