The release of the latest version of ChatGPT brought a renewed focus on artificial intelligence (AI) and machine learning. With the software able to pass difficult occupational tests and produce intelligent-sounding writing, it has stoked fear while showing the potential for AI innovation.

However, numerous tech companies have invested heavily in bolstering their AI capabilities. That fact alone could prompt investors to view Microsoft (MSFT), Alphabet (GOOGL) (GOOG), and Apple (AAPL) in a new light as they apply AI and machine learning to advance technological innovation. Here, three Motley Fool contributors look at what each of the companies is doing.

Microsoft is implementing artificial intelligence throughout its business

Microsoft is implementing artificial intelligence throughout its business

Justin Pope (Microsoft): Artificial intelligence is the latest rage on Wall Street; Microsoft recently announced a multiyear and multibillion-dollar partnership with OpenAI, the company that developed the AI-powered headline-making chatbot ChatGPT. But this isn’t Microsoft’s first rodeo; the company’s latest partnership builds on two existing investments in the same company, first in 2019 and then in 2021.

Microsoft’s relationship with OpenAI won’t immediately move the needle on the company’s income statement but carries multiple strategic advantages in the ruthlessly competitive technology sector. First, Microsoft aims to fellow tech giant Alphabet by going after Google Search. Microsoft is integrating ChatGPT into its Bing Search Engine and Edge web browser to improve the user experience.

Second, Microsoft has woven AI into its cloud platform Azure, recently announcing the full launch of Azure OpenAI Service. This platform is where enterprises can build and support AI applications on the Azure platform. Intelligent Cloud, which houses Azure, is already big business for Microsoft, doing $41.8 billion in revenue through six months of its fiscal 2023 year (40% of sales). But Microsoft hopes to not only bolster Azure’s growth with new applications but also lock in customers who build AI products on the platform.

Again, the financial impact of OpenAI won’t be felt today, and perhaps not tomorrow. Microsoft has a market cap approaching $2 trillion, putting a few billion dollars into perspective. However, Microsoft is seemingly playing the long game, banking on OpenAI’s technology to bolster products and services throughout the company. That benefit could become significant over time.

Until then, Microsoft’s presence throughout the tech world makes it a blue-chip stock worth considering for any long-term portfolio.

ChatGPT dominates the headlines, but Google still dominates internet search

ChatGPT dominates the headlines, but Google still dominates internet search

Jake Lerch (Alphabet): Fads come and go — especially on Wall Street. Remember the hype around Blockchain? NFTs? Fully autonomous vehicles?

In time, each of these technologies might live up to their promised potential. However, the world continues to wait. Similarly, OpenAI’s ChatGPT is all the rage today, but let’s take a step back. In this case, the narrative is that OpenAI’s ChatGPT, through its partnership with Microsoft, is about to overthrow Alphabet’s Google Search.

There are, however, a few problems with this thesis.

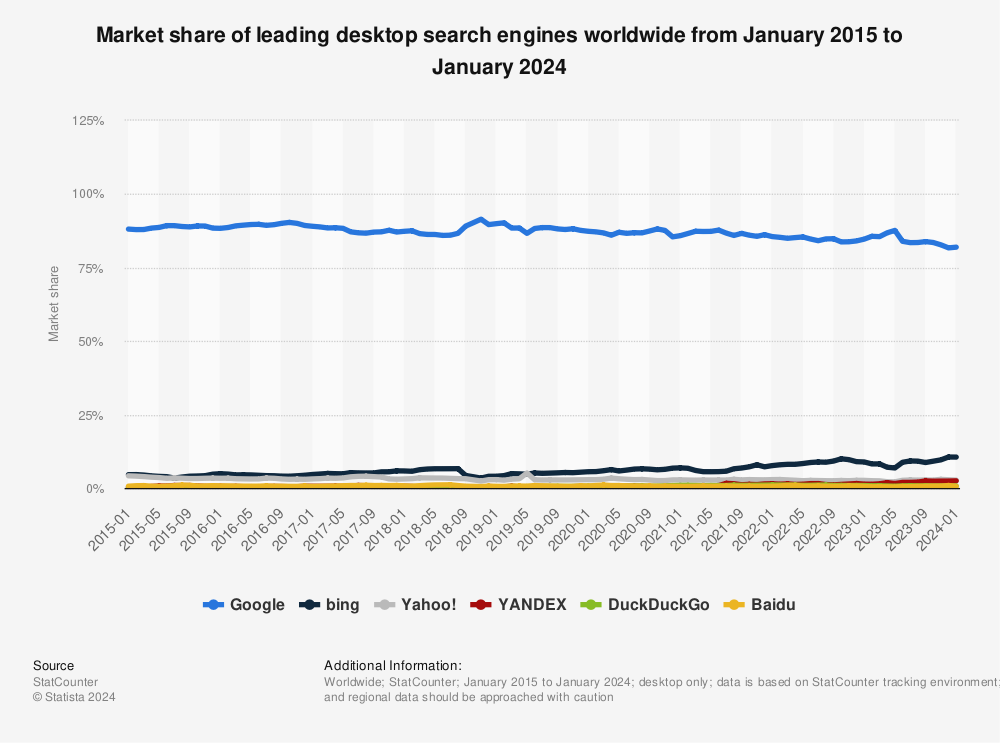

First, let’s get a sense of the landscape. It’s estimated that Google Search has roughly 84% of the desktop internet search traffic as of December 2022. Meanwhile, Microsoft’s Bing clocks in at less than 9%.

DATA SOURCE: STATISTA.

DATA SOURCE: STATISTA.

While that leaves plenty of opportunity for Microsoft, it’s also a huge hill to climb. One of the biggest advantages Alphabet has in this new AI-assisted search arms race is that Alphabet already has a head start in gathering user-specific data. And the company has tons of it.

Suppose you use Gmail, have a YouTube account, and use Google Maps to get around. In that case, Alphabet already knows where you live, who you know, and what entertainment you like. That’s an enormous leg up for Alphabet’s AI Bard. What’s more, Bard is built on Alphabet’s Language Model for Dialogue Applications (LaMDA), which might run faster — and therefore scale better — than OpenAI’s ChatGPT.

Even so, only time will tell which tool (ChatGPT or Bard) is more successful. However, for investors who might be tempted to ditch Alphabet, given all the hype around ChatGPT, I have this advice: Stay calm.

Alphabet’s massive search business isn’t going away anytime soon. Innovation, however impressive, rarely upends as quickly as people imagine. If you don’t believe me, just check for the fully autonomous self-driving car in your garage.

This tech giant is quietly biting into AI

This tech giant is quietly biting into AI

Will Healy (Apple): Despite Microsoft’s relationship with ChatGPT and Alphabet’s longtime focus on AI and machine learning, investors should not count out fellow tech giant Apple. Apple has not touted these capabilities quite as loudly as its competitors, and admittedly, stockholders should not expect to see an AI segment in the revenue breakdowns any time soon.

However, on Apple’s Q1 2023 earnings call, CEO Tim Cook referred to AI as a “major focus of ours.” He added that it would affect all of Apple’s products and services.

That statement appears mostly true already. Apps ranging from FaceID to the translate app to native sleep tracking rely on AI. These advancements enhance the functionality of Apple’s iPhones, Macs, iPads, and Apple Watches, placing AI and ML on nearly all of Apple’s 2 billion active devices.

Moreover, the number of AI/machine learning-based applications in Apple’s products will likely increase. Apple has long prioritized research and developing applications using AI and machine learning. Since 2020, the company has funded Apple Scholars in AI and machine learning, funding fellowships for Ph.D. candidates in this field. These have yielded studies such as showing how Apple’s RoomPlan can create 3D representations or sponsoring a conference where experts share research on neural information processing systems.

Such advancements could give Apple stock some much-needed help. In the first quarter of fiscal 2023 (which ended Dec. 31), net sales fell 5% on lower device sales. And since operating expenses rose, fiscal Q1 net income fell to $30 billion versus $35 billion the year before. That performance and the tech bear market have likely contributed to the 12-month decline in Apple stock.

Still, Apple’s challenges appear temporary, as revenue grew 9% in fiscal 2022 (which ended Sept. 24). Hence, it will likely return to double-digit growth as economic conditions improve. Additionally, Apple also claims more than $165 billion in liquidity, meaning it should possess the resources needed to keep up with or possibly surpass its peers in the AI and ML fields.

— Will Healy, Justin Pope, and Jake Lerch

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool