We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Credit Suisse Group AG (NYSE: CS)

Today’s penny stock pick is the financial services company, Credit Suisse Group AG (NYSE: CS).

Credit Suisse Group AG offers wealth management solutions, including investment advice and discretionary asset management services; risk management solutions, such as managed investment products; and wealth and succession planning.

It also provides financing and lending solutions, including consumer credit and real estate mortgage lending, real asset lending relating to ship, and aviation financing for UHNWI; standard and structured hedging, and lombard lending solutions, as well as collateral trading services; and investment banking solutions, such as global securities sales, trading and execution, capital raising, and advisory services. In addition, the company offers banking solutions, such as payments, accounts, debit and credit cards, product bundles, and mortgages; asset management products; equity and debt capital markets, and advisory services; cash equities, equity derivatives, and convertibles, as well as prime services and fixed income products, such as credit, securitized, macro, emerging markets, financing, structured credit, and other products.

Further, it provides HOLT, a framework for assessing the performance of approximately 20,000 companies; and equity and fixed income research services. The company serves private and institutional clients; ultra-high-net-worth individuals, high-net-worth individuals, and affluent and retail clients; corporate clients, small and medium-sized enterprises, external asset managers, financial institutions, and commodity traders; and pension funds, hedge funds, governments, foundations and endowments, corporations, entrepreneurs, private individuals, and financial sponsors.

Website: https://www.credit-suisse.com

Latest 10-k report: https://www.credit-suisse.com/media/assets/corporate/docs/about-us/investor-relations/financial-disclosures/sec-filings/form-20f-2022.pdf

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for CS in the last 3 months, the stock has an average price target of $4.22, which is nearly 95% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company secured a $54 billion lifeline from the Swiss National Bank to shore up liquidity and investor confidence.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Trend Channel: The daily chart shows that the stock has been trading within a downtrend channel, which is shown as purple color lines. The stock is currently moving higher with a historic high volume after taking support at the bottom rail of the trend channel. This is a possible bullish indication.

#2 Oversold RSI: The RSI is currently near oversold levels, indicating that a reversal may be imminent.

#3 Bullish Stoch: The %K line of the stochastic is above the %D line, and is also moving higher from oversold levels, indicating possible bullishness.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a potential support area, which is marked as a pink color dotted line. This is a possible bullish indication.

#5 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for CS is above the price of $2.50.

Target Prices: Our first target is $3.60. If it closes above that level, the second target price is $4.50.

Stop Loss: To limit risk, place a stop loss at $1.90. Note that the stop loss is on a closing basis.

Our target potential upside is 44% to 80%.

For a risk of $0.60, our first target reward is $1.10, and the second target reward is $2.00. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

- The company has a history of net losses. The net loss for 2022 was CHF 7.3 billion, and CHF 1.7 billion in 2021.

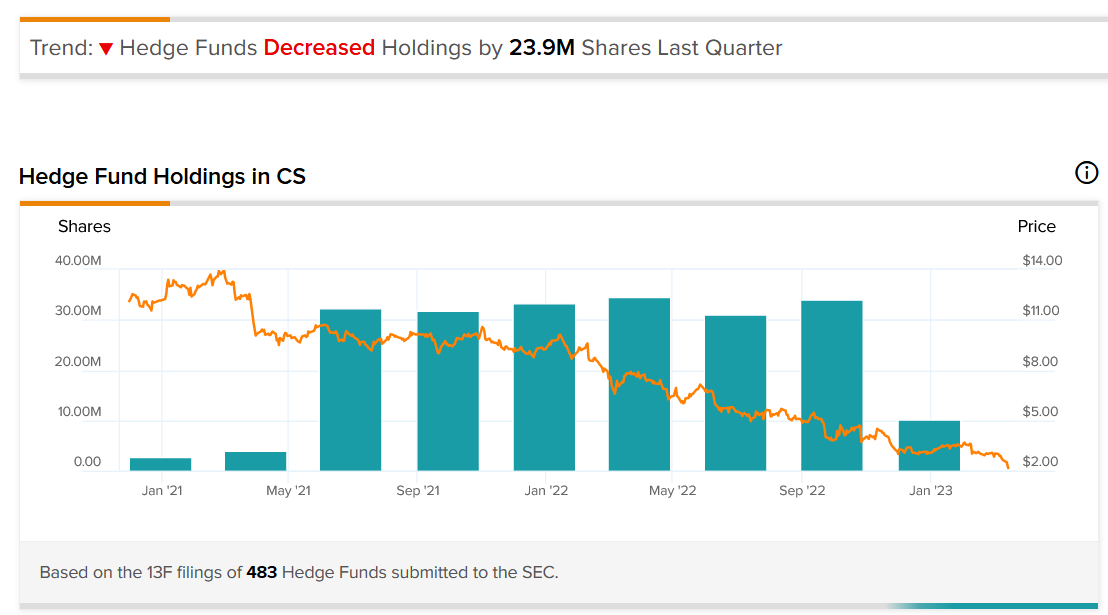

- Hedge Funds Decreased Holdings by 23.9M Shares Last Quarter.

- CS’s largest backer, Saudi National Bank recently announced that it could not offer any more financial assistance for regulatory reasons.

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company is involved in a number of judicial, regulatory, and arbitration proceedings concerning matters arising in connection with the conduct of its businesses. This includes NJAG litigation, DOJ RMBS settlement, Repurchase litigations, Bank loan litigation, and also individual investor actions.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day