Warren Buffett is arguably the greatest investor of all time. It’s not just that he’s compounded money at approximately 20% annually. It’s that he’s done so for decades on end.

Warren Buffett has been compounding money for 80 years. In terms of pure longevity, nobody else is even close. But let’s be clear.

Compounding money at 20% annually, even for just one decade, would be incredible. As you might imagine, you have to invest in really great businesses in order to be able to accomplish such a thing.

If you want great investment results, you have to invest in great businesses. Well, Warren Buffett’s firm recently invested hundreds of millions of dollars into a great business. And us mere mortal investors also have the chance to invest in this same business.

Today, I want to tell you about a high-quality dividend growth stock that Warren Buffett’s firm recently bought. Ready? Let’s dig in.

Before I get into the details, I want to put a short disclaimer out there. Although Warren Buffett still oversees the $300+ billion common stock portfolio for his conglomerate, Berkshire Hathaway, he does have two investing lieutenants – Todd Combs and Ted Weschler – who also manage billions of dollars each and make investments for the portfolio. With that in mind, it was probably not Warren Buffett who made this particular move.

Buffett has been pretty clear in the past that he almost never does anything for less than $1 billion. And seeing as how this move did come in at less than $1 billion, we can make certain inferences about that. However, it’s still a lot of Berkshire Hathaway money being invested here.

Plus, seeing as how Warren Buffett is the largest single Berkshire Hathaway shareholder, he still gets the exposure, either way. It doesn’t matter whether he or someone else does the investing. If it’s in the portfolio, it’s in the portfolio. So what exactly is in the portfolio now? This is a super interesting move.

Berkshire Hathaway’s latest 13F filing, released in August, shows a new position in D.R. Horton (DHI). This position was initiated in the second quarter of 2023. Berkshire Hathaway now owns nearly 6 million shares of D.R. Horton worth slightly over $700 million. Maybe $700 million isn’t worth Warren Buffett to get out of bed for. For the rest of us, that’s a massive sum of money. And it’s definitely noticeable, even in Berkshire Hathaway’s huge portfolio.

What does D.R. Horton do? D.R. Horton is a $40 billion (by market cap) home construction company.

Through its four brands, D.R. Horton builds everything from entry-level homes all the way up to luxury homes. However, seeing as how just under 70% of its homes were sold over the last year at a price of less than $400,000, D.R. Horton clearly focuses on the customer looking for an affordable home.

By volume, D.R. Horton is the largest homebuilder in the US. Although it’s a highly fragmented industry, a few major players control a significant portion of the overall market. While Berkshire Hathaway also opened new positions in other homebuilders during Q2, they’re extremely small investments relative to the D.R. Horton position. They’re just not worth discussing.

So why is this so interesting? Well, I say that for two reasons. First, as far as I know, Warren Buffett has never openly expressed any kind of enthusiasm for this industry. If anything, homebuilders, historically speaking, would be, in many ways, the opposite of what Buffett tends to like.

Second, I’ve always viewed the homebuilders as being capital-intensive businesses, prone to the boom-and-bust cycles of the US housing market. And that doesn’t lend itself well to smooth, upward revenues, profits, and dividends. I’ve gotta be honest. I’ve been wrong.

I started investing in early 2010. This was just after the financial crisis and Great Recession, all of which was, at least partially, caused by a very unhealthy US housing market. The homebuilders were toxic businesses and stocks back then. This stock suffered a peak-to-trough drop of something like 90% during that period. And there was a multiyear stretch in the aftermath of all of that in which these businesses – and their stocks – were just not good at all. And so I’ve had my view clouded by all of that.

The fundamentals for homebuilders today are totally different than they were even just 10 years ago.

I can’t begin to overstate how much improvement has taken place for the likes of D.R. Horton over the last decade, let alone going back 15 or more years.

Of course, much of that has to do with a healthier US housing market, where less speculation has taken place and the supply/demand dynamics are more favorable. Just about anybody with a pulse could have gotten a mortgage back in 2006, even if it wasn’t affordable. That’s not true now. Also, the US housing market is in need of millions of houses as the aftermath of the crisis resulted in a major crackdown on the entire industry.

That’s dented new supply in a big way. Affordable homes are desperately needed in a market that sadly lacks them. And D.R. Horton is in pole position to take advantage of this mismatch. Quite frankly, I don’t think D.R. Horton has ever looked better.

Let’s take a look at some numbers, shall we?

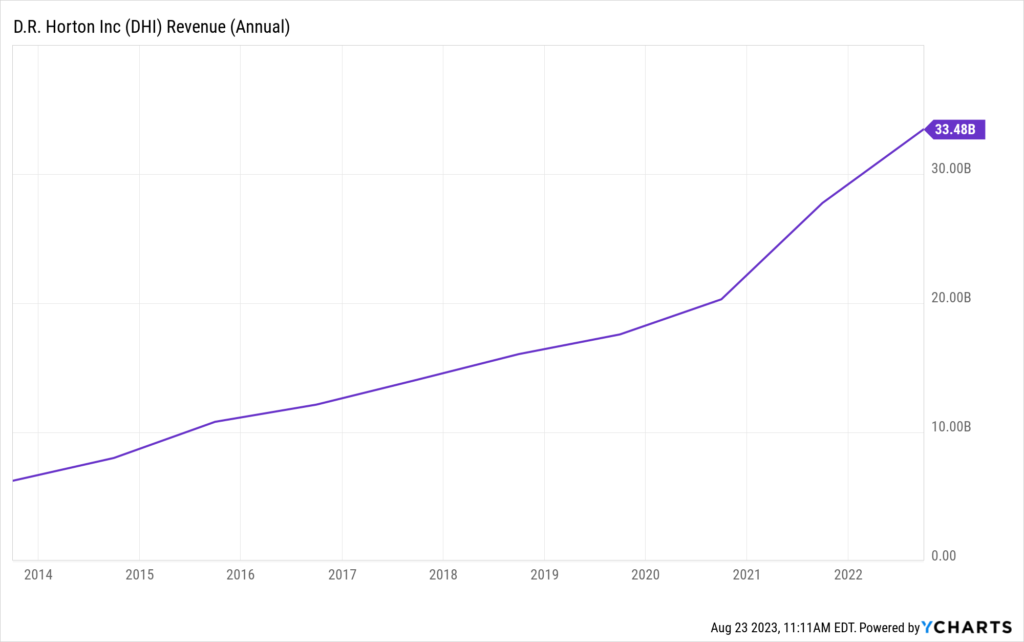

D.R. Horton has compounded its revenue at an annual rate of 20.4% over the last decade, moving up from about $6.3 billion in annual revenue to now $33.5 billion in annual revenue. That is extremely impressive. EPS sports a CAGR of 32.3% over this period, going from $1.33 to $16.51.

I mean, these are incredible numbers. This is the kind of growth that a small SaaS company would be envious of. And if you go back to before FY 2013, D.R. Horton was just trying to stop losing money there for a bit. So the turnaround has been nothing short of remarkable. But it’s not just growth.

I mean, these are incredible numbers. This is the kind of growth that a small SaaS company would be envious of. And if you go back to before FY 2013, D.R. Horton was just trying to stop losing money there for a bit. So the turnaround has been nothing short of remarkable. But it’s not just growth.

It’s an improvement in the business from top to bottom. Margins and returns on capital have gotten way better. ROE, for instance, was routinely in the low-teens area a decade ago. It’s now coming in at over 30%. ROIC has moved up from about 6% to around 25%. Net margin has expanded from the 7% area to the 15% area. And this is likely sustainable, as D.R. Horton has economies of scale in an industry where you need scale.

This is a very capital-intensive business model. And so the thing that may ward off investors actually serves as a competitive advantage in some ways. You simply have high barriers to entry in terms of the capital outlay.

But wait. There’s more.

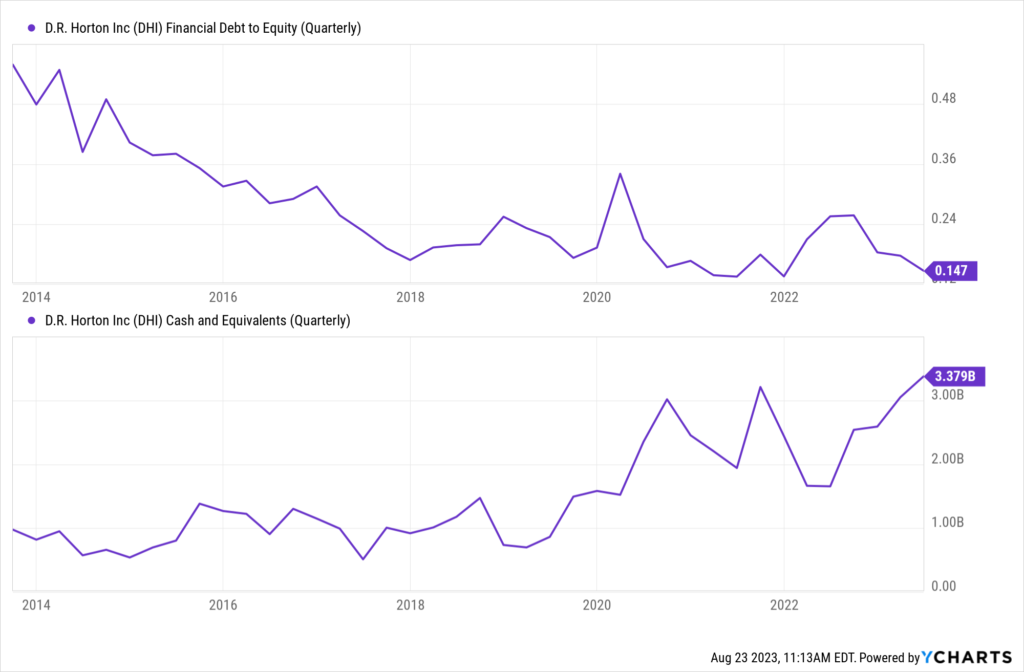

D.R. Horton has also fixed its balance sheet in the midst of all of this improvement. If we go back to 2010, when I first started investing and looking at businesses, the balance sheet for D.R. Horton was ugly. It was a really, really tough time back then. But the balance sheet is downright great now.

The long-term debt/equity ratio is only 0.3. There’s also plenty of cash and cash equivalents – enough to offset almost 1/2 of long-term debt. If we go back to a decade ago, the long-term debt/equity ratio was nearly 1.

Whereas a lot of companies out there have been gorging on debt while interest rates were low, D.R. Horton admirably repaired its balance sheet. Equity is way up. Cash is up. Long-term debt has been kept in check. I like it. I also like the dividend growth story here.

Whereas a lot of companies out there have been gorging on debt while interest rates were low, D.R. Horton admirably repaired its balance sheet. Equity is way up. Cash is up. Long-term debt has been kept in check. I like it. I also like the dividend growth story here.

I almost can’t believe I’m saying it, but D.R. Horton has turned into a consistent dividend grower of epic proportions. The company has increased its dividend for nine consecutive years. I wouldn’t expect a longer track record than that, as the business was struggling before this.

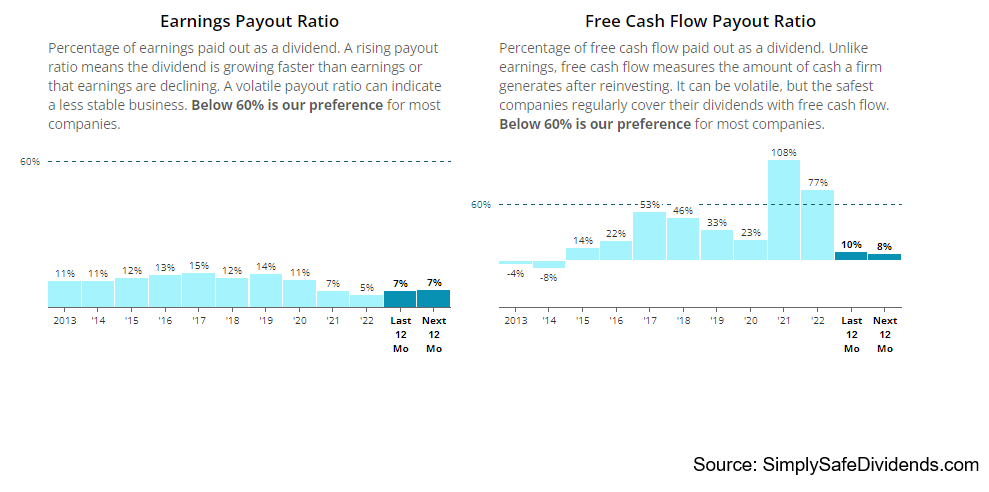

Still, what a start D.R. Horton is off to. The five-year DGR is 16.8%. And double-digit dividend growth has been coming in like clockwork, supported by that aforementioned double-digit EPS growth. Because of the underlying profit growth that’s supporting the dividend growth, the payout ratio is only 7.1%.

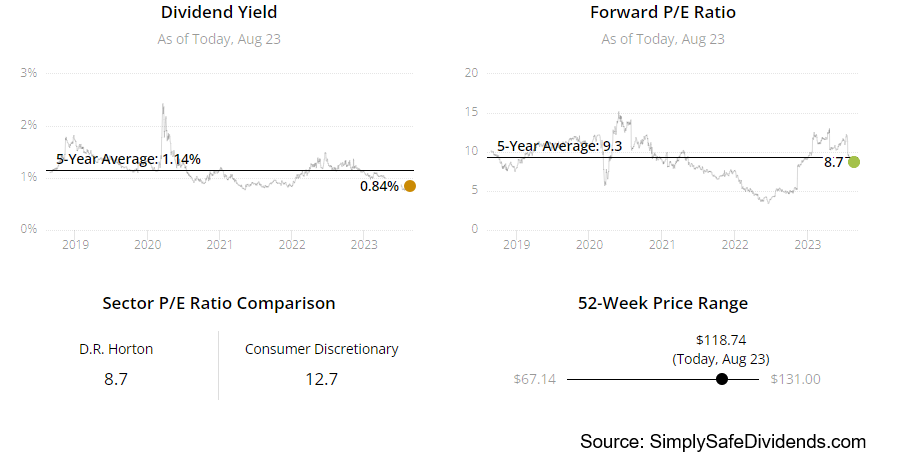

Yes, we have a payout ratio that’s below 10%. Now, the stock does only yield 0.9%. But I think the growth more than makes up for it. Like I said, I like the dividend growth story. I also like the valuation, which undoubtedly caught the eye of someone over at Berkshire Hathaway.

Perhaps there’s been a widespread bias against homebuilders. I’ve had one myself. And so these stocks have kind of been in the valuation penalty box for years. No matter, as the stock is still up more than 500% over the last decade. We can only imagine the kind of performance this stock would have put up had it also had multiple expansion over that period.

Perhaps there’s been a widespread bias against homebuilders. I’ve had one myself. And so these stocks have kind of been in the valuation penalty box for years. No matter, as the stock is still up more than 500% over the last decade. We can only imagine the kind of performance this stock would have put up had it also had multiple expansion over that period.

Regarding the multiples, all of them are low. The P/E ratio is just 8.3. Its five-year average is only 9.3, speaking on what I just mentioned about the penalty box. A low average, yes. But we’re even lower now. The sales multiple is barely over 1. These are undemanding multiples, in general. They are surprisingly undemanding for this level of growth, in particular. But what about the elephant in the room?

Is this still a boom-and-bust situation, or is there durable, secular growth in place because of the perennial shortage in US housing supply? That’s the million-dollar question. Or is it a $700 million-dollar question that Berkshire Hathaway already answered by investing in D.R. Horton?

Is this still a boom-and-bust situation, or is there durable, secular growth in place because of the perennial shortage in US housing supply? That’s the million-dollar question. Or is it a $700 million-dollar question that Berkshire Hathaway already answered by investing in D.R. Horton?

If this is still a highly cyclical business, the 60% runup in the stock price over the last year could be a trap, and the stock could fall dramatically at the first sign of an economic slowdown. If this is a secular growth story – and there is evidence in place to support that notion – D.R. Horton has an extremely long runway ahead of it, and the valuation isn’t pricing that in.

So should you buy stock in D.R. Horton and invest alongside Warren Buffett’s Berkshire Hathaway?

Well, that’s ultimately your call. It’s your money. But I must say, my prior bias against homebuilders has been wrong. We’re a long way away from the housing crisis that occurred nearly 20 years ago. The D.R. Horton of today is a lightyear away from, and better than, the D.R. Horton of 2013.

What we have now is a high-quality business growing at a fast clip, supported by an industry-leading share of a pie that, in and of itself, has to grow larger by sheer necessity. Profitability has moved from so-so to outstanding. The balance sheet is cleaner than ever. And the valuation is not egregious at all. The yield is low, but the dividend is extremely safe and growing quickly. It’s worth taking a good look at D.R. Horton here.

— Jason Fieber

P.S. Would you like to see my entire stock portfolio — the portfolio that’s generating enough safe and growing passive dividend income to fund my financial freedom? Want to get an alert every time I make a new stock purchase or sale? Get EXCLUSIVE access here.

Source: Dividends & Income