Realty Income (O) – Monthly Dividend

Realty Income A.K.A. the Monthly Dividend Company has rarely been attractively valued since the spring of 2010. However, rising interest rates have brought the price down to fair value. Consequently, this monthly dividend payer can be purchased with a 5.15% dividend yield and the 6.83% funds from operations or cash flow yield.

The real attraction here for Realty Income is the consistent, above average, dividend that has grown since the company was listed on the New York Stock Exchange in 1994. Although rising interest rates provide a challenge, I believe Realty Income (O) is up to the task.

The real attraction here for Realty Income is the consistent, above average, dividend that has grown since the company was listed on the New York Stock Exchange in 1994. Although rising interest rates provide a challenge, I believe Realty Income (O) is up to the task.

Growth may slow a bit, but the fair valuation opportunity is too good and rare for income investors to pass up. If we do enter a recession, the price could drop lower temporarily. However, in the long run I believe Realty Income offers peace of mind, a steady level of income and modest capital appreciation.

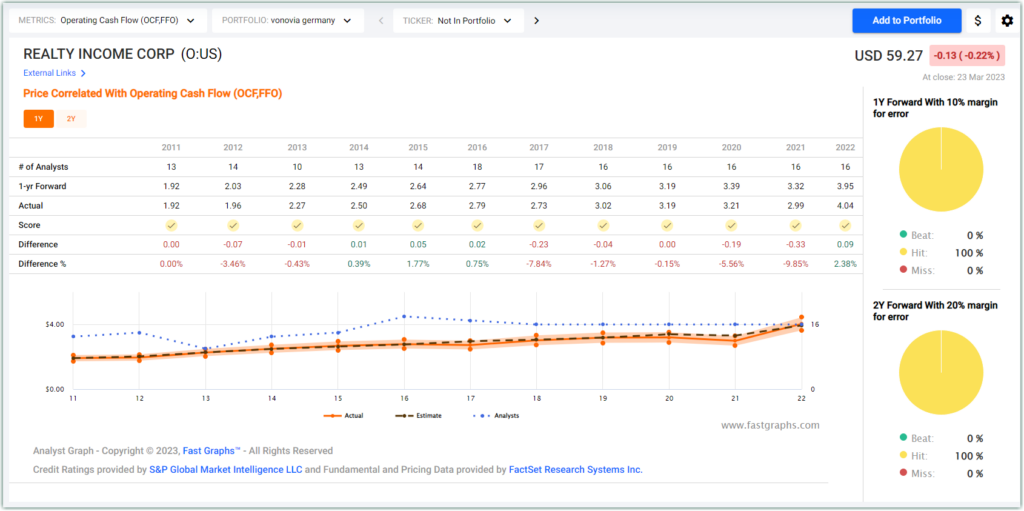

FAST Graphs Analyze Out Loud Video

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: FAST Graphs