With yields north of 7%, closed-end funds (CEFs) should be a staple of every American’s portfolio. Especially when you consider that the vast majority of these funds pay dividends every single month.

But the truth is, CEFs remain a niche product—only folks have taken the time to try them out realize what incredible income generators they are. (This is why I started my CEF Insider service: to bust the myths around CEFs and give members a selection of diversified funds they can use to build a retirement-changing income stream.)

Why are CEFs still off most people’s radar? Mainly due to the financial press and financial advisors, both of which have preached for decades that any yield of 7%, 9%, 10% or higher is unsustainable. But that’s flat-out wrong. Fact is, plenty of billionaires use CEFs to get huge income streams they can rely on for years.

With that in mind, we’re going to go debunk three big myths about CEFs. When we’re through, I think you’ll see that these funds aren’t just “nice to have” income payers but critical holds that could let you retire earlier than you thought—maybe even on dividends alone.

Myth #1: CEFs—and All High-Yield Funds—Lose Money

One reason why people think CEFs—and indeed all high-yield funds—lose money is because when they think of high yields, they often think of volatile sectors like energy. And when folks uncover one or two “bad apples” in sectors like these, they tend to “spoil the bunch.”

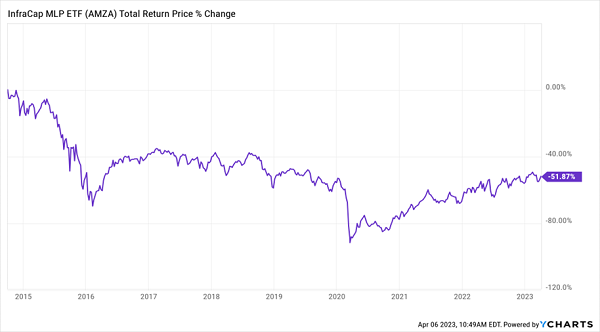

Consider the Infracap MLP ETF (AMZA), which, as the name says, tracks an index of master limited partnerships (MLPs). The fund pays an 8.9% dividend but has plunged 52%, even with dividends included.

Funds Like AMZA Are Why Investors Believe High Yielders Are Losers

But when we leave ETFs behind and look at CEFs from across the economy (not just in energy), the picture gets brighter: the vast majority of CEFs earned money over the last decade. In fact, over a hundred of funds tracked by CEF Insider earned a 7% or greater annualized return in that span—a sharp contrast to AMZA.

But when we leave ETFs behind and look at CEFs from across the economy (not just in energy), the picture gets brighter: the vast majority of CEFs earned money over the last decade. In fact, over a hundred of funds tracked by CEF Insider earned a 7% or greater annualized return in that span—a sharp contrast to AMZA.

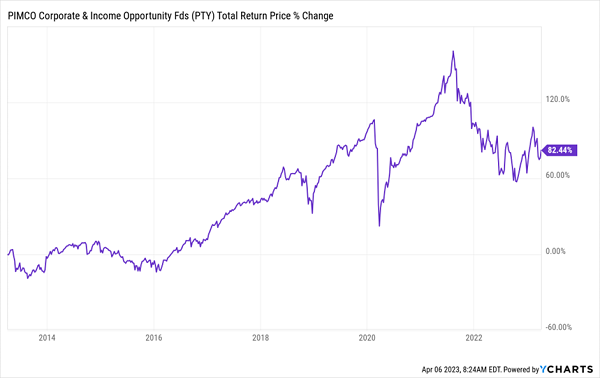

To take an example, let’s flip over to corporate bonds and consider the 11.2%-yielding PIMCO Corporate & Income Opportunity Fund (PTY), which returned 82% in the last 10 years:

Bond CEF Generates a Strong Return Through All Market Weather

PTY has over 400 peers among CEFs alone that have returned significant profits over the last decade or since their IPO (whichever is longer). This fact alone sends this myth to the dustbin.

PTY has over 400 peers among CEFs alone that have returned significant profits over the last decade or since their IPO (whichever is longer). This fact alone sends this myth to the dustbin.

Myth #2: CEFs Cut Payouts

If you can convince someone CEFs don’t lose money, the next argument you may hear will be that CEFs cut their dividends. And this does happen from time to time. But there’s more to the story.

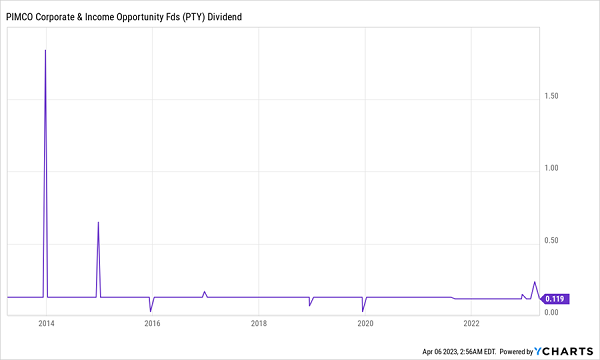

In many cases, for example, CEFs make small cuts so they have more funds available to invest (if their management teams spot bargains, say). In those cases, we’re often rewarded with bigger capital gains. Or sometimes management will “churn” its portfolio, selling profitable positions and handing them to us as big special dividends. For long-term holders, these one-off payouts offset the slightly lower income from the cut. Take PTY as an example:

PTY’s Huge Payouts

As you can see above, the huge extra payout in 2013 has made up for the 1.2-cent cut in 2021, and will cover those cuts for the next decade!

As you can see above, the huge extra payout in 2013 has made up for the 1.2-cent cut in 2021, and will cover those cuts for the next decade!

“Okay,” you may be thinking, “but surely getting a high yield means we have to sacrifice any chance at dividend growth, right?”

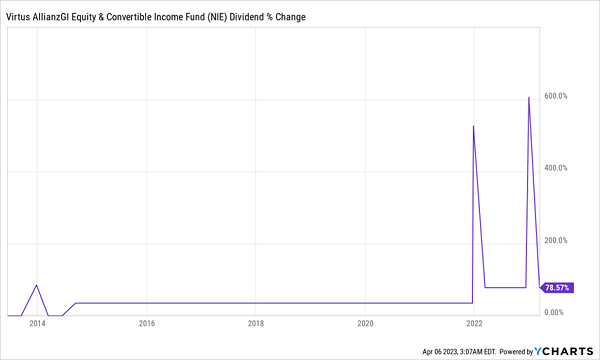

Nope! Fact is, CEFs do hike their regular payouts—and those hikes, as you can imagine, can grow wealth in a major way. Check out the Virtus AllianzGI Equity & Convertible Income Fund (NIE), which yields 10.3% and kept payouts stable for many years before dropping huge payout hikes and special dividends on its investors:

NIE: A Double-Digit Payout That Grows

The bottom line? Sure, dividend cuts do happen, but it also goes the other way, and strong CEFs hike their payouts, even though their current yields are often 7% and higher. Let’s say this myth is mostly busted.

The bottom line? Sure, dividend cuts do happen, but it also goes the other way, and strong CEFs hike their payouts, even though their current yields are often 7% and higher. Let’s say this myth is mostly busted.

Myth #3: CEFs and Other High-Yield Funds Underperform

Finally, you’ll hear people say that CEFs, and indeed all high-yield funds, underperform. And I’ll admit, this is often true. But not always—and if you’re good at finding the best funds, you can outperform the market by a lot.

In fact, if you go outside of equity funds, the opposite is true, and many CEFs outperform their benchmarks. That’s because these markets (here I’m talking about corporate bonds, municipal bonds, preferred stocks and so on) are smaller than the stock market, and personal connections matter, allowing CEF managers to get first crack at the best new issues. That’s a big advantage an actively managed CEF has over a “robotic” ETF.

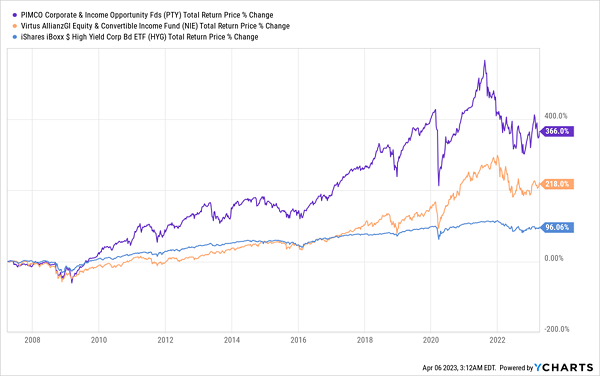

To see this in action, let’s stick with PTY, which trades corporate bonds and bond derivatives. A popular proxy for bonds in general is the iShares iBoxx $ High Yield Corporate Bond ETF (HYG). As you can see below, PTY (in purple) has drastically outperformed HYG since the latter’s inception in 2007. As did NIE (in orange), despite its conservative focus on low-volatility convertible bonds.

2 High-Yield CEFs Cruise Past the Benchmark

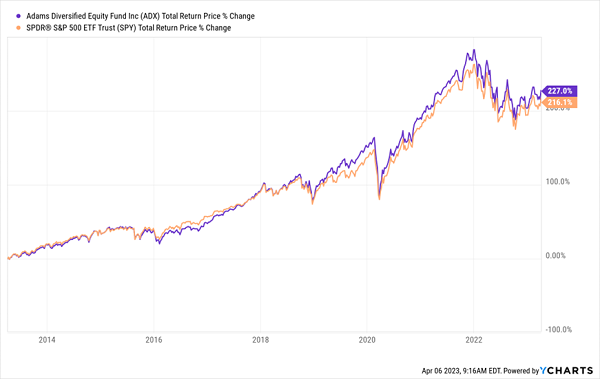

To be sure, there are a lot of indexes out there, like the well-known S&P 500 and Dow Jones Industrial Average. And, yes, even though it’s more difficult, there are high-yielding equity CEFs that trade in common stocks and outperform those indexes, too.

To be sure, there are a lot of indexes out there, like the well-known S&P 500 and Dow Jones Industrial Average. And, yes, even though it’s more difficult, there are high-yielding equity CEFs that trade in common stocks and outperform those indexes, too.

The Adams Diversified Equity Fund (ADX), for example, has outrun the S&P 500 for years—including over the last decade—while returning most of its profits in the form of a big year-end special dividend.

ADX: A High-Paying Equity CEF That Outperforms

The bottom line here is that this myth is easy to bust, but there are plenty of funds don’t beat their index. So while the myth that all funds underperform is wrong, we need to consider other factors, like performance history and the fund’s current discount to net asset value (NAV, or the value of its underlying portfolio) to give ourselves the best chance of outperforming in the future.

The bottom line here is that this myth is easy to bust, but there are plenty of funds don’t beat their index. So while the myth that all funds underperform is wrong, we need to consider other factors, like performance history and the fund’s current discount to net asset value (NAV, or the value of its underlying portfolio) to give ourselves the best chance of outperforming in the future.

Yours in profits and safety,

Michael Foster

This Instantly Gets You an “All-Weather” 9.5% Dividend (Paid Monthly!) [sponsor]

As I mentioned above, a mess like the one we’re seeing at SIVB demonstrates the power of safe—and monthly!—CEF dividends.

That, plus a high 9.5% current yield, is exactly what you get in the 4-CEF “mini-portfolio” I’ve constructed. With just shy of 10% of your investment boomeranging back to you in the form of a monthly dividend every year, you can relax and collect your checks—and tune out the market noise!

I’d love to show you these 4 funds right here, right now. But they’re all recommendations of my CEF Insider service, and that wouldn’t be fair to my paying members. So I’m going to do the next best thing:

Simply click here and I’ll take you to a page that gives you a guided tour of this portfolio and reveals my full CEF-investing strategy. Then I’ll show you how to download your own copy of an exclusive Special Report revealing these 4 CEFs’ names, tickers, best-buy prices and all of my research.

Don’t miss your chance to buy these four 9.5%-paying CEFs while the SIVB crisis has made them ridiculously cheap.

Source: Contrarian Outlook