Li Auto (LI) is an electric vehicle (EV) maker that manufactures, engineers, and designs SUVs.

What sticks out about Li Auto?

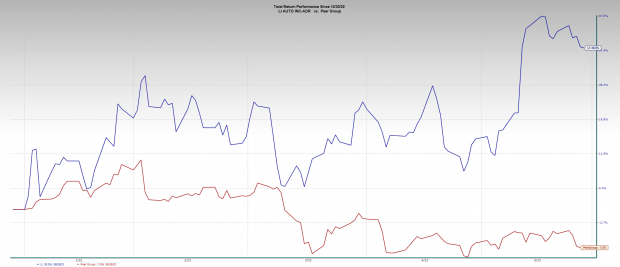

In my experience as an investor, relative price strength is among the best “tells” out there. Zacks Rank #1 (Strong Buy) stock Li Auto is exuding unusual relative price strength versus other stocks. The EV manufacturer has been outperforming the Chinese market and its peer group. Shares of LI are higher by 38% year-to-date, while the Zacks Automotive – Foreign peer group is lower by 7.5%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Meanwhile, the iShares China Large-Cap ETF (FXI) is lower by 5% year-to-date, and other EV makers, such as LI competitor Nio (NIO) , are lower by 21%. Most traditional auto manufacturers like General Motors (GM) are lagging versus LI and are flat year-to-date.

Fundamental Picture

Over the past two quarters, LI has produced robust top and bottom-line growth. Last quarter, EPS grew 163% while revenue grew 81%, year-over-year. Li Auto also has a history of topping consensus estimates. LI has produced positive earnings surprises in six of the past six quarters. (Last quarter, earnings surprised by a healthy 121%).

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

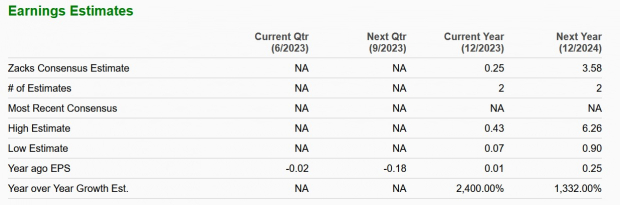

While it’s nice to have strong current earnings and a strong earnings’ track record, future earnings are where “the rubber meets the road.” Because of Li’s strong expected earnings estimates moving forward, the company earns the coveted Zacks Rank #1 (Strong Buy). Only 5% of stocks in the entire market earn this rating. For full-year 2023, Zacks Consensus Estimates predict that Li’s EPS will rocket by 2,400% year-over-year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Industry Group

As I mentioned earlier, LI is among the strongest stock in its industry group. However, that does not mean we should discount industry group strength. Studies have shown that roughly half of a stock’s price movement can be attributed to the underlying industry group. The Automotive – Foreign Industry is ranked 31 out of 250 groups tracked by Zacks (top 12%).

Technical View

Li is showing a lot of strength from a technical perspective. The stock is outperforming on a relative basis, forming a bull flag pattern, and just triggered a bullish “golden cross” earlier this month.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Strong fundamentals, relative performance, and price action suggest that Li Auto may be in the running to become the EV leader in China. Though China’s economy and stock market have been struggling recently, a recovery there is yet another potential catalyst for this potentially new leader.

— Andrew Rocco

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks