The last century has been an anomaly in a lot of ways.

One example of this is modern-day capitalism.

In any other century, ordinary human beings had almost no ability to move up economically and become financially independent.

Instead, regular people were destined for lives of financial servitude, needing to exchange labor for money until the end of days.

I implore you to not let this opportunity pass you by.

It’s incumbent upon us to take advantage.

The best possible way to take advantage?

Well, I’d argue the answer to that question is to employ dividend growth investing.

This is a long-term strategy whereby one buys and holds shares in world-class businesses that pay safe, growing dividends to their shareholders.

After all, it requires greatness from a business in order to be able to afford ever-larger cash dividend payments to shareholders.

You can find many examples of such businesses on the Dividend Champions, Contenders, and Challengers list.

This list has compiled invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

You’ll notice many household names on the list, and that isn’t by accident.

You’ll notice many household names on the list, and that isn’t by accident.

Great businesses tend to make themselves known over time.

I’ve used the dividend growth investing strategy for more than a decade now, letting it guide me as I’ve gone about building my FIRE Fund.

That’s my real-life, real-money portfolio.

It generates enough five-figure passive dividend income for me to live off of.

In fact, I’ve been in the fortunate position to be able to live off of dividends since I retired in my early 30s.

My Early Retirement Blueprint details how I was able to accomplish that feat.

A pillar of my success has been the strategy, of course.

A pillar of my success has been the strategy, of course.

But it’s not just about picking the right businesses to invest in.

It’s also about investing when valuations are right.

Price only tells you what you pay, but it’s value that tells you what you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Buying undervalued high-quality dividend growth stocks is a great way to take advantage of a unique time in history and eventually become financially independent.

Of course, recognizing undervaluation means that one already has a basic understanding of how valuation works.

No worries for anyone who doesn’t yet have this basic understanding in place.

My colleague Dave Van Knapp put together Lesson 11: Valuation, which is part of an overarching series on dividend growth investing, in order to help investors develop a mental framework for valuation.

The information in that lesson can help one to estimate the fair value of just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Air Products & Chemicals Inc. (APD)

Air Products & Chemicals Inc. (APD)

Air Products & Chemicals Inc. (APD) is a major global producer and supplier of industrial gases, now the largest supplier of hydrogen and helium in the world.

Founded in 1940, Air Products & Chemicals is now a $58 billion (by market cap) industrial gases major that employs more than 20,000 people.

The company’s FY 2023 sales were reported through four Industrial Gases business segments organized by geography: Americas, 43%; Asia, 26%; Europe, 24%; and the Middle East and India, 1%. Corporate and other accounted for the remainder.

This is a wonderful and extremely powerful business model.

This is a wonderful and extremely powerful business model.

I’ll give you three reasons why.

First, industrial gases are critical input for the manufacturing processes of many different end products ranging from electronics to vehicles.

Second, because of the critical nature of these industrial gases, and because constant and reliable access to these gases is a must, a manufacturer will set up a long-term contract with a dependable provider of said gases.

Complex infrastructure is then installed at a manufacturing site to ensure reliability, which makes it costly and difficult to switch providers later.

Third, Air Products & Chemicals is part of a global oligopoly – only three major companies in this space control the vast majority of the global market share.

Let’s review.

Air Products & Chemicals combines necessary input with long-term contracts fortified by complex infrastructure, and they do so within the favorable confines of a global oligopoly.

That adds up to a company that practically prints money and basically cannot lose over the long run.

And it’s why Air Products & Chemicals is positioned so well to continue growing its revenue, profit, and dividend for years to come.

Dividend Growth, Growth Rate, Payout Ratio and Yield

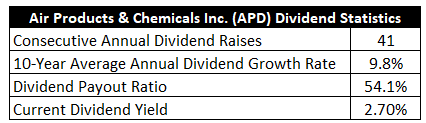

To date, the company has increased its dividend for 41 consecutive years.

That easily qualifies this company for its prestigious status as a Dividend Aristocrat.

The 10-year dividend growth rate is 9.8%.

The 10-year dividend growth rate is 9.8%.

In and of itself, that’s strong.

But what’s even better about the dividend growth is how consistent it’s been – Air Products & Chemicals has been consistently increasing its dividend at a high-single-digit rate like clockwork.

And you get to pair that kind of dividend growth with the stock’s yield of 2.7%.

It’s awfully hard to be unhappy with a near-3% yield and a near-10% dividend growth rate.

Assuming a static valuation, the sum of growth and yield should roughly equal out to an annualized total return.

That yield, by the way, is 60 basis points higher than its own five-year average.

Based on FY 2024 adjusted EPS guidance, at the midpoint, the payout ratio is 54.1%.

That payout ratio strikes a great balance – nearly perfect, really – between retaining earnings for growth against returning cash back to shareholders.

This Dividend Aristocrat brings the goods.

You get yield, growth, and safety all in one package.

Excellent dividend metrics right across the board.

Revenue and Earnings Growth

As excellent as these metrics may be, though, many of them are looking into the past.

However, investors must always look toward the future, as today’s capital is being risked for tomorrow’s rewards.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be of great use when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past with a future forecast in this way should give us enough information to make an informed call on what the future growth path of the business might look like.

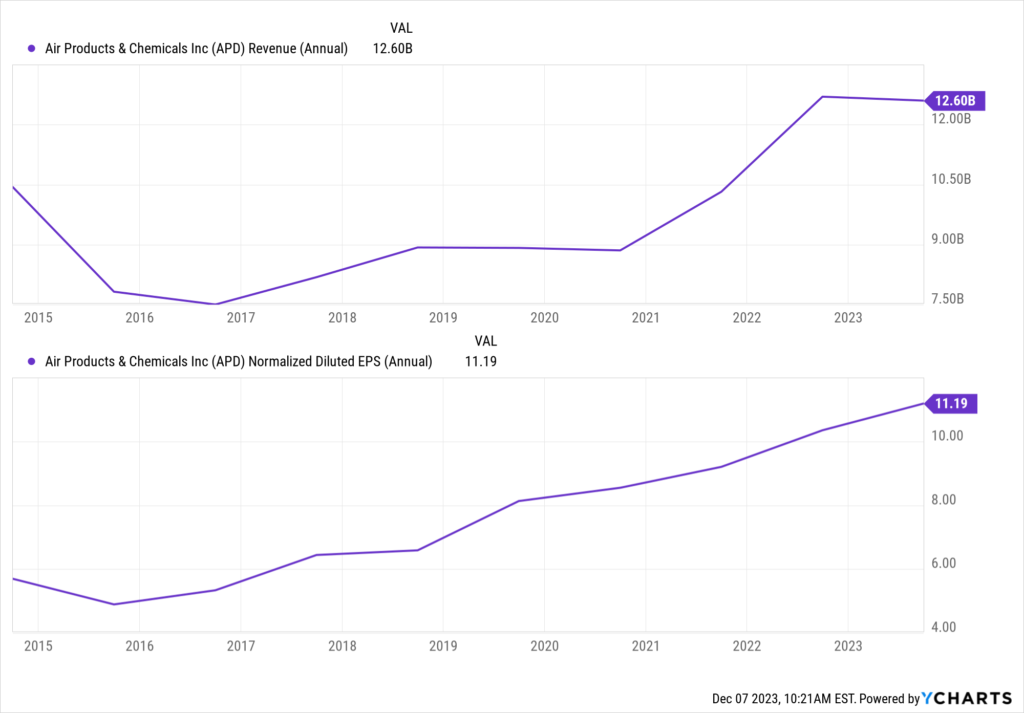

Air Products & Chemicals advanced its revenue from $10.4 billion in FY 2014 to $12.6 billion in FY 2023.

That’s a compound annual growth rate of 2.2%.

At first glance, this is quite mediocre.

However, we have to look beneath the surface here.

Management decided to intentionally make the business smaller and more efficient through what was called the “Five-Point Plan”, which was introduced in 2014.

This plan was designed to focus the business on industrial gases by jettisoning non-core operations.

Executing this plan led to spinning off the electronics material division in 2016, and the performance materials division was then sold in 2017 for $3.8 billion in cash.

This plan has worked out nicely.

Earnings per share grew from $4.61 to $10.33 over this time frame, which is a CAGR of 9.4%.

See, that’s more like it.

See, that’s more like it.

Management wanted a higher-margin business, and they got it.

We can now see how well bottom-line growth matches up with dividend growth over the last decade – almost the same number.

Really good stuff here.

Looking forward, CFRA believes that Air Products & Chemicals will compound its EPS at an annual rate of 12% over the next three years.

So that’s basically a continuation of the growth acceleration that started to play out between 2016 and 2017.

I think this passage by CFRA sums it up well: “We think [Air Products & Chemicals] has a solid backlog of growth projects, with a focus on expanding the scope of syngas supply agreements, acquiring air separation units, and winning agreements in large industrial gas projects. [Air Products & Chemicals] is well positioned to capitalize on gasification related to carbon capture and hydrogen mobility, which are long-term secular tailwinds.”

Simply put, Air Products & Chemicals is tapping into multiple areas where secular tailwinds are present.

It’s a great business located in a great spot.

This kind of long-term setup doesn’t get much better.

Supporting CFRA’s number is FY 2024 guidance from Air Products & Chemicals, which is calling for 13% YOY growth in adjusted EPS (at the midpoint).

This kind of low-double-digit EPS CAGR would support high-single-digit dividend growth with no issues whatsoever.

In the end, it looks like status quo to me.

That is to say, Air Products & Chemicals should be able to keep growing its dividend at a rate that’s similar to what’s already transpired over the last decade.

Seeing as how the stock yields almost 3% to start with, that’s a compelling arrangement.

Financial Position

Moving over to the balance sheet, Air Products & Chemicals has a rock-solid financial position.

The long-term debt/equity ratio is 0.5, while the interest coverage ratio is over 17.

The company’s ~$7 billion long-term debt load is fairly benign for a company with a market cap of nearly $60 billion.

Moreover, cash on hand offsets nearly half of the debt load.

Great balance sheet.

Profitability is also great.

Return on equity has averaged 16.3% over the last five years, while net margin has averaged 19.5%.

Air Products & Chemicals is routinely producing high returns on capital, which I love to see.

It’s a world-class enterprise, in my view.

And the company does benefit from durable competitive advantages, including global economies of scale, large barriers to entry, high switching costs, a global oligopoly, and long-term contracts with fixed infrastructure.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

A recession would impact the business in some way, as demand for industrial gases is correlated with manufacturing activity.

Since the company is heavily involved in a variety of major energy projects around the world, ongoing changes in the global energy complex adds uncertainty and risks.

Input costs can be volatile.

More than half of the company’s sales come from outside the Americas, heavily exposing the company to currency exchange rates and geopolitics.

Joint ventures are employed in order to help fund growth projects, but the financial health/commitment of partners may vary over time.

I see these risks as quite acceptable relative to the quality and growth profile of the business.

And the valuation, relative to the quality and growth, also appears to be more than acceptable…

Stock Price Valuation

Stock Price Valuation

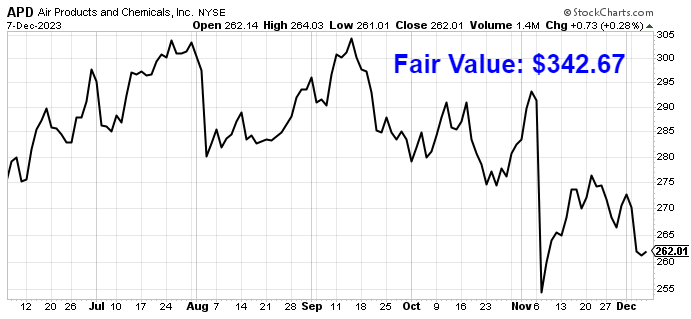

The stock is trading hands for a P/E ratio of 25.4.

That compares favorably to its own five-year average of 29.

Furthermore, using FY 2024 midpoint adjusted EPS guidance, the forward P/E ratio drops to 20.2.

The sales multiple of 4.6 is well off of its own five-year average of 5.6.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 8%.

Now, this 8% number is as high as I’ll allow for.

But if there’s any company that deserves the benefit of the doubt, it’s this one.

Air Products & Chemicals has been reliably increasing its dividend for decades.

The company’s demonstrated EPS and dividend growth over the last decade exceed 8%.

And the near-term forecast for EPS growth (which would support like dividend growth) is well over 8%.

In addition, the payout ratio is moderate.

Overall, I just don’t see why this company can’t grow its dividend at a high-single-digit rate over the coming years.

The DDM analysis gives me a fair value of $378.00.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I think I put together a realistic valuation, and the stock looks very undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates APD as a 4-star stock, with a fair value estimate of $314.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates APD as a 5-star “STRONG BUY”, with a 12-month target price of $336.00.

I came out on the high end this time around. Averaging the three numbers out gives us a final valuation of $342.67, which would indicate the stock is possibly 24% undervalued.

Bottom line: Air Products & Chemicals Inc. (APD) is a world-class enterprise that benefits from being part of a global oligopoly. It produces high returns on capital. And there are numerous competitive advantages in place. With a market-beating yield, high-single-digit dividend growth, a moderate payout ratio, more than 40 consecutive years of dividend increases, and the potential that shares are 24% undervalued, long-term dividend growth investors looking for a wonderful business at a wonderful price should take a good look at this Dividend Aristocrat.

Bottom line: Air Products & Chemicals Inc. (APD) is a world-class enterprise that benefits from being part of a global oligopoly. It produces high returns on capital. And there are numerous competitive advantages in place. With a market-beating yield, high-single-digit dividend growth, a moderate payout ratio, more than 40 consecutive years of dividend increases, and the potential that shares are 24% undervalued, long-term dividend growth investors looking for a wonderful business at a wonderful price should take a good look at this Dividend Aristocrat.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is APD’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 95. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, APD’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income