Stocks are pieces of real businesses. While some people treat stocks like baseball cards to be traded, real long-term investors know that serious wealth and passive income is built through the process of compounding over the course of decades. But how do you stick with it for decades on end?

By investing in wonderful businesses. It’s easy to sit back and let the process play out when you invest properly.

Now, I’ll be honest. Capitalism is brutal. It’s very difficult for businesses to survive, let alone thrive, over the course of decades. But those that can thrive for decades on end have shown themselves to be something special. And what better proof of that specialness than a lengthy track record of growing dividends?

This is a great initial litmus test of business quality. Can’t send out ever-larger dividends without the ever-growing profit there to support it. And you only grow your profit like clockwork when you run a wonderful business.

This basic logic is at the heart of why I only invest in high-quality dividend growth stocks. It’s also why I’m well into my second decade of successful investing.

If you want staying power as an investor, you invest in businesses with staying power. And the stocks I’m about to highlight have the ultimate staying power. So much so, in fact, that, once bought, one could consider holding them forever.

Today, I want to tell you about 5 high-quality “forever” dividend growth stocks.

Ready? Let’s dig in.

The first dividend growth stock to consider owning forever is Apple (AAPL).

Apple is a multinational technology company with a market cap of $2.4 trillion. Apple is a terrific business that seamlessly blends hardware, software, and services. In doing so, the company has created a unique ecosystem, which, in turn, has led to incredibly loyal customers. Like I said earlier, stocks are pieces of real businesses.

It only makes sense, then, that if you want to own the best stocks, you should own the best businesses. Well, is there any business better than Apple? If you ask Warren Buffett, the answer to that question is a resounding no. Buffett, arguably the greatest investor of all time, has said that Apple is “…probably the best business I know in the world”. And he’s putting his money where his mouth is. Not just a little bit of money either. He has about $135 billion invested in Apple. Buffett loves quality. You know what else he loves? Growing dividends.

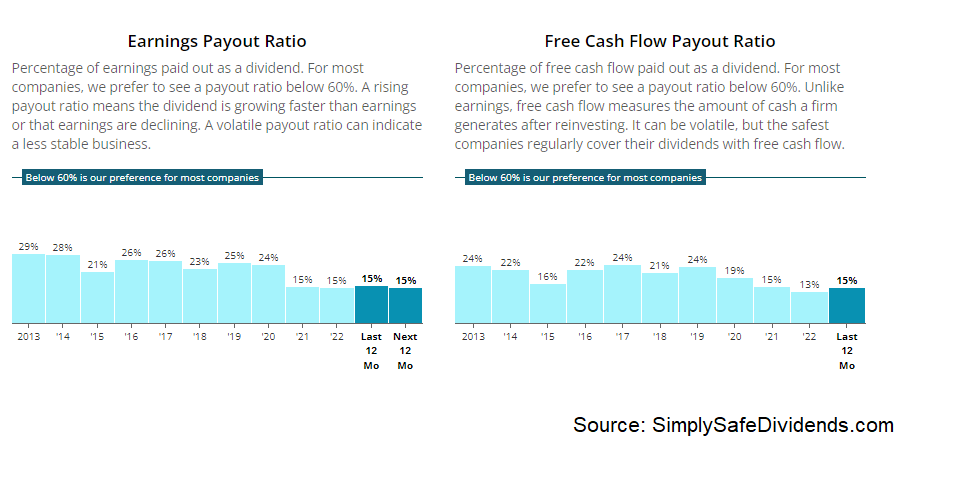

Apple has increased its dividend for 11 consecutive years. Not the longest track record out there, but every business has to start somewhere. Can’t have a 50-year track record without first building a 10-year track record. And I have a lot of confidence that Apple will continue to grow its dividend for decades to come. But getting back to the here and now – the five-year DGR is 8.2%.

Not bad at all. And with a payout ratio of only 15.6%, along with billions of dollars of cash on the balance sheet, shareholders should be looking forward to plenty more high-single-digit dividend raises. However, the stock’s low yield of only 0.6% does leave something to be desired. That’s not necessarily an indictment on Apple’s dividend. It’s partially a function of strong demand for the shares, which drives the price higher and the yield lower.

Not bad at all. And with a payout ratio of only 15.6%, along with billions of dollars of cash on the balance sheet, shareholders should be looking forward to plenty more high-single-digit dividend raises. However, the stock’s low yield of only 0.6% does leave something to be desired. That’s not necessarily an indictment on Apple’s dividend. It’s partially a function of strong demand for the shares, which drives the price higher and the yield lower.

The demand for shares is strong because this is the kind of business that you want to consider owning forever.

It’s all about supply and demand. A lot of people want to own a slice of Apple. Yet few people want to sell what they’ve got. Buffett, being an extremely long-term investor, certainly isn’t interested in selling his shares.

Meanwhile, Apple is buying back its own stock hand over fist. Even Apple wants to own Apple! This comes down to technology, which our world is becoming increasingly reliant on. People are practically addicted to their devices nowadays – devices like the ones that Apple sells. You know, smartphones, computers, tablets, etc. In fact, Apple has over 2 billion active devices.

This addiction is probably only going to become worse when AR/VR becomes viably mainstream. Guess who’s working on AR/VR? Apple, of course. This company is providing the tech we need today while simultaneously laying the groundwork for the tech of tomorrow. Tech will be with us forever. And increasingly so. There is no future society in which we use less tech.

A bet on Apple is a bet on amazing tech, which makes an easy case for Apple as a “forever” dividend growth stock. The best investor we’ve ever seen owns a significant chunk of the best business he’s ever seen. I’ve repeatedly called Apple a “must-own” stock for long-term dividend growth investors. If you own it, consider never selling it. This is the kind of business that can compound your wealth and passive income for decades while you sleep like a baby.

The second high-quality forever dividend growth stock to cover today is American States Water (AWR).

American States Water is an American water and electricity utility company with a market cap of $3 billion.

Okay. What could be more forever than water? Will humans ever stop needing water? I don’t think so. Well, this water utility is in the business of providing that necessary resource to sustain life.

I can’t imagine a more sure bet over the long run. If one could invest in, and profit from, oxygen, that’d be about the only thing surer than this. If the idea of investing in a utility providing water services to hundreds of thousands of customers isn’t sure enough for you, perhaps this will tilt the odds a bit more in your favor: American States Water has 50-year privatization contracts with the US government as a government contractor for water and wastewater services across military bases.

50 years isn’t forever, but it’s a very long time. And it’s this kind of surefire foundation at the business level that has led to a surefire dividend that gets paid and increased as certain as the sun rises and sets.

American States Water has increased its dividend for 68 consecutive years. Doesn’t that just take your breath away? It gives me goosebumps just saying it out loud. That’s the longest dividend growth track record in the world.

No company has done it more consistently, for longer, than this company. The 10-year DGR is 9.2%. And the dividend growth rate is also very consistent – even the most recent dividend raise was just a hair under 9%. Now, the stock does yield only 1.8%.

No company has done it more consistently, for longer, than this company. The 10-year DGR is 9.2%. And the dividend growth rate is also very consistent – even the most recent dividend raise was just a hair under 9%. Now, the stock does yield only 1.8%.

You can’t have it all. It would be silly to expect a high yield from something like this. The payout ratio of 75.4% looks high, but that’s largely because of artificially depressed FY 2022 EPS. If new rates get approved, as management expects, EPS will rise, causing the payout ratio to fall.

There is almost nothing more “forever” than water.

As I’ve said many times now, I think water will be the “liquid gold” of this century, just as oil was the “liquid gold” of the prior century. Demand for water isn’t going anywhere but up, yet accessing it is only becoming more difficult and expensive. All of that sounds like money for this company and its shareholders.

All American States Water does is quietly compound its shareholders’ wealth and dividend income. It’s simple. What you do with a business like this is, you buy the shares, then you plan on forgetting about those shares for the next few decades of your life. There’s so much uncertainty in life. Why not reduce that uncertainty a bit by owning a slice of a business that’s providing something that people quite literally cannot live without? If there was ever a “forever” dividend growth stock, it’s this one.

The third high-quality dividend growth stock that immediately comes to mind as a forever stock is Johnson & Johnson (JNJ).

Johnson & Johnson is a global healthcare conglomerate with a market cap of $401 billion. I have an uncomfortable fact about life for you. We all have these human bodies that are slowly deteriorating as we age, often requiring more healthcare as our ages rise. And there are more, not less, humans walking around on this planet every year. More than eight billion of us, at last count.

Plus, global wealth, on average, continues to rise. You can draw a line straight from all of that right to increasing spending on high-quality healthcare products and services. Said another way, you can draw a line from all of that right to Johnson & Johnson. That’s because it’s one of the world’s largest, most diversified, and best healthcare companies, providing a range of pharmaceuticals, medical devices, and consumer products. And that’s why it’s been able to reliably increase its dividend for longer than I’ve been alive for.

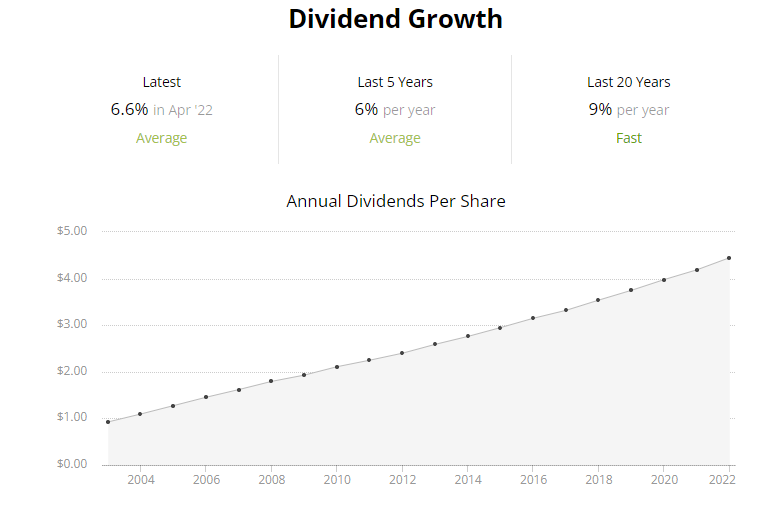

Johnson & Johnson has increased its dividend for 60 consecutive years. When I was born, Johnson & Johnson had already been increasing its dividend for two straight decades. It was almost a Dividend Aristocrat back when I was crawling around, unable to speak.

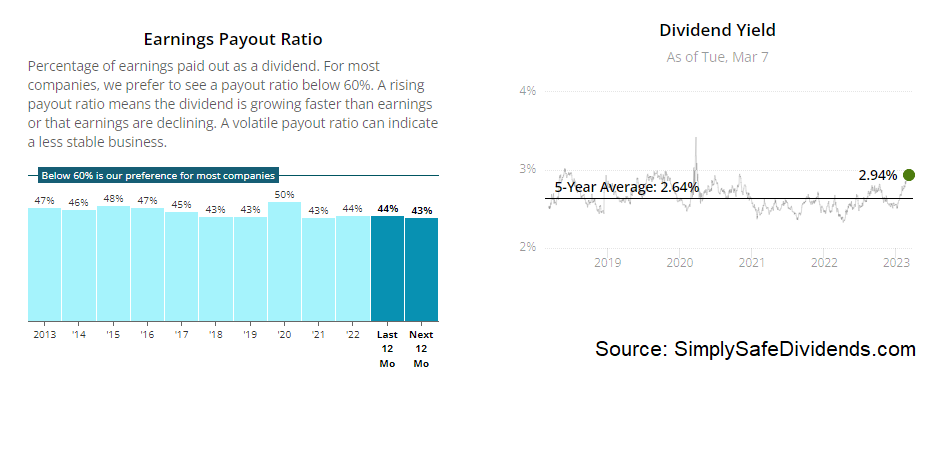

Incredible. The 10-year DGR of 6.4% won’t knock your socks off. Neither will the 2.9% yield. But with a payout ratio of 44.5%, based on FY 2022 adjusted EPS, as well as the fact that Johnson & Johnson has a AAA credit rating from Standard & Poor’s – a higher credit rating than the US government, which can actually print its own money – this is one of the safest, most reliable dividends on the planet. And that counts for a lot, in my view.

Incredible. The 10-year DGR of 6.4% won’t knock your socks off. Neither will the 2.9% yield. But with a payout ratio of 44.5%, based on FY 2022 adjusted EPS, as well as the fact that Johnson & Johnson has a AAA credit rating from Standard & Poor’s – a higher credit rating than the US government, which can actually print its own money – this is one of the safest, most reliable dividends on the planet. And that counts for a lot, in my view.

Johnson & Johnson has been successfully doing business for more than a century. I have no reason to believe they won’t keep doing that for another century. Johnson & Johnson has the hallmarks of a wonderful businesses. It’s been around for more than 100 years.

Johnson & Johnson has been successfully doing business for more than a century. I have no reason to believe they won’t keep doing that for another century. Johnson & Johnson has the hallmarks of a wonderful businesses. It’s been around for more than 100 years.

The dividend has been increased annually for six straight decades. It has one of the best balance sheets in Corporate America. The large, diversified organization is favorably positioned right in the middle of demographic and human condition trends that promote secular long-term growth.

I’ve been a Johnson & Johnson shareholder for more than a decade. And I have no plans to ever sell those shares. I’ll likely still hold those shares when I’m quite old myself and increasingly in need of the very healthcare products that Johnson & Johnson is so adeptly providing.

My mind cannot conjure up a future in which Johnson & Johnson is making less money and paying out a smaller dividend than it does today. No, every future path I imagine shows a bigger, more successful, and more profitable company paying out a larger dividend than it does today. If you’re looking for a dividend growth stock to hold forever, Johnson & Johnson should be at the top of the list.

The fourth dividend growth stock that I think is a forever stock is Microsoft (MSFT).

Microsoft is a multinational technology corporation with a market cap of $1.9 trillion. Boy, how things change. If I were writing this article 20 years ago, I definitely wouldn’t be featuring two tech companies. But that was then. And this is now. In 2023, if you’re not investing in high-quality tech companies, you’re missing out on a huge chunk of the economy and the growth of it. And make no mistake about it, Microsoft is a high-quality tech company.

Whereas Apple is mostly thought of as a hardware company, Microsoft gives you huge software exposure – ranging from Windows OS, Azure cloud, the Microsoft 365 productivity suite, LinkedIn, and even ChatGPT AI. The growth runway here is extremely long, and that goes for the dividend, too.

Whereas Apple is mostly thought of as a hardware company, Microsoft gives you huge software exposure – ranging from Windows OS, Azure cloud, the Microsoft 365 productivity suite, LinkedIn, and even ChatGPT AI. The growth runway here is extremely long, and that goes for the dividend, too.

Microsoft has increased its dividend for 21 consecutive years. I have no doubt that Microsoft will become a Dividend Aristocrat in a few years’ time. And the company will keep running past the 25-year mark. The 10-year DGR is 11.8% – and Microsoft has been very consistent with this, raising the dividend right around 10% or so annually for many years now.

With the payout ratio sitting at only 30.2%, and with its fortress-like balance sheet with a AAA credit rating from Standard & Poor’s – the only company other than Johnson & Johnson to have that distinction – this is easily one of the safest dividends in the entire world. However, you do give up yield for that safety – the stock only yields 1.1%. But that’s only looking at the dividend portion of the return. There’s also the capital gain.

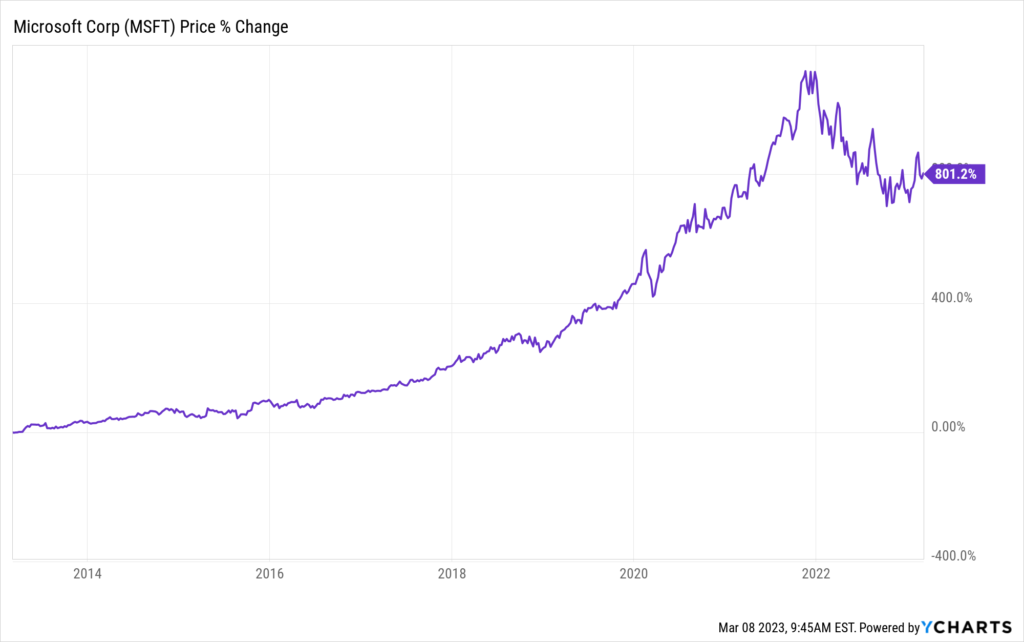

Microsoft has been a monster compounder for decades. And I’m extremely confident that it will continue to be one. This stock is up by more than 800% over the last decade. For those focusing on the 1% yield, that’s the definition of missing the total return forest for the yield trees. Don’t do that. Microsoft is creating generational fortunes for those wise enough to see the big picture here. I’ve been a Microsoft shareholder for nearly 10 years now.

The only thing keeping me from holding “forever” is the fact that I’m mortal. Otherwise, in the figurative sense, Microsoft is in every single way a “forever” stock for me. This is the kind of stock that, once you buy it, you just kind of forget about it while it compounds your wealth and passive income while you sleep like a baby. Long-term investing really can be that easy.

The fifth dividend growth stock that I’d argue is a “forever” stock is PepsiCo (PEP).

PepsiCo is a multinational food, snack, and beverage corporation with a market cap of $239 billion. I’ve given you some sure bets in today’s piece. Tech, water, healthcare. Now, we delve into food and beverages.

Because there is no future in which human beings will stop eating food or drinking beverages. If I could buy shares in the Sun and bet on the continued need for sunlight, I’d do so. But I can’t. The next best thing might be food and beverages. And not just food and beverages but branded food and beverages. It’s a recipe that’s been working for more than a century. And nearly half of that time has included a growing dividend straight into shareholders’ pockets.

PepsiCo has increased its dividend for 50 consecutive years. That’s up there with some of the longest track records in existence, showing just how consistent and reliable PepsiCo has been. Sun-rising-and-setting reliable? Maybe not quite. But it’s getting there.

The 10-year DGR is 7.8%, which is solid and easily beats inflation in most periods. That pairs well with the stock’s 2.7% yield, giving investors a fairly balanced combination of yield and growth. The payout ratio of 69.8%, based on midpoint guidance for FY 2023 Core EPS, is slightly elevated, but I see nothing but higher dividends for this company over the coming years.

The 10-year DGR is 7.8%, which is solid and easily beats inflation in most periods. That pairs well with the stock’s 2.7% yield, giving investors a fairly balanced combination of yield and growth. The payout ratio of 69.8%, based on midpoint guidance for FY 2023 Core EPS, is slightly elevated, but I see nothing but higher dividends for this company over the coming years.

This isn’t a get-rich-quick idea. But PepsiCo can make you fabulously wealthy over the course of decades.

And it can do that while you quietly collect ever-higher dividend payments. You’re literally getting paid to get rich. Does it get better than that? I don’t think so. PepsiCo has 23 different billion-dollar brands, including Doritos and the namesake Pepsi.

These brands are firmly entrenched into society’s collective mindshare, giving PepsiCo a wide economic moat. You don’t build brands like that overnight. And you don’t destroy them overnight, either. This stock compounded at nearly 12% annually over the last decade.

For a sleepy, large food and beverage business, that’s quite impressive. Using the rule of 72, that doubles your money every six years. And since this is arguably a “forever” stock, you could be looking at a lot of doublings. If you have PepsiCo in your portfolio, strongly consider keeping it for the rest of your life. And if you don’t have it in your portfolio, strongly consider changing that.

For a sleepy, large food and beverage business, that’s quite impressive. Using the rule of 72, that doubles your money every six years. And since this is arguably a “forever” stock, you could be looking at a lot of doublings. If you have PepsiCo in your portfolio, strongly consider keeping it for the rest of your life. And if you don’t have it in your portfolio, strongly consider changing that.

— Jason Fieber

P.S. Would you like to see my entire stock portfolio — the portfolio that’s generating enough safe and growing passive dividend income to fund my financial freedom? Want to get an alert every time I make a new stock purchase or sale? Get EXCLUSIVE access here.

Source: Dividends & Income