Novo Nordisk A/S (NVO) , a Zacks Rank #1 (Strong Buy), has benefitted from a recent resurgence in the health care sector. During bear markets, the best stocks bottom out well before the major indices, and that’s exactly what we saw with this pharmaceutical company last year. In fact, NVO bottomed in January of 2022 and finished the year with a 22.7% gain. The momentum is carrying forward into 2023 as NVO stock is hitting all-time highs.

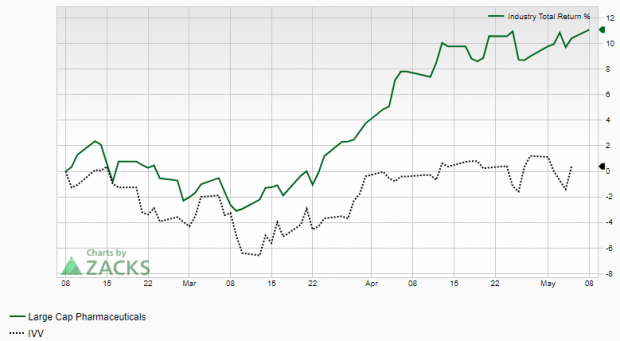

NVO is ranked favorably by our Zacks Style Scores with a best-in-class ‘A’ rating in our Zacks Growth category and a ‘B’ in our Momentum category. This indicates further upside is likely based on promising sales and earnings growth metrics. The company is part of the Zacks Large Cap Pharmaceuticals industry group, which currently ranks in the top 26% out of approximately 250 Zacks Ranked Industries. Because this group is in the top half of all industries, we expect it to outperform the market over the next 3 to 6 months, just as it has over the past several months:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Also note the favorable valuation characteristics for this industry group below:

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

Novo Nordisk is a global healthcare company that engages in the research, development, manufacturing, and marketing of pharmaceutical products. The company’s Diabetes and Obesity care segment provides insulin, antidiabetic, obesity, and other chronic disease products. NVO’s Biopharmaceuticals segment offers products in the areas of hemophilia, growth disorders, and hormone replacement therapy.

During the first quarter this year, the drugmaker saw sales of its obesity medications Wegovy and Ozempic rise over three-fold and 59%, respectively. These treatments have gained in popularity as they lead to greater weight loss than many other alternatives.

NVO maintains a strong presence in the Diabetes care market with a broad portfolio, improving its global market share to nearly 32% in the last 12 months. Drug sales have been gaining momentum, and label expansion of existing drugs is likely to boost sales further in the coming quarters. In addition, NVO has witnessed encouraging pipeline progress through its developmental drug phase process.

Earnings Trends and Future Estimates

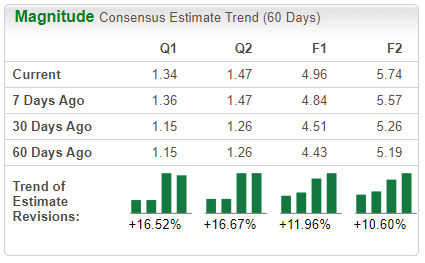

Novo Nordisk has surpassed earnings estimates in three of the past four quarters. For the current quarter, the company is expected to deliver earnings growth of 59.5% to $1.34/share on 40% higher revenues ($8.28 billion).

Analysts covering NVO are in agreement and have raised their future earnings estimates across the board. Looking at 2023 as a whole, analysts have raised their EPS estimates by 11.96% in the past 60 days. The Zacks Consensus Estimate now stands at $4.96/share, reflecting potential growth of 43.4% relative to last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s Get Technical

NVO shares have advanced more than 80% off the bottom from last year. Only stocks that are in extremely powerful uptrends are able to make this type of price move while the general market remains volatile. This is the kind of stock we want to include in our portfolio – one that is outperforming and receiving positive earnings estimate revisions.

Image Source: StockCharts

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping upward. The stock has been making a series of higher highs on increasing volume. With both strong fundamentals and technicals, NVO is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Novo Nordisk has recently witnessed positive revisions. As long as this trend remains intact (and NVO continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

NVO boasts a second-best ‘B’ rating for our overall VGM Zacks Style Score. The Zacks Rank #1 (Strong Buy) stock has vastly outperformed the market over the past year. A resurgence in health care stocks adds to the bullish sentiment.

Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Backed by a leading industry group and healthy history of earnings beats, it’s not difficult to see why this company is a compelling investment. Investors would be wise to consider NVO as a portfolio candidate if they haven’t already done so.

— Bryan Hayes

Want the latest recommendations from Zacks Investment Research? [sponsor]Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks