The market is dead wrong to be excited about the Fed’s “skip.”

Yesterday, the Federal Reserve announced it won’t be raising interest rates for now. And the S&P 500, Nasdaq, and Dow are all showing green – each is up around 1% as I write today.

But it may be too early to celebrate.

There’s a dark truth most investors are missing right now. And doing so might mean walking blindly into a short-term market crash.

At Wide Moat Research, we’re the detectives who search out the hidden truths the regular media won’t tell you about. We know how to read the economic tea leaves to prepare you for what’s most likely coming next.

And right now, it’s important you’re prepared for it.

In today’s essay, I’ll tell you what the Fed is hiding… and how you can avoid the fear and losses it could bring regular investors.

The Real Interest Rate

The Fed says it expects to hike interest rates twice more by the end of the year… But its actual plan could have a bigger impact than just those two rate hikes.

And this could drive the economy into a recession, lowering the stock market by 35%.

And we know this, thanks to the “real interest rate.”

You get the real interest rate by subtracting the inflation rate from the Fed funds rate. And the Fed funds rate is the interest rate U.S. banks pay each other to borrow or loan money.

The real interest rate drives credit. And that powers the economy. So let’s take a look at where we are today…

The current inflation rate is about 4.05% and the Fed funds rate is between 5% and 5.25%.

When the Fed started raising rates in March 2022, the real interest rate was -8.5%. Today, the real interest rate is around 1%.

The Fed’s economists estimate that a real rate of 0% to 1% is “neutral,” neither accelerating nor slowing the economy.

But by the end of the year, economists expect the economy to start shrinking and inflation to fall to 3.2%.

That means a real interest rate of 2.3%.

Considering the Fed has raised interest rates by 25 basis points (0.25% increments) three times this year… And this would be a 1.25%-plus increase from our current real interest rate of 1% in one go… It’s like the Fed hiking rates five more times this year.

When this happens, the economy could slow down even more… and plunge us into a recession no one wants to think about right now.

Why Stocks Might Fall Off a Cliff Soon

Economists expect a mild recession to start in a few months.

But the stock market is blind to this fact.

The S&P’s historical earnings growth rate has been 6.2% over the last 50 years. But thanks to big tech – which has higher margins and grows faster – analysts expect that S&P earnings will grow at 8.5% over time.

And thanks to this year’s tech rally, analysts are estimating even better results over the next couple of years.

2% earnings growth this year. And then about 25% combined earnings growth in the following two years. Sounds great, right?

2% earnings growth this year. And then about 25% combined earnings growth in the following two years. Sounds great, right?

There’s just one problem. These estimates are likely dead wrong.

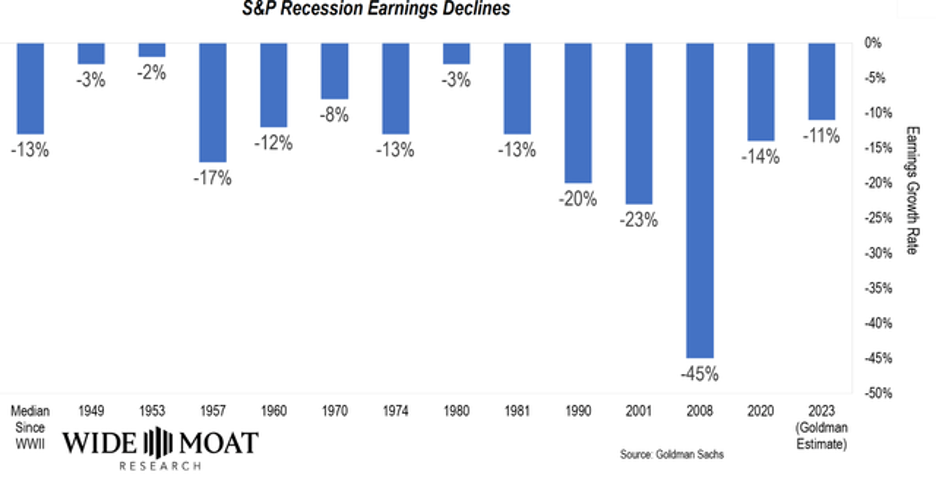

Since WWII, there hasn’t been a single recession in which earnings didn’t fall. Even when inflation was sky-high, earnings still declined in recessions.

Goldman Sachs, which has one of the 16 most accurate economist teams on earth, is saying Wall Street’s predictions are pure fantasy.

It’s factoring in the economy, corporate margins, credit conditions, and historical averages, and dozens of other metrics… And forecasting an 11% recession-fueled market decline this year.

And it’s not just Goldman.

And it’s not just Goldman.

Piper Sandler thinks earnings will fall 15%, Bank of America thinks 16%, and Morgan Stanley thinks it will be a 20% drop. The Fed’s own bank lending data is currently consistent with -13% earnings growth.

The bottom line is this: The Fed’s actions are leading us into a recession… But the market is not paying attention at all.

And that’s not all. Corporate profits are almost certain to miss expectations by 10% to 20%.

All told, that means the S&P is likely to hit a new bottom of 3,000 to 3,400 – a 20% to 35% drop from here.

In other words, the S&P is extremely overvalued, and almost all the risk is to the downside.

But Wall Street doesn’t want you to know that, because it’s making a lot of money in this supposed bull market.

And if a recession hits, it’ll be average investors who piled into this frenzy that will end up getting burned.

Safe Investing,

Adam Galas

Analyst, Intelligent Income Daily

Source: Wide Moat Research