Investing is a lot like anything else in life.

You tend to get out of it what you put into it.

If you’re focused, disciplined, consistent, and patient, you will almost certainly experience amazing results.

That’s especially true if you pair the right temperament with the right strategy.

What might the right strategy be?

Well, I’m a huge advocate for the dividend growth investing strategy.

This is a strategy whereby you buy and hold shares in world-class businesses that pay reliable, rising dividends to their shareholders.

These are the businesses that sell the products and/or services that the world demands more and more of.

You can find hundreds of examples on the Dividend Champions, Contenders, and Challengers list, which has compiled invaluable data on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

You’ll notice many household names on this list.

You’ll notice many household names on this list.

It’s not a surprise.

After all, great businesses tend to become widely known over time.

I’ve been personally using this strategy for more than a decade now, using it to build the FIRE Fund.

That’s my real-money portfolio, and it produces enough five-figure passive dividend income for me to live off of.

Indeed, I’ve been fortunate enough to have my bills covered by dividends for years now.

In fact, I was even able to retire in my early 30s.

My Early Retirement Blueprint explains how that happened.

Now, this strategy is more than just investing in the right businesses.

Now, this strategy is more than just investing in the right businesses.

It’s also about investing at the right valuations.

Price simply measures what you pay, but it’s value that you actually get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Taking advantage of the superior strategy of dividend growth investing by buying high-quality dividend growth stocks when they’re undervalued can lead to remarkable results over the long run.

Is this easier said than done?

Is undervaluation too difficult to spot?

I don’t think so.

My colleague Dave Van Knapp made it easier than you might think.

His Lesson 11: Valuation, which is part and parcel of an overarching series of “lessons” on dividend growth investing, lays out a valuation template that can be used to estimate the fair value of just about any dividend growth stock.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Realty Income Corp. (O)

Realty Income Corp. (O)

Realty Income Corp. (O) is a real estate investment trust that leases freestanding, single tenant, triple-net-leased retail properties.

Founded in 1969, it’s now a $40 billion (by market cap) real estate giant that employs just under 400 people.

The portfolio of over 13,000 properties is diversified across the US, Puerto Rico, Spain, Italy, and the UK.

The company serves more than 1,300 clients operating across 85 different industries.

The property portfolio has an occupancy rate of 99%.

Approximately 83% of the properties are retail in nature, while the remainder is mostly industrial.

No one tenant accounts for more than 4% of annualized contractual rent.

Real estate can be really great.

Part of the appeal is in the way supply is naturally constrained.

Like the old saying about land goes: “They’re not making it anymore.”

Other than small reclamation projects, the usable land we have now is all we’ll ever have.

Commercial real estate one-ups this natural supply/demand favorability by erecting profitable properties on tracts of prized land.

If one can build or buy a well-located property and then rent it out to a suitable tenant, that’s a cash cow.

Multiplying this formula over and over again to the point of amassing a large and diversified portfolio of cash cows is what Realty Income has turned itself into.

But real estate can be, in some ways, not so great.

It’s difficult, expensive, and time consuming to acquire real estate on your own.

Becoming your own landlord involves scouting, lining up financing, studying comps, closing, leverage, finding tenants, managing properties, etc.

And that’s not even getting into how challenging and risky it is to scale this on your own.

That’s precisely where a real estate investment trust like Realty Income can enter the picture.

When you buy shares in Realty Income, you instantly own a slice of a portfolio of thousands of commercial properties that already have paying tenants installed.

You become a scaled-up landlord on the spot… without doing any of the heavy lifting yourself.

No hassles from tenants about this or that, because Realty Income handles it for you.

What’s great about Realty Income’s business model is the nature of a commercial triple-net lease – it’s a lease agreement on a property in which the tenant agrees to pay all of the expenses of the property, including real estate taxes, building insurance, and maintenance.

This significantly reduces Realty Income’s overhead, while also smoothing out results.

Furthermore, Realty Income leases its properties to some of the most successful tenants a landlord could hope for.

Realty Income’s top 20 tenants include the likes of FedEx Corporation (FDX) and Tractor Supply Co. (TSCO).

The diversification across tenants, industries, and geographies, all while maintaining a high level of quality, sets Realty Income and its shareholders up for continued prosperity in real estate.

That prosperity should translate into revenue, profit, and dividend growth for many years to come.

Dividend Growth, Growth Rate, Payout Ratio and Yield

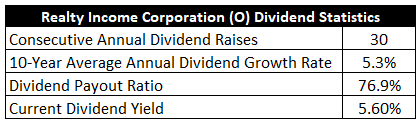

Already, Realty Income has increased its dividend for 30 consecutive years, with a 10-year dividend growth rate of 5.3%.

That makes Realty Income a vaunted Dividend Aristocrat.

More impressively, it’s one of the only REITs in the world that is a Dividend Aristocrat.

But the dividend growth story is even better than it seems, as Realty Income tends to increase its dividend every quarter.

In fact, the REIT has increased its dividend for 103 consecutive quarters.

In fact, the REIT has increased its dividend for 103 consecutive quarters.

Coming at it from another angle, Realty Income has raised the dividend 121 times since its 1994 IPO.

That level of consistency is incredible.

And it’s not just frequent dividend increases here but also frequent dividend payments.

That’s because this dividend is paid monthly.

It’s like collecting a monthly “rent check” – without doing any of the heavy lifting.

Realty Income takes this monthly dividend commitment to shareholders so seriously, it has trademarked its moniker: The Monthly Dividend Company®.

These monthly dividends aren’t small, either.

The stock yields 5.6% right now.

That’s 130 basis points higher than the stock’s own five-year average yield.

This heavy dividend is protected by a 76.9% payout ratio, based on AFFO/share guidance for the year.

The payout ratio looks elevated at first glance, but this is a pretty common level for a REIT.

Realty Income’s enduring commitment to paying a large dividend every month, and increasing the size of that dividend every quarter, is a sight to behold.

For income-oriented dividend growth investors, or even just investors who are looking to bolster the overall yield of their portfolios, these are compelling numbers.

Revenue and Earnings Growth

As compelling as these dividend metrics may be, many of the numbers are looking into the past.

However, investors must look into the future, as today’s capital gets risked for tomorrow’s rewards.

As such, I’ll now build out a forward-looking growth trajectory for the business, which will be of great aid when it comes time to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Fusing the proven past with a future forecast in this manner should allow us to appropriately judge where the business might be going from here.

Realty Income moved its revenue from $780 million in FY 2013 to $3.3 billion in FY 2022.

That’s a compound annual growth rate of 17.4%.

As great as this result is, it’s somewhat misleading.

REITs fund growth via debt and equity issuances.

Furthermore, Realty Income’s recently merged with VEREIT, a competing REIT, which substantially increased revenue.

With a REIT, you must look at profit growth on a per-share basis.

And when assessing profit for a REIT, it’s imperative to use funds from operations instead of normal earnings.

FFO is a measure of cash generated by a REIT, which adds depreciation and amortization expenses back to earnings.

Realty Income grew its FFO/share from $2.41 to $4.04 over this 10-year period, which is a CAGR of 5.9%.

This is the far more accurate indication of the true growth profile for Realty Income.

To be quite frank, I think that’s a great result.

REITs are income vehicles, and they’re not expected to compound at sky-high rates.

Despite natural limitations, including its structure and size, Realty Income still compounded its bottom line at a ~6% rate annually.

We can also see a pretty close relationship between bottom-line growth and dividend growth, which further goes to show just how tightly this ship is run.

Looking forward, CFRA currently has no headline prediction for Realty Income’s FFO/share growth over the next few years.

This is disappointing, as I do like to compare the proven past up against a future forecast.

However, because of how unusually consistent Realty Income has been, which extends over an unusually long period of time, I’d be inclined to assume a continuation of the status quo.

That’s my default setting in a situation like this.

CFRA gives praise to Realty Income, stating: “We see robust demand continuing for freestanding retail space, driven by a favorable supply/demand environment. We believe [Realty Income] is poised to outperform retail REIT peers in a more uncertain operating environment given its top tenants are concentrated in industries deemed essential, such as convenience, drug, dollar, quick service restaurants, and grocery stores.”

CFRA also adds: “We see revenue growth of approximately 18%- 20% in 2023, driven by significant acquisitions ([Realty Income] guiding for $7 billion) and regular rent increases. Occupancy remained strong in Q2, flat Q/Q at 99.0% – the highest occupancy level in 10 years – while [Realty Income’s] releasing recapture rate was a healthy 103.4%. We forecast occupancy will remain higher than its historical average of 98% throughout 2023 due to the company’s desirable property locations and high non-discretionary retailer demand.”

If it’s not clear by now, this is a top-tier commercial real estate operation.

However, the major challenge for a continuation of the status quo, in terms of growth on a per-share basis, is Realty Income’s size.

The larger this REIT gets, the harder it becomes for it to grow a rates similar to what it’s enjoyed in the past.

Most recently, for Q2 FY 2023, Realty Income reported 3.1% YOY growth in AFFO/share.

Is that the new growth profile?

I think it’s premature to say that it is.

But it may be indicative of broader limitations of growth opportunities, and it may be why Realty Income’s management recently decided to move outside of its core real estate type by diving into Las Vegas gaming with a 21.9% indirect interest in The Bellagio Las Vegas through a joint venture.

I naturally lean toward giving Realty Income and its management team the benefit of the doubt.

I don’t think it’s unreasonable to assume a mid-single-digit growth rate from Realty Income, in terms of both FFO/share and the dividend.

If the growth slowdown persists for a number of quarters into the future, it might then be time to lower the expectations.

Some growth expectations have obviously already been lowered and priced in, seeing as how the yield on the stock has risen (partially through a decline in the stock’s price).

Said another way, the market seems to be adjusting the yield higher in order to compensate for the possibility of less growth in the future.

Of course, there are other macroeconomic reasons for this, and competitive yields elsewhere (because of rising interest rates) are undoubtedly pressuring the stock.

Either way you slice it, starting off with a higher yield than what’s typically been available over the last several years does make it easier to, potentially, accept less dividend growth than what’s typically been available over the last several years.

If you can start off with a near-6% yield, even a lower-than-normal dividend growth rate of somewhere around 4% would get you pretty close to a 10% annualized total return (assuming a static valuation).

That’s lining you up for a market-smashing yield and income growth that exceeds the now-tamer inflation rate.

Plus, that big dividend is coming in monthly.

Not bad at all.

Financial Position

Moving over to the balance sheet, Realty Income has a solid financial position.

The company has $49.7 billion in total assets against $20.8 billion in total liabilities.

Realty Income’s credit ratings are well into investment-grade territory: A3, Moody’s; A-, S&P Global.

Furthermore, many of the REIT’s top tenants have their own investment-grade credit ratings.

Realty Income found a real estate recipe that works.

The combination of triple-net leases and a diversified roster of top tenants has led to one of the best long-term track records in all of commercial real estate.

And with deep industry expertise, long-term contracts, and massive scale, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

Real estate demand is cyclical, and the financial health of Realty Income’s tenants could sour in a prolonged recession.

A REIT’s capital structure relies on external funding for growth, which exposes the company to volatile capital markets and interest rates.

Higher interest rates can hurt the company twice over: Debt becomes more expensive, and equity can also become more expensive (because income-sensitive investors have alternatives, which can reduce demand for and pricing on the stock).

A recession can also hurt the company twice over: Demand for commercial real estate can cool, and equity issuances after a drop in the stock’s price would come at a higher cost.

Any wholesale changes in physical retail could hamper long-term growth.

The company’s scale is an advantage, but it also introduces questions around growth and the law of large numbers.

I see the risks as being worthy of contemplation.

However, with the stock’s price down 20% over the last year, the valuation is also very much worth contemplating…

Stock Price Valuation

The stock is trading hands for a forward P/FFO ratio of 13.8.

That’s based on FFO/share guidance for this year.

We can look at that number as an analogue to a P/E ratio on a normal stock, and it just goes to show how low the valuation is.

We can also look at the cash flow multiple, which is another way to judge the valuation for a REIT.

The P/CF ratio is currently 12.8.

To put that into perspective, the five-year average cash flow multiple for Realty Income is 19.3.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 4.5%.

I’m erring on the side of caution here, bringing down the expectations just a bit relative to what Realty Income has consistently delivered over the last decade.

I do think it’ll be difficult for the REIT to produce a 5%+ CAGR in EPS and the dividend over the next 10+ years.

Size and saturation will almost certainly work against the firm.

In some ways, Realty Income is a victim of its own success.

That said, a minor slowdown wouldn’t be catastrophic at all, especially since the yield has already risen in order to meet that lower growth rate in the middle.

The DDM analysis gives me a fair value of $58.33.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I may have been on the cautious side with my valuation, yet the stock still comes out looking undervalued anyway.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates O as a 4-star stock, with a fair value estimate of $76.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates O as a 4-star “BUY”, with a 12-month target price of $66.00.

I came out low on this one, but we all agree that some cheapness appears to be present. Averaging the three numbers out gives us a final valuation of $66.78, which would indicate the stock is possibly 18% undervalued.

Bottom line: Realty Income Corp. (O) is a high-quality REIT that has shown a rare level of endurance and consistency. Few companies take the commitment to shareholders more seriously than this one. With a market-smashing yield, a mid-single-digit dividend growth rate, a reasonable payout ratio, 30 consecutive years of dividend increases, and the potential that shares are 18% undervalued, this Dividend Aristocrat should be a strong investment candidate for long-term dividend growth investors who are looking for sustainable yield.

Bottom line: Realty Income Corp. (O) is a high-quality REIT that has shown a rare level of endurance and consistency. Few companies take the commitment to shareholders more seriously than this one. With a market-smashing yield, a mid-single-digit dividend growth rate, a reasonable payout ratio, 30 consecutive years of dividend increases, and the potential that shares are 18% undervalued, this Dividend Aristocrat should be a strong investment candidate for long-term dividend growth investors who are looking for sustainable yield.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is O’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 80. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, O’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income