The Walt Disney Company (DIS) has assets that span movies, television, publishing, and theme parks. Analysts have taken a bearish stance on the stock, landing it into an unfavorable Zacks Rank #5 (Strong Sell).

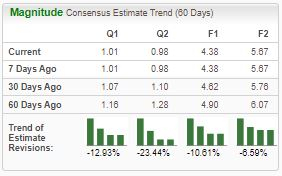

Estimates have been taken lower across the board.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

In addition, the company resides in the Zacks – Media Conglomerates industry, which is currently ranked in the bottom 29% of all Zacks industries. What’s been going on with the company? Let’s take a closer look at its current standing.

Disney

Disney shares have faced adverse price action for some time now, down more than 50% since making all-time highs in early 2021 as the company tries to regain its ‘blockbuster’ movie status. Following hit-after-hit throughout the last decade, several of Disney’s recent releases have failed to attract viewers, with slowing Disney+ subscriber growth also hampering results.

The company reported 150.2 million Disney+ subscribers throughout its latest quarterly release, down 14 million, or 8%, from the same period last year. Nonetheless, shares bounced nicely following the mentioned release, helping deliver an 8.3% return since the report date and matching the S&P 500’s performance.

The recent favorable price action off the 2023 lows is undoubtedly a good start, but the company’s earnings picture remains under considerable pressure.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Disney’s growth profile remains overall positive, underpinned by its Growth Style Score of “A’. Consensus expectations for its current year indicate 16.4% earnings growth on nearly 4% higher sales, with FY25 consensus estimates currently suggesting an additional 30% of earnings growth on 5% higher revenues.

The company’s shares presently trade at a 1.9X forward 12-month price-to-sales ratio, beneath the 2.9X five-year median and five-year highs of 4.8X.

Bottom Line

Negative earnings estimate revisions from analysts paint a challenging picture for the company’s shares in the near term.

The Walt Disney Company is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company’s earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy) – these stocks sport a notably stronger earnings outlook paired with the potential to deliver explosive gains in the near term.

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks