What can investing do for you?

Perhaps that’s the wrong question to ask.

What can’t investing do for you?

See, that’s a much better question.

I say that because investing can radically alter your reality for the better.

I say that because investing can radically alter your reality for the better.

It’s certainly done just that for me.

I was once in debt and without any sense of freedom – chained to a listless life.

I’m now financially free, loving the options and autonomy that financial freedom comes with.

Investing helped me to execute a complete life turnaround in only a few short years.

In fact, I was able to even retire in my early 30s, as my Early Retirement Blueprint explains.

I lived below my means.

And I invested my hard-earned savings into high-quality dividend growth stocks.

These are stocks that represent equity in great businesses paying safe, growing dividends to their shareholders.

You can find hundreds of examples by perusing the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

The FIRE Fund – my real-money stock portfolio, which produces enough five-figure passive dividend income for me to live off of – is chock-full of high-quality dividend growth stocks.

Of course, investing is more than just finding the right businesses to invest in.

Of course, investing is more than just finding the right businesses to invest in.

It’s also very much about valuation at the time of investment.

You can’t egregiously overpay for anything, even a great business.

After all, price is only what you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Investing can radically alter one’s life for the better, and buying high-quality dividend growth stocks when they’re undervalued is one of the best ways to invest.

Now, all of what I just laid out does require a basic understanding of valuation.

Fortunately, it’s not that difficult.

My colleague Dave Van Knapp put together Lesson 11: Valuation in order to help make the concept of valuation much easier to understand and apply.

Part of a larger series of “lessons” on dividend growth investing, it provides a valuation template that can be easily employed in the process of valuing just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

ASML Holding NV(ASML)

ASML Holding NV(ASML)

ASML Holding NV(ASML) develops, produces, markets, sells, and services advanced semiconductor equipment systems.

Founded in 1984, ASML is now a $268 billion (by market cap) technology behemoth that employs nearly 40,000 people.

ASML is a semiconductor industry leader, providing chipmakers with everything they need – hardware, software, and services – to mass produce patterns on silicon through lithography.

The company is primarily known for its specialized EUV lithography machines, a market that ASML has cornered.

It’s estimated that it has a 90% share of this market.

Morningstar says this about ASML: “ASML is the predominant supplier of photolithography equipment for semiconductor manufacturers. We expect it to materially benefit from the proliferation of extreme ultraviolet, or EUV, lithography at leading-edge chipmakers, which we believe justifies ASML’s wide economic moat rating.”

So we have two extraordinary aspects about ASML, which makes the business extremely appealing for long-term investors.

First, ASML’s EUV lithography machines are required for the manufacture of advanced chips.

Second, these complex machines, costing well over $100 million each and made up of thousands of parts that have to be shipped in dozens of containers, are essentially only provided by ASML.

This monopoly over necessary machines to manufacture necessary products that the world depends on has turned ASML into a business that practically prints money.

Revenue and profit are high, recurring, and growing at a fast clip, which has led to a dividend that’s growing at a fast clip.

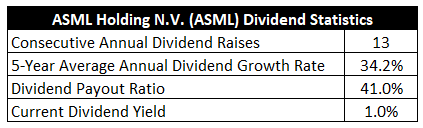

Dividend Growth, Growth Rate, Payout Ratio and Yield

Already, ASML has increased its dividend for 13 consecutive years.

Per the company’s own words, “ASML aims to distribute a dividend that will be growing over time, paid quarterly.”

I like the sound of that.

I like the sound of that.

And there’s no doubt that ASML has been making good on this.

The dividend more than doubled between FY 2019 and FY 2022.

That’s good for a CAGR of 34.2%, which is an incredible rate of dividend growth.

Yet the payout ratio is still only at 41%, based on FY 2022 numbers.

That leaves plenty of headroom for more strong dividend growth, which ASML is clearly committed to.

Now, the stock only yields 1%.

So one does have to sacrifice some yield in order to gain access to that high dividend growth rate, which I think is a more-than-fair trade-off to make.

Notably, this yield is 10 basis points higher than its own five-year average.

For long-term dividend growth investors who lean toward the high-quality compounders, rather than yield plays, ASML is very promising.

Revenue and Earnings Growth

As promising as these numbers could be, though, many of them are looking into the past.

But investors must look into the future, as capital is being risked today for the rewards of tomorrow.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be highly useful when the time comes to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past against a future forecast in this manner should allow us to roughly gauge where the business may be going from here.

ASML advanced its revenue from 5.2 billion euros in FY 2013 to 21.2 billion euros in FY 2022.

That’s a compound annual growth rate of 16.9%.

World-class top-line growth here.

Very impressive.

Meanwhile, earnings per share grew from 2.34 euros to 14.13 euros, which is a CAGR of 22.1%.

Truly outstanding.

There were some modest share buybacks over the last decade, but significant margin expansion caused much of the excess bottom-line growth.

Looking forward, CFRA believes that ASML will compound its EPS at an annual rate of 25% over the next three years.

To accelerate bottom-line growth off of an already-outstanding level, especially at a base that’s larger than it was a decade ago, would be magnificent achievement.

As high as it is, it doesn’t seem unrealistic at all.

It can be supported by really high sales growth, which ASML is achieving and guiding for more of.

In fact, ASML just raised FY 2023 YOY sales growth guidance in its recent Q2 report to 30% from a prior 25%.

In that same quarter, ASML registered net profit that was up 35% from a year ago.

CFRA lays out the investment case well with this passage: “ASML has a monopoly position supplying lithography systems to leading edge logic and memory (DRAM) customers, and a large market share position supplying immersion systems for trailing edge fabs. As clients expand their capacity to meet secular demand trends and migrate to more advanced nodes (technology transition spending remains resilient), this should continue to drive ASML’s sales in the medium term.”

Fabs are being built all over the world in order to meet increasing demand for the high-end chips that are powering more and more elements of everyday life in modern-day society.

And with geopolitical tensions between China and Taiwan – approximately 90% of the world’s advanced chips are manufactured in Taiwan – the global buildout of fabs is also meant to reduce reliance on this one country.

Well, all of these fabs will require the machines that ASML – and ASML alone – makes.

If that’s not a clear-cut long-term investment case, I don’t know what is.

Taking CFRA’s projection as our near-term base case for EPS growth, which is basically backed by ASML itself, that sets up the dividend to continue growing at a similar rate.

A dividend that’s growing at well into the double digits easily sets up a scenario for double-digit annualized total return, assuming no collapse in valuation.

This is extremely compelling, especially if one can wait for the dividend to grow into a meaningful amount of income.

Financial Position

Moving over to the balance sheet, ASML has a fantastic financial position.

The long-term debt/equity ratio is 0.4, while the interest coverage ratio is well over 100.

Furthermore, cash and cash equivalents add up to more than twice that of long-term debt.

This is a fortress balance sheet.

Profitability is superb.

Net margin has averaged 25.9% over the last five years, while ROE has averaged 38.4%.

Very high returns on capital here.

Fundamentally speaking, ASML is one of the highest-quality businesses I’ve ever seen.

And with economies of scale, a monopolistic market position, R&D, IP, an entrenched installed base of machines, technological know-how, and high barriers to entry, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

The semiconductor industry is cyclical, and ASML’s machines are very expensive.

Geopolitical tensions have led to the restriction of high-end equipment sales to China, which could reduce ASML’s sales.

Taiwan accounts for nearly 40% of ASML’s sales by geography, and Taiwan is under constant threat of war with China.

Technology changes fast, and ASML must continue to invest in R&D and stay ahead of the curve.

ASML has customer concentration and is dependent on only a few major global semiconductor manufacturers.

Being a global company, ASML has exposure to different currencies.

I see considerable risks here, especially in terms of Taiwan, but this is also a business of considerable quality.

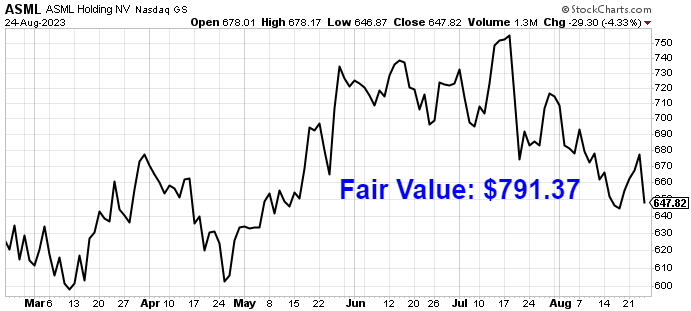

And with the stock down more than 20% from its all-time high, the valuation is worth considering…

Stock Price Valuation

The P/E ratio is 33.2.

Is that too rich for one of the world’s best businesses?

I don’t think so.

It’s quite a bit lower than its own five-year average of 41.6.

The sales multiple of 9.5 is also below its own five-year average of 10.8.

And the yield, as noted earlier, is higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis.

I factored in a 10% discount rate, an 18% dividend growth rate for the next 10 years, and a long-term dividend growth rate of 8%.

This is a rare case in which the expectation for a dividend growth rate of almost 20% over the near term could actually be conservative.

After all, ASML has demonstrated the willingness and wherewithal to grow its dividend at a much higher rate than this, supported by an EPS CAGR of over 20%.

Moreover, the near-term forecast for EPS growth, which is over 20% annually, would easily support an 18% dividend growth rate.

This view is further bolstered by a low payout ratio and clean balance sheet.

When I come across an exceptional business, I value it as such.

The DDM analysis gives me a fair value of $776.11.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I don’t think I was being overly aggressive at all with my valuation, yet the stock still looks at least slightly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates ASML as a 4-star stock, with a fair value estimate of $750.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates ASML as a 5-star “STRONG BUY”, with a 12-month target price of $848.00.

We’ve got a decently tight consensus here. Averaging the three numbers out gives us a final valuation of $791.37, which would indicate the stock is possibly 14% undervalued.

Bottom line: ASML Holding NV (ASML) is one of the best businesses in the world. It effectively operates as a monopoly, which results in producing some of the most impressive numbers I’ve ever seen. With an acceptable yield, a sky-high dividend growth rate, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 14% undervalued, dividend growth investors who are looking for a terrific business to help them grow their wealth and passive income ought to have their eyes on this name.

Bottom line: ASML Holding NV (ASML) is one of the best businesses in the world. It effectively operates as a monopoly, which results in producing some of the most impressive numbers I’ve ever seen. With an acceptable yield, a sky-high dividend growth rate, a low payout ratio, more than 10 consecutive years of dividend increases, and the potential that shares are 14% undervalued, dividend growth investors who are looking for a terrific business to help them grow their wealth and passive income ought to have their eyes on this name.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is ASML’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 82. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, ASML’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income