The recent passing of Charlie Munger at 99 years old weighs on me.

Perhaps best known as the sidekick of the legendary investor Warren Buffett, Munger was a formidable investor (and teacher, orator, intellectual, philanthropist, etc.) in his own right.

One of Munger’s best lessons is to always invert problems in order to solve them.

This advice definitely applies to investing.

For example, by avoiding terrible businesses, one naturally falls into terrific businesses.

Sounds simple.

Well, there’s a lot of beauty in simplicity.

I take this to heart by following the dividend growth investing strategy.

This strategy almost automatically funnels one right into great businesses (and, by extension, allows one to avoid bad businesses).

That’s because this strategy espouses buying and holding shares in world-class businesses that pay reliable, rising dividends to shareholders.

To that point, it requires a certain amount of greatness from an enterprise in order to afford this kind of behavior.

It’s very difficult to pay out ever-larger sums of money to your investors without producing the ever-growing profit necessary to support those payments.

Take a look at the Dividend Champions, Contenders, and Challengers list to see what I mean.

That list has compiled invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

It’s a who’s who of some of the world’s best businesses.

It’s a who’s who of some of the world’s best businesses.

Following this strategy has helped me to build the FIRE Fund.

That’s my real-life, real-money portfolio, and it’s jam-packed with some of the world’s best businesses.

Not only that, but this portfolio generates enough five-figure passive dividend income for me to live off of.

In fact, this dividend income even allowed me to retire in my early 30s.

My Early Retirement Blueprint explains how I was able to do such a thing.

Now, sticking to great businesses by avoiding bad ones has been key to my success.

However, buying when undervaluation is present (and, in the process, avoiding overvaluation) has also been very important.

It’s price that you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Employing Charlie Munger’s advice would have us avoid terrible businesses at high prices, which would pull us toward undervalued high-quality dividend growth stocks.

Of course, employing this advice does necessitate some basic understanding of valuation.

Have no fear.

Fellow contributor Dave Van Knapp’s Lesson 11: Valuation is here to help

Part of an overarching series of “lessons” designed to teach the dividend growth investing strategy, it lays out a valuation template that can be easily applied toward just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Xylem Inc. (XYL)

Xylem Inc. (XYL)

Xylem Inc. (XYL) is a water technology company.

Founded in 2011, Xylem is now a $26 billion (by market cap) water technology leader that employs approximately 22,000 people.

Although Xylem was founded in 2011 after being spun out from former parent company ITT Inc. (ITT), its roots (under ITT) date back decades.

As an independent business, Xylem now focuses on providing a range of water technology solutions for commercial and residential customers.

These solutions range across the transport, treatment, testing, and more efficient usage of water.

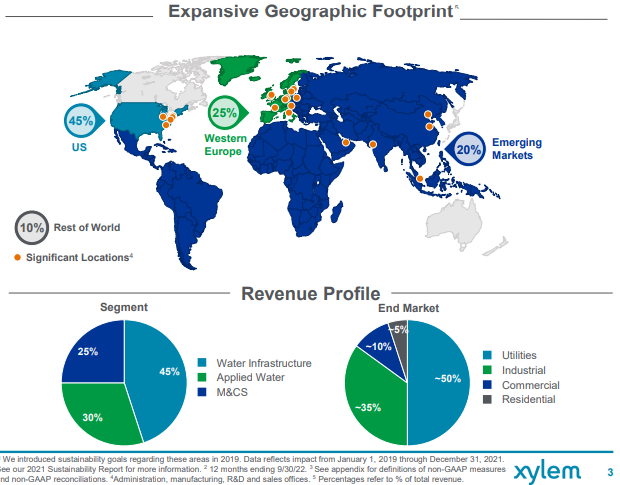

FY 2022 revenue can be broken down across three business segments: Water Infrastructure, 43%; Applied Water, 32%; and Measurement & Control Solutions, 25%.

Xylem derived 46% of FY 2022 revenue from the US, 26% from Europe, 20% from emerging markets, and 8% from other geographies.

Xylem derived 46% of FY 2022 revenue from the US, 26% from Europe, 20% from emerging markets, and 8% from other geographies.

Water Infrastructure, the largest segment by revenue, is where a range of Xylem products, such as wastewater pumps, filtration, treatment equipment, and controls are designed to help with the transportation and treatment of water.

The Applied Water segment is where products including pumps and valves drive increased efficiency for customers.

Measurement & Control Solutions, the smallest business segment by revenue, is where products, such as meters and sensors, are used to help with testing.

In addition, Xylem created a new business segment called Integrated Solutions & Services after acquiring Evoqua Water Technologies Corp., a leader in mission-critical water treatment solutions and services, in 2023 for $7.5 billion.

The acquisition of Evoqua turned Xylem into the world’s largest pure-play water technology company.

That’s a great spot to be in.

And that’s because water is fast becoming the “liquid gold” of this century, much in the same way that oil was for the last century.

Clean, usable water is becoming increasingly costly and difficult to access for a worldwide population that continues to grow in size.

Yet, with urbanization and a global rise in wealth playing out, demand for clean water and the related infrastructure is likely only going to climb over the coming years.

That means replacing aging infrastructure in developed countries, and it also means laying out new infrastructure in developing countries.

Furthermore, technologies ranging from semiconductor production to data centers are extremely thirsty for water and must be as efficient as possible.

All of this secular change and growth obviously plays right into the hands of Xylem.

The long-term tailwinds are gusting its way.

And it’s why Xylem’s revenue, profit, and dividend are positioned to grow at high rates for years to come.

Dividend Growth, Growth Rate, Payout Ratio and Yield

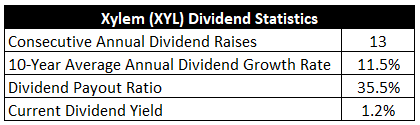

Already, Xylem has increased its dividend for 13 consecutive years.

The 10-year dividend growth rate of 11.5% shows what a start Xylem has been off to.

The 10-year dividend growth rate of 11.5% shows what a start Xylem has been off to.

The most recent dividend raise came in at 10%, so the double-digit dividend growth train rolls on.

Now, the stock only yields 1.2%, which is in line with its own five-year average.

With a lowish yield like that, one really does need to see double-digit growth in order to make sense of an investment.

Assuming a static valuation, one’s total return is going to come from the sum of business growth and dividend income.

Based on that, we can see a case for double-digit annualized total return from Xylem, which is very nice.

Since the payout ratio is only 35.5%, based on midpoint guidance for this year’s adjusted EPS, strong dividend growth could persist for the foreseeable future.

Put simply, Xylem has been growing its dividend at a high rate for years, and I see that continuing for years to come.

For dividend growth investors who gravitate toward high-quality compounders, these are very appealing metrics.

Revenue and Earnings Growth

As appealing as these metrics might be, though, they’re mostly looking backward.

However, investors must always look forward, as present capital is being risked for future rewards.

That’s why I’ll now build out a forward-looking growth trajectory for the business, which will be extremely useful when the time comes later to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Blending the proven past with a future forecast in this manner should give us what we need to roughly gauge what the future growth path of the business may look like.

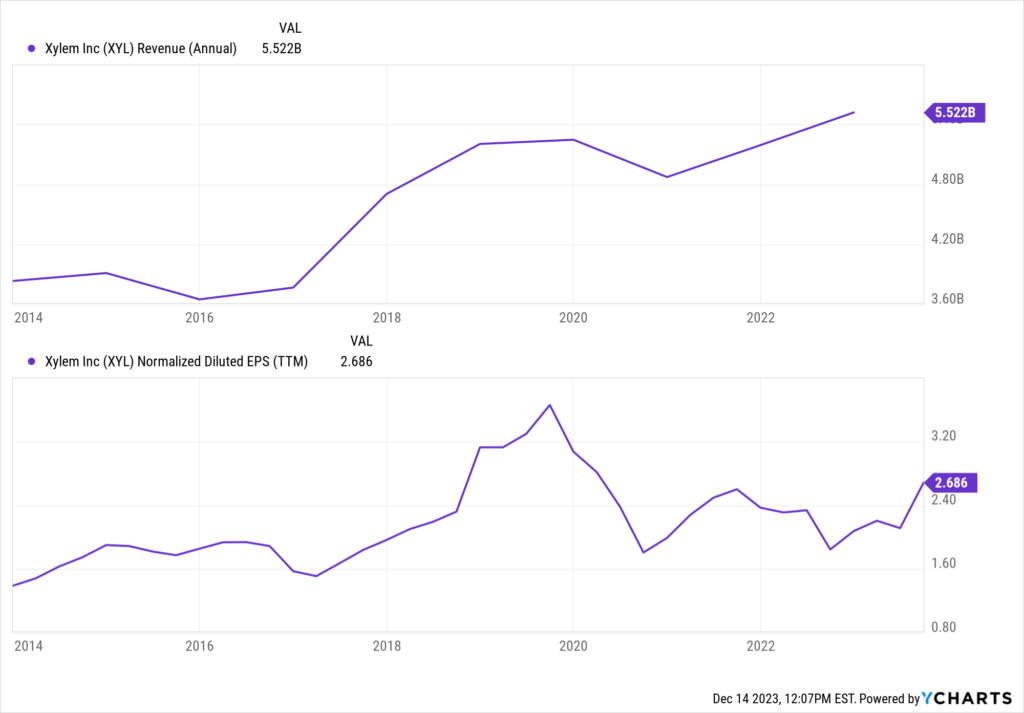

Xylem increased its revenue from $3.8 billion in FY 2013 to $5.5 billion in FY 2022.

That’s a compound annual growth rate of 4.2%.

Not bad.

I suppose I might have expected a slightly higher number, but a mid-single-digit top-line growth rate is nothing to sneeze at.

I suppose I might have expected a slightly higher number, but a mid-single-digit top-line growth rate is nothing to sneeze at.

Meanwhile, earnings per share grew from $1.22 to $2.85 (adjusted) over this period, which is a CAGR of 9.9%.

Very nice.

That’s a bit more like it, right?

We can now see how well dividend growth and EPS growth line up over the last decade, showing deft control by management.

Now, I did use adjusted EPS for FY 2022, and that’s only because Xylem recorded a one-time non-cash pension plan settlement that was unrelated to core operations.

Still, what we seem to have here is a fast-growing business squarely focused on the coming century’s “liquid gold”.

Call me crazy, but I think that’s very interesting.

Looking forward, CFRA is projecting a 15% CAGR for Xylem’s EPS over the next three years.

Boy, that’s even more interesting.

This would represent a material acceleration in bottom-line growth for Xylem, if it comes to pass.

CFRA sees big sales growth over the near term, supported by “…contributions from Evoqua, as well as pricing actions, improved backlog conversion, robust wastewater utility demand, and infrastructure projects.”

In addition, CFRA cites the easing of recent headwinds as reasoning for faster growth ahead: “Supply chain bottlenecks have limited the speed at which [Xylem] has been able to convert orders to sales, though we are seeing sequential improvements, with Measurement & Control growth accelerating as headwinds ease. Demand remains robust for the digital transformation of the water business, and we see ongoing support from industry adoption of digital solutions. We view [Xylem] as better positioned for top- and bottom-line expansion following the integration of Evoqua, which resulted in enhanced exposures towards high growth markets.”

This is a convergence of multiple favorable developments: a transformational acquisition, easing headwinds, and faster-gusting tailwinds (e.g. large infrastructure spending).

Whereas the last decade was quite good for Xylem, the next decade could be far, far better.

I’ll note that Xylem’s current midpoint adjusted EPS guidance for this year is $3.72.

If Xylem hits that number, that would result in 30.5% YOY growth in adjusted EPS.

Frankly, Xylem doesn’t need to knock it out of the park with huge growth.

It’s just so hard to imagine a future in which demand for these products isn’t there.

We’re talking about the proper care and usage of a finite precious resource that is required to sustain human life.

That kind of visibility on the demand runway is worth a lot, in my view.

But if Xylem can grow at a high rate on top of that, all the better.

Helping Xylem further is its large installed base, which creates a high degree of recurring revenue.

Overall, the low-double-digit dividend growth rate of the last decade seems likely to continue into the years ahead.

That’s a lot of compounding to be excited about.

Financial Position

Moving over to the balance sheet, Xylem has a rock-solid financial position.

The long-term debt/equity ratio is 0.5, while the interest coverage ratio is over 13.

Xylem’s long-term debt load of under $2 billion is fairly immaterial for a company with a market cap exceeding $25 billion.

Furthermore, cash on hand offsets about half of all long-term debt.

It’s also worth noting that the Evoqua acquisition was funded with Xylem stock, so the debt load hasn’t exploded higher in recent quarters.

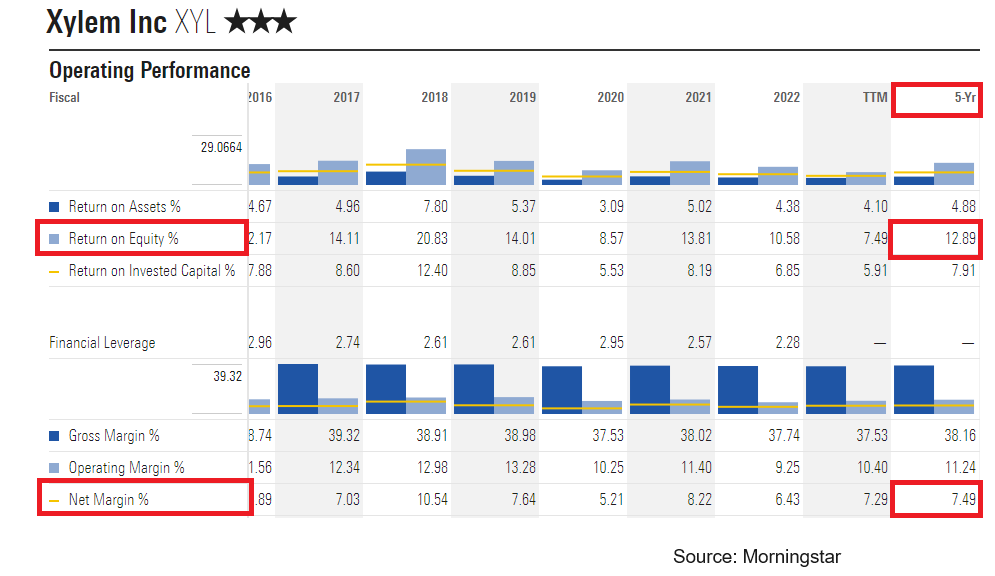

Profitability is good, but I wish the returns on capital were higher.

Return on equity has averaged 12.9% over the last five years, while net margin has averaged 7.5%.

I’m looking forward to seeing the combined enterprise improve these numbers over the coming years.

I’m looking forward to seeing the combined enterprise improve these numbers over the coming years.

Overall, Xylem is a compelling way to play the world’s increasing thirst for clean, usable water.

Xylem caters to a precious resource that has, essentially, an unlimited demand runway.

And with economies of scale, industry know-how, switching costs, IP, R&D, brand power, and an installed base that’s entrenched, Xylem does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

Xylem has exposure to global geopolitics and public funding quagmires, thanks to large infrastructure projects that usually spawn from government entities.

An international footprint exposes Xylem to fluctuating currency exchange rates.

The Evoqua acquisition was Xylem’s largest ever, and there are serious integration and execution risks now present.

Input costs can be volatile, and higher-than-normal inflation may weigh on near-term results.

Xylem, like any other business, has risks, but I think the business model and quality more than make up for these risks.

Also, with the stock down more than 20% from its 52-week high, the current valuation looks decently appealing…

Stock Price Valuation

The stock is trading hands for a forward P/E ratio of 29.3.

That’s based on midpoint guidance for this year’s adjusted EPS.

At first glance, that actually looks rather high.

But I think two important things should be kept in mind.

First, this stock’s five-year average P/E ratio is 46.8, so there’s always a big valuation premium attached to the name.

Second, we’re talking about a business that caters to, arguably, the world’s most important precious resource – a precious resource with a demand runway that’s infinitely long.

There’s a certain amount of value in that kind of long-term certainty.

Also, the stock’s yield, as noted earlier, is right in line with its own five-year average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis.

I factored in a 10% discount rate, a 10-year dividend growth rate of 14%, and a long-term dividend growth rate of 8%.

That initial dividend growth rate reflects the near-term EPS growth acceleration that’s expected (by CFRA) to play out after a convergence of factors start to work in Xylem’s favor and blow a strong tailwind its way.

I’m then assuming that dividend growth settles into a high-single-digit range, which would be below Xylem’s demonstrated 10-year dividend growth rate.

Xylem has been used to growing its dividend at a low-double-digit rate, so there are no herculean expectations being placed on the business here.

I’m simply assuming that Xylem is able to move just a bit faster over the coming years than it has over the last 10 years.

With Evoqua on board, supply chain headwinds easing, and major infrastructure projects coming online around the world, Xylem has a lot to work with.

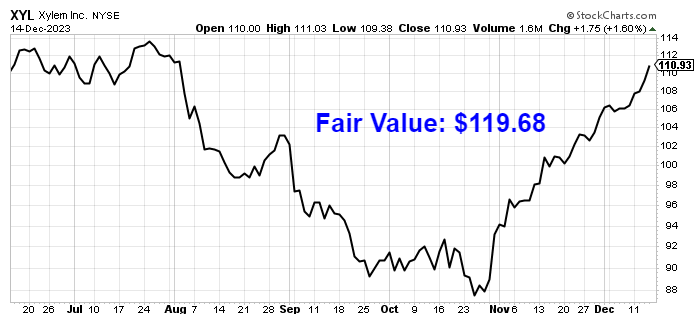

The DDM analysis gives me a fair value of $118.03.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I think I put together a pretty reasonable valuation model, yet the stock comes out looking modestly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates XYL as a 3-star stock, with a fair value estimate of $106.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates XYL as a 5-star “STRONG BUY”, with a 12-month target price of $135.00.

I came out somewhere in the middle this time around. Averaging the three numbers out gives us a final valuation of $119.68, which would indicate the stock is possibly 9% undervalued.

Bottom line: Xylem Inc. (XYL) is the world’s largest pure-play water technology company, catering to what is arguably the world’s most important precious resource. The demand runway for this company’s products is about as long and visible as it gets. With a market-like yield, a low payout ratio, double-digit dividend growth, more than 10 consecutive years of dividend increases, and the potential that shares are 9% undervalued, long-term dividend growth investors looking for a high-quality compounder with direct exposure to water should definitely consider this idea.

Bottom line: Xylem Inc. (XYL) is the world’s largest pure-play water technology company, catering to what is arguably the world’s most important precious resource. The demand runway for this company’s products is about as long and visible as it gets. With a market-like yield, a low payout ratio, double-digit dividend growth, more than 10 consecutive years of dividend increases, and the potential that shares are 9% undervalued, long-term dividend growth investors looking for a high-quality compounder with direct exposure to water should definitely consider this idea.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is XYL’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 66. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, PLD’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income