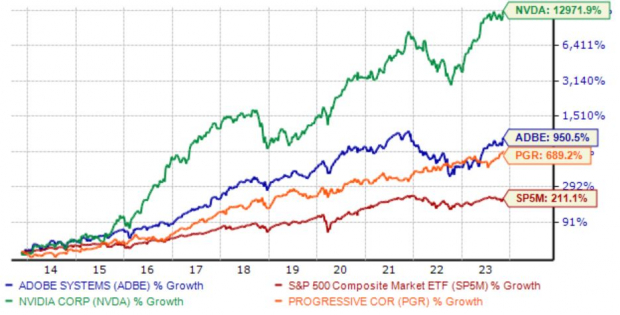

Investors are always searching for stocks that deliver market-beating gains. And many have done precisely that over the last decade, exceeding the S&P 500’s impressive 211% gain and 12% annualized return.

Three stocks – NVIDIA (NVDA) , Progressive (PGR) , and Adobe Systems (ADBE) – have all outperformed the S&P 500 over the last decade, providing at least a 20% annualized return. This is illustrated below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

As we can see, NVIDIA has been in a league of its own, representing one of the best-performing stocks over the last decade. Let’s take a closer look at each.

NVIDIA

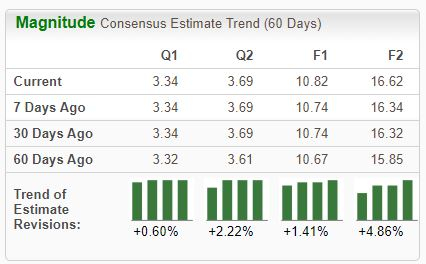

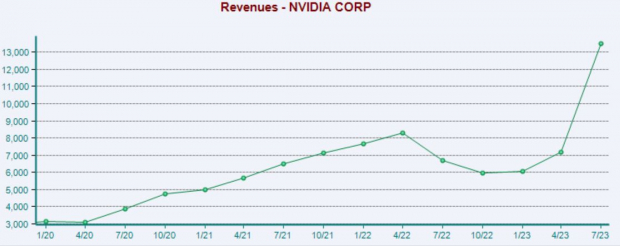

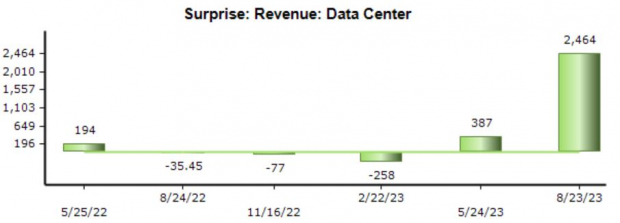

NVIDIA has been the dominant story in 2023, with the hype surrounding Wall Street’s shiny new toy, artificial intelligence (AI), driving share performance year-to-date. The company’s Data Center revenues have melted higher due to scorching demand, causing analysts to revise their earnings expectations across the board.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

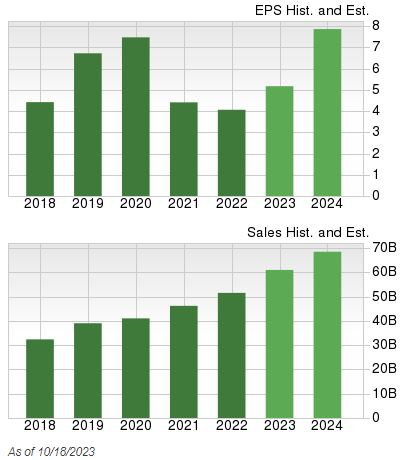

Demand for the company’s AI chips is fully expected to further bolster its top and bottom line, with estimates suggesting 220% earnings growth in its current year on 100% higher sales. Unsurprisingly, growth isn’t expected to cool, with FY25 estimates indicating an additional 50% of earnings growth on 50% higher sales.

The demand boom NVIDIA has been witnessing is easy to visualize in the chart below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company’s quarterly release, which is expected next week on November 21st, will help cap off the Q3 earnings cycle. Regarding headline figures, consensus estimates suggest 480% earnings growth on 171% higher sales. Both items have enjoyed positive revisions since the end of August.

Regarding Data Center sales, the Zacks Consensus Estimate presently stands at $12.6 billion, suggesting 230% growth from the same period last year. The company has exceeded consensus Data Center sales estimates in back-to-back releases, with the latest beat totaling nearly $2.5 billion.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

NVIDIA’s annualized return over the last decade is a remarkable 62%.

Progressive

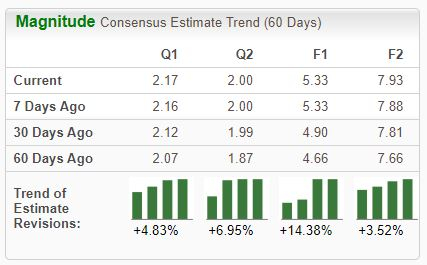

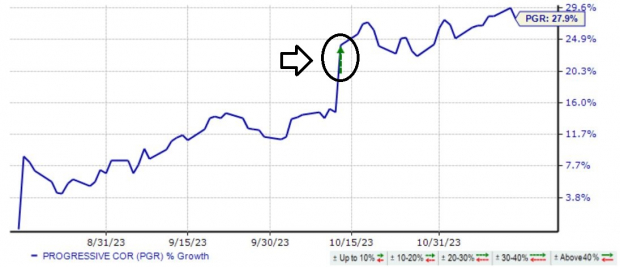

Progressive, a current Zacks Rank #1 (Strong Buy), is a massive American insurance company. Analysts have taken their expectations higher across the board, most notably following its latest quarterly release last month in mid-October.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Regarding the mentioned release, Progressive saw Net Premiums Earned climb 20% year-over-year to $14.9 billion, with total Policies in Force also growing 10%. Regarding headline figures, PGR beat the Zacks Consensus EPS Estimate by 20% and posted a modest revenue surprise.

PGR shares found momentum following the print, now heading toward all-time highs.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company’s growth expectations are undoubtedly worth highlighting, with consensus estimates for its current fiscal year (FY23) suggesting 31% earnings growth paired with a 20% sales climb. Peeking a bit ahead, consensus expectations for FY24 reflect earnings and revenue growth rates of 48% and 13%, respectively.

The stock carries a Style Score of “A” for Growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Progressive’s annualized return over the last decade presently sits at 22%.

Adobe Systems

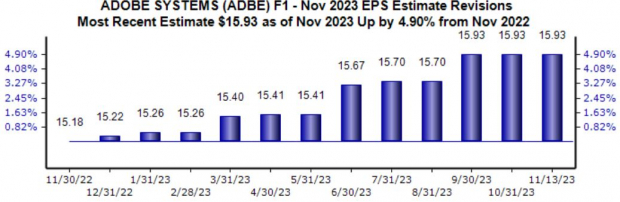

Adobe, a current Zacks Rank #2 (Buy), is one of the biggest software companies in the world, generating the bulk of its revenue via licensing fees from its customers. The company’s shares have benefited in 2023 amid a favorable sentiment shift for the tech sector overall, up more than 75%.

Revisions for its current fiscal year have remained on a positive trend since last November, up nearly 5% over the period.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Adobe is another notable tech company with a ‘late’ reporting date; ADBE will reveal its next quarterly results on December 13th. Consensus expectations for the quarter to be released suggest 15% earnings growth on 10% higher sales, with both estimates being revised modestly higher since the end of August.

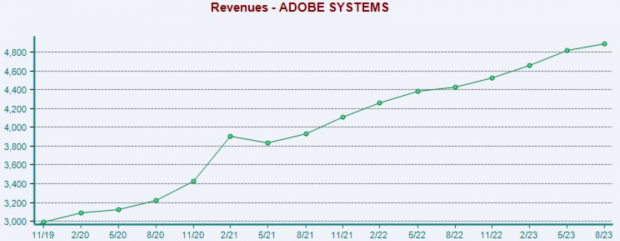

Like NVDA, Adobe’s sales growth has remained visibly strong.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

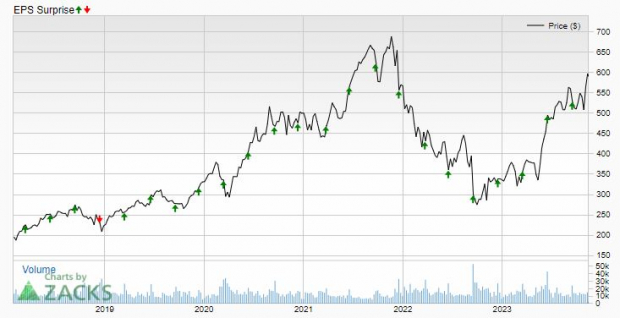

It’s worth noting that the company is a consistent earnings performer, beating consensus revenue and earnings expectations in 13 consecutive releases. The latest EPS miss tracks all the way back to 2018.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Adobe’s annualized return over the last decade is an impressive 26%.

Bottom Line

Beating the market is the goal of all investors, which is precisely what all three stocks above – NVIDIA (NVDA) , Progressive (PGR) , and Adobe Systems (ADBE) – have done over the last decade, all providing annualized returns of over 20%.

In addition, all three currently sport a favorable Zacks Rank, reflecting optimism among analysts.

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks