Introduction

John Deere (DE) and Caterpillar (CAT) are both well-known companies that have been around for decades. John Deere was founded in 1837 while Caterpillar was founded in 1925, just two years shy of its 100-year in existence. These two companies have been through the Great Depression of the 1920s, the second world war, the Korean War, Vietnam War, the high inflationary period in the 1970s, the Gulf War, the dotcom bubble, the Great Financial Crisis, and more recently the Covid-19 pandemic. And the key takeaway is this: they both survived all these, and continue to thrive, and they are likely to continue to thrive in future.

Both companies have rewarded their long-time shareholders (more on this later) so these are definitely companies investors should have in their portfolio – purchased at the right price of course.

FAST Graphs Analyze Out Loud Video on John Deere & Caterpillar

Introduction to John Deere: More Than A Tractor Company

At the CES 2023, John Deere CEO John May shared the following,

Today, John Deere leverages a vast tech to give our machines superhuman capabilities. This begin with our equipment. Over 500,000 connected machines run across more than a third of the earth’s land surface. You might want to think of them as robots that precisely execute jobs in the land, on roads, and at construction sites. Within these machines, we have integrated displays with embedded software, GPS hardware with precisely signal correction; machine learning, cloud computing and one of the leading digital platforms in the agricultural industry, the John Deere Operations Center. Each one of these technologies brings unique and specific benefits to our customers.

If anyone still thinks that John Deere (DE) is only about boring farm tractors and farm equipment, that excerpt from John May’s keynote speech at CES 2023 would sound totally unbelievable. It may be difficult to visualize this company that started in 1837 as a technology company today but that is how investors should view John Deere.

It will not be too overboard to think of John Deere as an AI company.

Its most recent acquisitions include SparkAI (“provides contextual cues that the autonomous tractor is sometimes missing in order to make confident decisions in real-time), Light (“which specializes in depth sensing and camera-based perception for autonomous vehicles“), Bear Flag Robotics (its “technology enables tractors to run autonomously, human supervisors use software to monitor and command the fleet from a remote mission control room or personal device“), and not to forget Blue River Technologies which was acquired as early as 2017 before the AI buzz and fad took off (its “See & Spray and Sense & Decide devices to analyze every plant in a field and apply herbicides only to weeds and overly crowded plants needing thinning“).

It is therefore no coincidence that after consecutive years of falling sales from 2013 to 2016 that Deere managed to improve sales again, with its 2022 sales almost doubling that of 2016.

Daniel Theobald, the founder and Chief Innovation Officer at Vecna, a provider of mobile robots, platforms, and remote presence devices, shared the following perspective about John Deere,

Daniel Theobald, the founder and Chief Innovation Officer at Vecna, a provider of mobile robots, platforms, and remote presence devices, shared the following perspective about John Deere,

It’s a smart move by Deere. They realize the time window in which ag industry execs will continue to buy dumb equipment is rapidly coming to a close. The race to automate is on and traditional equipment manufacturers who don’t embrace automation will face extinction. Agriculture is ripe for the benefits that robotics has to offer. Automation allows farmers to decrease water use, reduce the use of pesticides and other methods that are no longer sustainable, and helps solve ever worsening labor shortages.

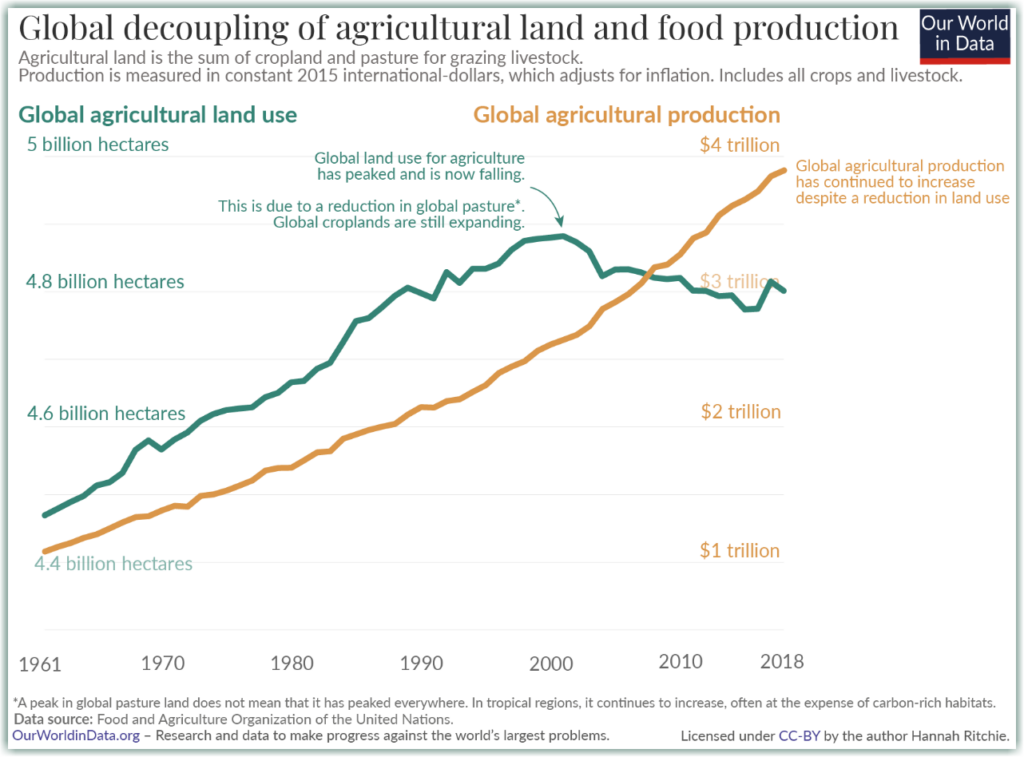

This is a strange world that we are living in. The United Nations predicts that the world’s population will increase from the current 8 billion to 9.7 billion in another 27 years. The increasing human population naturally results in an increase in demand for land for housing and of course for food. Yet, the amount of agricultural land for food production has been on the decline for the past twenty years.

John Deere’s CEO said as much in his CES 2023 speech,

John Deere’s CEO said as much in his CES 2023 speech,

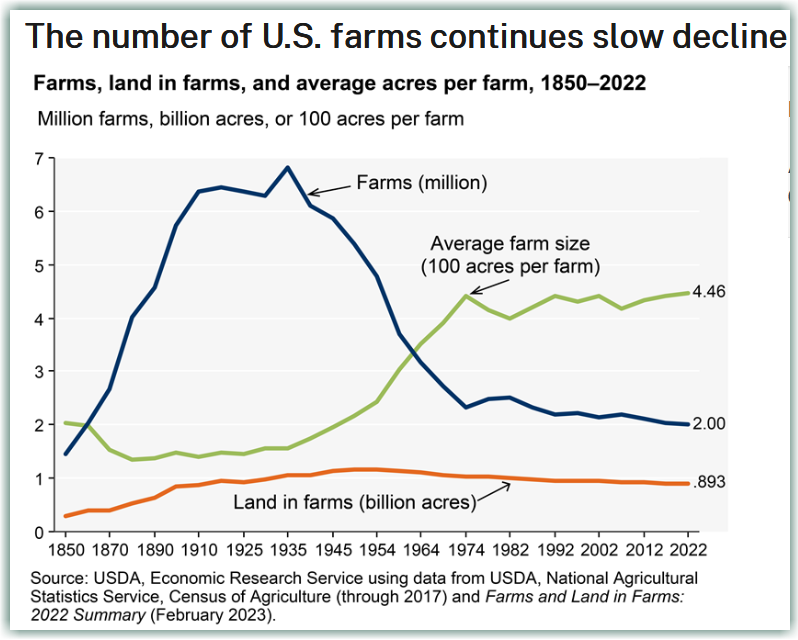

Over the next 25 years, the global population is expected to grow from 8 billion people to nearly 10 billion people. This requires us to produce 50% more food as both population grows and diets change around the world. But it is not just about growing more. The amount of US farmland has been declining over the past 40 years and this trend will likely continue as the population continues to increases. More people, less land, the math doesn’t work.

That is confirmed by the United States Department of Agriculture (USDA).

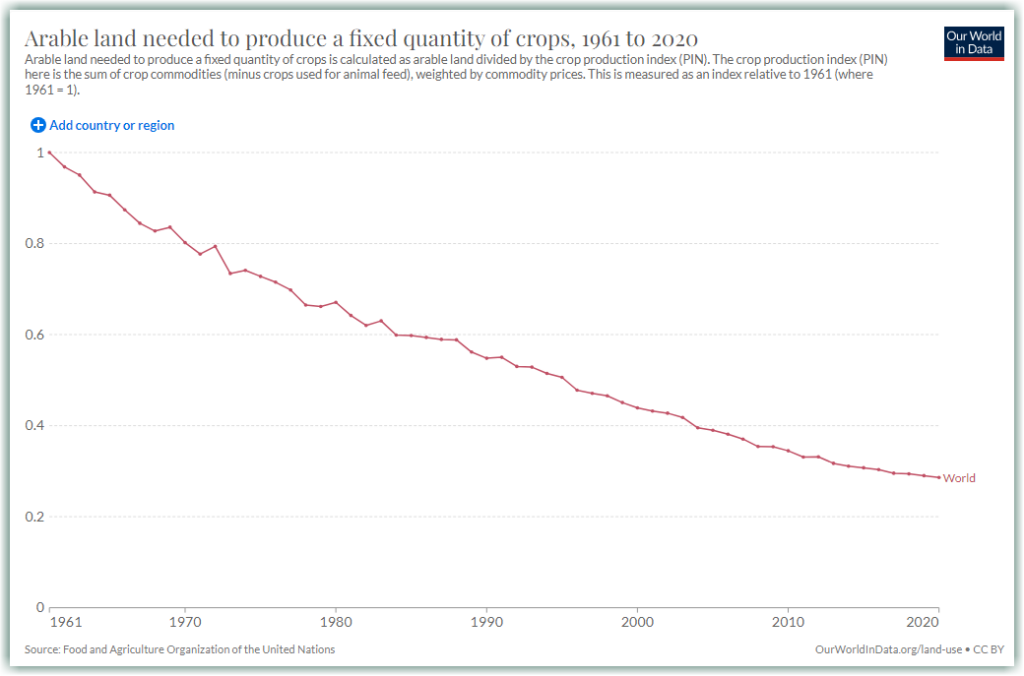

How is it possible, or tenable, to have more food produced on less land?

How is it possible, or tenable, to have more food produced on less land?

Thanks to the power of technology and technological advancement, be it farming techniques, more productive seeds that need less water, better fertilizers, and of course with technology-enabled machines and smarter use of cloud computing and analytics, more can be done with less – less land, less water, fewer farmers. In short, more food can be produced on less arable land.

These two tailwinds – the increasing demand for food and the increasing automation of equipment – will keep John Deere at the forefront for a long time. People can reduce spending on clothes, bags, watches, sports equipment, cars, boats, etc, but they have to keep eating.

These two tailwinds – the increasing demand for food and the increasing automation of equipment – will keep John Deere at the forefront for a long time. People can reduce spending on clothes, bags, watches, sports equipment, cars, boats, etc, but they have to keep eating.

What are the revenue segments?

John Deere does more than just sell farm-related equipment. They provide machinery for different industries beyond agriculture, into construction, forestry, military, and equipment rental.

According to the 2022 10K, John Deere has four business segments.

According to the 2022 10K, John Deere has four business segments.

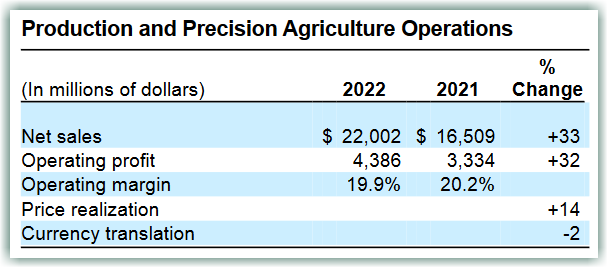

Segment One: Production and Precision Agriculture (PPA)

The segment’s main products include large and certain mid-size tractors, combines, cotton pickers, sugarcane harvesters and loaders, and soil preparation, seeding, application, and crop care equipment.

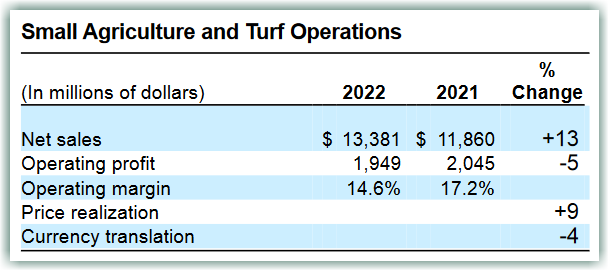

Segment Two: Small Agriculture and Turf segment (SAT)

Segment Two: Small Agriculture and Turf segment (SAT)

The segment’s primary products include certain mid-size and small tractors, as well as hay and forage equipment, riding and commercial lawn equipment, golf course equipment, and utility vehicles.

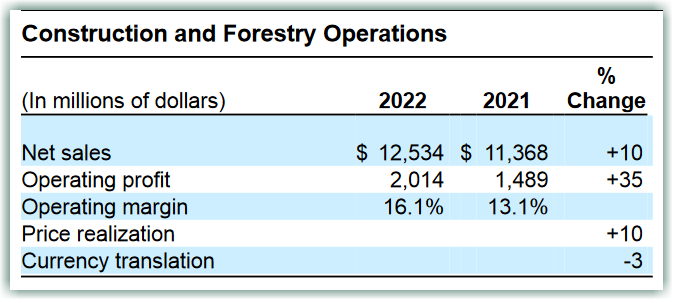

Segment Three: Construction and Forestry segment (CF)

Segment Three: Construction and Forestry segment (CF)

The segment’s primary products include crawler dozers and loaders, four-wheel-drive loaders, excavators, skid-steer loaders, milling machines, and log harvesters.

Net sales for the first three segments increased in 2022 due to improvements in the supply chain that allowed timely shipment of its equipment. The increase in operating profits for the Production and Precision Agriculture segment and the construction and Forestry Operations segment is due to the increase in prices and shipment. The decrease in operating profits for the Small Agriculture and Turf Operations segment is due to higher production costs, higher selling, administrative and general expenses, and research and development expenses.

Net sales for the first three segments increased in 2022 due to improvements in the supply chain that allowed timely shipment of its equipment. The increase in operating profits for the Production and Precision Agriculture segment and the construction and Forestry Operations segment is due to the increase in prices and shipment. The decrease in operating profits for the Small Agriculture and Turf Operations segment is due to higher production costs, higher selling, administrative and general expenses, and research and development expenses.

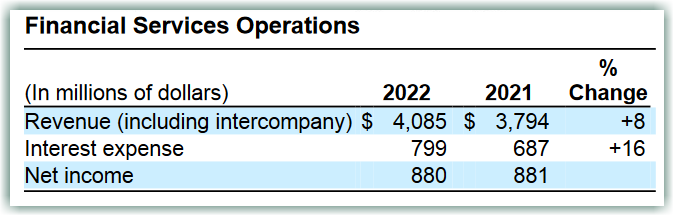

Segment Four: Financial Services segment (FS)

Finances sales and leases by John Deere dealers of new and used production and precision agriculture, small agriculture and turf, and construction and forestry equipment. In addition, the financial services segment provides wholesale financing to dealers of the foregoing equipment, finances retail revolving charge accounts, and offers extended equipment warranties.

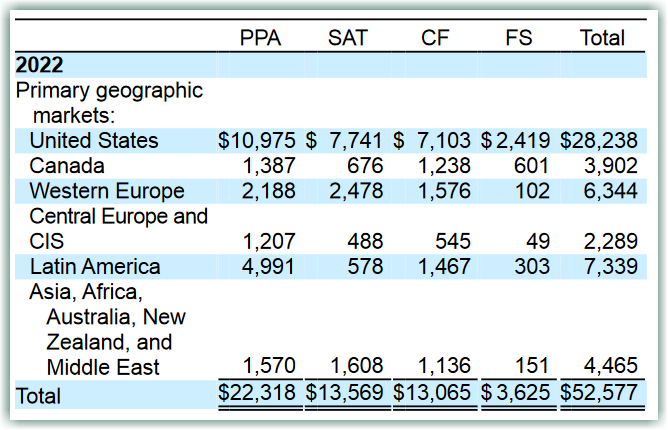

Most of the revenue (53.7%) comes from the United States, and most of the revenue comes from the Production and Precision Agriculture (PPA) segment. The growth and focus on the PPA segment demonstrate that John Deere is moving in the right direction with its autonomous tractors and the infusing of AI and robotics into its machines. John Deere already has semi-autonomous features in some of its machines, and its line of fully autonomous tractors, the 8R series of tractors, was said to be available for sale in late 2022. These new lines of tractors are likely to be driving sales for the PPA segment.

Most of the revenue (53.7%) comes from the United States, and most of the revenue comes from the Production and Precision Agriculture (PPA) segment. The growth and focus on the PPA segment demonstrate that John Deere is moving in the right direction with its autonomous tractors and the infusing of AI and robotics into its machines. John Deere already has semi-autonomous features in some of its machines, and its line of fully autonomous tractors, the 8R series of tractors, was said to be available for sale in late 2022. These new lines of tractors are likely to be driving sales for the PPA segment.

Geographically, the company is confident that the industry outlook for large agriculture equipment in the U.S. and Canada (these two countries make up 55% of the PPA sales in 2022) to be up approximately 10% in 2023, and for demand to continue to be elevated as the order book extends to 2024, reflecting strong demand.

Geographically, the company is confident that the industry outlook for large agriculture equipment in the U.S. and Canada (these two countries make up 55% of the PPA sales in 2022) to be up approximately 10% in 2023, and for demand to continue to be elevated as the order book extends to 2024, reflecting strong demand.

Future Growth Catalyst

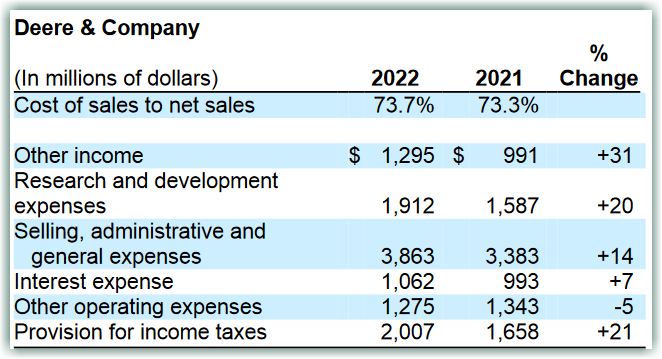

There is a category of income known as “Other Income”. This income stream does not fall under any of the four income streams mentioned above. What is this segment that brought in $1.295 billion in 2022, a 31% increase over 2021?

According to the explanation under the segment “revenue recognition” in the 2022 10K (pages 48 to 49),

According to the explanation under the segment “revenue recognition” in the 2022 10K (pages 48 to 49),

Certain equipment is sold with precision guidance, telematics, and other information gathering and analyzing capabilities. These technology solutions require hardware, software, and may include an obligation to provide services for a period of time. These solutions are mostly bundled with the sale of the equipment but can also be purchased or renewed separately.

The revenue related to the hardware and embedded software is recognized at the time of the equipment sale and recorded in “Net sales” in the statements of consolidated income. The revenue for the future services is deferred and recognized over the service period. The deferred revenue is recorded as a contract liability in “Accounts payable and accrued expenses” in the consolidated balance sheets and is recognized in “Other income” with the associated expenses recognized in “Other operating expenses” in the statements of consolidated income.

You will not hear this “other income” mentioned in the earnings call transcripts, nor will you hear about “software as a service”, “subscription” or “recurring revenue”, not in the earnings call and certainly not in the 10K. This income stream includes the premiums for extended warranties that come with buying John Deere’s equipment.

To the disappointment of the readers, this “Other income” currently does not include as recurring revenue generated from their connectivity services. As of July 2021, John Deere’s customers no longer need to pay any subscription fees to stay connected to its JDLink Connectivity Service. According to the official website,

Connectivity subscriptions or renewals are no longer required so customers can simply activate the service and leave it on.

However, the company made it clear that it can charge a fee in the future if it decides to do so. On page 57 of the 2022 10k, it states,

The company invoices in advance of recognizing the sale of certain products and the revenue for certain services. These relate to extended warranty premiums, advance payments for future equipment sales, and subscription and service revenue related to precision guidance and telematic services.

We think it is definitely possible for John Deere to start charging a basic subscription for the JDLink service in the future. By keeping it free now, it allows farmers to explore the possibilities and convenience of cloud services, providing services such as:

- monitoring machine health and sending alerts to the farmer and the dealer of issues

saves time by remotely viewing in-cab displays, reducing trips to the machine - reduces or even eliminates technician trips to a machine through remote diagnostic and remote software

- reprogramming capabilities

- connects experts with the information needed to respond to downtime faster and prevents it altogether

This may sound speculative at the moment but the company has expressed plans to do so. It was quoted by Reuters that Deere executives told analysts at a conference that the company will largely maintain its “point-of-sale” model for equipment, but will integrate a software-as-a-service (SAAS) model for its autonomous solutions. Joshua Jepsen, Deere’s deputy financial officer, said,

While it may take us a few years to build out a base of recurring revenues, autonomous solutions, on top of our underlying machine forms, will be recurring.

As for now, what John Deere is doing looks like the typical “freemium” model that many software companies adopt, letting users try a product for free for a period of time, letting them experience the full suite of services, and eventually requiring the users to pay a fee.

Once John Deere starts implementing the recurring revenue model, it will have 4 revenue streams from the sales of one machine: the upfront sales from the machine, the sales from replacement machine parts, the sales from warranty premiums, and lastly the sales from the subscription service to JDLink.

Why did the share price plunge?

The company reported good Q2 earnings. Profits increased 36% to $9.65 per share from $6.81 per share a year ago, exceeding analysts’ forecast earnings of $8.64 a share. The company raised its outlook for net income to be between $9.25 billion and $9.5 billion, up from the previous $8.75 billion and $9.25 billion, reflecting the strong results and optimism for the rest of the fiscal year.

Yet, the stock sold off 10% from 19 May 2023 to 31 May 2023, falling from $387 to $345. Perhaps investors were spooked by some of the specific growth figures for certain geographical regions and business segments. For instance, sales in the small ag and turf segment in the U.S. and Canada are expected to be down around 5%. Sales of tractors and combines in South America are expected to stay flat while sales in Asia are expected to be slightly down. Perhaps the spotty growth guidance did not meet investors’ expectations despite management’s overall optimism in the strength of the business.

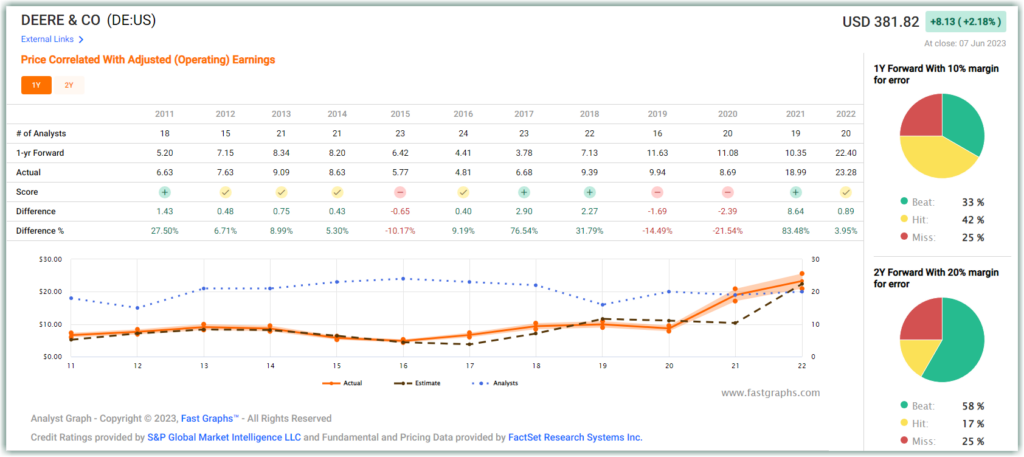

Investors should be cognizant that John Deere operates in a cyclical industry, one that are not just affected by commodity prices but also the weather. Despite these and other uncertainties, the company gave good guidance. Just 25% of the past 1-year and 2-year guidance missed the mark, and these misses are not overly egregious, ranging from -10% to -21%. Notably, the company exceeded guidance more often than it misses them, and when the company exceeds guidance it could outperform by as high as 83%.

In our opinion, the sell-off is unwarranted and presented an excellent dip-buying opportunity between 20 May and 1 June. The stock price has already recovered to $376 at the point of writing this on 7 June 2023, so it is still undervalued, fairly valued, or overvalued?

In our opinion, the sell-off is unwarranted and presented an excellent dip-buying opportunity between 20 May and 1 June. The stock price has already recovered to $376 at the point of writing this on 7 June 2023, so it is still undervalued, fairly valued, or overvalued?

Valuation

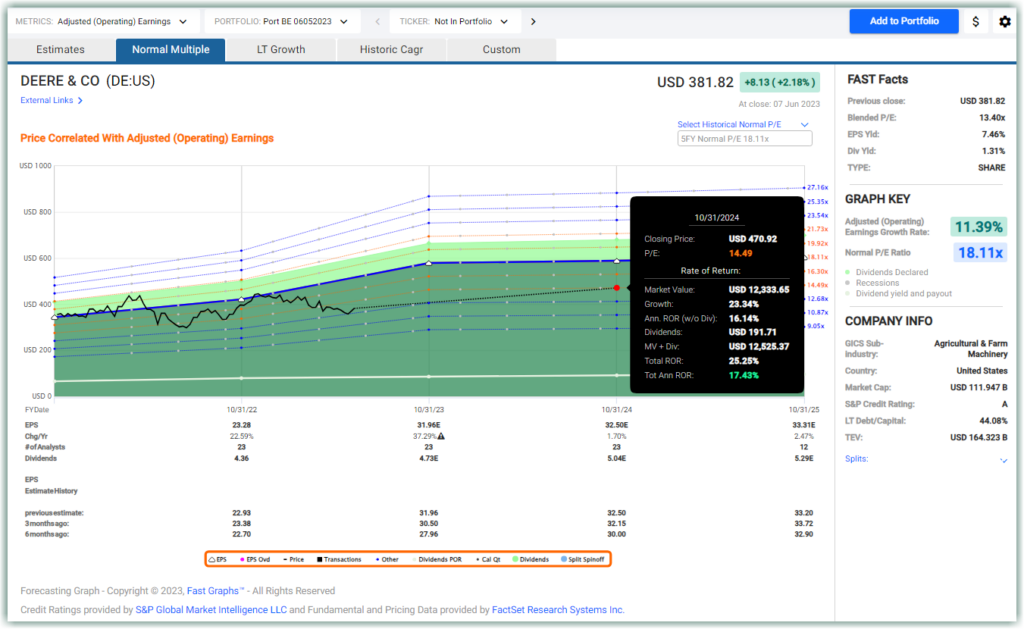

John Deere typically traded at a blended P/E of 15 over a 20-year time frame but its normal blended P/E for the last five years has been around 18 times earnings. This premium is due to the company’s pivot to become a technology-enabled company that utilizes artificial intelligence, cloud computing capabilities, precision agriculture, autonomous vehicles and more, to drive productivity so farmers can produce more with less.

It is currently trading at a blended P/E of just 13.40 which is definitely undervalued. Even if the company trades up to around 15x earnings, it can potentially provide a total annualized rate of return of 17.4% in 18 months or a 23% capital appreciation.

It is currently trading at a blended P/E of just 13.40 which is definitely undervalued. Even if the company trades up to around 15x earnings, it can potentially provide a total annualized rate of return of 17.4% in 18 months or a 23% capital appreciation.

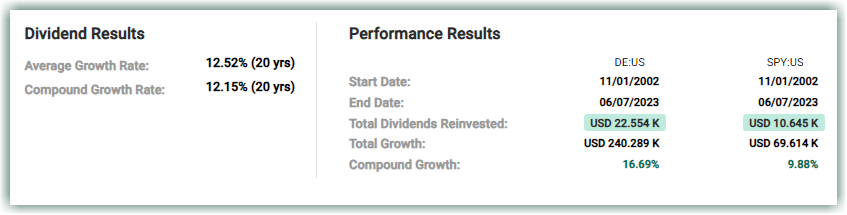

Conclusion on John Deere

John Deere is an A-rated company that is currently selling at a discount to its intrinsic value. Although it operates in a cyclical industry, the company has been able to meet or beat earnings estimates 75% of the time and has grown earnings over the long run. Over the past 20 years, John Deere has demonstrated its ability to grow dividends at double-digit rates, and it trounced the SPY by more than 600 basis points, turning a $10k investment into close to a quarter of a million dollars.

What about Caterpillar (NYSE: CAT)?

What about Caterpillar (NYSE: CAT)?

Introduction to the Construction Behemoth Caterpillar

According to the 2022 10K,

Caterpillar is the world’s leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives.

The company principally operates through its three primary segments – Construction Industries, Resource Industries and Energy & Transportation – and also provides financing and related services through its Financial Products segment. Caterpillar is also a leading U.S. exporter. Through a global network of independent dealers and direct sales of certain products, Caterpillar builds long-term relationships with customers around the world.

The products are designed to serve customers in the following industries: construction, mining, oil and gas, marine, power generation, rail and industrial.

How Has Business Been, and What Is 2023’s Outlook?

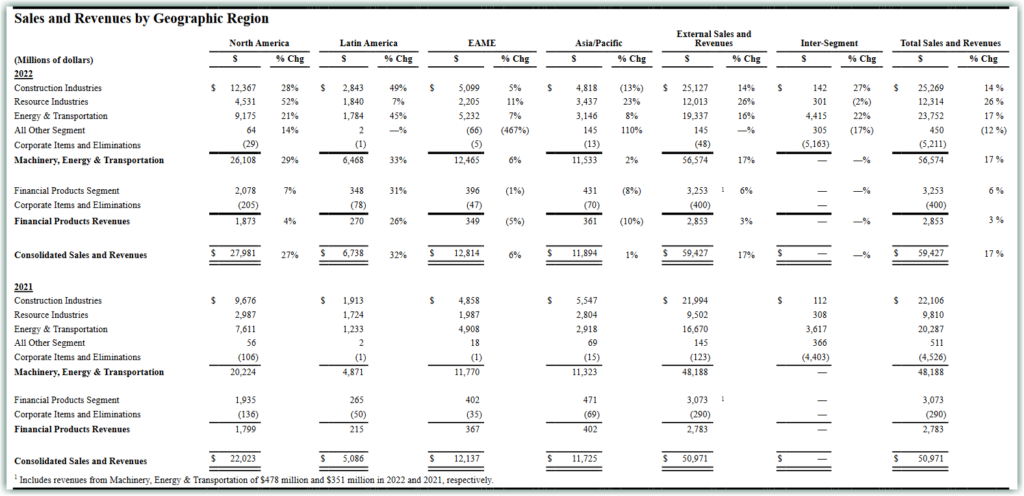

The business had been roaring in 2022, with sales up by double-digits in almost every geographical region and in almost every major segment.

Management however is not guiding for the same kind of growth in 2023.

Management however is not guiding for the same kind of growth in 2023.

CEO Jim Umpleby said in the Q1 2023 earnings call,

We expect higher sales in the second quarter compared to the first, as is the typical seasonal pattern. Looking to the second half of 2023, it is important to highlight the second half of last year included the dealer inventory build of $1.4 billion, as dealers began to restock their inventories. We are not planning for this trend to repeat. Instead, we expect to see dealers decrease inventories compared to the first quarter levels and end 2023 about flat relative to the end of 2022.

Although we expect sales to users to remain positive for our primary segments in each quarter, our planning assumption is that Caterpillar second half sales will have a dealer inventory impact…

However, there is greater excavator inventory in a few regions, as supply dynamics improved in 2022, which, coupled with the slowing in China, has resulted in improved excavation product availability. Given the improved availability of excavators, we expect that dealers will scale back their levels of excavator inventory in the second half of the year, even though demand remains healthy. As a reminder, dealers are independent businesses and control their own inventory.

There are a few things to take away from this. Firstly, although there is still demand for the kind of products that Caterpillar sells, due to improvements in the supply chain, dealers no longer need to stock up in order to meet the demand, unlike from 2021 to 2022 when COVID was raging across the globe causing labor shortages at ports and other chokepoints of the supply chain. Secondly, although Caterpillar does direct sales, it is very dependent on independent dealers. Who are these independent dealers? How large is this network?

We need to bear in mind that dealers do not just sell Caterpillar products but also other brand-name products. The independent dealers also need to clear their inventory of products by other companies, not just those from Caterpillar.

According to the 2022 10K,

We distribute our machines principally through a worldwide organization of dealers (dealer network), 43 located in the United States and 113 located outside the United States, serving 192 countries. We sell reciprocating engines principally through the dealer network and to other manufacturers for use in products. We also sell some of the reciprocating engines manufactured by our subsidiary Perkins Engines Company Limited through its worldwide network of 88 distributors covering 185 countries. We sell the FG Wilson branded electric power generation systems through its worldwide network of 110 distributors covering 109 countries. We also sell some of the large, medium speed reciprocating engines under the MaK brand through a worldwide network of 20 distributors covering 130 countries.

The majority of these dealers are independent, that is they are not Caterpillar’s employees. There is an understanding between Caterpillar and these independent dealers: in return for warranty and technical support, these dealers will promote and demonstrate Caterpillar products to potential customers.

With supply chain issues normalizing, management expects dealers’ inventory stocking patterns to normalize as well, and the following was shared during the Q1 2023 earnings call,

In the second quarter of 2022, we saw a decrease in dealer inventory of $400 million. We expect a smaller decrease in the second quarter of 2023. Specific to second quarter margins versus the prior year, adjusted operating margins at the enterprise and segment level should be substantially stronger than the prior year on favorable price and volume. However, we do expect to see a return to the typical seasonal pattern of lower second quarter margins compared to the first quarter, despite higher sales.

This normalization of orders post-COVID is only expected to be a short-term road bump. What matters is the long-term prospects of this company. And thanks to the Infrastructure Bill that was passed in 2021 provides more than $1 trillion dollars of tailwinds for companies like Caterpillar and John Deere.

Is Caterpillar Still A Buy?

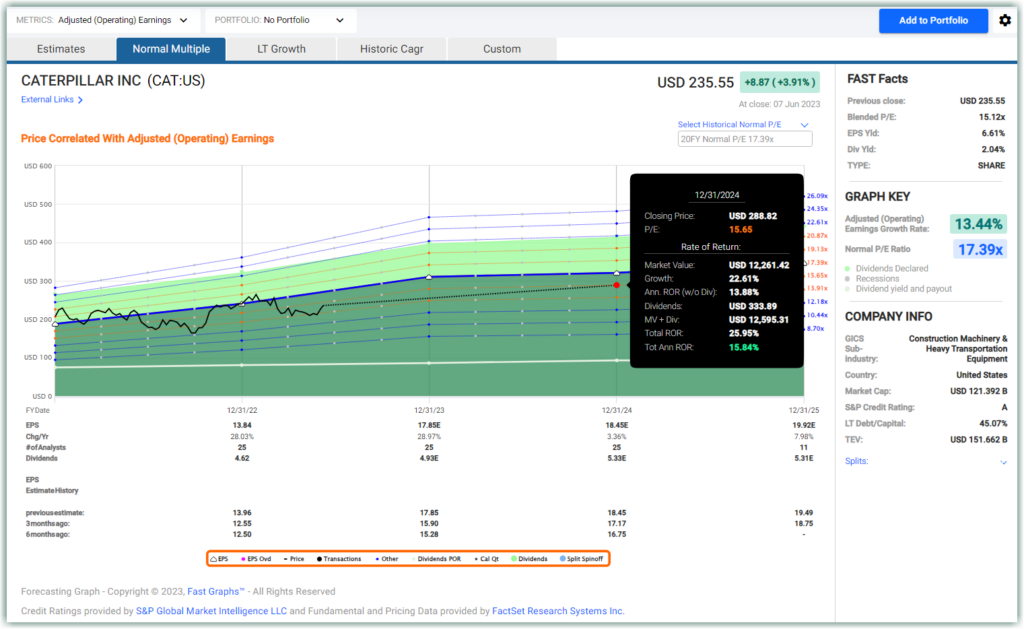

About a month ago, Caterpillar was trading at $209 per share at a blended P/E of 13.7, which is below the 5-year normal P/E of 18.17 and below the 20-year normal P/E of 17.39.

The stock has since appreciated by 12.41% from 12 May 2023 to 7 June 2023 and is trading at a blended P/E of 15.12. Taking a more conservative view to assume that even if Caterpillar trades up just slightly from 15.12 to a blended P/E of 15.65 (lower than either the 5-year or 20-year normal P/E), the current valuation still potentially offers a 22.61% upside in 18 months.

The stock has since appreciated by 12.41% from 12 May 2023 to 7 June 2023 and is trading at a blended P/E of 15.12. Taking a more conservative view to assume that even if Caterpillar trades up just slightly from 15.12 to a blended P/E of 15.65 (lower than either the 5-year or 20-year normal P/E), the current valuation still potentially offers a 22.61% upside in 18 months.

Risks

Risks

Not everyone agrees with our valuation. Morningstar analyst Dawit Woldemariam pegged Caterpillar’s fair value at $209 meaning after the 12% run up it is already overvalued. In his 27 April 2023 note, he wrote,

We believe investors reacted negatively toward management’s comments around dealer inventories. For 2023, the company expects inventory purchases to be flat compared with 2022. Management highlighted that improving supply chains have led to greater excavator inventories in some regions.

This means dealers will likely pull back on inventory purchases in this product category. In our view, the counterbalance to that is solid end user demand across segments. We continue to think end users will drive near-term sales growth for Caterpillar.

There are puts and takes to the short term, but we think it’s best to take a longer-term approach to the Caterpillar story. Recall, the company is heavily exposed to the U.S. infrastructure story, which we expect to be a key catalyst to sales growth in our forecast. We have yet to see material spend flow through, but we expect 2024 and 2025 to be strong years for Caterpillar.

We agree with this analyst fundamentally on Caterpillar’s long-term prospects and near-term speed bumps but we believe that Caterpillar is still well-priced based on its normal P/E.

An analyst from Zacks mentioned that the slowdown in China’s housing market will be a drag on sales. While we agree, we also think that this risk is overblown. The Asia Pacific region accounts for 20% of the total 2022 sales.

While not insignificant, it is the second smallest revenue-contributing region with North America (47%) and Europe, Africa, and the Middle East (21.5%) both contributing a greater share of the total revenue.

Besides, China is just one of the countries in the Asia Pacific, albeit the largest. Other Asia Pacific countries have their own infrastructure plans, like India’s National Infrastructure Pipeline with $1.5 trillion worth of projects, and Indonesia’s Masterplan for Acceleration and Expansion of Indonesia’s Economic Development. In short, there are other growth opportunities in other markets.

Conclusion on Caterpillar

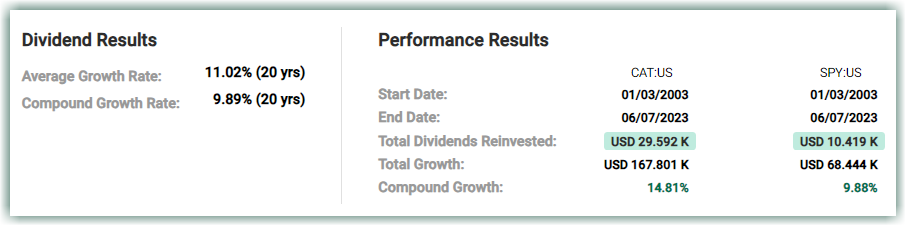

Caterpillar (CAT) is an A-rated company that is supported by strong tailwinds, namely the $1.2 trillion infrastructure bill from the U.S. as well as infrastructure developments in countries elsewhere. Despite some short-term growth normalization as supply chain issues ease and dealers’ inventory levels go down, its long-term growth prospects are good.

Over the past 20 years, Caterpillar has rewarded shareholders richly, turning a $10k investment into $167k. And despite a dividend cut in 2013, Caterpillar still managed an average dividend growth rate of 11.02% and returned more than three times the dividends that a similar investment in S&P500 would have given.

Final Thoughts

Final Thoughts

We like both John Deere and Caterpillar. Both are A-rated companies with solid balance sheets, with similar market cap and similar long-term debt to capital ratio.

We believe that they are both still attractively priced, despite the run up in their prices over the past month. If we have to choose, John Deere will be the better buy for three reasons.

Firstly, it offers a slightly better upside potential than Caterpillar. John Deere’s stock price has not run up as much in the last one month compared to Caterpillar. Secondly, it has more growth potential through its investment in its technology stack to develop a cloud platform that will help generate up to 10% of is total revenue by 2030. Thirdly, John Deere is fuelled by not just one but two tailwinds – the infrastructure bill as well as the never-ending, ever-growing demand for more food in the face of a growing global population.

— James Long

Source: FAST Graphs