Dividend Growth Stocks for Current Income and Dividend Growth

Dividend Growth Stocks for Current Income and Dividend Growth General Mills (GIS) Consumer staple stocks are blue chips that are considered some of the safest dividend growth stocks you can invest in, especially for dividend growth and dividend growth of income.

Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation will be going over General Mills in this first of a three-part series we’re doing on consumer staple stocks.

We’re going to look at three of the most popular consumer staple stocks that have recently come into value that look very attractive for those of you who are looking to build a foundational position in your portfolios for dividend growth stocks and current dividend income.

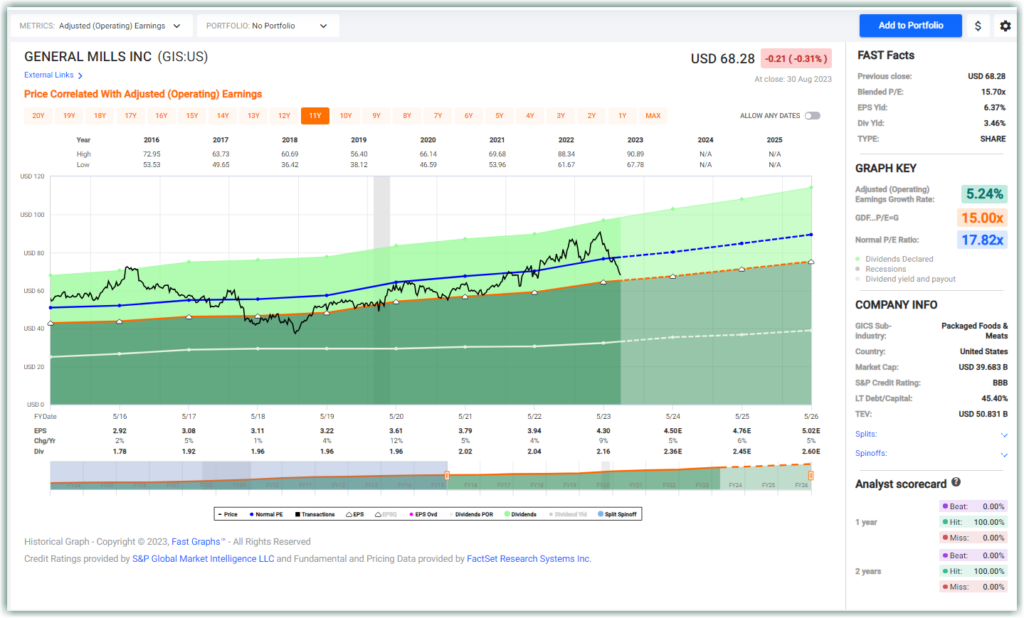

The first one we’re going to look at today. General Mills. General Mills has some very interesting characteristics. Number one, you can see, based on the historical graph of operating earnings, that the company has been very consistent in growing its earnings year after year after year. The next two that we will be covering is upcoming videos are Conagra and Kellogg, and there could be more!

The first one we’re going to look at today. General Mills. General Mills has some very interesting characteristics. Number one, you can see, based on the historical graph of operating earnings, that the company has been very consistent in growing its earnings year after year after year. The next two that we will be covering is upcoming videos are Conagra and Kellogg, and there could be more!

FAST Graphs Analyze Out Loud Video on General Mills (GIS)

— Chuck Carnevale

He issued warnings for RNG before it crashed 89%, BYND before it crashed 90%, TDOC before it crashed 84%, and FVRR before it crashed 86%. Now, he's stepping forward to name the popular stock that could go down as one of the worst-performing tickers of the year. It could be the most dangerous stock of 2026. Click here for its name and ticker, 100% free.

Source: FAST Graphs