When scanning for new stocks investors can prioritize many different variables based on their investment goals. Some investors want quick trades, while others may buy a stock for regular dividend payments.

However, one of the most fruitful methods for compounding capital over the long run is to buy and hold compounder stocks, even better if you can purchase them at a discount.

What is a Compounder Stock?

A compounder stock is a company with high return on invested capital, a robust franchise, recurring revenues, intangible assets, pricing power, and low capital intensity. These are companies that have exhibited exceptional long-term returns, and regularly outperform during economic downturns. They remain resilient during tough economic times because their products are necessities, with wide margins, and very regular purchases or usage.

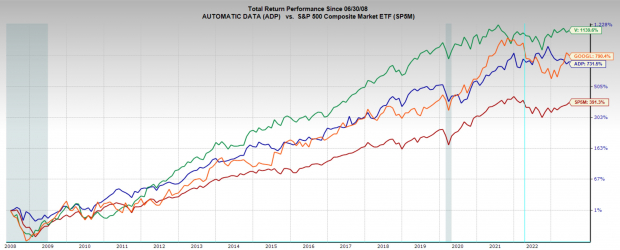

Visa (V) , Automatic Data Processing (ADP) , and Alphabet (GOOGL) all have the qualities of a compounder stock, and currently enjoy high Zacks Ranks, further improving near-term expectations. Additionally, they are all trading below their respective long-term average valuations, making them very appealing investment options.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Visa

Visa is a quintessential compounder stock. Visa boasts gross margins of 99%, net margins of 50%, and functions essentially as a tax on debit and credit card purchases. Using Visa products is a non-discretionary decision, and Visa cards are sometimes used multiple times per day, whether it’s a recession or boom time.

This near monopoly status on consumer payment processing has led to very strong and steady returns for V stock. Over the last 15 years Visa has compounded at an annual rate of 18%, leading to an 11x return over that period.

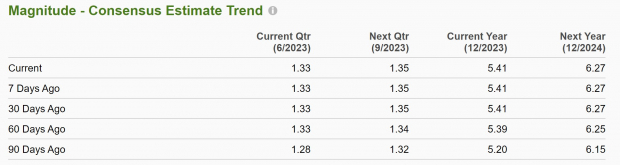

Visa also has a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Analysts have almost unanimously upgraded their earnings estimates for Visa across timeframes. Current quarter earnings are projected to grow 6% YoY and FY23 earnings are expected to climb 14.5% YoY.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Visa is currently trading at a compelling discount to its historic valuation. At 26.4x one-year forward earnings it is above the market average of 20.2x, but below its 10-year median of 28x. While this isn’t a huge discount, it is rare that quality companies like this trade far below their average.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Alphabet

Alphabet is of course the parent company to Google, the world’s principal search engine, online advertising platform, and leading technology company. GOOGL as well fits pristinely into the compounder stock category, with wide margins, strong brand, and is minimally affected by economic cycles.

Over the last 20 years Alphabet has compounded at an impressive 22.2% annually, returning a total of 4,500% over that time.

GOOGL has enjoyed some slight revisions higher in its earnings estimates over the last 90 days earning it a Zacks Rank #2 (Buy). FY23 earnings estimates have increased by 5% over the last three months and are forecast to grow 18.6% YoY. Earnings are expected to grow by 14.5% annually over the next 3-5 years for the technology giant.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Alphabet is currently trading at a one-year forward earnings multiple of 21.9x, which is just above the market average of 20.2x, and below its 10-year median of 26.5x. At the beginning of 2023 GOOGL’s forward earnings multiple traded down to its 10-year low, and even now it is still at a compelling valuation.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Automatic Data Processing

Founded in 1949, Automatic Data Processing is one of the leading providers of cloud-based human resources solutions. ADP’s technology assists with payroll, talent management, Human Resources and benefits administration, and time and attendance management to 990,000 clients across 140 countries.

ADP stock has compounded at an annual rate of 15% over the last 15 years, returning 730% to investors over that time.

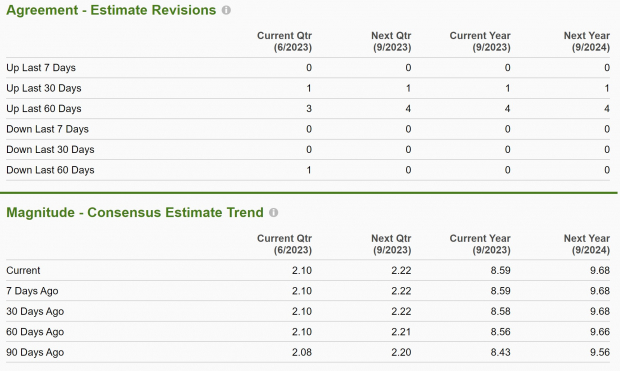

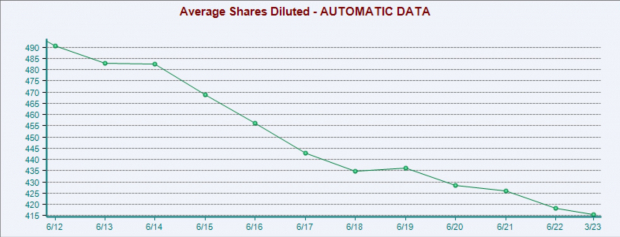

ADP has a Zacks Rank #2 (Buy) and earnings are projected to grow by 12% annually over the next 3-5 years. Additionally, the stock yields a 2.3% dividend yield, which has increased by 11.1% annually over the last five years. Showing its commitment to returning cash to shareholders, ADP management has also diligently bought back shares in the company, reducing the share count by 15% over the last ten years.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Advanced Data Processing is trading at a one-year forward earnings multiple of 26.4x, which is above the market average of 20.2x, and below its 10-year median of 28x. You can see all these stocks consistently trade above the market average, and for good reason. Because they are such stellar companies, their earnings are expected to grow faster than the market average, earning them premium valuations.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

While none of these stocks offer bargain valuations, they are companies with some of the most consistently growing earnings in the market. Because of that, they rarely trade at significant discounts. However, today they are below historical averages, making them appealing to investors with a longer time frame and penchant for these types of stocks.

— Ethan Feller

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks