I’ve been investing for about 13 years now.

It’s been a life-changing journey.

Indeed, it is a journey – a path of continuous learning and discovery.

To that point, I’ve learned a lot of lessons along the way.

One of the biggest lessons I’ve learned?

Focus on quality.

It should go without saying that investing in lower-quality businesses will result in lower-quality performance.

But one sometimes has to play with fire and get burned before they figure things out.

I now focus exclusively on high-quality businesses when I invest new capital.

The best way to limit oneself to high-quality businesses, in my view, is to employ the overarching framework of the dividend growth investing strategy.

This is a strategy whereby one buys and holds shares in world-class businesses that are paying reliable, rising dividends to their shareholders.

And how can businesses afford to pay reliable, rising dividends?

And how can businesses afford to pay reliable, rising dividends?

By producing reliable, rising profits.

Of course, only high-quality businesses can reliably produce rising profits.

You can see what I mean by taking a good look at the Dividend Champions, Contenders, and Challengers list.

This list contains invaluable information on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

You’ll notice dozens upon dozens of the world’s best businesses on the list – these are often household names.

I’ve been investing in these businesses for more than a decade now, which has helped me to build the FIRE Fund.

This is my real-money portfolio, and it produces enough five-figure passive dividend income for me to live off of.

I not only live off of dividends, but I’ve been doing so for years.

I not only live off of dividends, but I’ve been doing so for years.

In fact, I retired in my early 30s.

Want to know how I did that?

Check out my Early Retirement Blueprint for the details.

Now, quality is very, very important.

But so is valuation.

See, price only tells you what you pay, but it’s value that you end up getting.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

If you invest in high-quality businesses when they’re undervalued, and do so within the framework of dividend growth investing, you almost can’t help but to build up fabulous wealth and passive dividend income over time.

The good news here is, it’s not as difficult as you might think it is to ascertain a fair value estimate of a business.

My colleague Dave Van Knapp has made that process much easier, via introduction of Lesson 11: Valuation.

Part of a series of “lessons” that are designed to “teach” dividend growth investing, it lays out a valuation template that can be used to value just about any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Tractor Supply Co. (TSCO)

Tractor Supply Co. (TSCO)

Tractor Supply Co. (TSCO) is an American retail chain of stores that sells products catering to farmers, ranchers, and customers living a rural lifestyle.

Founded in 1938, Tractor Supply is now a $23 billion (by market cap) niche retail dominator that employs more than 36,000 people.

Tractor Supply owns and operates approximately 2,300 stores spread out across 49 states.

Stores contain roughly 17,000 to 23,000 products, along with 250,000 products online.

I’ve said this before, and I’ll say it again: Outside of the mass-market merchandisers, I believe that a retailer needs two important features in order to thrive in this environment.

I’m not saying these two features are all a retailer needs.

What I am saying is, they’re critical ingredients for success – and without them, a retailer will almost certainly fail over time.

One of those features is differentiation.

Differentiation allows a retailer to stand out from the pack and gain the attention of consumers.

Tractor Supply stands out in a big way by providing unique merchandise to customers living a specific lifestyle.

If you’re living on a farm, you can’t just go down to any ol’ store and get what you need.

Animal feed would be a great example of what I mean.

The other feature is a coherent, cohesive omnichannel strategy.

Almost every successful retailer I’ve studied has this.

While Tractor Supply is growing its e-commerce platform, this is one of the few retailers where this feature isn’t quite as crucial as it usually is.

Morningstar puts it like this: “A unique merchandise assortment partially insulates the firm from e-commerce competitors, offering products that have either immediate need or are expensive to ship.”

Let’s go back to the animal feed example.

Animal feed is not something that a farmer is likely to buy online.

It’s often needed now, and it’s very heavy and expensive to ship.

Morningstar adds more to this story: “Tractor Supply continues to see e-commence growth (up a mid-single-digit clip in 2022). We suspect e-commerce makes up a high-single-digit percentage of Tractor Supply’s sales, well ahead of the farm and ranch retail average of about 1%.”

Despite having a retail model that isn’t necessarily a good fit for e-commerce, Tractor Supply is excelling in this area and clearly well ahead of the competition.

Being ahead of the competition is nothing new for Tractor Supply, and that’s why it has a long runway for revenue, profit, and dividend growth over the coming years.

Dividend Growth, Growth Rate, Payout Ratio and Yield

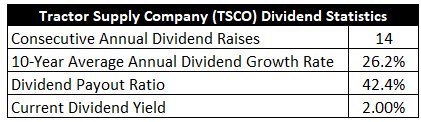

To date, the company has increased its dividend for 14 consecutive years.

And what a fast start Tractor Supply has gotten off to.

The monstrous 10-year dividend growth rate of 26.2% shows that.

Now, one often has to sacrifice yield in a big way when the dividend growth rate is this high.

However, that’s not the case here.

However, that’s not the case here.

The stock offers a very respectable yield of 2%, which easily beats what the broader market offers.

That yield, by the way, is 70 basis points higher than its own five-year average.

With a low payout ratio of 42.4%, even after all of that dividend growth, there’s still plenty of headroom here for the dividend to go higher.

This is a safe dividend that’s growing at an astounding rate.

Excellent dividend metrics here.

Revenue and Earnings Growth

As excellent as the numbers may be, though, many of them are looking backward.

However, investors must look forward and acknowledge that today’s money is being risked for the rewards of the future.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be instrumental later when estimating fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Amalgamating the proven past with a future forecast in this way should allow us to roughly approximate where the business might be going from here.

Tractor Supply advanced its revenue from $5.2 billion in FY 2013 to $14.2 billion in FY 2022.

That’s a compound annual growth rate of 11.8%.

Very strong top-line growth here.

Earnings per share grew from $2.32 to $9.71 over this 10-year period, which is a CAGR of 17.2%.

This is highly impressive.

That said, seeing as how the dividend has grown faster than EPS over the last decade, which expanded the payout ratio, I would expect the two growth rates to be in closer alignment over the next decade.

The main cause of excess bottom-line growth, from what I can see, has been margin expansion.

Opportunities for future margin expansion may be less accessible, though, so that could constrain EPS growth just a bit.

Looking forward, CFRA believes that Tractor Supply will compound its EPS at an annual rate of 15% over the next three years.

I like that number.

As I just noted, it’s quite possible that a lot of margin expansion potential has already been taken advantage of.

CFRA delves into this: “We anticipate stable operating margin in the near term as [Tractor Supply] opens two new distribution centers and demand normalizes for higher-margin items, while transportation costs decline and demand increases for lower-margin items.”

Furthermore, the pandemic resulted in a population shift away from urban areas and into suburban and rural settings.

While that’s great for Tractor Supply, this isn’t a recurring phenomenon.

On the other hand, I think Tractor Supply is still in the early chapters of a long growth story.

The small store count (relative to other major retailers) gives the company an easy pathway to higher revenue and bigger profits (which should translate to a larger dividend).

Indeed, CFRA notes that Tractor Supply “continues to execute its long-term strategic plan to aggressively expand its store footprint, remodel stores, and add side lots to hundreds of stores.”

I think CFRA sums up the investment thesis well when it gushes over Tractor Supply’s “specialized market niche, catering to untapped rural areas and consumers with above-average incomes and a below-average cost of living, which we believe differentiates [Tractor Supply] from other general merchandise retailers, pet retailers, value retailers, and home center retailers.”

I have zero issues with CFRA’s growth projection.

If we take that as our base case, it would allow for like dividend growth over the next few years.

And that could settle into a high-single-digit to low-double-digit rate of growth over the medium term.

Starting out with that 2% yield, this easily sets shareholders up for an annualized total return in the double digits.

I see nothing to dislike about that.

Financial Position

Moving over to the balance sheet, Tractor Supply has a stellar financial position.

The long-term debt/equity ratio is 0.6, while the interest coverage ratio is nearly nearly 40.

Profitability is extremely robust for a retailer.

Over the last five years, the firm has averaged annual net margin of 7.2% and annual return on equity of 44.8%.

Circling back around to margin expansion, which I touched on earlier, Tractor Supply was regularly printing net margin closer to the 6% level at the beginning of the last decade.

I also want to point out how exceptional the ROE is, considering that Tractor Supply doesn’t utilize a lot of leverage.

From everything I can see, this is a special retailer.

And with economies of scale, brand power, an entrenched foothold in a niche market, and a unique product assortment, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

Retail is infamous for its intense competition, although Tractor Supply’s differentiation model alleviates some of the competitive pressure.

Retailers do not benefit from switching costs, but Tractor Supply’s unique product mix in locations with limited or no alternatives is a boon to the business.

There is exposure to the idiosyncratic economics of farms and ranches.

A recession could temporarily affect the business, but the non-discretionary nature of some of its products (like feed) helps to protect Tractor Supply.

I see the balance sheet as an edge, but the company’s plans to aggressively grow the footprint and improve existing stores could start to weigh on the superior financial position.

Tractor Supply’s e-commerce channel is still nascent and behind many other retailers.

There are no real barriers to entry, which could invite future competition.

I believe we’re mostly looking at a pretty standard array of retail risks, but Tractor Supply strikes me as an extraordinary operation.

And with the stock down nearly 15% from its 52-week high, the attractive valuation makes the operation look that much more investable…

Stock Price Valuation

The stock is trading hands for a P/E ratio of 22.2.

That compares favorably to its own five-year average of 23.4.

Not a huge discount.

Nonetheless, it is a discount.

Since one could argue that Tractor Supply is currently in a better position than it’s ever been in, a discount, instead of a premium, is surprising.

Also, the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 8%.

That dividend growth rate is on the high end of what I allow for.

Now, it’s rare that a retailer gets the designation, as retailing is so tough and competitive.

However, Tractor Supply is also a lot smaller (both in market cap and store count) than a lot of other retailers I track.

Because of that, among other reasons, I think the company is still in the early innings of a long game of outsized growth.

There’s so much room for footprint buildout here, and the returns on capital are very high.

Overall, it’s a terrific business, and terrific businesses tend to get the benefit of the doubt from me.

The DDM analysis gives me a fair value of $222.48.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

The valuation was quite fair and sensible, yet the stock still looks modestly undervalued.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates TSCO as a 3-star stock, with a fair value estimate of $214.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates TSCO as a 4-star “BUY”, with a 12-month target price of $270.00.

Averaging the three numbers out gives us a final valuation of $235.49, which would indicate the stock is possibly 9% undervalued.

Bottom line: Tractor Supply Co. (TSCO) is one of America’s best retailers, and yet its small size would indicate its best days are still yet ahead. With a market-beating yield, a low payout ratio, a double-digit dividend growth rate, nearly 15 consecutive years of dividend increases, and the potential that shares are 9% undervalued, long-term dividend growth investors looking for a high-growth business should have their sights trained on this name.

Bottom line: Tractor Supply Co. (TSCO) is one of America’s best retailers, and yet its small size would indicate its best days are still yet ahead. With a market-beating yield, a low payout ratio, a double-digit dividend growth rate, nearly 15 consecutive years of dividend increases, and the potential that shares are 9% undervalued, long-term dividend growth investors looking for a high-growth business should have their sights trained on this name.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is TSCO’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 68. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, TSCO’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income