Covered call ETFs have exploded in popularity in recent years as investors have jumped at their double-digit yields, monthly payouts, and low volatility.

These qualities especially appeal to retirees seeking to live off dividends and preserve capital.

But are covered call ETFs good long-term investments? Are their big yields safe?

In this guide, we will answer these questions and review:

- How covered call ETFs work

- Dividend safety concerns

- Performance of covered call ETFs

- Tax consequences of owning covered call ETFs

- Whether retirees should own these high-yield funds

Let’s start with a look at the investment strategy used by these funds.

How Covered Call ETFs Work

Understanding the basics of covered calls will help with grasping how these funds work.

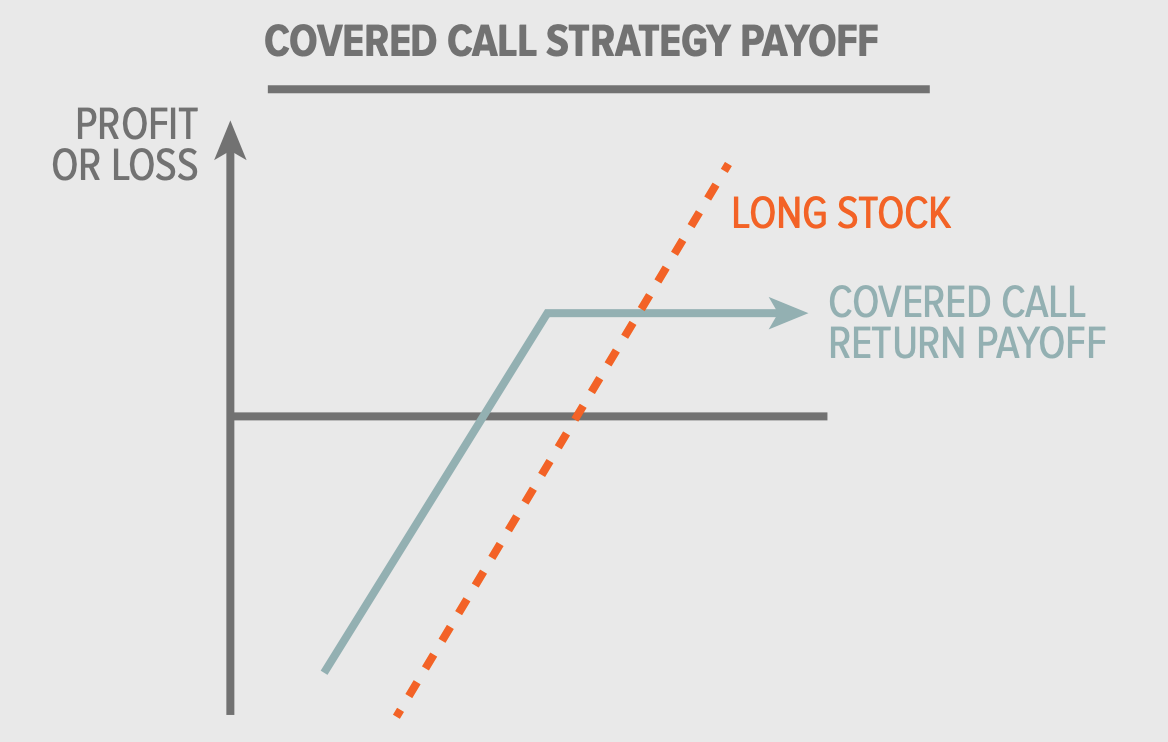

A covered call investment strategy entails buying a stock and selling a call option on the same stock to generate income.

A call option gives the buyer of that option the right to purchase your shares at a specified price (strike price) by a certain date (expiration date).

In exchange for this option, the buyer gives you an upfront payment, called a premium.

Suppose you own 100 shares of Coca-Cola (KO), which trade at $61 per share.

You decide to sell a call option on Coke with a $61 strike price and an expiration date three weeks from now.

In exchange, you receive $1.15 for each of your 100 Coca-Cola shares, providing $115 of immediate income.

If Coke’s price rose from $61 to $64 at the expiration date, the options buyer would pay you $61 (the strike price) for your shares.

You’d keep the $1.15 per share of premium income. But you would have made $3 per share if you held Coke with no options strategy behind it.

However, if Coca-Cola’s share price stagnated or declined, you keep your shares and pocket the premium to pad your return.

Essentially, a covered call strategy caps your upside compared to owning the underlying stock only but provides some downside cushion due to the premium received.

Source: Global X ETFs

Source: Global X ETFs

Covered call ETFs follow this strategy at scale. Most funds own a basket of stocks that track a popular index, such as the S&P 500, Nasdaq 100, or Russell 2000.

They then sell call options on the underlying index. These options typically expire within one month, creating an ongoing stream of premium income from which to pay monthly dividends.

Are Covered Call ETF Dividends Safe?

No. Investors in most covered call ETFs, including favorites like JEPI and QYLD, should be comfortable with potential swings in their dividend income of 30% to 50% any given year, depending on the market environment.

Covered call ETFs fund most of their dividend payouts from the premium income received when they sell call options.

The price of those premiums, and thus the amount of cash available for paying dividends, is driven by the market’s forward-looking assessment of stock price volatility.

When the market anticipates higher volatility, perhaps due to a shifting economic outlook, option premiums increase due to the wider range of expected stock price outcomes.

But when expected volatility declines, so do option prices. And these swings can be substantial.

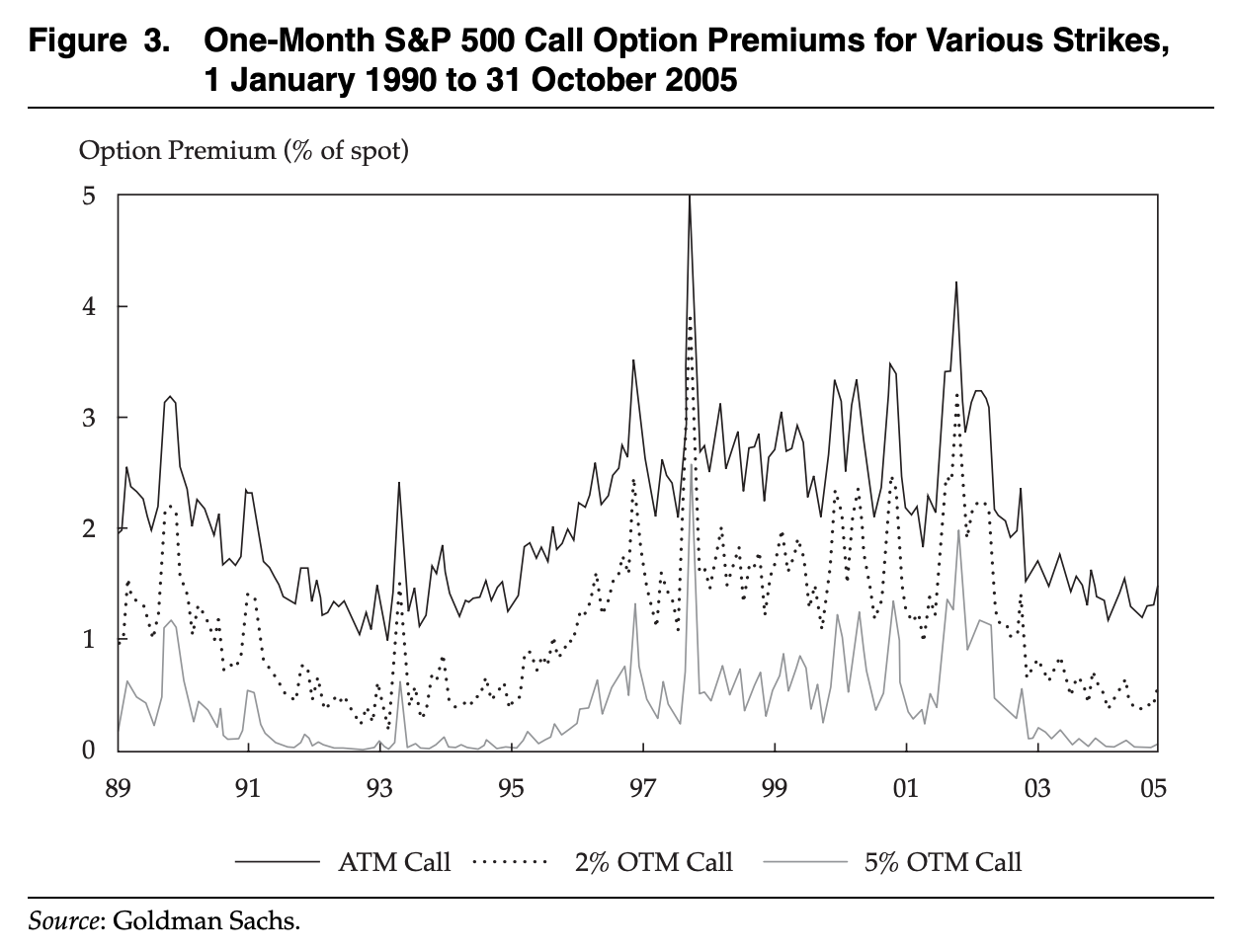

The chart below plots one-month S&P 500 call option premiums from 1990 through 2005 for three different strike prices. Premiums are expressed as a percentage of a stock’s current price.

(Most covered call ETFs use at-the-money (ATM) strikes, where the stock’s price matches the option’s strike price when the option is written.)

As you can see, ATM call premium yields ranged from a low of about 1% to as high as 4%.

Source: Goldman Sachs Research Paper

Source: Goldman Sachs Research Paper

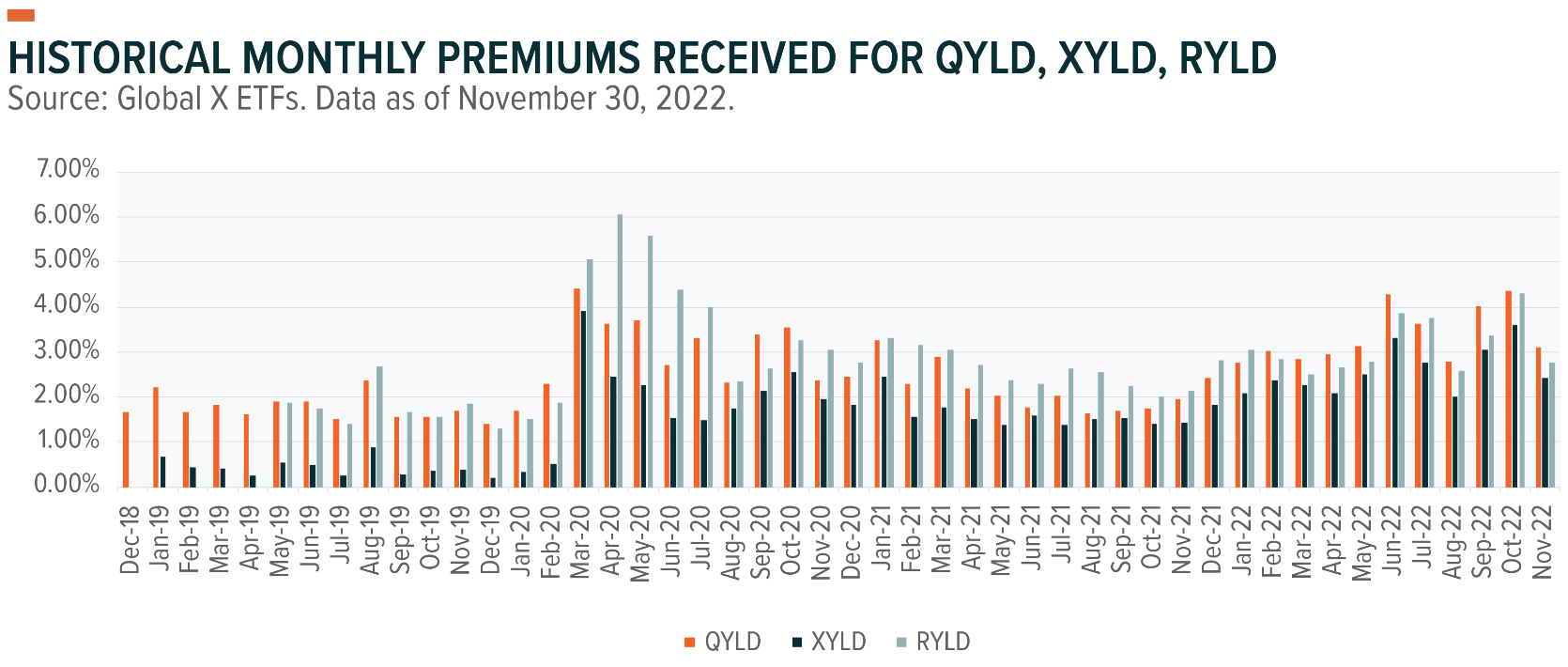

Similar swings have occurred in recent years for popular covered call ETFs such as QYLD (tracks the Nasdaq 100), XYLD (S&P 500), and RYLD (Russell 2000).

For example, prior to 2020, monthly premiums never topped 1% for XYLD. But more recently they averaged closer to 2% and even passed 3% a few times. That’s two to three times as much income compared to 2019, with no change in the underlying strategy.

Source: Global X ETFs

Source: Global X ETFs

Premiums have remained elevated since the pandemic, which unleashed higher volatility that an influx of retail traders further amplified.

This above-trend income has fueled the double-digit dividend yields seen across many covered call ETFs today. But it seems unlikely to last.

Based on historical premiums during periods of normal volatility, mid-single-digit dividend yields appear more sustainable for these funds in the long run.

Income investors should consider the current high yields as no more than a bonus, which will shrink whenever elevated stock price volatility reverts to the mean.

Investors who can stomach some dividend fluctuations may still wonder if covered call ETFs are good long-term holdings for total returns and lower volatility.

Performance of Covered Call ETFs

Critics of covered call investing often argue that you pay the full cost to hold a stock, but you don’t get all of the upside when the stock rises – and stocks generally rise over time.

And if the stock falls by more than the premium you received from selling a call option, you still have the downside of being long the stock.

During strong bull markets, this logic prevails as upside stock price volatility generally comes in higher than options markets had priced in.

As a result, covered call ETFs leave money on the table and trail long-only stock indices.

For example, the Global X NASDAQ 100 Covered Call ETF (QYLD) buys all the stocks in the Nasdaq 100 index and sells one-month call options on the underlying index.

From the fund’s December 2012 inception through December 2021, growth-oriented stocks boomed. The tech-heavy Nasdaq 100 delivered an annualized total return of 22.3% a year, crushing QYLD’s 8.4% per year return.

The tide partially reversed in 2022 as rising interest rates cooled the market’s frenzy. The Nasdaq 100 index lost 33%, but QYLD was down only 19%.

So, what does performance look like over a full market cycle? The most popular covered call ETFs do not have very long operating track records, making it harder to judge their performance.

But we can look at the historical performance of benchmark indices such as the CBOE S&P 500 BuyWrite Index (BXM), which has nearly 40 years of pricing data. BXM holds S&P 500 stocks and writes 1-month, at-the-money covered calls.

The Asset Consulting Group studied the performance of BXM from June 1986 through December 2011. BXM delivered an annualized return of 9.1%, about in line with the S&P 500’s 9.0% return.

However, BXM’s equity-like return came with volatility that was about 30% lower than the volatility of the S&P 500.

Goldman Sachs reached a similar conclusion in 2006 after studying BXM’s performance from 1990 through 2005.

While BXM underperformed the S&P 500 by more than 5% annually between 1995 and 1998, its outperformance in the low-volatility period of the early 1990s and the bear market of 2000-02 made up for the difference.

Source: Goldman Sachs Research Paper

Source: Goldman Sachs Research Paper

These studies suggest covered call strategies have potential to deliver total returns comparable to long-only equity indices such as the S&P 500, while realizing lower standard deviation of returns.

However, unlike benchmarks such as BXM, covered call ETFs charge management fees and incur frequent trading costs to implement their strategies. These expenses serve as a drag on performance compared to owning passive index funds.

For example, JEPI charges a management fee of 0.35% compared to 0.1% for the S&P 500 ETF (SPY). And QYLD’s 0.6% expense ratio triples the 0.2% fee charged by Invesco’s ETF tracking the Nasdaq 100 (QQQ).

Some investors may find these higher costs to be worth the hassle they avoid from trying to implement a covered call strategy on their own.

But these expenses add up over time, increasing the odds that holding a low-cost passive index fund would deliver superior total returns, albeit with most of the gains driven by capital appreciation rather than dividend income.

Tax consequences of Covered Call ETFs

Covered call ETF investors receive a 1099 form at tax time, but their use of options results in different tax implications compared to traditional ETFs.

Option income is generally taxed as short-term gains, so investors may prefer to hold covered call ETFs in tax-advantaged accounts.

That said, the tax characterization of distribution amounts for some funds can vary significantly from one year to the next depending on the market environment.

For example, 85% of QYLD’s 2019 distributions were treated as short-term gains. But in 2022, nearly all of the distributions were a return of capital.

QYLD provides a tax primer for investors wanting to learn more about how the fund’s accountants make these determinations.

JEPI is a little different than QYLD because it uses equity-linked notes to implement its strategy. These notes produce interest income rather than qualified dividends, so the majority of JEPI’s distributions will be taxed as ordinary income most years.

The bottom line is that tax-sensitive investors should consider owning covered call ETFs in tax-advantaged accounts.

Should You Own Covered Call ETFs?

Covered call ETFs can play a role in retirement portfolios since this strategy has potential to generate decent total returns, reduce volatility, and provide high income (the tradeoff for giving up future capital appreciation).

When investors reach a certain net worth and start seeking income investments, these qualities become more appealing. Especially if you’re worried that the stock market could stagnate or decline, an environment in which covered call ETFs have historically outperformed long-only equity indices.

That said, everything in moderation. As conservative investors, we wouldn’t feel comfortable allocating most of our portfolio to a strategy that relies on derivatives, which could experience less predictable trading conditions during periods of stress in financial markets.

Investors considering these funds should also understand that their double-digit yields are likely unsustainable. Anchoring expectations on mid-single-digit yields is more reasonable over the long term.

And don’t forget that these funds can deliver disappointing total returns for years at a time, particularly when markets rise at a swift pace. Covered call ETFs should not be used to try and time moves in the market.

Finally, investors with investment horizons spanning multiple decades and a desire to maximize total returns should consider long-only, low-cost strategies, such as building a portfolio of individual dividend stocks or index investing.

Avoiding the performance drag caused by management fees and transaction costs can produce a bigger portfolio over time. As Jack Bogle said, in investing, you get what you don’t pay for.

— Simply Safe Dividends

Sponsored Link: Simply Safe Dividends provides a monthly newsletter and a comprehensive, easy-to-use suite of online research tools to help dividend investors increase current income, make better investment decisions, and avoid risk. Whether you are looking to find safe dividend stocks for retirement, track your dividend portfolio’s income, or receive guidance on potential stocks to buy, Simply Safe Dividends has you covered. Our service is rooted in integrity and filled with objective analysis. We are your one-stop shop for safe dividend investing. Brian Bollinger, CPA, runs Simply Safe Dividends and previously worked as an equity research analyst at a multibillion-dollar investment firm. Check us out today, with your free 10-day trial (no credit card required).

https://www.simplysafedividends.com/

Source: Simply Safe Dividends