It saddens me to hear of so many people who financially struggle every day.

As someone who grew up very poor, I know what it’s like.

Sure, there are a lot of problems in the world.

And life can be really tough sometimes.

But if you can find a way to live even just a smidge below your means, the opportunities to invest your spare money and grow your wealth and passive income are immense.

Consider the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

These are all dividend growth stocks.

High-quality dividend growth stocks represent equity in world-class businesses that pay reliable, rising dividends to their shareholders.

And how are reliable, rising dividends funded?

And how are reliable, rising dividends funded?

By producing reliable, rising profits.

You have hundreds of possible ideas on this list alone.

For more than a decade, I’ve personally been living below my means and investing my spare money into high-quality dividend growth stocks.

This is how I built the FIRE Fund.

That’s my real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

Indeed, I’ve been in the fortunate position of being able to live off of dividend income since I achieved financial independence and retired in my early 30s.

How was I able to retire at such a young age?

My Early Retirement Blueprint explains.

Suffice it to say, as I discussed earlier, living below my means and intelligently investing my capital was key to my success.

To that latter point, intelligent investing means you pay attention to valuation at the time of investment.

To that latter point, intelligent investing means you pay attention to valuation at the time of investment.

Whereas price tells you what you pay, it’s value that tells you what you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Living below your means and using your spare capital to buy high-quality dividend growth stocks when they’re undervalued is a great way to incrementally build wealth, passive income, and freedom over time.

Now, this does mean that one has some familiarity with the concept of valuation.

If you need help with that, fellow contributor Dave Van Knapp has you covered.

He put together Lesson 11: Valuation, which is part and parcel of a comprehensive series of “lessons” on dividend growth investing.

It provides a valuation system that can be easily used to estimate the fair value of just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Magna International Inc. (MGA)

Magna International Inc. (MGA)

Magna International Inc. (MGA) is a multinational mobility solutions and technology company for automakers that designs, develops, and manufactures automotive systems, assemblies, modules, and components.

Founded in 1957, Magna is now a $17 billion (by market cap) manufacturing monster that employs more than 170,000 people.

FY 2022 revenue can be broken down by product category: Body Exteriors & Structures, 42%; Power & Vision, 31%; Seating Systems, 14%; and Complete Vehicles & Other, 13%.

Based out of Canada, Magna is one of the world’s largest manufacturers of OEM components for various automakers.

Magna is large, yes.

But it’s also quite broad.

Magna is so broad, it could almost be its own carmaker.

Morningstar sheds some light on this: “Many suppliers focus on a particular area of the vehicle. In sharp contrast, Magna’s capabilities are so broad that the firm could nearly design, develop, supply, and assemble vehicles all on its own.”

We know two things about mobility.

It’s becoming more pervasive.

And it’s becoming more complex.

Companies that are already in the industry are expanding their EV and self-driving efforts, while many competitors-in-waiting are trying to jump in.

Simultaneously, and related to that first point, vehicles are becoming increasingly complex and technological.

This clearly bodes well for Magna.

Any company that’s trying to quickly scale up in mobility is naturally going to consider partnering with a capable manufacturer.

And the more complex vehicles become, the more important it is for the manufacturer to be technologically adept.

Magna is, arguably, the most capable and adept manufacturer of all.

In a world that demands more complex mobility, Magna’s revenue, profit, and dividend should continue to grow for years to come.

Dividend Growth, Growth Rate, Payout Ratio and Yield

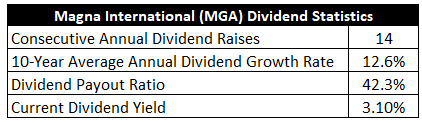

Thus far, Magna has increased its dividend for 14 consecutive years.

The 10-year dividend growth rate for Magna is 12.6%, which is strong, although more recent dividend raises have been in the mid-single-digit range.

Not surprising to see some lumpiness here, as the auto industry was directly and severely impacted by the pandemic and related shutdowns.

But I think Magna’s commitment to the dividend during this period, in spite of unprecedented manufacturing interruptions, speaks volumes.

With the stock yielding 3.1%, investors are getting paid to wait until the industry recovers and fully normalizes.

With the stock yielding 3.1%, investors are getting paid to wait until the industry recovers and fully normalizes.

This market-beating yield, by the way, is 30 basis points higher than its own five-year average.

And this dividend is protected by a payout ratio of 42.3%, based on TTM adjusted EPS.

Really balanced dividend metrics here.

You get a solid dividend that’s safe and growing at an appreciable clip.

Revenue and Earnings Growth

As balanced as these metrics may be, some of the numbers are looking backward.

But investors must look into the forward, as today’s capital is being put up for the rewards of tomorrow.

That’s why I’ll now build out a forward-looking growth trajectory for the business, which will be extremely useful when the time comes to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past against a future forecast like this should allow us to roughly gauge where the business might be going from here.

Magna moved its revenue up from $34.8 billion in FY 2013 to $37.8 billion in FY 2022.

That’s a compound annual growth rate of 0.9%.

Definitely not encouraging.

However, as I touched on earlier, the last few years have been extremely tough and unusual.

And this hasn’t been the fault of Magna, nor has it been a sign of poor business performance.

Rather, external circumstances impacted the entire industry.

Magna is still trying to get back to peak FY 2018 revenue (nearly $41 billion), which I think they’ll get to within the next year or two.

The most recent quarter showed approximately $11 billion in revenue, which is a great sign.

Earnings per share grew from $3.38 to $4.10 (adjusted) over this period, which is a CAGR of 2.2%.

It’s the same story as revenue.

One of disappointment but understanding.

It’s ultimately where the business is going that matters most.

And we may have very good news on that front.

Looking forward, CFRA believes that Magna will compound its EPS at a 10% annual rate over the next three years.

This looks realistic to me.

It’s pretty much in line with what Magna was doing before the pandemic hit.

There are signs that a bottom has already formed, and it looks like the upswing is upon us.

Magna’s Q2 report, its most recent, showed an 81% YOY increase in adjusted EPS.

This upswing could be coming at just the right moment, in time for what may be a secular tailwind.

CFRA speaks on this: “We also view [Magna] as a winner from the secular growth of EVs and AV technologies over the next decade, and expect its Power & Vision and Complete Vehicles segments to grow faster than other segments as a result.”

If the future is more electric vehicles and/or autonomous vehicles, which seems to be where we’re headed, that almost certainly translates into more reliance on the likes of Magna.

I wouldn’t assume double-digit dividend growth from Magna over the next few years, even if double-digit EPS growth materializes.

The business is still licking some wounds.

But even a high-single-digit dividend growth rate would be enough to support a pretty compelling investment case, as you’re starting of with a fairly juicy yield of over 3%.

And it’s quite possible, due to the tailwinds that I just pointed out, that Magna does deliver something closer to a double-digit dividend growth rate when looking out beyond the next few years.

That would be getting things back to what Magna was delivering on earlier on in the decade.

Not a bad setup at all.

Moving over to the balance sheet, Magna has a very good financial position.

Financial Position

The long-term debt/equity ratio is 0.2, while the interest coverage ratio is nearly 11.

I’ll note that cash offsets almost half of all long-term debt, and long-term debt has been heading lower since peaking in FY 2020.

Profitability is adequate, but I see room for improvement.

Net margin has averaged 3.5% over the last five years, while return on equity has averaged 12.1%.

These numbers have both been negatively affected by pandemic-related issues that have plagued the industry.

Returns on capital were much higher than this before FY 2020, and I don’t see why Magna can’t get back to where it was before – possibly even beyond that level.

Magna is a good business, even in the middle of a storm, and it’s quite possible that it becomes a great business on the back of industry trends that play to its strengths.

And with economies of scale, barriers to entry, and switching costs, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Competition, regulation, and litigation are omnipresent risks in every industry.

Recent quarters have been impacted by exposure to Russia, and that situation has not gotten any better.

Input costs are highly volatile.

Magna has customer concentration risk: Its six largest customers account for nearly 80% of annual sales.

Demand for auto manufacturing is tied to macroeconomic factors that are beyond Magna’s control.

The direct exposure to economic cycles is amplified by the capital-intensive business model.

Kinks in the global supply chain are unwinding, but this remains an ongoing challenge.

Constant technological changes in mobility introduce the risk of Magna being left behind.

The company’s international footprint exposes it to geopolitical risks and currency exchange rates.

These risks are fairly standard for this type of business model, but the business itself strikes me as anything but standard.

And with the stock down by almost 50% from its 2021 peak, the valuation also strikes me as anything but standard…

Stock Price Valuation

The P/E ratio is sitting at 13.6, based on TTM adjusted EPS.

That’s well below the broader market’s earnings multiple.

It’s also favorable in comparison to its own five-year average of 18.

The P/S ratio of 0.4 is slightly lower than its own five-year average of 0.5.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 7%.

Magna’s demonstrated dividend growth over the last decade has been generally quite a bit higher than this.

And the near-term forecast for EPS growth would support like, double-digit dividend growth over the coming years.

Moreover, the payout ratio isn’t very high.

However, I’m balancing all of that against the fact that recent dividend increases have been in the mid-single-digit range.

In addition, the industry does not seem to be fully normalized yet.

Magna could surprise me to the upside here and get back to its historical dividend growth rate soon.

But I think it’s prudent to err on the side of caution.

The DDM analysis gives me a fair value of $65.63.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I stand behind my valuation, and the stock’s price looks cheap against it.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates MGA as a 3-star stock, with a fair value estimate of $71.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates MGA as a 3-star “HOLD”, with a 12-month target price of $65.00.

I came out to within pennies of where CFRA is at, but we’re all pretty close to one another here. Averaging the three numbers out gives us a final valuation of $67.21, which would indicate the stock is possibly 12% undervalued.

Bottom line: Magna International Inc. (MGA) is perfectly positioned to capture incrementally more business from the increasing pervasiveness and complexity of mobility. With a market-beating yield, a double-digit long-term dividend growth rate, a moderate payout ratio, nearly 15 consecutive years of dividend increases, and the potential that shares are 12% undervalued, long-term dividend growth investors looking to profit from the rise of EVs and AVs ought to have their eyes on this name.

Bottom line: Magna International Inc. (MGA) is perfectly positioned to capture incrementally more business from the increasing pervasiveness and complexity of mobility. With a market-beating yield, a double-digit long-term dividend growth rate, a moderate payout ratio, nearly 15 consecutive years of dividend increases, and the potential that shares are 12% undervalued, long-term dividend growth investors looking to profit from the rise of EVs and AVs ought to have their eyes on this name.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is MGA’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 70. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, MGA’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income