We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: The Honest Company, Inc. (NASDAQ: HNST)

Today’s penny stock pick is the American digital-first consumer goods company, The Honest Company, Inc. (NASDAQ: HNST).

The Honest Company, Inc. based in Los Angeles, was founded by actress Jessica Alba, Christopher Gavigan, and Brian Lee. The company manufactures and sells diapers and wipes, skin and personal care, and household and wellness products. The company also offers baby clothing and nursery bedding products. It sells its products through digital and retail sales channels, such as its website and third-party ecommerce sites, as well as brick and mortar retailers.

Website: https://www.honest.com

Latest 10-k report: https://investors.honest.com/node/8451/html#i5312d1d77b654fed898ba79468a435db_64

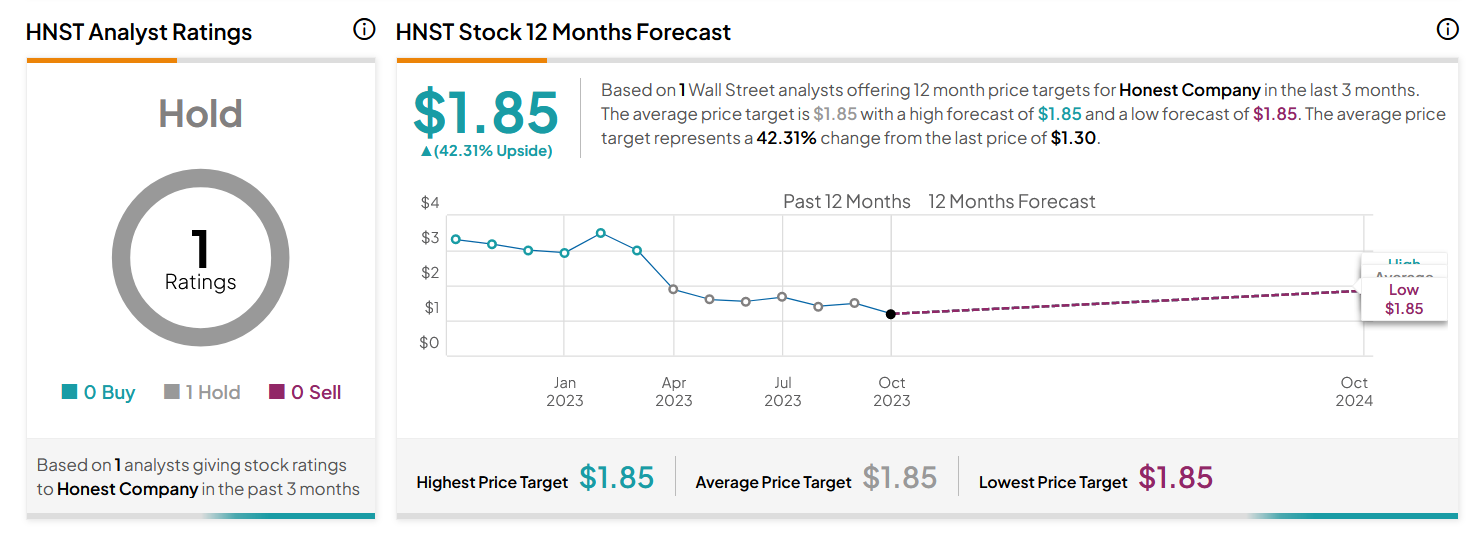

Analyst Consensus: As per TipRanks Analytics, based on 1 Wall Street analyst offering 12-month price targets for HNST in the last 3 months, the stock has an average price target of $1.85, which is nearly 42% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- Rumors of acquisition. The strength of the company’s brand is expected to make HNST an ideal acquisition target for a deep-pocketed strategic buyers.

- Consumer Defensive stocks are trading higher in general, due to the ongoing Israel-Hamas war.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock currently looks poised for a breakout from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish Stoch: The %K line of the stochastic is above the %D line, indicating possible bullishness.

#3 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#5 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, and is also moving higher from oversold levels, indicating possible bullishness.

#6 Bullish RSI: In the weekly chart, the RSI is currently moving higher from oversold levels. This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for HNST is above the price of $1.40.

Target Prices: Our first target is $2.00. If it closes above that level, the second target price is $2.70.

Stop Loss: To limit risk, place a stop loss below $1.00. Note that the stop loss is on a closing basis.

Our target potential upside is 43% to 93%.

For a risk of $0.40, our first target reward is $0.60, and the second target reward is $1.30. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

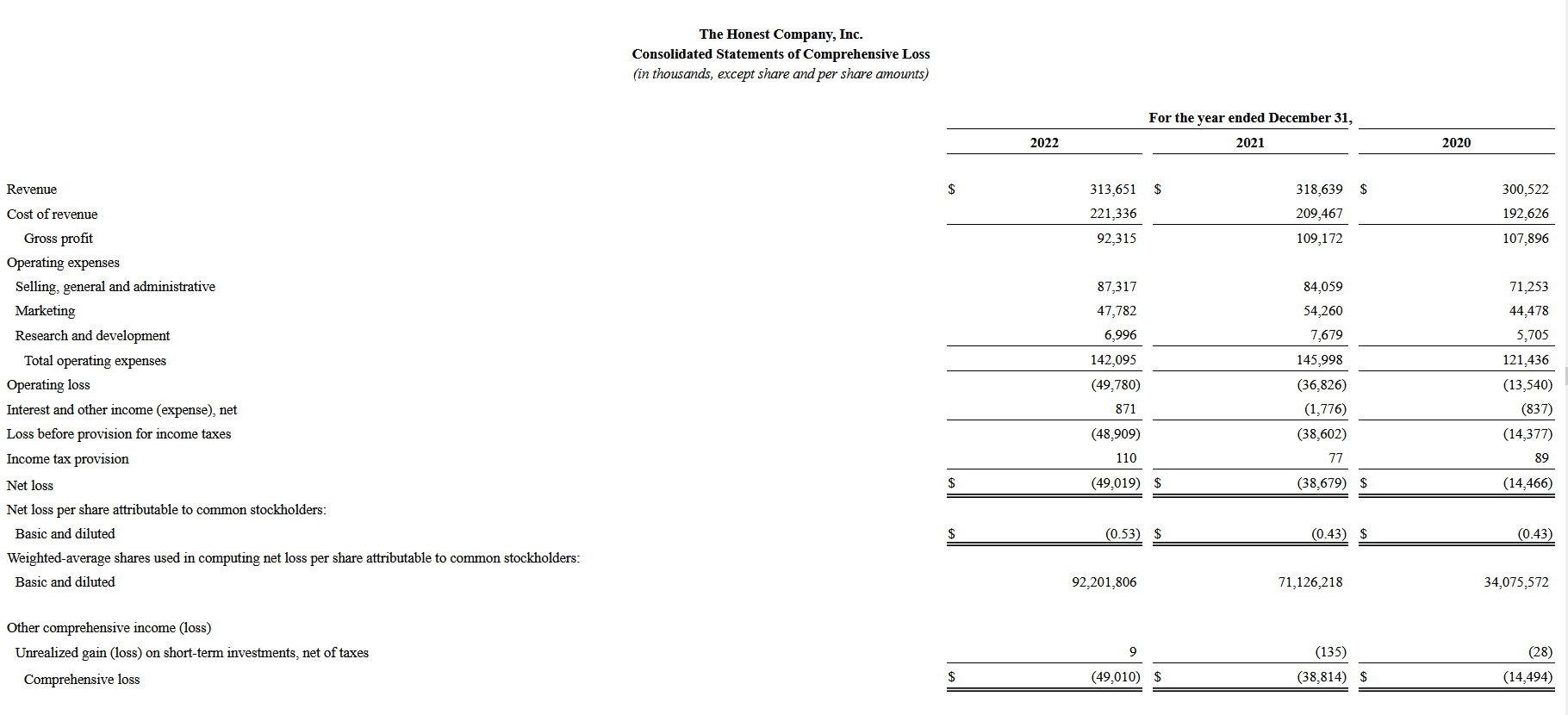

- The company has a history of net losses since its inception. HNST incurred net losses of $49.0 million, $38.7 million, and $14.5 million in the years ended December 31, 2022, 2021, and 2020, respectively.

- The company has been party to multiple legal proceedings.

- On September 17, 2019, the Nevada Department of Taxation issued a Deficiency Notice against the Company to initiate administrative legal proceedings before the Department for the alleged non-compliance with employee retention requirements provided in exchange for tax benefits in establishing the Company’s Las Vegas distribution center in a December 2016 Abatement Agreement the Company had executed with the State of Nevada via its Governor’s Office of Economic Development.

- On September 23, 2020, the Center for Advanced Public Awareness served a 60-Day Notice of Violation on the Company, alleging that the Company violated California’s Health and Safety Code (“Prop 65”) because of the amount of lead in the Company’s Diaper Rash Cream and seeking statutory penalties and product warnings available under Prop 65.

- On September 15, 2021, Cody Dixon filed a putative class action complaint in the U.S. District Court for the Central District of California alleging federal securities law violations by the Company, certain current officers and directors, and certain underwriters in connection with the Company’s IPO.

- On August 10, 2022, Catrice Sida and Kris Yerby filed a putative class action complaint in the U.S. District Court for the Northern District of California alleging violations of California’s Unfair Competition Law, False Advertising Law, Consumers Legal Remedies Act, breach of warranty, and unjust enrichment related to plant-based claims on certain of the Company’s wipes products.

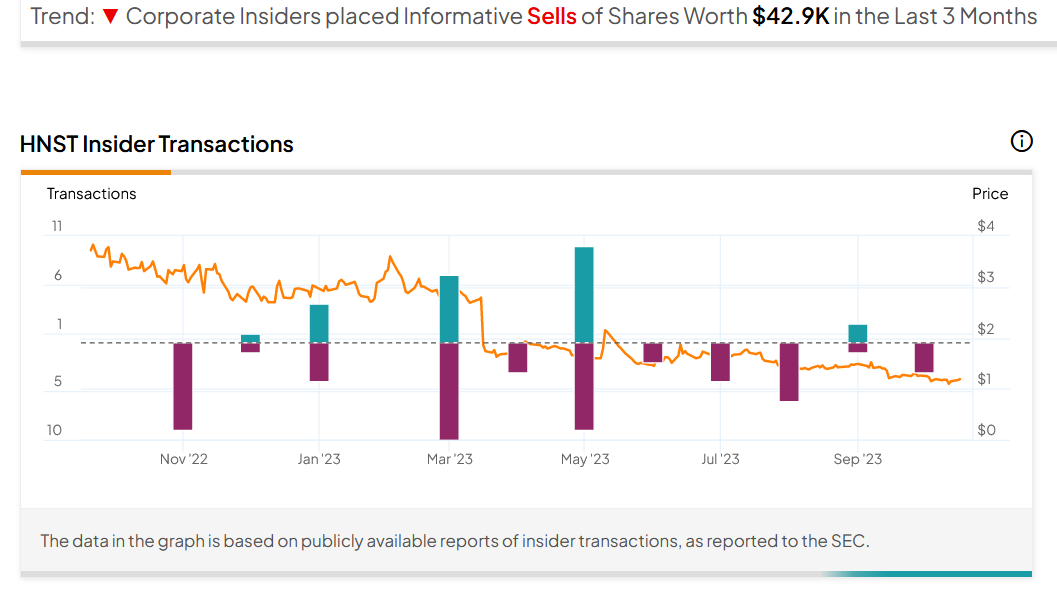

- Corporate Insiders placed Informative Sells of Shares Worth $42.9K in the Last 3 Months.

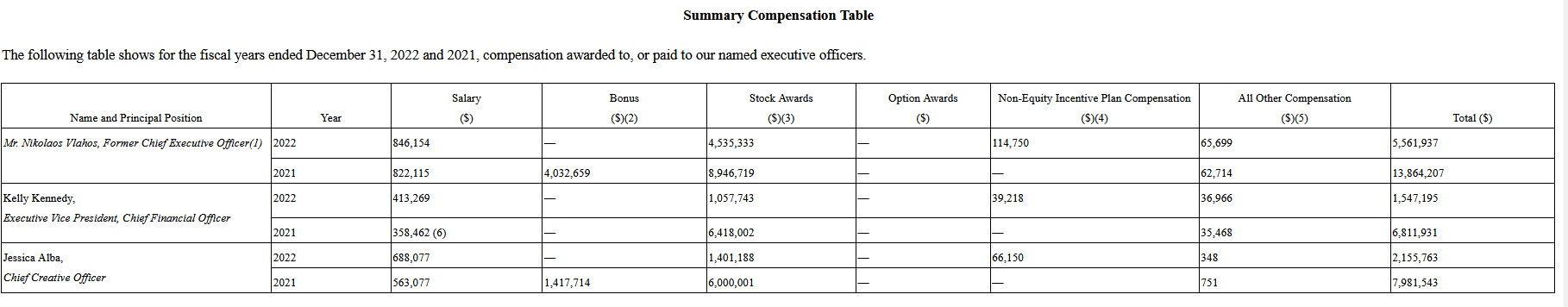

- Despite being a loss-making company, the executives are being paid significant compensation.

- The markets in which the company operate are highly competitive and rapidly evolving, with many new brands and product offerings emerging in the marketplace. HNST faces significant competition from both established, well-known legacy CPG players and emerging natural brands.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.