Summary Medical Properties Trust

- Medical Properties Trust’s dividend at the 2022 rate of $1.16 is safe even if Prospect, its third-largest operator, does not pay a single cent in 2023.

- The overexposure to Steward is being addressed with definitive actions, lowering it from 30% to 24% of its total annual revenue.

- Medical Properties Trust’s balance sheet will be shored up by the end of 1H 2023, bringing its cash and cash equivalent to among the highest level in its entire history in existence.

- Medical Properties Trust is so undervalued right now that the downside is limited, while the upside is far greater.

Medical Properties Trust’s ideal role in Income portfolios is to provide a stable stream of income. The primary concern should be the safety of this income stream, and less so about price appreciation. In fact, if the income is safe, a lower share price means investors can buy more shares to increase their dividend income.

Besides studying MPW from the point of view of an Income Investor, we are examining Medical Properties Trust through the eyes of a Value Investor to determine if it is truly a bargain or is it a value trap. Lastly, we hope to determine if investing in MPW is a case of “Heads, I win. Tails, I do not lose much“, an investment philosophy advocated by Monish Pabrai known as Dhandho, which is an approach to business that seeks to minimize risk while maximizing reward.

Concerns Past, Present, and Future

The Past: First, it was Steward causing a threat of credit rating downgrade for MPW

MPW’s exposure to the financially pressured tenant Steward was a concern for the rating agency S&P Global Ratings, which on 22 December 2022 placed MPW on CreditWatch with negative implications. Should Steward, MPW’s largest operator, fail, it could result in MPW having to cut its dividends to service higher interest repayments.

We are glad to see improvements on this front.

Firstly, Steward Health Care System completed the extension of its ABL agreement with its lenders, through December 2023, alleviating the main concern of the rating agency. Having this credit line means Steward can tap into this credit facility (and not have to ask MPW for a loan or for rent deferral) if it ever needs help to meet its rent obligations.

Secondly, the Yale New Haven Health System acquisition of Prospect’s Connecticut facility for approximately $457 million is expected to close by the middle of 2023. LifePoint Health’s subsidiary acquisition of majority stakes in Springstone Health Opco and closing the transaction in the first half of 2023 means Medical Properties Trust expects to receive $200 million in full satisfaction of the loan, also by the middle of 2023, and retain its minority equity interest and will continue to own and lease Springstone’s behavioral hospitals.

Together with the $235 million in cash and cash equivalents as of 31 December 2022, notwithstanding the funds from operations from Q1 and Q2 of 2023, MPW will have at least $892 million by the middle of 2023, which translate to the highest amount in cash and cash equivalent it has ever had in its entire history with the exception of 2019.

Thirdly, after the acquisition of the entire $1.2 billion Utah hospital portfolio currently operated by Steward Health Care System to CommonSpirit Health, Steward’s concentration in MPW’s portfolio will fall by 6% to 24%, directly addressing the credit agency’s concern about MPW’s overexposure to Steward/

All these give us reasons to be confident that MPW will not get a credit rating downgrade and its interest expense will not increase.

The Present: Then came Prospect not paying rent

Honesty is always appreciated in a company’s management. Therefore ,when the management at Medical Properties Trust (MPW) considers a worst-case scenario of Prospect not paying rent at all, that gains our respect. Nevertheless, Prospect not paying rent is still a concern, but not concerning enough to justify the price drop.

First it was Steward, now it is Prospect, MPW’s third largest revenue source accounting for 11.5% of the company’s revenue last quarter. It is as if the drama at MPW never ends.

Most Income Investors are likely to seek safe and growing (or at least stable) dividend-paying companies to provide them with a steady stream of income to use. Therefore, hearing the CFO speak about Prospect not paying the full rent for January and February 2023 was concerning. Consequently, we can understand why many Income Investors will want to call it quits with MPW, sell their holding, and forget about it. On the other hand, we do not believe in selling our stocks or anything else for that matter, for prices lower than their true worth valuation.

MPW is in our Income portfolios and our primary concern is dividend safety. Will Prospect’s problems result in MPW cutting the dividend is the most important question?

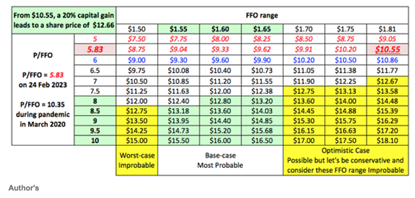

In the Q4 2022 earnings conference call, CFO Steven Hamner presented a normalized FFO range of approximately $1.50 to $1.65, with the FFO of $1.50 representing a hypothetical, worst-case scenario of Prospect (more on that later) paying $0 rent in 2023. And after making the necessary adjustments in this hypothetical worst-case scenario, an AFFO of $1.29 is derived. Multiplying that by the share count of 597 476 shares as of 31 December 2022 gets projected full-year adjusted funds from operations in 2023 of $770 million, which is more than sufficient to cover the $1.16 x 597.4 million = $693 million in dividend payment in 2023 assuming that the dividend remains flat at $1.16 same as 2022. However, the question would be whether management considers that enough coverage to continue their dividend, raise it, or worst-case reduce it. We do not believe a complete dividend cut would be in the cards.

To summarize this segment, even if Prospect does not pay MPW a single cent in 2023, the expected adjusted funds from MPW’s operations ($770 million) from 2023 can fully cover more than a year’s worth of dividends ($693 million per year) at a rate of $1.16 per share, leaving $892 million (by the middle of 2023) for normal business operations.

Based on the best available information and comments from the management, we would expect the dividend from MPW to be safe for at least 2023. The different scenarios are summarized in the table below.

The Future: Will Circle Health become a concern?

The Future: Will Circle Health become a concern?

During the latest earnings call, John Pawlowski from Green Street Advisors asked a direct question,

Did you provide any operators at all financial support in the fourth quarter through the rent deferrals, loans, equity stakes? Or do you expect to have to in the coming quarters outside of Prospect?

And MPW’s CEO answered there were none other than Prospect.

Of course, unforeseen circumstances can happen, and the nature of such events is “unforeseeable” in nature. It will be prudent to examine the other large revenue contributor, Circle Health, for potential red flags.

Circle Health is MPW’s second-largest revenue contributor, bringing in 11.9% of Q4 2022’s revenue, and a total of $204 million of revenues for the full financial year 2022. If something unexpected were to crop up at Circle Health, it could become another Steward or Prospect.

Circle Health is MPW’s second-largest revenue contributor, bringing in 11.9% of Q4 2022’s revenue, and a total of $204 million of revenues for the full financial year 2022. If something unexpected were to crop up at Circle Health, it could become another Steward or Prospect.

Circle Health is a hospital operator in the United Kingdom. It has UK’s largest national network of private hospitals. It also offers innovative neurological and musculoskeletal rehabilitation services and pathway management services, and runs clinics in China. According to publicly available information from its website, its business generates revenue of 1 billion British pounds. 90% of adults are within 90 minutes from its 50+ hospitals.

Based on CEO’s commentary about Circle Health over the past few quarters, Circle Health is doing well. Here are some snippets from Q3 2021 to Q2 2022.

Q2 2022 Earnings Call

Circle continues to reflect steady operations and coverages. Self-pay admissions continue to trend upwards, which is a good thing in the U.K. as growing NHS backlogs are driving substantial wait times in the public sector and overall volumes are approximating pre-pandemic levels. Circle also continues to report that they are not experiencing any significant issues with staffing

Q1 2022 Earnings Call

Next, Circle in the UK, which continues to be a superb operator producing coverages that continue to exceed MPT’s original projections. Post COVID, the self-pay inpatient volumes are trending between 40% to 75% above, where they were in 2019. Self-pay in the United Kingdom is a very profitable aspect of their business.

Circle is seeing some labor shortages primarily with nurse staffing as a result of the spike in Omicron that called an unusually high number of nurses to be out sick or in quarantine.

Q4 2021 Earnings Call

Circle, which represents 11% of our portfolio, continued to show strong coverages. Their coverage for the third quarter in 2021 reflects stabilization at a high coverage level, driven by a robust increase in self-pay volumes, which provide for increased reimbursement.

Q3 2021 Earnings Call

Circle, which represents 11% of our portfolio, continues to show strong coverages. Their coverages for the Second Quarter in 2021 was substantially more than it was in the Fourth Quarter of 2020, which was also a strong quarter.

Circle continues to have a strong liquidity position. As a reminder, the American Insurance Company Centene (CNC), which already owned interest in Circle is now 100% owner of Circle. (See the FAST Graph below)

Income Investors Invest for Dividends, Not For Share Price Appreciation, but…

Income Investors Invest for Dividends, Not For Share Price Appreciation, but…

… nobody minds share price appreciation, especially in MPW’s case because that will be a clear signal to all that the short attacks have been repelled and Income Investors can return to putting MPW in the sleep-well-at-night (SWAN) bucket.

The bulk of the article, and most of the articles written on MPW thus far, has focused on its fundamentals because that is what matters in the long term.

However, sentiments, news, and short sellers (17.46% at the time of writing) all contribute to moving share prices up or down in the short term. Therefore it pays to consider the possible catalysts in 2023 that can move the share price positively.

4 Possible Catalysts for MPW in 2023

1) With the improvement in Steward’s financial stability and MPW’s balance sheet, and with the anticipated further improvements to be announced in the Q4 2022 earnings call on 23 February 2023, it is very possible that MPW will be removed from S&P Global Ratings CreditWatch placement.

2) Successful monetization of Prospect’s assets. It was not that the assets were undesirable. There was a potential financial partner who was in months of deep discussions up to as recently as January 2023, if successfully concluded, would have begun the monetization process of Prospect’s managed care business that would have provided immediate liquidity for operations. That fell through. Yet, with Prospect’s managed care business valued at around $1 billion, and the CEO saying that MPW is “entitled to enough of it to get all of our money back” in the event of a successful sale of Prospect’s managed care business, even the announcement of such a deal will certainly boost investors’ confidence.

Note that in the high-end of the guidance of $1.65 in FFO in the base case scenario where management considers Prospect paying its rent and interest obligations from California and Connecticut but not from the Pennsylvania investment, the company did not factor in any successful monetization of Prospect’s managed care business. Therefore, if that does happen, even if the consummation of such a deal were to happen only in FY 2024, it will still be a positive shot in the arm.

3) we will not be holding our breath, but if Prospect can start paying its rent and interest obligations from the second quarter of this fiscal year (it did not fully pay its rent in January and February 2023), that will be a sign that Prospect’s management efforts to return the business to profitability through cost-cutting measures are working. This will also lift the guidance up from the low end of the FFO of $1.50 that the company guided.

If Prospect remains troubled, well, the worst-case scenario has already been baked into the $1.50 FFO guidance.

4) MPW plans to buy back $500 million worth of shares at a time when the share price is 50% off its high. Let’s say it wants to conserve more cash and spends just $300 million of that allocated sum. At the price of $10.55 on 24 February 2023, the company can buy back and take 28.4 million shares off the market. This will reduce the share count from 597.4 million to 569 million shares, which will correspondingly reduce the dividend payout from $693 million ($1.16 x 597.4 million) to $660 million ($1.16 x 569 million), a $33 million savings. This would be another indication that the dividend might be currently safe.

And if MPW spends all the $500 million on share buyback at the price of $10.55, it will reduce the share count by 47.3 million shares, bringing down the total number of shares outstanding to 550.1 million, which will reduce the dividend payout to $638.1 million, a $54 million in savings, which also exceeds the revenue Prospect contributed in any single quarter.

Valuation

MPW is unquestionably cheap.

It was trading at a P/FFO of 10.35 in the depths of the pandemic, in March 2020, when the whole world plunged into full lockdown and hospitals were mandated by governments to pause elective surgeries indefinitely just to focus on caring for Covid-patients.

When we calculate the P/FFO using both extremes of the FFO guidance for 2023, the resulting P/FFO numbers indicate that at the closing price of $10.55 on 24 February 2023, MPW was selling at a valuation 30%-35% below the valuation it sold at during the worst of the pandemic. And that has been the case for the past 6 months.

When we calculate the P/FFO using both extremes of the FFO guidance for 2023, the resulting P/FFO numbers indicate that at the closing price of $10.55 on 24 February 2023, MPW was selling at a valuation 30%-35% below the valuation it sold at during the worst of the pandemic. And that has been the case for the past 6 months.

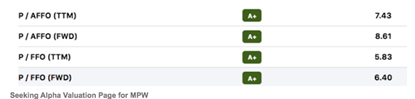

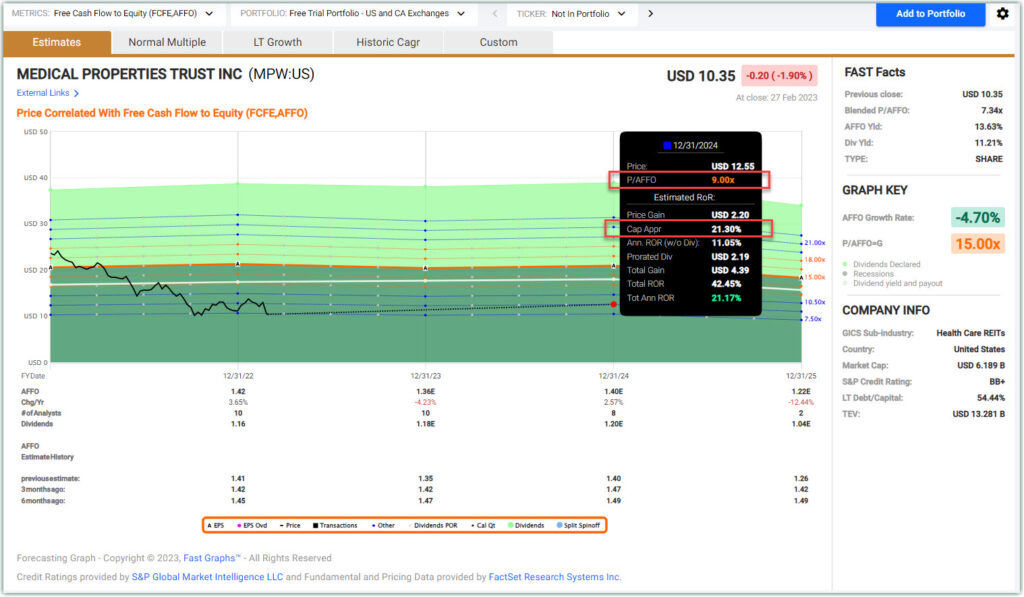

Forward P/AFFO is expected to be 8.61, and forward P/FFO is expected to be 6.4. MPW’s normal P/AFFO for the past 5 years is 12.33, so at a P/AFFO (TTM) of 7.43, MPW is currently trading at a 39.7% discount from its own historical normal. Once again, a strong indication of significant and justifiably low valuation.

MPW just needs to trade around that at a P/AFFO of 9.00 to provide an 21.30% capital appreciation in less than two years.

MPW just needs to trade around that at a P/AFFO of 9.00 to provide an 21.30% capital appreciation in less than two years.

And if MPW can trade at a P/FFO of 7.50, it has the potential to provide a 26.44% capital appreciation in less than two years.

And if MPW can trade at a P/FFO of 7.50, it has the potential to provide a 26.44% capital appreciation in less than two years.

It could be easier to see from the matrix below, which presents a range of possibilities.

It could be easier to see from the matrix below, which presents a range of possibilities.

Based on management’s commentary on their guidance, an FFO range from $1.55 to $1.65 is more likely. The stock ended at $10.55 on 24 February at a P/FFO of 5.83, which is way lower than the pandemic P/FFO of 10.35. Can it go lower? Certainly, but we would say even if it does go lower from this point onwards, the downside risk is much less, while the upside potential is much higher, whether it comes from the stock trading nearer to its pre-pandemic normal P/FFO of between 11-12 or the company reporting at an FFO of $1.55 or greater.

Based on management’s commentary on their guidance, an FFO range from $1.55 to $1.65 is more likely. The stock ended at $10.55 on 24 February at a P/FFO of 5.83, which is way lower than the pandemic P/FFO of 10.35. Can it go lower? Certainly, but we would say even if it does go lower from this point onwards, the downside risk is much less, while the upside potential is much higher, whether it comes from the stock trading nearer to its pre-pandemic normal P/FFO of between 11-12 or the company reporting at an FFO of $1.55 or greater.

And the return potential above is based purely on price appreciation alone. Factoring returns from dividends, it is not difficult to see double-digit return potential in less than 2 years.

We believe that an investment in Medical Property Trust fits what Monish Pabrai said, “Heads I win. Tails I don’t lose much.”

The Probability of a Dividend Cut?

Since an investment in MPW is primarily focused to the investor seeking high current income, the probability of a dividend cut is of utmost importance. Therefore, we looked to our associate, Professor Nathan Mauck, and asked him to run MPW through his proprietary Dividend prediction model.

Nathan is an associate professor of finance at the University of Missouri – Kansas City. He holds a Ph.D. in finance from Florida State University and an undergraduate degree in finance from Kansas State University.

Nathan is an associate professor of finance at the University of Missouri – Kansas City. He holds a Ph.D. in finance from Florida State University and an undergraduate degree in finance from Kansas State University.

Mauck has won numerous teaching awards, primarily for courses focused on valuation. He has published over 20 peer-reviewed academic research journal articles, a textbook, various book chapters, and his work has been featured in popular press publications such as The Wall Street Journal. Here are the results:

My dividend cut prediction model puts MPW at a 10% chance to cut dividends. For comparison, my model would put the probability of a JNJ cut at 6%, KO at 6%, CAT at 7.5%, and FDX at 10%.

This model is based off the following factors and a regression model looking at dividend cuts since 2015 for all publicly traded U.S. firms: market cap, net income, cash, and debt where the last three are scaled by total assets.

During this period (before COVID), about 4.5% of all dividend-paying firms cut their dividends in a given quarter, this jumped to about 16% in the second quarter of 2020.

10% probability for MPW is higher than many solid payers but lower than firms with negative net income.

The Importance of REIT Status

MPW enjoys benefits and privileges from its REIT status. If it were forced to surrender that status it would not enjoy the income tax privileges it currently has. Consequently, if MPW were to cut its dividend, its REIT status could possibly be in jeopardy. If this were to happen, there would be three possible consequences:

One, its taxable income will be subject to U.S. federal income taxes at regular corporate rates.

Two, since the dividends shareholders receive will also be taxed, the dividends shareholders get are taxed twice, and no shareholder would like that, and they would likely dump the shares.

Three, MPW will not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost.

MPW generated net income of $902 million in 2022.

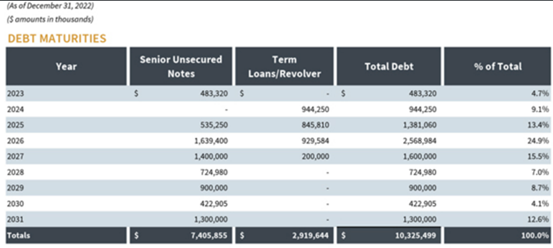

The debt due in 2023 is $483,320 thousand

The amount of outlay required at the low end of management’s guidance, which factored in Prospect paying $0 in rent and interest in 2023

= dividends + debt repayment due in 2023

= 597,476 thousand shares x $0.83 per share + $483,320 thousand of senior unsecured notes payable in 2023

= $979 million

Scenario 1: MPW maintains this revenue figure, after taking into account losses in rent from the sold properties and the increase in rent due to contractual agreement

There will be a shortfall of less than $100 million. Considering MPW has $235 million in cash and cash equivalents as of 31 December 2022 and it expects to receive $657 million in cash by the middle of 2023 to come to a combined total of around $892 million by the first half of 2023, the less than $100 million in shortfall is easily covered without needing to issue new shares or to tap into credit lines, leaving the company with a sizable sum of around $800 million which it can choose to do deals (or not), or to standby to pay the $944 million in term loan in 2024.

Scenario 2: Assuming a severe unforeseen event hit MPW in 2023 and drops its net income by 20% of the 2022 amount, MPW would only bring in $902, 597 thousand x 80% = $722 million

There will be a shortfall of $250 million. Assuming MPW will have $892 million by the first half of 2023, this $250 million shortfall is manageable without needing to issue new shares or tap into credit lines, leaving the company with more than $600 million in cash reserves to standby to pay the $944 million in term loan in 2024.

In both scenarios, even in the very unlikely scenario 2, implies that management will still end up with a sizable cash cushion of more than half a billion dollars, which is likely to discourage attempts of cutting the dividend.

From 2022 Q4 10Q based on this repayment schedule, the cash that MPW needs to set aside for debt repayment for the next few years (2024 to 2027) will be substantial. The company probably will find it harder to finance more deals, with its current leverage of around 6x.

From 2022 Q4 10Q based on this repayment schedule, the cash that MPW needs to set aside for debt repayment for the next few years (2024 to 2027) will be substantial. The company probably will find it harder to finance more deals, with its current leverage of around 6x.

Conclusion:

Medical Properties Trust (MPW) is very cheap now. It got even cheaper after the earnings call on 24 February when worries around Prospect became full-blown and the share price plummeted by 13.6% in just two days from $12.21 as of close on 23 February 2023 to close at $10.55 on 24 February 2023.

However, “cheap” should not be confounded with “value” as many stocks are cheap for good reasons. If the fundamentals are not present to support a long-term thesis, “cheap” can get cheaper. Remember General Electric (GE)? Was GE cheap in 2008 when it traded at a PE of 10? Without counting the dividends, an investor would have been holding the bag at a -0.8% loss after 15 years. And even with the dividends, it will just be a mere 3% total annualized rate of return at a time when S&P 500 returned 8.47% in the same period.

We do believe that Medical Properties Trust is not a GE, that its fundamentals are strong and the business model is resilient. Certainly, MPW is in a tough spot now and to stage a comeback it must have strong fundamentals. On the other hand, we have yet to see a company that did not face some fundamental issues from time to time. MPW itself expects, and we along with it, to see some weakness in FFO and AFFO growth over the next year or two. However, MPW is a company with a history of growth through acquisition, and management believes that the pipeline is very promising. But even though the pipeline is promising, management is committed to first righting the ship before adding new hospitals.

Medical Properties Trust has a strong balance sheet that will be significantly strengthened by the middle of 2023.

Medical Properties Trust projected adjusted funds from operation in a worst-case scenario of Prospect not paying a single cent of rent or interest in 2023 is still sufficient to cover a dividend at 2022’s rate of $1.16 per share.

Additionally, Medical Properties Trust’s largest operator Steward is righting itself and seems capable of paying back rental and interest in 2023. And Medical Properties Trust’s reduced exposure to Steward reduces its risk profile.

Medical Properties Trust has four potential catalysts to reinvigorate the share price, and at least a couple of these are likely to happen between 2023 and 2024.

Medical Properties Trust is so undervalued now that further downside risk is minimized. It is irrational for the company to be priced as if it is going out of business. Cash flow issues with the largest operator Steward are being resolved at least for 2023. The second largest operator Circle Health seems to be doing well so no problems on that front. The third largest operator is facing some issues but that represents 11.5% of the total revenue in Q4, and even in a scenario where this operator stops paying its dues, MPW will still be profitable and is still able to pay out the dividends at the 2022 rate of $1.16.

However, we would be remiss if we did not highlight that in the worst-case scenario, the payout ratio based on AFFO will be much higher at 89.9%, and if that unlikely scenario happens, it will definitely increase the risk of management making the decision to reduce the distribution to conserve cash. On a positive note, from management’s commentary during the Q&A, it was clear that it was focused on managing cost and leverage and is definitely not expanding at any cost. Management is watching interest rates closely, especially when the Fed is still determined to fight inflationary pressures, and since it has international operations and is exposed to currency fluctuations.

From the points of view of an Income Investor, a Value Investor, and a Dhando Investor, Medical Property Trust appears to be a worthwhile investment for those investors needing current income. Naturally, there is risk. On the other hand, the risk is being compensated by a very high current yield, and an extremely low valuation. In other words, the risk is already in the price. Finally, yield is high enough that if even if was to be reduced (not eliminated) it would still represent an opportunity for abnormally high income for those who need it.

— James Long & Chuck Carnevale

Source: FAST Graphs