Cummins Inc. (CMI) is a historic U.S. engine maker that’s benefitting from strong growth in its legacy segments and posting huge expansion in its future-focused Accelera unit that includes hydrogen technology and much more.

Cummins posted back-to-back years of big revenue growth and its outlook for 2023 is equally impressive.

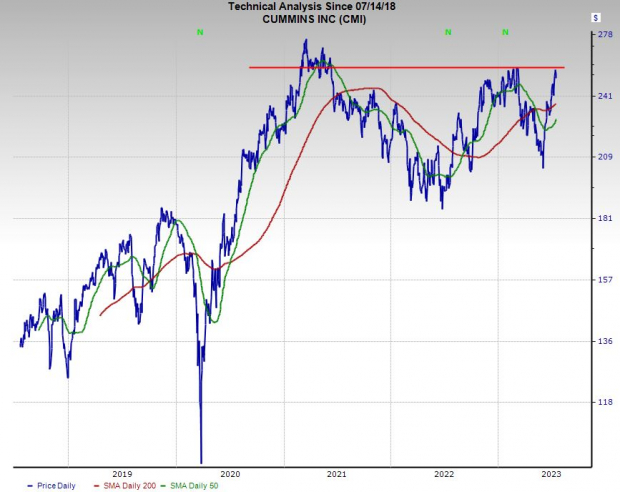

On top of all that, CMI shares have soared roughly 20% since the start of June after it found support at a key long-term moving average.

Cutting-Edge Old Tech and New Age Efforts

The Indiana-based firm is one of the most well-known engine makers in the U.S., with a diverse and ever-growing portfolio of power solutions. Cummins’ products include diesel, natural gas, electric, and hybrid powertrains. CMI also makes powertrain-related components such as filtration, turbochargers, fuel systems, controls systems, air handling systems, brakes, suspension systems, and beyond.

Alongside these wide-ranging offerings, Cummins is investing rather heavily in new-age technologies such as electric power generation systems, batteries, electrified power systems, electric powertrains, hydrogen production, and fuel cell products. The company also utilized its sturdy balance sheet to make some strategic forward-looking acquisitions.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Cummins last August bout Meritor to help it add a leading maker of electric powertrain solutions for both commercial vehicles and industrial markets. CMI then in November bought Siemens’ Commercial Vehicles business to help further accelerate its development of electrified power solutions.

On top of that, Cummins back in October said it would start producing electrolyzers in the U.S. The move is part of its effort to drive forward the green hydrogen push, which the Federal government is actively supporting through spending and tax incentivizes.

The next frontier that could make hydrogen fuel cell technology one of the most important players in a greener economy is figuring out how to make electrolyzing water into hydrogen and oxygen far more cost competitive. Cummins is aiming to become part of the pioneering class of clean hydrogen and other futuristic power.

Recent Growth and Outlook

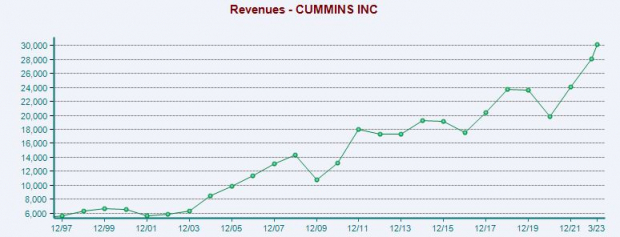

Cummins’ revenue climbed 21% in 2021 and 17% in 2022 to help it blow away its pre-covid levels at $28.07 billion in FY22 vs. $23.57 billion in FY19. The company’s growth is a bit less steady compared to some other segments of the economy. But that is par for the course for CMI because it is forced to navigate larger economic cycles that impact its customers’ decisions on when to buy its rather expensive offerings.

The company’s New Power division has been rebranded to Accelera and includes batteries, fuel cells, hydrogen-production technologies such as electrolyzers, and more. It is still by far the smallest segment, but its sales soared 174% in the first quarter of 2023. Cummins also significantly upped its revenue guidance for 2023 in early May.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Zacks estimates call for CMI’s sales to climb another 17% in 2023 to reach nearly $33 billion. Meanwhile, its adjusted earnings are projected to soar 31% this year to $19.80 a share.

Cummins is projected to follow up this very impressive and tough-to-compete against stretch with top and bottom line growth next year as well. CMI’s earnings revisions have started to trend higher once again to help the stock land a Zacks Rank #1 (Strong Buy) right now.

Other Fundamentals

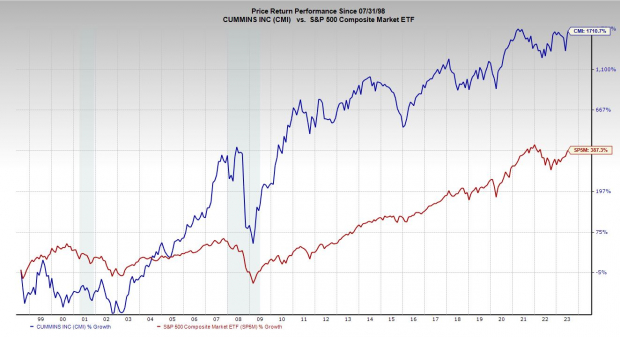

CMI shares have crushed the S&P 500 over the last 25 years, up roughly 1,700% vs. 390%. More recently, Cummins stock has climbed nearly 90% in the past five years. CMI stock is up just 4% in 2023. That said, Cummins has roared back recently, up around 20% since the start of June after it found support right around its 200-week moving average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

CMI is now back well above its 50-week moving average, and it is clear of both its 50-day and 200-day moving averages again as well. Despite the resurgence, CMI still trades roughly 10% below its own record highs at the moment.

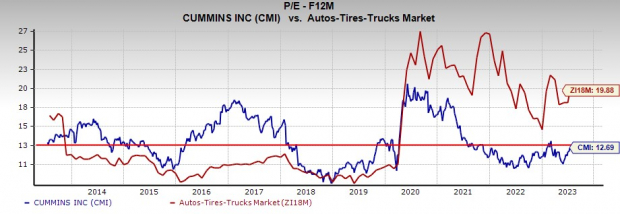

On the valuation front, Cummins trades at a nearly 40% discount to its own decade-long highs and 5% beneath its median at 12.7X forward 12-month earnings. This marks a 35% discount to its industry despite CMI’s massive outperformance over the last decade.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

Cummins has boosted its dividend every year for more than a decade, including a 7.4% annualized increase over the last five years. The firm on July 11 increased its dividend by another 7% from $1.57 a share to $1.68 a share. The new payout would have it yield 2.7% to top its industry’s 1.1% average.

If Cummins reports upbeat results and offers solid guidance when it releases its Q2 earnings in early August, CMI stock might be able to break out to new 52-week highs and start to mount a comeback toward its peaks.

— Benjamin Rains

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks