Amgen Business Introduction

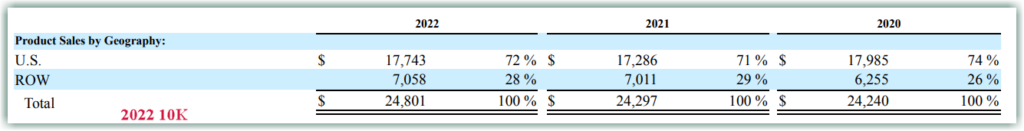

According to Amgen (AMGN) 2022 10K,

“Amgen focuses on areas of high unmet medical need and leverages its expertise to strive for solutions that improve health outcomes and dramatically improve people’s lives. A biotechnology pioneer, Amgen has grown to be one of the world’s leading independent biotechnology companies, has reached millions of patients around the world and is developing a pipeline of medicines with breakaway potential.”

FAST Graphs Analyze Out Loud Video on Amgen, Inc (AMGN)

Amgen sells its products to healthcare providers, including physicians or their clinics, dialysis centers, hospitals, and pharmacies in over 100 countries but primarily in the US.

In the US, sales are done through pharmaceutical wholesale distributors, and the three largest ones are McKesson Corporation (MCK), AmerisourceBergen Corporation (ABC), and Cardinal Health (CAH), each representing more than 10% of total revenues for each of the years 2022, 2021 and 2020.

In the US, sales are done through pharmaceutical wholesale distributors, and the three largest ones are McKesson Corporation (MCK), AmerisourceBergen Corporation (ABC), and Cardinal Health (CAH), each representing more than 10% of total revenues for each of the years 2022, 2021 and 2020.

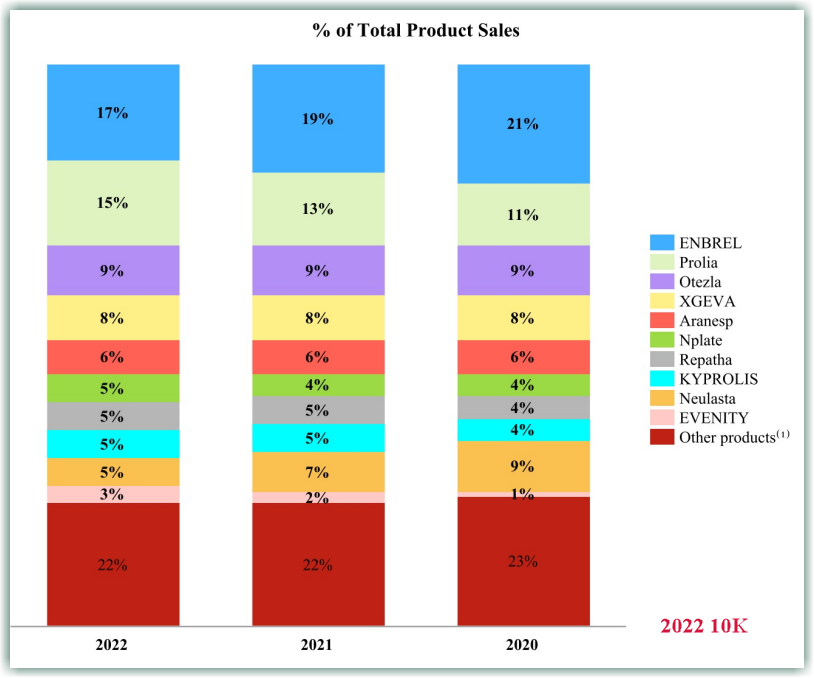

Amgen has several blockbuster drugs. The top four generate 49% of the total sales for each of the years 2022, 2021, and 2020. In 2022, Enbrel brought in $4.21 billion for treating severely active rheumatoid arthritis, Prolia made $3.72 billion for the treatment of postmenopausal women with osteoporosis at high risk of fracture, Otezla is used for the treatment of adults with plaque psoriasis and made $2.23 billion, and XGEVA is used for prevention of skeletal-related events ($1.98 billion).

Reasons why investors like AMGN, and reasons for caution

Reasons why investors like AMGN, and reasons for caution

1. High Dividend Yield

We are quite sure that you are reading this because you are attracted to the delectable dividend 3.77% yield that Amgen is offering at the current stock price of $225.88 as of 5 July 2023. However, we are not yield-chasers here and we do not recommend that for you. Beyond the yield, we will examine if Amgen can continue to sustain the dividend payout which reached $4.2 billion in fiscal year 2022 on the back of $26 billion of revenue and $6.6 billion in net income. In her May 2023 note to investors, Morningstar analyst Karen Andersen remains confident that the current dividend payout will not hamper AMGN from growing its business. She wrote:

“We see Amgen’s current level of dividend payment (roughly $4 billion annually) and share repurchases (likely to fall below dividend payment following the Horizon deal) is appropriate, as it maximizes returns to shareholders but still leaves some free cash flow remaining to repay debt as it comes due or support M&A. We see Amgen’s current level of dividend payment (roughly $4 billion annually) and share repurchases (likely to fall below dividend payment following the Horizon deal) is appropriate, as it maximizes returns to shareholders but still leaves some free cash flow remaining to repay debt as it comes due or support M&A.

However, even if the dividend is likely to be safe for now, we will caution investors to maintain vigilance as the dividend payout ratio has more than tripled from 13.86% (on a GAAP basis) in 2011 to 64.1% (on a GAAP basis) in FY 2022.”

2. Steady Past Performance

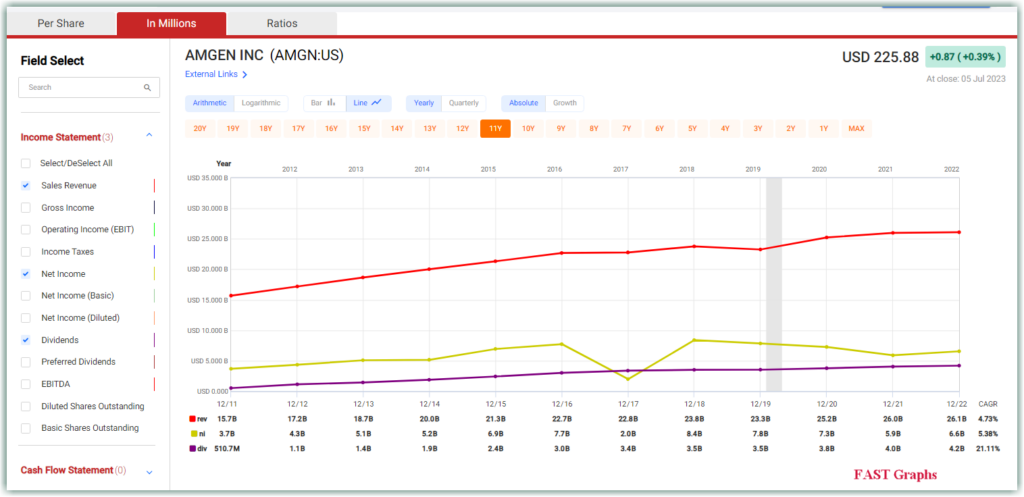

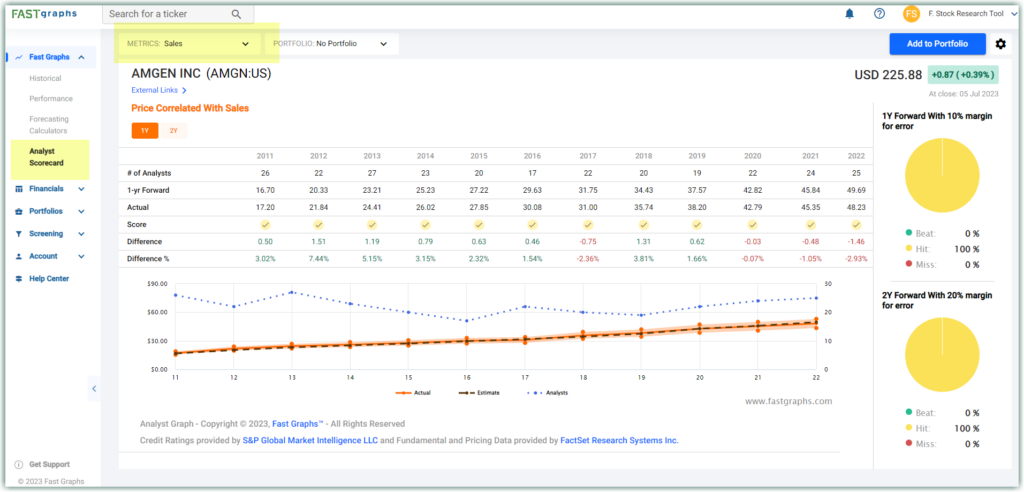

Investors find Amgen an attractive candidate because it has dependably grown revenue, earnings, and of course the dividend.

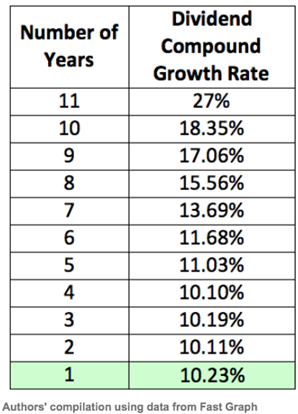

Over the past eleven years (the period chosen is for the purpose of including the growth of the dividends which the company started issuing in 2011), AMGN has grown revenues by a CAGR of 4.73%, net income by 5.38%, and dividends by an impressive 21.11%.

Over the past eleven years (the period chosen is for the purpose of including the growth of the dividends which the company started issuing in 2011), AMGN has grown revenues by a CAGR of 4.73%, net income by 5.38%, and dividends by an impressive 21.11%.

It is easy to see that AMGN appeals to both income investors as well as dividend growth investors. During Q1 2023 earnings call, CFO Peter Griffith said:

“We plan to continue to meaningfully increase our dividends. We continue to expect share repurchases not to exceed $500 million in 2023.”

That echoed management’s commitment to rewarding shareholders through dividends and share buybacks. In the Q1 2023 10Q, the following purpose was noted:

“We intend to continue to invest in our business while returning capital to stockholders through the payment of cash dividends and stock repurchases, thereby reflecting our confidence in the future cash flows of our business and our desire to optimize our cost of capital.”

And together with the remaining $7.0 billion of authorization remaining available under AMGN’s stock repurchase program, it is clear that the company intends to continue with its shareholder-friendly practices.

Once again, we would like to caution investors to maintain vigilance. When the dividend is growing at a rate (21.11%) that is far higher than revenue (4.73%) and net income (5.38%), an increase in the dividend payout ratio is to be expected. Investors need to be aware that a decline in the dividend growth rate has already happened.

Although it seemed to have plateaued at a growth rate of 10% in the past four years, it is possible and perhaps even advisable for future dividend growth rates to be pegged to the growth rate of the revenue and net income in order to have a more sustainable dividend payout.

Although it seemed to have plateaued at a growth rate of 10% in the past four years, it is possible and perhaps even advisable for future dividend growth rates to be pegged to the growth rate of the revenue and net income in order to have a more sustainable dividend payout.

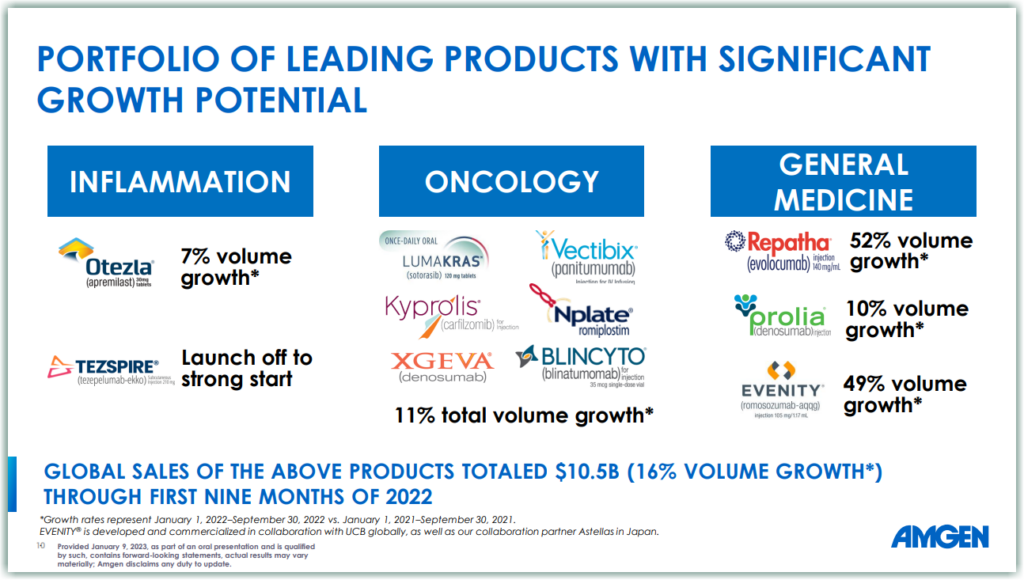

3. Strong Line of Products

As mentioned in the introduction, Amgen has a huge array of products, and the top four (Enbrel, Prolia, Otezla, and XGEVA) generated 49% of the total sales for the past three years, each bringing in between $1.98 billion to $4.21 billion in 2022.

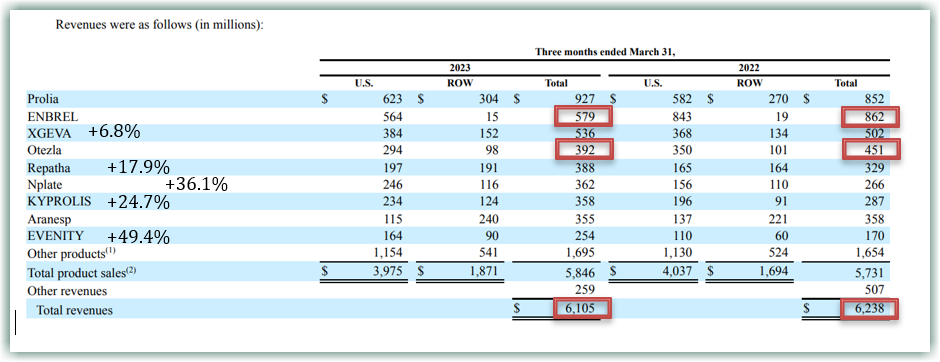

Therefore, analysts and investors were concerned to see declining sales in two of the four top-blockbuster products when compared to the same quarter in 2022, Enbrel by 32.8% and Otezla by 13.1%. These two declines overshadowed the gains made by Prolia (8.8%) and Xgeva (6.8%), as well as the double-digit gains made by other products (see table below). Due to the overall strong sales, Amgen managed to beat Q1 2023 estimates for earnings but missed the estimates for sales.

Zack’s research on 30 June 2023 noted that,

Zack’s research on 30 June 2023 noted that,

“… increased pricing headwinds and competitive pressure are hurting sales of many of Amgen’s products, including some biosimilars. Increasing biosimilar competition for some legacy products and weakness in key brands like Otezla and Lumakras create potential revenue headwinds.”

Management’s Q1 2023 commentary on year-over-year price erosion also worried investors. Across the board, price erosion occurred for Amgen’s products, and the following were highlighted: Enbrel, OTEZLA, KYPROLIS, LUMAKRAS, MVASI and KANJINTI.

Should investors be concerned? We think that investors should remain vigilant as a long-term trend of sustained price decreases will naturally lower margins and profits. Over the past 5 years, AMGN’s gross margins have been declining, from 82.75% in 2018 to 75.45% in 2022.

Gross margins for its peers improved and exceeded AMGN’s in 2022, something that happened in 4 out of the past 21 years.

Gross margins for its peers improved and exceeded AMGN’s in 2022, something that happened in 4 out of the past 21 years.

However, we are not overly worried about this, as Amgen continued to be very profitable. Its operating margins and net margins consistently hover around 35% and 25% respectively. Also, going back to the “Revenue Per Product in Q1 2023 vs Q1 2022” table above, investors should acknowledge and take heart for the strong growth in most of the products in AMGN’s portfolio.

And while we will always take management’s optimism with a pinch of salt, we noted that management expressed cautious optimism about the rest of the year. Management explained that part of the reason for price declines in some of the products is meant to maintain its market share in the face of intensifying competition, and competition goes with the territory so the actions taken by management to lower prices in such situations are not surprising.

4. Strong Products and Promising Pipeline

When evaluating any pharmaceutical company, it is necessary to look at the performance of the top products.

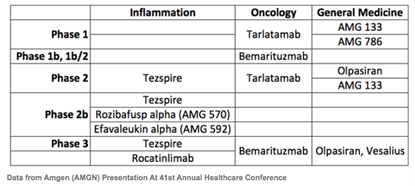

In addition, it is also important to study the size of the pipeline, and AMGN has a promising pipeline targeting three therapeutic areas, namely inflammation, oncology, and general medicine.

In addition, it is also important to study the size of the pipeline, and AMGN has a promising pipeline targeting three therapeutic areas, namely inflammation, oncology, and general medicine.

In addition to this pipeline, existing FDA-approved products are also under investigation for applications in different areas of therapies, such as Repatha for lowering LDL-C levels, and Lumakras for treating non-small cell lung cancer, colorectal cancer and other solid tumors.

In addition to this pipeline, existing FDA-approved products are also under investigation for applications in different areas of therapies, such as Repatha for lowering LDL-C levels, and Lumakras for treating non-small cell lung cancer, colorectal cancer and other solid tumors.

Remember the news and uproar around shortages of diabetes medication like Ozempic and Trulicity because many people including celebrities were buying and taking these as weight-loss drugs? AMGN has a promising candidate in the pipeline known as AMG133, already moving into a Phase 2 study.

In January of 2023, AMGN launched its biosimilar product Amjevita to rival AbbVie’s Humira. More on this later.

In the earlier sections, both risks and opportunities were discussed. In the subsequent section, the focus will be more on the other risks (or uncertainties), some of which AMGN has no control over.

Four Risks and Uncertainties

1. Tax Woes with the IRA

This is not new news. Back in August 2022, the Wall Street Journal reported that AMGN “owes billions of dollars in back taxes and penalties after the allegedly improper shift of nearly $24 billion in profits to a Puerto Rico subsidiary” in order not to pay taxes.

That matter has yet to be resolved, but it is already causing issues with its planned acquisition of Horizon Therapeutics. In recent years, AMGN has been on an acquisition spree (like the Chemocentryx acquisition that was concluded in October 2022 which added Tavneos to its product lineup as well as three early-stage drug candidates that target chemoattractant receptors and other inflammatory diseases and an oral checkpoint for cancer) to beef up its portfolio of products in anticipation of the patent expiration of many of its products (more on this later), and the acquisition of Horizon is supposed to bring similar benefits by adding the product Tepezza. However, when Q1 2023 sales of Tepezza declined by 19% compared to its 2022 results, investors became worried with regard to the soundness and prospect of this proposed acquisition which will add to AMGN’s already heavy debt.

2. The pending acquisition of Horizon Therapeutics

The Federal Trade Commission (FTC) has filed to block AMGN’s acquisition of Horizon Therapeutics. Although according to this Wall Street Journal article, FTC’s premise of anticompetitive behavior is shaky at best, which means AMGN’s acquisition has a high likelihood of succeeding, the fact is the acquisition has to be pushed back to Q3 of 2023, and investors hate uncertainties of any sorts.

3. Patent Cliff

What is even more worrying is the pending patent cliff. Enbrel, its top-selling product which treats diseases like rheumatoid arthritis, is already facing competition from AbbVie’s Humira. According to this article by Fiercepharma,

“… nine products in the Big Biotech’s offerings face patent expirations between 2021 and 2030. Among them, TNF blocker Enbrel, bone med Prolia/Xgeva and inflammatory disease therapy Otezla make up 41% of the company’s estimated 2025 total revenue.”

Otezla, which Celgene sold to Amgen in 2019 for $13.4 billion to win antitrust clearance for its BMS merger, could lose 81% of its revenue, or nearly $2.7 billion, between 2025 and 2030, sell-side consensus showed. Enbrel and Prolia/Xgeva also need to brace for more than 50% erosion during that period, with losses of $1.6 billion and $2.9 billion, respectively.

AMGN’s management certainly knows this better than anyone else, hence its numerous acquisitions in recent years, as well as its investment into its promising pipeline. We believe that this is a real threat, and it is one that the management is actively addressing, and that means additional costs invested in R&D and acquisition costs involved in opening up new markets for existing products, and the subsequent increase in long-term debt is likely to happen. With its BBB+ credit rating, positive cash flow, and cash balance, AMGN should be able to manage the above challenges adequately. Investors just need to go in with their eyes wide open.

4. Sales of AMGN’s Amjevita

Finally, the sales of Humira’s rival did not go as well as planned, so much so that “Amjevitat” was not even mentioned in the Q1 2023 earnings call. However, we believe that the sales of this product are just in the early innings, and with time the sales team will do its job of reaching out to more customers.

Conclusion

Nobody likes uncertainties. However, the only certainty in investing is that stock prices go up, and they will go down. Just because AMGN’s stock price declined should not immediately signal a bargain for value investors to plow into the company. Rather, value investors should examine the strengths of the business (profitability, industry-leading margins, double-digit growth in many existing products, shareholder-friendly practices), and the areas of opportunities (pipeline), in conjunction with the weaknesses (patent cliff, declining sales in 2 top performers) and threats (competition, regulators, uncertainties regarding the success of new acquisitions).

Management is critical to navigating the challenges of an industry as tough and competitive as the one that AMGN is in. Over the past 12 years, it is evident that the management has done an excellent job in growing sales year after year, even through the pandemic, and has been giving great guidance to analysts, which indicates management’s brutal honesty and in-depth knowledge when it assesses its business.

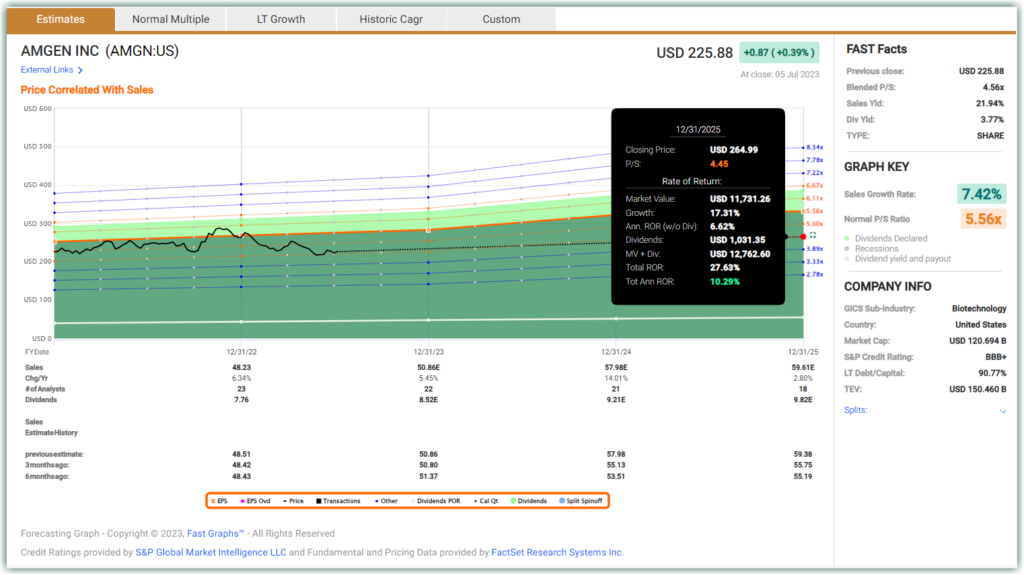

Historically, AMGN’s sales CAGR has ranged between 6-7% in more recent years to 12% when considering a 20-year period. Taking a conservative approach to factor in a margin of safety, assuming that AMGN trades at a P/S of 4.45 which is lower than both the blended P/S of 4.54 and its normal P/S of 5.56, AMGN is still able to provide a 10.29% total annualized rate of return by 2025, a 17.31% capital gain in two-and-a-half years. Therefore, we believe that the uncertainties are already priced in at the current price levels of around $220-$225.

Historically, AMGN’s sales CAGR has ranged between 6-7% in more recent years to 12% when considering a 20-year period. Taking a conservative approach to factor in a margin of safety, assuming that AMGN trades at a P/S of 4.45 which is lower than both the blended P/S of 4.54 and its normal P/S of 5.56, AMGN is still able to provide a 10.29% total annualized rate of return by 2025, a 17.31% capital gain in two-and-a-half years. Therefore, we believe that the uncertainties are already priced in at the current price levels of around $220-$225.

Back to certainty and uncertainty. We are long AMGN and believe that it is undervalued now, but we do not advocate holding an outsize position as part of being prudent. We will continue to monitor its sales and earnings as active investors. As Peter Lynch famously said,

Back to certainty and uncertainty. We are long AMGN and believe that it is undervalued now, but we do not advocate holding an outsize position as part of being prudent. We will continue to monitor its sales and earnings as active investors. As Peter Lynch famously said,

“If you can follow only one bit of data, follow the earnings (assuming the company in question has earnings). I subscribe to the crusty notion that sooner or later earnings make or break an investment in equities. What the stock price does today, tomorrow, or next week is only a distraction.”

Although we believe that the days of double-digit growth rates in earnings may not be so achievable today, we do believe that it is still a good company to own in one’s portfolio. Let us, as prudent investors, monitor the earnings of this wonderful company, and trust in the management who has been doing a good job to continue to do their best in the interest of shareholders.

— James Long

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: FAST Graphs