OI Glass (OI) is shaping up to be a sound investment in terms of growth and value landing a Zacks Rank #1 (Strong Buy) and the Bull of the Day.

Formally known as Owens-Illinois, OI Glass stock may be a strong option for investors’ portfolios as the largest manufacturer of glass containers in the world.

Furthermore, the Zacks Glass Products Industry is currently in the top 7% of over 250 Zacks industries indicating now may be an ideal time to buy OI Glass stock as a leader in the space.

Undervalued Growth

The broader glass industry is starting to experience new heights in its post-pandemic recovery. The operating environment for many glass products companies has stabilized despite what is still challenging macro conditions.

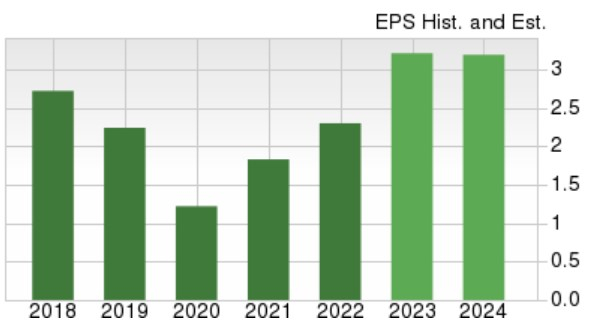

However, OI Glass’s main initiative is focused on margin expansion to help offset the impact of softer demand and it’s starting to show. Fiscal 2023 earnings are now forecasted to soar 39% to $3.21 per share versus EPS of $2.30 last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Plus, FY24 earnings are expected to be up another 1% and it’s noteworthy that OI Glass has now surpassed EPS estimates for 12 consecutive quarters. Annual earnings estimates for both FY23 and FY24 have continued to trend higher over the last 60 days with OI Glass most recently beating Q2 EPS estimates by 6% in early August.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Attractive Valuation & Lofty Price Target

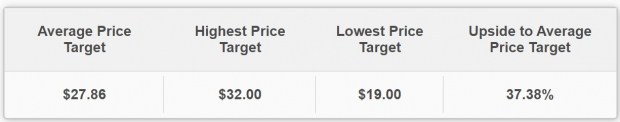

Making OI Glass’s growth and bottom line expansion look undervalued is the fact that its stock trades at $19 and just 6.3X forward earnings.

Although OI Glass stock is up a respectable +18% YTD, rising earnings estimates support the notion that OI shares are still cheap offering a 46% discount to its industry average of 11.7X and trading well below the S&P 500’s 21.1X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

More reassuring is that analysts are starting to take notice as well. To that point, the Average Zacks Price Target of $27.86 a share represents 37% upside for OI Glass stock. Plus, five of the seven brokers surveyed by Zacks.com that cover OI Glass stock have strong buy ratings.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

It’s often wise for investors to own stock in a company that has dominance or an edge in its market. Even better is when investors can get this exposure at an attractive discount and OI Glass stock seems to fit the bill.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks