Note: On January 23, I’ll be launching a premium investing service in partnership with Dave Van Knapp, Mike Nadel, Jason Fieber and Christian Phillips. We’ll be featuring real-life dividend portfolios, high-yield opportunities, option income trade alerts and real estate income insights. If this sounds like something you’d be interested in, I encourage you to keep following my work — I’ll share more details in the coming weeks.

I’m alerting you to an income trade I made Wednesday with Invesco QQQ Trust (QQQ), the popular tech-focused ETF that could be a great momentum play into 2024. In short, on January 3, I bought 100 shares of QQQ at a price of $399.23… and simultaneously sold one January 19, 2024 $400 call option for $5.23 per share.

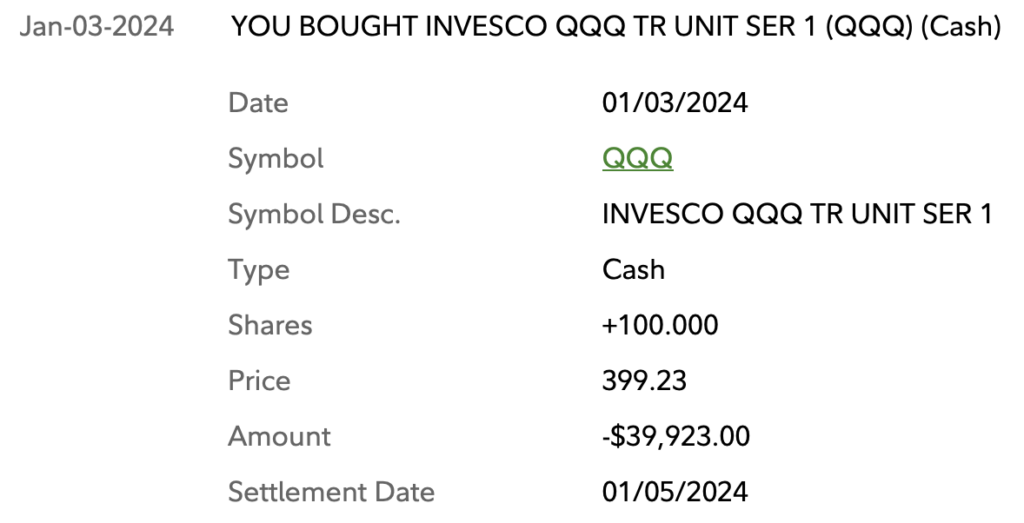

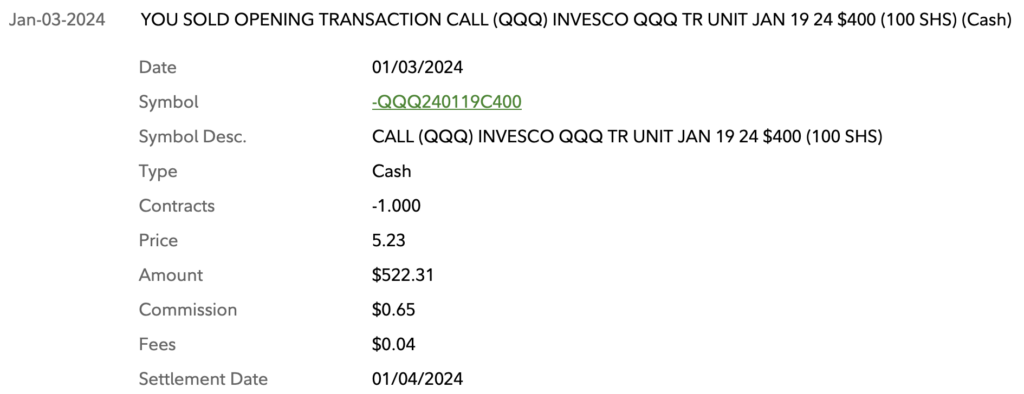

This kind of option trade is called a covered call. My call option is “covered” by the shares I bought. Here’s what my “Buy-Write” order looked like after it got filled…

BUY

WRITE

By selling a call option on QQQ, I’m giving the buyer of the option the right, but not the obligation, to purchase my 100 shares at $400 per share (the “strike” price) anytime before January 19 (the “expiration” date).

In exchange for that opportunity, the buyer of the option paid me $5.23 per share, which is known as the “premium”.

Because I collected immediate income when the trade opened, I immediately lowered my cost basis from $399.23 per share to $394 per share ($399.23 – $5.23).

The ability to immediately lower cost-basis like this is precisely what makes these kinds of trades safer than simply purchasing shares of the underlying stock or ETF the traditional way, which is buying them outright at the market price.

Yes, I’m limiting my potential upside: if QQQ shares climb to $420, for example, I’ll be forced to sell at “just” $400… but I’d still be selling shares for more than what I bought them for AND generating high income in the process.

It’s a trade-off… and one I’m willing to make, because this strategy, by its very nature of SELLING a call option instead of BUYING one — is designed to be conservative and generate income.

There are two likely scenarios for how this will all play out… and they both spell double-digit annualized yields.

Scenario #1: QQQ stays under $400 by January 19, 2024

If QQQ stays under $400 by January 19, I’ll get to keep my 100 shares.

In the process, I’ll also have received $523 in call income ($5.23 x 100 shares).

The call income was collected as soon as the order was filled on January 3.

It was deposited in the account where I made the trade, which is my 401k retirement account.

On a percentage basis, I received a 1.3% return in income ($5.23 / $499.23) in just 16 days.

That works out to a 29.9% annualized yield.

Scenario #2: QQQ climbs above $400 by January 19, 2024

If QQQ climbs over $400 by January 19, my 100 shares will get sold — or “called away” — at $400 per share.

In Scenario 2, like Scenario 1, I get to keep the $523 in call income. I’ll also generate a $77 capital gain ($0.77 x 100) because I bought at $399.23 and will be selling at $400.

In this scenario, I’ll be looking at a total profit of $600.

From a percentage standpoint, I’d be getting a 1.3% return in the form of income for selling the call option and a 0.2% capital gain. That doesn’t sound like a lot, but if I can repeat these results over the period of a year, that works out to a 34.3% yield from QQQ.

Potential Risks: Selling options isn’t for everyone. There are downsides. I already mentioned one of them: your upside is limited. Remember, even if the underlying stock you own soars, you’ll still be obligated to sell it at the agreed upon strike price. The other risk is that the stock could tank. The income you collected from selling the call provides a bit of a cushion, but if the underlying drops significantly more than what you collected in premium, that premium will be of little comfort. For this reason, I ONLY sell options on stocks or funds I want to own anyways — just in case I get stuck sitting on some unrealized losses for a while. So just make sure you’re OK with the potential outcomes of the trade before you get in.

Bottom Line: Selling covered options is one of my favorite ways to generate relatively safe, high-yields in my retirement account. In fact, over the years I’ve generated tens of thousands of dollars selling options. If this is something you’re interested in learning more about, be sure to keep following my work. As I mentioned earlier, on January 23 I’ll be launching a premium investing service where at least once per month I’ll share a real-life option trade I’m making in my retirement portfolio. Stay tuned!

-Greg Patrick

Please keep in mind that trade alerts like the one above are for information purposes only. I’m not a registered financial advisor and these aren’t specific trade recommendations for you as an individual. Each of our readers have different financial situations, risk tolerance, goals, time frames, etc. The ideas we publish are simply ideas that we feel fit our specific needs and that we’re personally making in our own portfolios. You should also be aware that some of the trade details (specifically stock prices and options premiums) are certain to change from the time I make my trade to the time you’re alerted about it. So please don’t attempt to make this trade yourself without first doing your own due diligence and research.