Among the consumer discretionary sector, Royal Caribbean Cruises’ (RCL) stock is standing out with a Zacks Rank #1 (Strong Buy) and lands the Bull of the Day.

Royal Caribbean’s stock continues to gain steam with this summer’s peak travel season boosted by pent-up demand following the pandemic. This was reconfirmed in Royal Caribbean’s second quarter results last Thursday with the company impressively surpassing top and bottom-line expectations and raising its full-year EPS guidance.

Q2 Review

Driven by stronger pricing in correlation with higher demand, Royal Caribbean beat Q2 earnings expectations by 15% last week. Earnings came in at $1.82 per share compared to EPS estimates of $1.58.

More importantly, the company’s post-pandemic rebound now looks in full swing after posting an adjusted loss of -$2.08 a share in the prior-year quarter. On the top line, Q2 sales of $3.52 billion surpassed estimates by 4% and soared 61% from a year ago.

It’s also noteworthy that Royal Caribbean has now surpassed earnings expectations for six consecutive quarters.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Higher Guidance

Strong Q2 results led to Royal Caribbean raising its full-year fiscal 2023 EPS guidance by 33% to between $6.00-6.20 a share. This makes Royal Caribbean shares very attractive as earnings estimate revisions should keep going up and are widely considered the most significant catalyst in the upward price movement of a stock.

The Zacks Consensus for Royal Caribbean’s FY23 earnings has already soared 19% over the last week to estimates of $5.63 per share compared to $4.73 a share seven days ago. Fiscal 2024 EPS estimates have climbed 7% over the last week and are now expected at $7.70 a share compared to $6.93 per share a week ago.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Stellar Performance

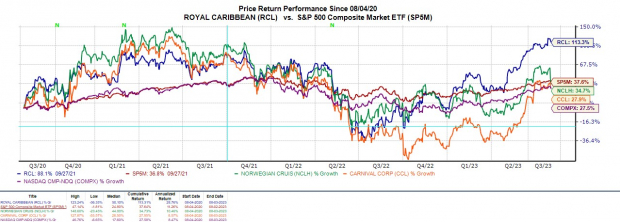

Correlating with the reassuring trend of rising earnings estimates throughout the year, Royal Caribbean stock has now soared +112% in 2023.

This has largely outperformed the S&P 500, Nasdaq, and Norwegian Cruise Line’s (NCLH) +41% while being roughly on par with Carnival Cooperation’s (CCL) +117%.

Royal Caribbean stock has wiped away any losses from the pandemic and is now up +113% over the last three years. This also tops the broader indexes, Norwegian’s +35%, and Carnival’s +28%. Despite this year’s impressive rally, Royal Caribbean’s stock still trades very reasonably at 18.6X forward earnings which is attractively below its industry average of 29.5X and the S&P 500’s 21.2X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Takeaway

Following strong Q2 results last week, the rally in Royal Caribbean stock may accelerate this year. Earnings estimates have continued to soar and the company’s P/E valuation is also supportive of the rally gaining more steam even with RCL shares up over +100% in 2023.

— Shaun Pruitt

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks