Consumer Staples Stocks

Even though the stock market, as measured by the S&P 500, looks fully valued to overvalued today, here are a baker’s dozen, 13 Consumer Staple Stocks that look attractively valued.

In this video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation, will analyze 13 Consumer Staples Stocks that appear attractive for investment. Chuck will discuss their earnings growth, valuation, and dividend yields. While he does not recommend any specific stocks, he will provide valuable insights into their performance and potential returns.

In covering the Consumer Staple Sectors today I want to make a point because I’ve had comments and, you know, what I consider to be people who really haven’t watched the videos or understood what I’m doing here. I’m not necessarily recommending these stocks.

In covering the Consumer Staple Sectors today I want to make a point because I’ve had comments and, you know, what I consider to be people who really haven’t watched the videos or understood what I’m doing here. I’m not necessarily recommending these stocks.

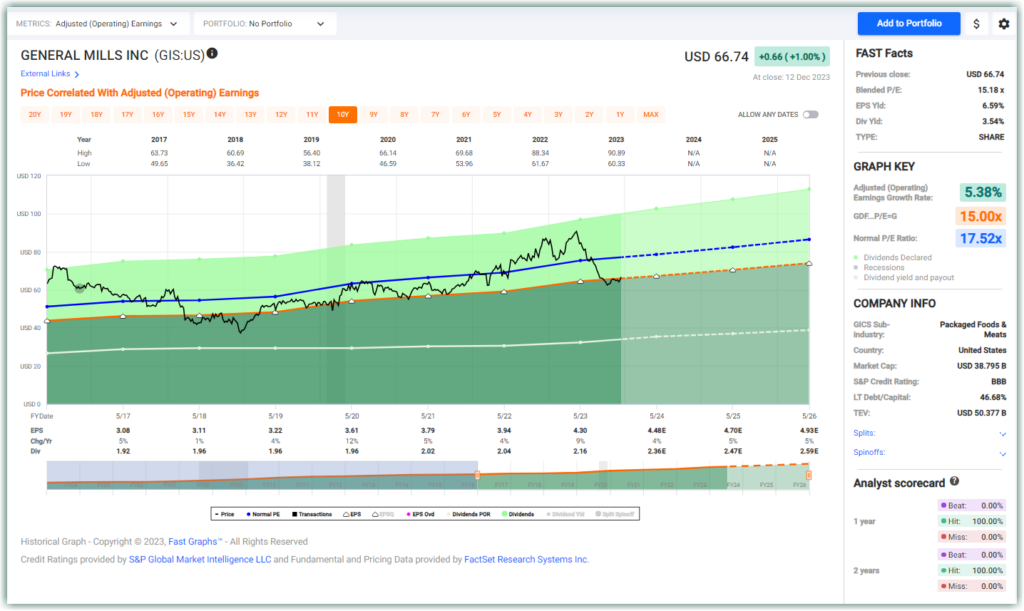

What I’m doing is I’m pointing out, by using a screen, stocks in each sector that appear to be fully valued that can serve as research candidates if any of them strike your fancy. I’m going to let you decide whether or not you like these stocks or not. And as always, I’m going to utilize the Fast Graphs Fundamentals Analyzer software tool to illustrate what these 13 companies look like and what their valuations look like as compared to the overall stock market.

FAST Graphs Analyze Out Loud Video on Consumer Staples Stocks Church & Dwight (CHD), Clorox Co (CLX), Colgate Palmolive (CL), Conagra Brands (CAG), Coca-Cola Europacific Partners (CCEP), Campbell Soup (CPB), Empire Co (EMP.A:CA), General Mills (GIS), Herbalife Ltd (HLF), Loblaw Cos (L:CA), Altria Group (MO), Metro Inc (MRU), Nomad Foods (NOMD), Philip MOrris International (PM), Smucker JM Co (SJM), Weston George Ltd (WN:CA).

— Chuck Carnevale

Source: FAST Graphs