Company Overview

Healthy energy drink maker Celsius Holdings (CELH) is currently one of the most compelling growth stories on Wall Street. The company is separating itself from the pack with its delicious and healthy carbonated and non-carbonated energy drinks. Under the “Essential Energy” brand, the company offers sparkling and carbonated options in various flavors clinically proven to burn body fat and speed up the metabolism while exercising. Celsius also offers “Smartly Sweetened”, “Performance Energy”, and “Recovery Fuel”. Unlike many of its competitors, Celsius energy drinks use no aspartame, high fructose corn syrup, added sodium, or artificial flavors.

Record Earnings

Last Wednesday, CELH shares were energized by the company’s first-quarter earnings results. Revenue grew 94% year-over-year, while EPS shot higher by 344%. CELH bested Zacks Consensus Estimates by a wide margin of 81.82%. President and Chief Executive Officer John Fieldly said,

“During the first quarter of 2023, Celsius delivered an all-time quarterly record revenue of $260 million in sales and over $34 million in net income, driven by expanded availability and increased consumer awareness. In addition, we continue to further transition into PepsiCo’s (PEP) best-in-class distribution system.”

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

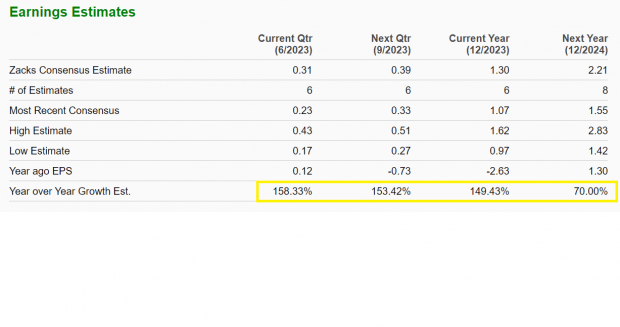

Caffeinated Earnings Forecasts

When determining a stock’s prospects, forward earnings estimates supersede current earnings. Celsius is a company that boasts both. For full-year 2023, Zacks Consensus Estimates forecast 149.43% EPS growth, year-over-year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Beyond the strong forecast, analysts raised estimates following the recent earnings report – another bullish sign.

Price & Volume

After the hefty price move earlier in the week, it’s understandable that investors wonder whether buying Celsius at these levels is chasing. However, CELH is showing all the classic signs of a breakaway gap. A breakaway gap occurs at the beginning of a move when a stock gaps above prior resistance.

Breakaway gaps typically have 3 characteristics inherent in them, including:

· Massive volume: Heavier than average volume turnover signifies strong demand on the price gap. Last Wednesday, CELH’s volume swelled to levels 575% above the norm.

· Large price move: Small gaps typically get filled, while large gaps tend to spark new trends. CELH closed higher by nearly 20% and finished near the top of the daily price range.

· Break above resistance: CELH broke out of a five-month base structure. Bulls will not need to fight overhead supply now that the stock is back to fresh highs.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Conclusion

Celsius has all the ingredients of a winning stock, including a unique product offering, strong current and future earnings growth, and signs of heavy buying demand from a price and volume perspective.

— Andrew Rocco

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks