You’re supposed to have good luck when you catch a glimpse of a shooting star.

But what if that streak across the sky is a Starlink satellite?

Last week, Elon Musk’s space transportation company, SpaceX, completed its 100th Starlink launch mission.

It has sent nearly 5,000 Starlink satellites into orbit so far. And it hopes to launch up to 42,000 in total.

Starlink can deliver high-speed internet anywhere in the world with its satellites. It’s been a game-changer for people who live in remote areas. Other than using satellites for a connection, they have few or no options for connecting to the rest of the world.

In fact, Starlink has partnered with U.S. wireless network operator T-Mobile to see if its satellites can provide service in places its cellular network doesn’t reach.

That has people wondering if satellites are going to replace cell towers?

That could be a big deal for the companies that own cell towers. If new technology such as Starlink makes cell towers obsolete, their investments could be worthless.

Today I’ll show you why we’ll still need cell towers for many years to come. Plus, I’ll recommend one cell tower company that’s on sale right now.

Starlink’s Latency Problem

Starlink is an amazing feat of engineering.

But it won’t match the performance of a cell tower network.

It all boils down to physics.

Starlink satellites are about 342 miles above the Earth’s surface.

Cell phones using 4G LTE networks can connect to a tower that’s up to 20 miles away. 5G networks using the faster millimeter wave technology connect to towers less than half a mile away.

The large distance between Starlink satellites and the ground means you need more power and larger antennas to send a signal.

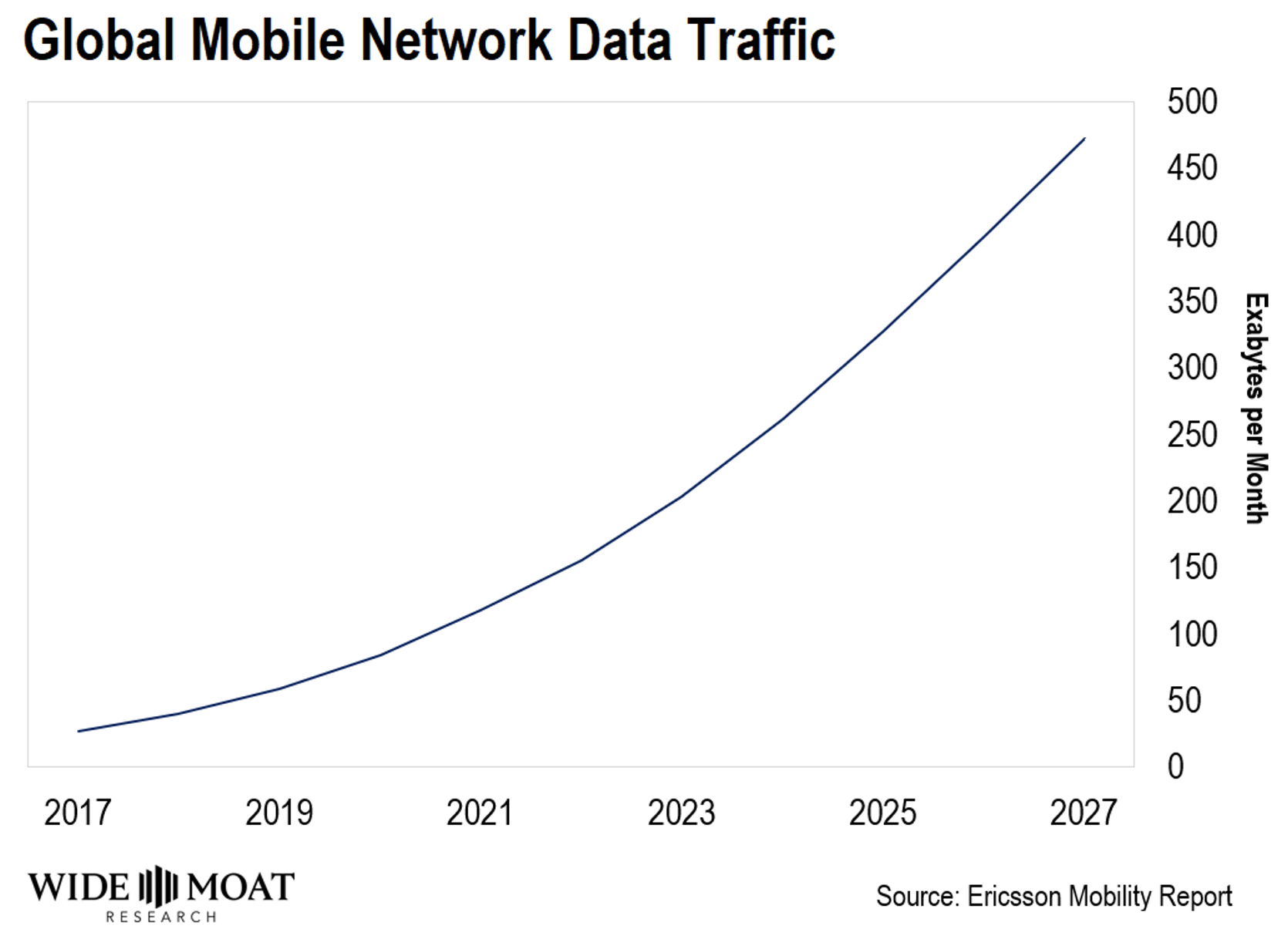

Plus, each satellite can handle only a certain amount of data at a time. That’s a problem that will grow as more users sign up for the service and use more data over time.

Last year, Starlink speeds started dropping as the network hit its maximum capacity. It got better once the company launched more satellites. But Musk admitted Starlink would have trouble handling urban areas with a lot of users.

Last year, Starlink speeds started dropping as the network hit its maximum capacity. It got better once the company launched more satellites. But Musk admitted Starlink would have trouble handling urban areas with a lot of users.

Another limitation of Starlink is that the time it takes to get a response – or latency – is longer because the data has to travel out to space and back.

Latency on Starlink service is around 40-50 milliseconds. That’s good enough for browsing the web. But if you play computer games that require fast responses, you may start to notice the delay.

5G can reach latency of less than 10 milliseconds. That may not seem like a big deal. After all, humans can barely notice a difference in latency of less than 30 milliseconds.

But machines do…

And developing technologies such as virtual reality and self-driving cars will need very low latency.

For example, if you’re speeding down the highway at 60 miles an hour, you’ll travel 4.4 feet in 50 milliseconds. A lower latency could be the difference between life and death.

Cell towers will stick around because they last a long time and can be easily upgraded.

Towers can last for decades with proper maintenance. That’s important because technology is constantly changing. And a single tower can be used for multiple carrier networks.

Starlink satellites can’t be upgraded once they’re launched into space. And they last about five years before falling out of the sky and burning up in the atmosphere.

So even though Starlink is great for connecting people in hard-to-reach areas, it won’t replace the cell towers that our mobile networks rely on today.

That’s why fears about cell towers becoming obsolete are overdone…

6.3% Yield on This Bargain Cell-Tower Play

One cell tower company on sale today is Crown Castle (CCI).

Crown Castle owns more than 40,000 cell towers, 120,000 small cell sites, and 85,000 miles of fiber across America.

It’s increased its dividend nine years in a row and yields 6.3%.

That’s roughly four times more income than you’ll get buying the S&P 500. It yields just 1.5%.

Here at Wide Moat Research, we’re focused on finding the safest income investments on the market. Crown Castle trades at 13 times cash flow. That’s the cheapest it’s been in the past decade.

The discounted price means that you can get this reliable income stock with a good margin of safety.

When the rest of the stock market figures out cell towers aren’t going away, you’ll be poised to profit.

Happy investing,

Justin Law

Analyst, Intelligent Income Daily

Source: Wide Moat Research