Altria Group (MO) is one of the world’s largest tobacco companies. This is a “sin” stock. Works for some. Not for others. And that’s okay. Me? I’m a fan of personal freedoms.

If an adult chooses to buy and consume a legal product, more power to them. And I’m happy to profit from that. Well, profit Altria does. And they return most of that profit back to their shareholders in the form of a massive dividend.

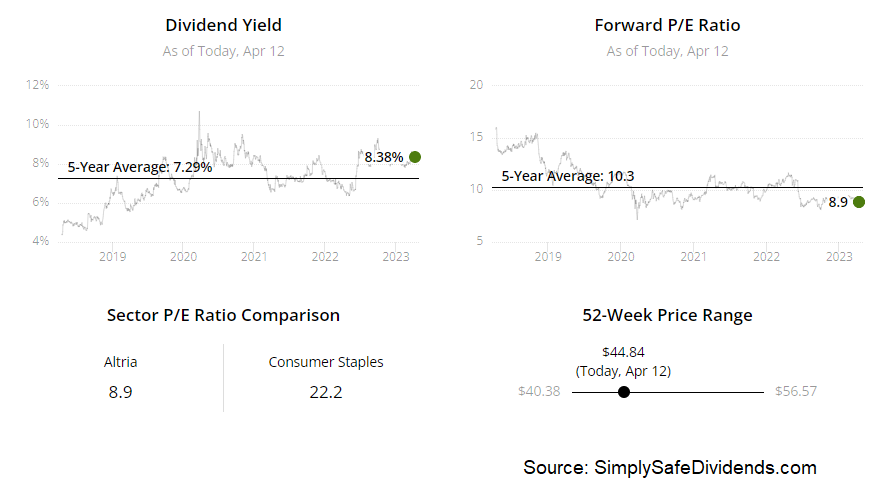

Altria’s stock is yielding 8.5%. The stock can move sideways and still earn an 8.5% annual return. As long as it doesn’t decline much, you’ve got a pretty nice floor on your return, based on just the dividend alone.

You’re not going to get much growth here, though. This is a mature business selling a product in secular decline. It’s a bit of a melting ice cube in some ways, but the ice cube is huge and appears to have many more years of melting in front of it before it’s in danger of disappearing. That’s been true for decades already, as evidenced by Altria’s 53 consecutive years of dividend increases, making it a rare Dividend King.

The 10-year DGR is 8.1%, although more recent dividend raises have been in the 4% range. The 74.5% payout ratio, based on FY 2023 guidance for adjusted EPS at the midpoint, is high and constrains the dividend growth, but Altria has been navigating a high payout ratio for many years.

This stock looks modestly undervalued to me. Based on that aforementioned adjusted EPS guidance, the forward P/E ratio is 8.8. So we’ve got a P/E ratio that’s pretty close to where the yield is – both with an 8-handle. That’s remarkable. Not something you see very often.

This stock looks modestly undervalued to me. Based on that aforementioned adjusted EPS guidance, the forward P/E ratio is 8.8. So we’ve got a P/E ratio that’s pretty close to where the yield is – both with an 8-handle. That’s remarkable. Not something you see very often.

That said, Altria has been cheap for years. The market has been sniffing out the challenges and secular decline in its core product, and that’s led to compressing multiples. Again, though, I’ll note that the yield gets you to a pretty good return all by itself.

The business just has to avoid collapse. We last analyzed and valued Altria in August, estimating fair value for the business at nearly $48/share. The stock’s price is currently below $45. Decent upside. But it’s really that yield that stands out. If you’re okay with the nature of the products and their secular decline, as well as the debt load, it’s a compelling income play.

— Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.